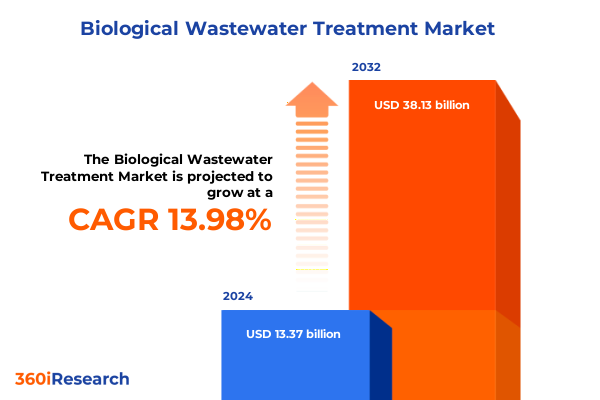

The Biological Wastewater Treatment Market size was estimated at USD 10.21 billion in 2025 and expected to reach USD 11.13 billion in 2026, at a CAGR of 10.93% to reach USD 21.13 billion by 2032.

Innovative Biological Processes Driving Sustainable Wastewater Management and Charting the Path for Industry Transformation

Biological wastewater treatment has emerged as a cornerstone of sustainable water management, harnessing natural processes to remediate contaminants and preserve vital water resources. By leveraging microbial communities and biochemical pathways, these systems transform organic pollutants, nutrients, and emerging micropollutants into benign byproducts, aligning with broader environmental objectives. The growing emphasis on ecological restoration and regulatory compliance has propelled adoption of advanced biological treatments from municipal facilities to industrial effluent applications.

In recent years, accelerating population growth and intensifying industrial activities have exacerbated water scarcity and contamination challenges. Consequently, stakeholders are prioritizing resilience and sustainability in wastewater management, driving innovation in process design and operational efficiency. Biological treatment platforms, such as activated sludge, biofilm reactors, and membrane bioreactors, offer scalable and cost-effective solutions to meet stringent discharge standards while enabling resource recovery and circular economy principles.

Moreover, the convergence of digital tools, real-time monitoring, and artificial intelligence has unlocked new avenues for process optimization and risk mitigation. These technologies are enabling predictive maintenance, performance analytics, and remote control, thereby enhancing overall system reliability and reducing operational expenditures. As water treatment facilities seek to balance environmental stewardship with fiscal responsibility, the integration of advanced monitoring platforms and data-driven decision-making frameworks has become indispensable.

In this context, stakeholders ranging from municipal authorities and industrial operators to technology providers and investors are seeking a clear understanding of market dynamics and competitive landscapes. This summary delivers that clarity by weaving together market drivers, technological advancements, regulatory influences, and strategic considerations. It serves as a roadmap for organizations aiming to refine their product portfolios, optimize process configurations, and forge partnerships that accelerate the transition toward more efficient and sustainable wastewater treatment paradigms.

Emerging Technological Breakthroughs Coupled with Evolving Regulatory Frameworks Accelerating Transformation of Biological Wastewater Treatment Practices

The landscape of biological wastewater treatment is undergoing a paradigm shift driven by technological breakthroughs and seismic regulatory changes. Advanced process configurations, including moving bed biofilm reactors and integrated membrane bioreactors, are redefining system performance by enhancing treatment efficiency and reducing energy consumption. Simultaneously, digitalization initiatives-from sensor-equipped aeration systems to AI-powered control platforms-are enabling near real-time monitoring and predictive adjustments that optimize performance and preempt operational disruptions.

Furthermore, escalating regulatory requirements are compelling plant operators to achieve lower discharge limits for nutrients such as nitrogen and phosphorus. In response, nutrient recovery schemes and resource reclamation strategies are gaining prominence, aligning with circular economy principles. Government incentives and carbon credit mechanisms are also fostering investment in low-carbon treatment pathways, thereby amplifying the focus on green infrastructure and renewable energy integration within treatment facilities.

Moreover, the convergence of environmental policy and financial markets is driving interest in green bonds and sustainability-linked financing, making capital more accessible for projects that demonstrate verifiable ecological benefits. These developments are reshaping vendor strategies, with equipment manufacturers and service providers forging alliances to deliver turnkey solutions that integrate advanced biological units with digital management systems. As a result, the sector is witnessing an accelerated migration from legacy treatment modalities toward holistic frameworks that emphasize resilience, adaptability, and resource efficiency.

Assessment of the Cumulative Effects of 2025 US Tariffs on Supply Chains Cost Structures and Competitive Dynamics in Biological Wastewater Treatment

The implementation of new tariffs on imported treatment components in 2025 has introduced a fresh set of challenges for the biological wastewater treatment industry. Elevated duties on key equipment, including high‐performance membranes and specialized reactors, have increased capital expenditure profiles and compressed profit margins for system integrators and technology providers. In turn, this has necessitated a strategic reassessment of supply chains to mitigate cost pressures and maintain competitive positioning.

In response to higher import costs, several leading suppliers are pursuing local manufacturing initiatives and forging regional partnerships to secure preferential procurement channels. This localization trend not only addresses tariff-related hurdles but also enhances logistics efficiency and reduces lead times for critical spare parts. Moreover, domestic production of core components is stimulating innovation in modular design, enabling scalable deployment of treatment units tailored to varied flow rates and contaminant loads.

Consequently, industry stakeholders are placing renewed emphasis on end-to-end value chains, from raw material sourcing to after-sales service. Collaborative models that integrate design, fabrication, and operational support are emerging as a means to deliver cost‐effective and resilient solutions amid the evolving trade landscape. Ultimately, this tariff-driven realignment is reinforcing the importance of agility and diversification in procurement strategies, while catalyzing investment in localized manufacturing capacity and strategic alliances.

Deep Dive into Segmentation Strategies Revealing Critical Insights Across Process Applications Equipment Configurations and Microorganism Typologies

A nuanced understanding of segment-specific drivers is essential for charting future growth trajectories in biological wastewater treatment. Within process typologies, aerobic systems maintain a prominent position due to their robustness and versatility; activated sludge remains a stalwart, while biofilm systems and trickling filters are gaining traction for their operational resilience. Meanwhile, anaerobic technologies such as fixed film filters and upflow anaerobic sludge blanket reactors are being leveraged for their energy recovery potential. In parallel, denitrification units within anoxic regimes are increasingly deployed to meet stringent nutrient removal targets, thereby complementing aerobic and anaerobic configurations in integrated treatment schemes.

When examining application landscapes, municipal infrastructures continue to represent the largest deployment base, driven by urbanization and public health imperatives. At the same time, industrial sectors-particularly food and beverage, petrochemical, pharmaceutical, and pulp and paper operations-are adopting customized biological solutions to manage complex effluent profiles. Agricultural operations are also emerging as key adopters, utilizing nutrient management systems that promote water reuse and soil health while mitigating environmental impacts.

From an equipment perspective, aeration technologies occupy a central role, with diffused aeration and mechanical aeration units engineered to optimize oxygen transfer. Clarification systems remain indispensable for solid-liquid separation, while membrane bioreactor modules offer compact footprints and high effluent quality. Reactors designed for continuous stirred tank operations, membrane bioreactor integration, and sequencing batch processes enable flexible process control tailored to specific influent characteristics.

Finally, the choice of microorganisms underpins system efficacy, with algae strains such as Chlorella and Spirulina being explored for nutrient uptake, and specialized bacterial consortia-nitrifying and denitrifying species-driving targeted pollutant removal. Filamentous and yeast fungi contribute to floc formation and organic degradation, while protozoan communities, including ciliates and flagellates, play a critical role in maintaining biomass stability and effluent clarity.

This comprehensive research report categorizes the Biological Wastewater Treatment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Process

- Equipment

- Microorganism Type

- Application

Comparative Regional Analysis Unveiling Market Drivers and Challenges Across Americas EMEA and Asia Pacific Biological Wastewater Treatment Sectors

Regional dynamics are shaping divergent growth pathways in biological wastewater treatment. In the Americas, infrastructure modernization and funding initiatives are underpinning upgrades to legacy treatment plants. Municipal projects are increasingly integrating membrane bioreactor systems and nutrient recovery modules, while industrial facilities in North America are partnering with technology providers to deploy energy‐efficient and low‐footprint solutions. Latin American markets, meanwhile, are pursuing decentralized treatment units to address water access challenges in rural and peri-urban communities, supported by multilateral development programs.

Across Europe, the Middle East, and Africa, environmental regulations are driving investment in tertiary biological treatment, particularly in regions with stringent discharge thresholds. Northern European countries are pioneering pilot projects that combine advanced biofilm reactors with anaerobic digestion for energy self-sufficiency. In the Middle East, oil and gas operators are funding wastewater recovery plants that integrate advanced microbial consortia, while water-scarce nations are exploring wastewater reuse in agriculture. Concurrently, emerging economies in Africa are receiving international aid to build scalable modular systems capable of delivering basic sanitation and environmental protection.

In the Asia-Pacific domain, rapid urbanization and industrialization are exerting pressure on water resources, triggering large-scale municipal and industrial treatment projects. China and India are scaling up urban sewage treatment networks with a strong focus on nutrient removal and energy recovery. Australia and New Zealand are implementing advanced ecosystem-based designs that emphasize environmental conservation and resource circularity. Southeast Asian nations are incrementally adopting advanced treatment units to comply with evolving effluent standards and foster economic development through improved public health outcomes.

This comprehensive research report examines key regions that drive the evolution of the Biological Wastewater Treatment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Leaders Driving Adoption Partnership Strategies and Technology Advancements in Biological Wastewater Treatment Industry

Leading industry participants are driving innovation through product portfolio expansion, strategic collaborations, and targeted acquisitions. Global environmental services firms are partnering with specialized equipment manufacturers to introduce modular treatment solutions that streamline installation and reduce commissioning timelines. Simultaneously, membrane technology providers are investing in R&D to enhance fouling resistance and lifecycle performance, responding to customer demand for reliable and low-maintenance systems.

Emerging technology companies are carving niche positions by commercializing microbial consortia optimized for specific contaminants, such as nitrogenous compounds or emerging micropollutants. These offerings, when integrated into conventional treatment train designs, deliver enhanced removal efficiencies without significant footprint expansion. At the same time, established equipment vendors are developing digital service platforms that bundle remote monitoring, predictive maintenance, and performance benchmarking, thereby transitioning from traditional product-centric models to value-added service ecosystems.

Market leaders are also pursuing cross-sector partnerships to address industry-wide challenges such as microplastic contamination and energy consumption. By collaborating with academic institutions and government agencies, companies are co-developing pilot facilities to validate next-generation treatment approaches. These collaborative frameworks not only accelerate innovation but also de-risk technology adoption for end users. Overall, the competitive landscape is evolving from pure-play equipment provision toward integrated solutions aligned with sustainability and digital transformation agendas.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biological Wastewater Treatment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Aquatech International

- Beijing Enterprises Water Group Limited

- Bluewater Bio Limited

- Calgon Carbon Corporation

- Ecolab Inc.

- Evoqua Water Technologies LLC

- HUBER SE

- Ion Exchange (India) Limited

- Kurita Water Industries, Ltd.

- Mitsubishi Chemical Holdings Corporation

- Pentair plc

- SUEZ S.A.

- United Utilities Group PLC

- Veolia Environnement S.A.

- Xylem Inc.

Strategic Recommendations Empowering Industry Leaders to Navigate Complex Market Dynamics Seize Opportunities and Drive Growth in Biological Wastewater Treatment

Industry leaders should prioritize the integration of digital twins and Internet of Things (IoT) capabilities to gain holistic real-time visibility into treatment performance. By deploying advanced sensor networks and AI-driven analytics, operators can proactively address process anomalies and optimize energy usage. In parallel, investing in modular membrane bioreactor designs will enable rapid scaling of treatment capacity, accommodating variable flow rates and influent compositions with minimal downtime.

Furthermore, localizing manufacturing capabilities through regional partnerships can mitigate tariff-related risks and bolster supply chain resilience. Establishing assembly and fabrication centers closer to end markets will reduce lead times for critical components while fostering agility in custom system configurations. Complementary to this approach, strategic alliances with nutrient recovery and resource reclamation specialists will enhance circular economy outcomes and unlock new revenue streams from recovered phosphates and biogas.

Additionally, building cross-disciplinary innovation platforms with research institutions and regulatory bodies will facilitate pilot testing of microplastics removal technologies and advanced biofilm carriers. Engaging proactively with policymakers to shape emerging discharge standards can create first-mover advantages. Finally, embedding sustainability metrics and carbon accounting frameworks within core business processes will strengthen access to green financing and reinforce corporate environmental responsibility commitments.

Transparent Overview of Research Methodology Highlighting Data Collection Validation Techniques Analytical Frameworks and Quality Assurance Protocols

The research underpinning this analysis employed a blend of secondary and primary data collection methodologies. Initially, an extensive review of technical papers, industry journals, and regulatory documents was conducted to establish a foundational understanding of evolving treatment technologies and policy landscapes. Concurrently, patent filings and technology white papers were scrutinized to identify emerging innovations and competitive activity.

Primary research comprised structured interviews with wastewater treatment facility operators, equipment manufacturers, and microbial culture specialists, providing qualitative insights into practical implementation challenges and performance benchmarks. Supplementing these discussions, quantitative surveys were administered to key stakeholders to validate trends and capture perspectives on investment priorities and technology adoption timelines. Data triangulation techniques were then applied to reconcile diverse inputs, ensuring analytical robustness.

Analytical frameworks such as SWOT analysis, PESTEL evaluation, and Porter's Five Forces were employed to synthesize macroeconomic, regulatory, and competitive factors. Segmentation matrices were developed to ascertain relative attractiveness across process, application, equipment, and microorganism categories. Rigorous quality assurance protocols, including cross-validation with third-party databases and expert panels, were implemented to enhance data integrity and minimize bias.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biological Wastewater Treatment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biological Wastewater Treatment Market, by Process

- Biological Wastewater Treatment Market, by Equipment

- Biological Wastewater Treatment Market, by Microorganism Type

- Biological Wastewater Treatment Market, by Application

- Biological Wastewater Treatment Market, by Region

- Biological Wastewater Treatment Market, by Group

- Biological Wastewater Treatment Market, by Country

- United States Biological Wastewater Treatment Market

- China Biological Wastewater Treatment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Synthesis of Critical Findings Providing Strategic Perspective on Sustainable and Competitive Biological Wastewater Treatment Practices

This executive summary synthesizes critical insights from an in-depth exploration of biological wastewater treatment technologies and market dynamics. It underscores the convergence of advanced aerobic and anaerobic processes, digital transformation, and regulatory evolution as central catalysts for industry renewal. The analysis reveals how 2025 tariff adjustments are reshaping procurement strategies and driving localization of component manufacturing.

In examining segmentation, the report highlights the interplay between process typologies, application domains, equipment configurations, and microbial consortia in determining system performance and value proposition. Regional evaluations demonstrate varied adoption pathways shaped by infrastructure maturity, policy frameworks, and resource imperatives in the Americas, EMEA, and Asia-Pacific regions. Key corporate profiles illustrate how incumbents and challengers are redefining competitive boundaries through technological partnerships and service-oriented business models.

Ultimately, the findings present a strategic roadmap for stakeholders seeking to align operational practices with sustainability goals and capture emerging market opportunities. By integrating actionable recommendations into planning cycles, industry leaders can enhance resilience, foster innovation, and contribute to the global transition toward efficient and environmentally responsible wastewater treatment outcomes.

Connect with Ketan Rohom Associate Director of Sales and Marketing to Unlock Exclusive Biological Wastewater Treatment Insights and Research Solutions

For stakeholders seeking a comprehensive understanding of the latest biological wastewater treatment innovations and market dynamics, direct discussions can unlock tailored solutions that align with organizational goals. Engaging with Ketan Rohom, Associate Director of Sales and Marketing, provides an opportunity to access in-depth expertise on process optimizations, emerging technologies, and strategic positioning. Through this personalized consultation, decision-makers can explore advanced treatment methodologies, evaluate competitive landscapes, and secure bespoke research assets that inform critical investment and operational decisions. Initiating contact with Ketan Rohom ensures that your team gains priority access to detailed market intelligence, enabling rapid alignment of treatment strategies with evolving regulatory requirements and sustainability targets. Embarking on this collaborative journey will empower your organization to harness the full potential of biological wastewater treatment solutions and achieve measurable environmental and economic outcomes.

- How big is the Biological Wastewater Treatment Market?

- What is the Biological Wastewater Treatment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?