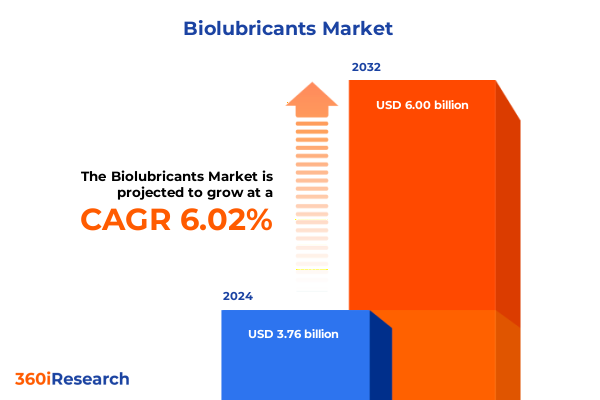

The Biolubricants Market size was estimated at USD 3.98 billion in 2025 and expected to reach USD 4.21 billion in 2026, at a CAGR of 6.06% to reach USD 6.00 billion by 2032.

Unveiling the Biolubricants Revolution: A Comprehensive Introduction to Sustainable Lubricant Innovations Transforming Industrial Applications

In an era defined by heightened environmental awareness and regulatory pressure, the lubricants industry is undergoing a profound transformation driven by sustainability imperatives. Traditional petroleum-based lubricants, while historically prevalent, are increasingly scrutinized for their environmental footprint, spurring demand for renewable alternatives. Biolubricants, derived from animal fats and vegetable oils, have emerged as a viable solution, combining biodegradability and low toxicity with high-performance properties. This introduction sets the stage for exploring how biolubricants are reshaping lubrication strategies across diverse sectors.

Transitioning away from fossil derivatives, manufacturers and end users are embracing bio-based formulations that not only meet stringent environmental standards but also deliver competitive performance under demanding operating conditions. Advances in feedstock processing technologies and application-specific formulations have expanded the scope of biolubricants far beyond niche segments. As policymakers enforce stricter emissions and waste management regulations, the momentum behind sustainable lubricant innovations continues to accelerate, laying a robust foundation for market evolution and competitive differentiation.

Navigating Paradigm Shifts Driving Biolubricant Adoption and Technological Advancements Across Global Industrial and Automotive Sectors

Over the past decade, transformative shifts in both market demand and technological capability have redefined the biolubricant landscape. Regulatory frameworks mandating reduced greenhouse gas emissions and enhanced biodegradability have galvanized investment in research and development. Producers are increasingly focusing on optimizing enzymatic transesterification processes and integrating advanced catalysts to improve yield and product consistency. Concurrently, digitalization of manufacturing workflows, including predictive analytics for feedstock variability and real-time quality control, has accelerated product development cycles and lowered production costs.

Equally notable is the evolution of feedstock sourcing strategies. While animal fats remain a reliable option in certain industrial applications, vegetable oils have gained prominence due to scalability and diverse geographic availability. Innovations in oleochemical processing, such as epoxidation and hydroesterification, have expanded the range of tailor-made lubricant properties, catering to high-temperature stability and extreme-pressure conditions. These technological milestones, coupled with heightened collaboration between industry stakeholders and research institutions, underscore the rapid maturation of biolubricant offerings and their readiness for mainstream adoption.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Biolubricant Supply Chains, Pricing Dynamics, and Competitiveness

In 2025, the United States implemented a series of updated tariff measures affecting key imports of vegetable oils and specialized chemical intermediates used in biolubricant synthesis. These measures, aimed at protecting domestic agriculture and supporting local manufacturing, have introduced new cost considerations for global suppliers and downstream formulators. As a result, procurement teams are re-evaluating their supply chains to mitigate exposure to duties on palm oil and soybean derivatives imported from major producing regions. This strategic recalibration is driving a renewed focus on domestic feedstock development and long-term sourcing partnerships.

The cumulative impact of these tariffs has manifested in localized price volatility and shifting trade flows. Some global manufacturers have responded by establishing regional processing facilities within the United States to circumvent import duties, while others have accelerated development of alternative raw materials such as canola oil and non-food grade animal fats. These adaptations signal a broader trend toward vertical integration and supply chain resilience. At the same time, end users are closely monitoring unit costs and total landed expenses, placing a premium on transparent cost structures and collaborative supplier agreements.

Deep Dive into Market Segmentation Insights Revealing Feedstock, Processing, Application, Distribution, and End-User Nuances

A nuanced segmentation analysis reveals the multifaceted nature of the biolubricants market and highlights where strategic opportunities lie. Across feedstocks, the market is studied through the lens of animal fats and vegetable oils, with the latter further broken down into canola oil, palm oil, and soybean oil, each presenting unique benefits from oxidative stability to cold flow performance. Distinct production processes also define product differentiation, encompassing enzymatic transesterification, epoxidation, esterification, and hydroesterification, technologies that influence product properties such as biodegradability, viscosity index, and thermal stability.

Applications serve as another critical axis for segmentation, spanning gear oils, greases, hydraulic fluids, and metalworking fluids, each demanding tailored performance profiles from wear protection to load carrying capacity. Distribution channels further shape market reach, with offline channels maintaining relationships through traditional distributors and technical sales teams, while online platforms facilitate faster procurement cycles and broader geographic coverage. Finally, end users-from automotive and aviation to construction, energy, marine, and transportation-drive demand patterns based on sector-specific lubricant requirements. By examining these segmentation dimensions together, stakeholders can identify high-potential niches and align their innovation roadmaps accordingly.

This comprehensive research report categorizes the Biolubricants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Production Process

- Application

- Distribution Channel

- End-User

Exploring Regional Dynamics Shaping the Biolubricants Landscape Across Americas, Europe Middle East Africa, and Asia-Pacific Markets

Regional dynamics exert a powerful influence on the adoption and growth trajectories of biolubricants. In the Americas, strong policy support in North America, combined with abundant agricultural feedstock in South America, has fostered an integrated value chain that leverages both raw material supply and advanced manufacturing capabilities. The legal frameworks in Canada and the United States emphasize renewable portfolio standards and low-carbon fuel regulations, which indirectly bolster demand for bio-based lubricants in transportation and heavy machinery sectors.

Within the Europe, Middle East & Africa region, stringent environmental directives in the European Union drive the adoption of biodegradable lubricants, especially in marine and metalworking applications where spill risk is high. Simultaneously, emerging markets in the Middle East and select African economies are beginning to recognize the operational benefits of biolubricants, spurring pilot projects within the energy and construction industries. Asia-Pacific presents a dual narrative, with leading economies like China and India investing heavily in sustainable industrial policies and local innovation ecosystems, while Southeast Asian nations contribute significantly to palm oil feedstock availability. This confluence of regulatory momentum, feedstock abundance, and industrial modernization underscores the region’s pivotal role in shaping global supply and demand balances.

This comprehensive research report examines key regions that drive the evolution of the Biolubricants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players and Strategic Alliances Driving Innovation, Portfolio Expansion, and Competitive Positioning in Biolubricants

The competitive environment in the biolubricants sector is characterized by a blend of chemical conglomerates, specialty oleochemical manufacturers, and agile technology startups. Leading chemical companies have significantly expanded their portfolios through acquisitions and joint ventures, integrating advanced catalyst technologies and proprietary additive packages to enhance performance benchmarks. Meanwhile, established oleochemical firms are investing in R&D centers dedicated to optimizing enzymatic transesterification processes and exploring novel feedstocks derived from agricultural waste streams.

Strategic alliances also play a pivotal role in driving innovation. Partnerships between chemical developers and end-user OEMs enable co-development of application-specific formulations that meet rigorous industry specifications. In parallel, collaborations with academic institutions facilitate accelerated knowledge transfer and pilot-scale validation of cutting-edge production techniques. This ecosystem of players, spanning from global enterprises to niche innovators, collectively advances the technical frontier of biolubricants, setting the stage for new breakthroughs in efficiency, sustainability, and cost-effectiveness.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biolubricants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aztec Oils Ltd

- Benjn.R.Vickers & Sons Limited’s

- Bio-Circle Surface Technology GmbH

- BioBlend Renewable Resources, LLC

- Biona Jersín S.R.O.

- CASTROL LIMITED

- Chevron Corporation

- Emery Oleochemicals GmbH by Henkel AG & Co. KGaA

- Enilive S.p.A.

- Exxon Mobil Corporation

- FUCHS LUBRICANTS DENMARK ApS

- Igol Lubricants Private Limited

- Klüber Lubrication München GmbH & Co. KG by Freudenberg Group

- Lubrication Engineers, Inc.

- Magna International Pte Ltd.

- MO8 Specialities Limited

- Peter Greven GmbH & Co. KG

- Polnox Corporation

- Quaker Chemical Corporation

- Royal Dutch Shell PLC

- RSC Bio Solutions LLC

- Safety-Kleen Systems, Inc

- Solution Biogen Sdn Bhd

- TotalEnergies SE

Actionable Strategies for Industry Leaders to Enhance Sustainability, Optimize Production, and Capitalize on Emerging Biolubricant Trends

Industry leaders seeking to capitalize on the momentum in biolubricants must prioritize integrated strategies that marry sustainability objectives with operational efficiency. Investing in localized feedstock sourcing initiatives can mitigate tariff exposure and supply chain disruptions, while co-locating processing facilities near agricultural hubs enhances feedstock-to-product yield. Simultaneously, committing resources to advanced transesterification and epoxidation research will differentiate formulations on critical performance parameters such as oxidative stability and load-bearing capacity.

Equally important is deepening collaboration across the value chain. Establishing strategic partnerships with OEMs to co-develop application-specific fluids can unlock premium market segments and foster long-term procurement agreements. Embracing digital tools to optimize production scheduling and quality assurance, alongside engaging with policymakers to shape favorable regulatory frameworks, will further cement a leadership position. Finally, adopting a circular economy mindset-recycling used oil streams and valorizing by-products-will enhance both sustainability credentials and cost competitiveness over the medium to long term.

Unraveling the Research Methodology Underpinning Robust Biolubricant Market Analysis Through Primary and Secondary Data Triangulation

The insights presented in this report are grounded in a rigorous research methodology combining primary and secondary data sources. Primary research involved structured interviews and surveys with key stakeholders across the biolubricants value chain, including feedstock suppliers, technology providers, OEMs, and end users. These engagements provided direct visibility into operational challenges, performance expectations, and investment priorities.

Secondary research drew upon scientific journals, patent databases, industry white papers, and trade publications to contextualize technological trends and regulatory developments. Detailed analysis of customs data and corporate disclosures enabled mapping of trade flows and strategic investments. The triangulation of qualitative insights with quantitative data ensured a robust, objective framework for assessing market dynamics, competitive landscapes, and future opportunities. Throughout the process, data was validated through cross-referencing multiple sources to maintain the highest standards of analytical integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biolubricants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biolubricants Market, by Source

- Biolubricants Market, by Production Process

- Biolubricants Market, by Application

- Biolubricants Market, by Distribution Channel

- Biolubricants Market, by End-User

- Biolubricants Market, by Region

- Biolubricants Market, by Group

- Biolubricants Market, by Country

- United States Biolubricants Market

- China Biolubricants Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Critical Insights and Strategic Takeaways Highlighting Challenges, Opportunities, and Future Outlook in Biolubricants

The biolubricants sector stands at the nexus of environmental stewardship and industrial performance, propelled by regulatory mandates, technological innovation, and shifting consumer expectations. While challenges related to feedstock variability, cost pressures from evolving tariff regimes, and the complexities of scale-up remain, the opportunities for growth are substantial. Segmentation analysis reveals high-potential areas where tailored product formulations can address specific end-user needs, and regional insights highlight diverse pathways to market penetration.

As key players continue to forge strategic alliances and invest in next-generation processing technologies, the trajectory toward mainstream adoption becomes increasingly clear. Organizations that act decisively-aligning sustainability goals with innovation roadmaps, optimizing supply chains for resilience, and engaging collaboratively with stakeholders-are poised to secure a competitive advantage. This synthesis of critical findings underscores the importance of a holistic, forward-looking approach to harnessing the full potential of biolubricants in a rapidly evolving global marketplace.

Engaging with Ketan Rohom to Secure the Definitive Biolubricants Market Research Report and Empower Strategic Decision Making

We invite you to engage with Associate Director of Sales & Marketing, Ketan Rohom, to explore how this comprehensive biolubricants market research report can empower your strategic planning and competitive edge. His deep expertise in sustainable industrial trends and market dynamics ensures that your organization gains actionable insights tailored to your unique growth objectives.

Connect with Ketan Rohom today to discuss report customization, bulk licensing options, or targeted consulting services. By partnering directly, you’ll receive dedicated support in interpreting the analysis, benchmarking against industry peers, and charting a roadmap that leverages the transformative potential of biolubricants across your operations and product lines.

- How big is the Biolubricants Market?

- What is the Biolubricants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?