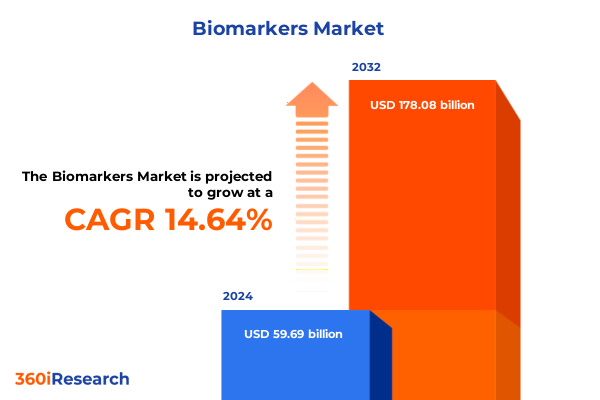

The Biomarkers Market size was estimated at USD 68.08 billion in 2025 and expected to reach USD 77.73 billion in 2026, at a CAGR of 14.72% to reach USD 178.08 billion by 2032.

Charting the Dawn of Biomarker Innovation as Revolutionary Diagnostic Tools and Personalized Medicine Strategies Converge to Redefine Patient-Centric Healthcare Delivery

Biomarker science stands at the forefront of a healthcare renaissance, redefining how conditions are diagnosed, monitored, and managed. This executive summary synthesizes the pivotal developments shaping the biomarker domain, offering an authoritative perspective on the innovations, market dynamics, and strategic considerations that will drive future progress. By focusing on the critical intersections of technology evolution, regulatory change, and collaborative research ecosystems, this overview equips decision-makers with the insights necessary to navigate complexity and capitalize on emerging opportunities.

As the industry pivots towards precision medicine and patient-centric care pathways, stakeholders across academia, diagnostics, pharmaceutical development, and healthcare delivery must be attuned to the transformative forces at play. This introduction delves into the fundamental drivers of biomarker adoption, highlighting the integration of advanced analytic frameworks and the expansion of novel molecular targets. In doing so, it lays the groundwork for a detailed exploration of landscape shifts, tariff impacts, segmentation strategies, regional nuances, company dynamics, and actionable recommendations that will be elaborated in the subsequent sections.

Navigating Dynamic Shifts in Biomarker Research Landscape Fueled by Technological Convergence Regulatory Evolution and Collaborative Ecosystem Transformations

The biomarker landscape is witnessing unprecedented transformation driven by the convergence of cutting-edge technologies and evolving regulatory paradigms. Breakthroughs in next generation sequencing and digital polymerase chain reaction are enabling unparalleled sensitivity and specificity in molecular detection, while chemiluminescent immunoassay and matrix assisted laser desorption ionization time of flight mass spectrometry deliver rapid, high-throughput capabilities that accelerate clinical decision-making.

Concurrently, regulatory agencies worldwide are issuing progressive guidelines to streamline biomarker qualification and companion diagnostic approvals, fostering a more predictable environment for translational research and commercial deployment. This regulatory evolution is complemented by intensifying public–private partnerships, as leading biopharmaceutical companies, academic institutions, and diagnostic developers pool resources to validate novel biomarker candidates and co-develop integrated diagnostic platforms. As a result, collaborative consortia are catalyzing shared data ecosystems that enhance reproducibility and drive cross-sector innovation.

Together, these technological and ecosystem-level shifts are reshaping traditional R&D workflows, shortening development timelines, and lowering barriers to market entry. Companies that embrace agile development models, leverage AI-driven data analytics, and foster open innovation networks will be best positioned to thrive in this dynamic, increasingly competitive arena.

Evaluating the Complex Ripple Effects of 2025 United States Tariffs on Biomarker Supply Networks Research Pipelines and Commercial Partnerships

In 2025, newly enacted United States tariffs on diagnostic reagents and laboratory instrumentation have generated complex repercussions across global biomarker supply chains. The imposition of additional duties on imported mass spectrometry hardware and sequencing platforms has prompted both domestic and international manufacturers to reassess manufacturing footprints and sourcing strategies. Many organizations are accelerating plans to localize critical component production, exploring contract manufacturing expansion and forging strategic alliances with domestic suppliers to mitigate escalating input costs.

These tariff-related cost pressures are also rippling through research budgets, compelling academic and commercial laboratories to reprioritize ongoing projects and negotiate revised vendor contracts. Multinational diagnostic developers have responded by restructuring pricing models and introducing tiered service offerings designed to preserve access to essential assays without compromising quality or throughput.

Despite the near-term disruptions, the tariffs are catalyzing a broader push toward supply chain resilience and innovative cost management. Companies are increasingly investing in modular instrument architectures and open-source assay kits that enable flexible substitution of components. As a result, the sector is witnessing a pronounced shift toward diversified vendor ecosystems and collaborative procurement initiatives, laying the foundation for a more stable and cost-efficient future.

Unveiling Critical Segmentation Perspectives Across Source Technology Type Application and End Users to Illuminate Biomarker Market Complexity and Innovation Pathways

A nuanced understanding of the biomarker market’s segmentation is essential for stakeholders aiming to tailor strategies and investments effectively. Segmentation based on biomarker source scrutinizes the relative roles of blood, saliva, tissue, and urine specimens in diagnostic and research applications, further distinguishing between plasma and serum matrices to capture subtle but critical differences in assay performance. Parallel technological segmentation spans immunoassay methodologies, including chemiluminescent immunoassay, Elisa, and lateral flow assay, as well as advanced mass spectrometry techniques such as gas chromatography mass spectrometry, liquid chromatography mass spectrometry, and matrix assisted laser desorption ionization time of flight. Polymerase chain reaction platforms extend into both digital polymerase chain reaction and quantitative polymerase chain reaction, while sequencing technologies encompass next generation sequencing and traditional Sanger sequencing.

Further depth is achieved through biomarker type segmentation, where cellular biomarkers stand alongside genetic biomarkers-subdivided into DNA and RNA biomarkers-metabolomic biomarkers, and protein biomarkers, each offering unique insights into disease mechanisms. Application-based segmentation reveals how clinical trials, diagnostics, drug discovery, and personalized medicine differ in their biomarker requirements and validation processes, while end user segmentation highlights the distinct needs of academic and research institutes, diagnostic laboratories, hospitals, and pharmaceutical companies. This comprehensive segmentation framework illuminates the multifaceted nature of the biomarker ecosystem and guides stakeholders in identifying the most relevant opportunities for innovation and investment.

This comprehensive research report categorizes the Biomarkers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Biomarker Source

- Technology

- Biomarker Type

- Application

- End User

Distilling Regional Biomarker Insights from Americas to EMEA and Asia-Pacific Revealing Differentiated Market Drivers Challenges and Growth Enablers

Regional dynamics play a pivotal role in shaping the trajectory of biomarker development and adoption. In the Americas, a mature clinical research infrastructure and strong reimbursement frameworks provide a fertile environment for rapid translation of novel biomarkers into practice. North America’s leadership in venture capital funding and strategic partnerships accelerates commercialization, while Latin America’s expanding laboratory networks and growing investment in healthcare technology underscore its rising importance as a regional growth engine.

Across Europe, the Middle East, and Africa, a diverse regulatory landscape requires navigational acumen, as centralized pathways such as CE marking coexist with country-specific requirements. Western Europe’s emphasis on value-based healthcare and established patient registries fosters rigorous biomarker qualification, while emerging markets in the Middle East and Africa are benefitting from government-led capacity building and increasing cross-border clinical collaborations.

In the Asia-Pacific region, rapid technological adoption, cost-effective manufacturing hubs, and supportive government initiatives are driving widespread deployment of biomarker assays. Key markets in East Asia are distinguished by strong integration of digital health platforms and a growing biotech ecosystem, whereas Southeast Asian economies are witnessing accelerated infrastructure expansion and regional partnerships that enhance access to cutting-edge diagnostic solutions.

This comprehensive research report examines key regions that drive the evolution of the Biomarkers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Corporations Elevating Biomarker Research Through Strategic Alliances Advanced Portfolios and Pioneering Clinical and Commercial Initiatives

Leading players in the biomarker arena are distinguished by robust innovation pipelines, strategic collaborations, and comprehensive product portfolios. Thermo Fisher Scientific has reinforced its market position through acquisitions that enhance its mass spectrometry and Next Generation Sequencing capabilities, while Roche Diagnostics continues to advance companion diagnostics with a focus on oncology and immunology. Illumina’s sustained investment in sequencing throughput improvements and platform affordability has reshaped genomics research, and Danaher’s diversified diagnostics segment benefits from integrated solutions that span sample preparation to data analytics.

Concurrently, companies such as Agilent Technologies and Waters Corporation are driving forward high-resolution mass spectrometry innovations, whereas Qiagen’s portfolio expansion in digital PCR and multiplex assays reinforces its presence in molecular diagnostics. Emerging specialty firms and startups are also contributing to ecosystem vitality by introducing targeted biomarker panels and microfluidic platforms that address niche clinical and research applications. These competitive dynamics underscore the importance of strategic alliances, M&A activity, and cross-sector partnerships in sustaining momentum and delivering differentiated offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biomarkers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Alto Neuroscience,Inc.

- APIS Assay Technologies Limited

- Augurex Life Sciences Corp

- Bio-Rad Laboratories, Inc.

- BioAgilytix

- Biocrates Life Sciences AG

- Biofourmis Inc.

- Biognosys AG

- BIOINFRA Life Science Inc.

- BioStarks

- BioVision Inc.

- Charles River Laboratories, Inc.

- Clarigent Corporation

- EKF Diagnostics Holdings PLC

- Elo Health, Inc.

- F. Hoffmann-La Roche, Ltd.

- Merck KgaA

- Nightingale Health Plc

- Owkin Inc.

- Owlstone Medical Limited

- PerkinElmer, Inc.

- Personalis, Inc.

- Proteomedix AG

- QIAGEN GmbH

- Renalytix PLC

- Siemens Healthcare GmbH

- Sino Biological Inc.

- Thermo Fisher Scientific, Inc.

- VivoSense, Inc.

Formulating Actionable Industry Roadmap for Stakeholders to Capitalize on Biomarker Opportunities Optimize Operations and Foster Cross-Sector Value Creation

To capitalize on the evolving biomarker landscape, industry leaders must prioritize diversification of supply chains through strategic partnerships and domestic manufacturing capacity expansion. Investing in modular, platform-agnostic technologies will enable rapid adaptation to regulatory changes and emerging assay requirements, while fostering internal centers of excellence for data integration and AI-driven analytics will unlock deeper insights from complex datasets.

Engagement with regulatory bodies at the earliest stages of biomarker development is essential to secure streamlined approval pathways and establish clear evidentiary standards. Collaboration across the value chain-spanning academics, diagnostic developers, and pharmaceutical sponsors-will accelerate translational workflows and enhance cohort diversity in validation studies. Moreover, commitment to robust quality management systems and real-world performance monitoring will differentiate high-value assays in an increasingly competitive market.

Finally, cultivating multidisciplinary talent pools and embracing digital transformation in laboratory operations will bolster agility and drive sustainable growth. By implementing these targeted strategies, stakeholders can strengthen their positioning and drive enduring impact in biomarker research and application.

Outlining Rigorous Multimodal Research Methodology Integrating Primary Interviews Secondary Data Analytics and Quantitative Validation to Ensure Comprehensive Biomarker Insights

This report is underpinned by a rigorous, multimodal research methodology designed to ensure validity and depth of insight. The foundational layer comprises primary qualitative interviews with an extensive panel of industry experts, including scientific leaders, regulatory advisors, and commercial executives, to capture firsthand perspectives on emerging trends and strategic imperatives. These insights are complemented by exhaustive secondary research encompassing peer-reviewed publications, regulatory agency databases, technical whitepapers, and company disclosures to construct a comprehensive evidence base.

Quantitative validation is achieved through a structured survey of end users, capturing feedback on adoption drivers, technology preferences, and unmet needs across different biomarker modalities. Data triangulation techniques reconcile disparate sources, ensuring coherence and robustness of findings. Advanced analytics, including trend extrapolation and impact scoring, are applied to identify high-priority segments and regional variances. Throughout the research process, strict adherence to ethical standards and confidentiality protocols safeguards data integrity and stakeholder trust.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biomarkers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biomarkers Market, by Biomarker Source

- Biomarkers Market, by Technology

- Biomarkers Market, by Biomarker Type

- Biomarkers Market, by Application

- Biomarkers Market, by End User

- Biomarkers Market, by Region

- Biomarkers Market, by Group

- Biomarkers Market, by Country

- United States Biomarkers Market

- China Biomarkers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Key Takeaways on Biomarker Trends Strategic Imperatives and Future Directions to Inspire Informed Decision-Making and Sustainable Sector Advancement

The biomarker landscape is undergoing a transformative evolution, driven by technological breakthroughs, regulatory modernization, and strategic collaborations that together accelerate the translation of scientific discoveries into clinical practice. Despite challenges such as tariff disruptions and regional regulatory complexity, the sector is poised to deliver more precise diagnostics, personalized treatment pathways, and improved patient outcomes. Stakeholders equipped with a nuanced understanding of segmentation dynamics and regional drivers will be best positioned to harness emerging opportunities.

As leading companies refine their portfolios and new entrants introduce specialized solutions, the imperative for agile strategies and data-driven decision-making becomes increasingly clear. By integrating comprehensive market insights with actionable recommendations, industry participants can navigate uncertainties and lay the groundwork for sustained innovation. Ultimately, the convergence of scientific rigor, regulatory alignment, and commercial acumen will define the next chapter of biomarker advancement, shaping a future in which precision medicine is both the standard of care and the catalyst for global health improvement.

Engage with Our Associate Director to Acquire the Definitive Biomarker Market Research Report and Propel Strategic Investments in Next-Generation Diagnostic Solutions

For enterprises eager to harness the full potential of biomarker innovations and secure a competitive advantage in the rapidly evolving healthcare landscape, our comprehensive market research report offers unparalleled depth and strategic clarity. By engaging directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch), you will gain personalized guidance on selecting the most relevant modules to inform your investment decisions, optimize pipeline development, and navigate complex regulatory environments. Ketan’s expertise in translating detailed market intelligence into actionable business strategies ensures that stakeholders receive a tailored package aligned with their unique operational needs and growth priorities. Don’t miss this opportunity to empower your organization with definitive insights and strategic foresight. Reach out to Ketan Rohom today to acquire the full report and embark on a data-driven journey toward pioneering diagnostic solutions and personalized therapeutic breakthroughs

- How big is the Biomarkers Market?

- What is the Biomarkers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?