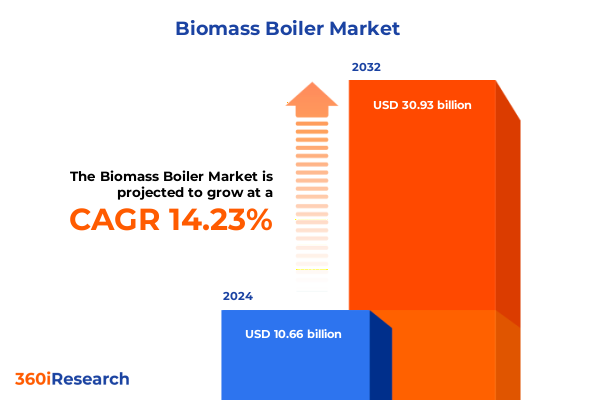

The Biomass Boiler Market size was estimated at USD 12.06 billion in 2025 and expected to reach USD 13.64 billion in 2026, at a CAGR of 14.40% to reach USD 30.93 billion by 2032.

Charting the Evolution of Biomass Boiler Technology Amid Growing Sustainability Imperatives, Regulatory Developments, and Global Energy Transition Challenges

The global drive toward carbon neutrality and sustainable energy solutions has positioned biomass boilers at the forefront of renewable heat generation. In a world increasingly focused on reducing greenhouse gas emissions, biomass boilers harness organic materials such as agricultural residues and wood byproducts to provide reliable thermal energy with a lower environmental footprint than conventional fossil fuel systems. As policy frameworks evolve to incentivize decarbonization, organizations across industrial, commercial, and residential segments are evaluating biomass technology as a strategic lever to align with aggressive emissions targets and rising corporate sustainability mandates.

Against this backdrop of regulatory momentum and corporate ambition, the biomass boiler landscape has transitioned from niche deployments to mainstream consideration in many regions. Advances in combustion control, fuel processing, and emissions management have enhanced system efficiencies while reducing operational complexity. Consequently, decision makers are able to integrate biomass solutions into existing energy infrastructures without compromising performance or reliability. This shift underscores the growing recognition of biomass boilers as a viable pathway for unlocking sustainable heat generation and supporting broader energy transition objectives.

Uncovering the Transformative Shifts in Renewable Energy Policies, Technological Advancements, and Decarbonization Strategies Reshaping Biomass Boiler Adoption

Renewable energy policies and shifting market incentives have triggered profound transformations in the biomass boiler sector. As governments worldwide strengthen climate goals and introduce financial mechanisms to support low-emission technologies, project developers and equipment manufacturers have responded with a wave of innovation. Novel combustion architectures and improved feedstock handling systems now deliver higher thermal efficiencies while meeting increasingly stringent emissions standards. In parallel, digital monitoring and advanced control platforms have emerged as catalysts for operational optimization, enabling predictive maintenance and real-time performance analysis across decentralized installations.

Moreover, the intersection of distributed energy strategies and hybrid renewable systems has redefined the role of biomass boilers. By pairing biomass with solar thermal, heat pumps, or combined heat and power installations, operators achieve greater resilience, flexible load management, and improved economics under dynamic energy pricing models. This convergence of technologies illustrates the sector’s adaptability in addressing complex energy challenges. As a result, biomass boilers are securing new footholds in district heating networks, agro-industrial applications, and remote off-grid communities where conventional energy sources face logistical or cost barriers.

Analyzing the Cumulative Impact of Recent United States Tariff Measures and Trade Regulations on Industry Supply Chains and Cost Structures in 2025

Recent trade measures enacted by the United States government have reverberated throughout biomass boiler supply chains, prompting a thorough reassessment of sourcing, manufacturing, and distribution practices. Tariffs targeting key boiler components and raw materials have increased landed costs and introduced planning complexities for import-reliant businesses. In response, several leading manufacturers have accelerated localization efforts, establishing regional fabrication centers to mitigate cross-border duties and streamline logistics.

At the same time, import levies on pelletized feedstock from select exporting countries have elevated fuel supply risks, spurring end users to diversify procurement strategies. Collaborative procurement models and long-term off-take agreements are gaining traction as mechanisms to stabilize fuel pricing and secure uninterrupted operations. Looking ahead, engagement with policy stakeholders and active participation in consultation forums have become imperative for industry players seeking to anticipate regulatory shifts. By aligning trade advocacy with strategic supply chain adjustments, biomass boiler firms can effectively navigate the evolving U.S. tariff landscape and maintain competitive momentum.

Unveiling Critical Segment Dynamics Across Fuel Types, Boiler Technologies, Capacity Ranges, Pressure Categories, Applications, End Uses, and Distribution Channels

A nuanced understanding of market segments is critical to tailoring biomass boiler offerings that resonate with diverse customer needs. When differentiating by fuel category, agricultural waste solutions have proven particularly attractive to agro-sector enterprises seeking circular economy synergies, while wood pellet systems appeal to stakeholders prioritizing densified feedstock efficiency. In the realm of technology, fire tube models have maintained their stronghold among smaller installations due to straightforward design and lower initial investment, whereas water tube configurations dominate higher capacity applications by delivering rapid response times and superior thermal uniformity.

Capacity considerations further influence purchasing decisions, with compact units under five hundred kilowatts serving localized energy needs and mid-range systems addressing facility-level process heating requirements. For larger campuses and utility interfaces, boilers above two thousand kilowatts offer scalability and integration with centralized energy networks. Pressure type also shapes system selection; high-pressure boilers fulfill stringent steam quality criteria in industrial processes, while low-pressure variants cater to space heating or district heating schemes. Application contexts-commercial, industrial, and residential-drive customization in controls, emissions performance, and service agreements, reinforcing the importance of segment-specific design and after-sales support.

End-use segmentation reveals that district heating operators increasingly value modular boiler arrays for load flexibility and redundancy, while power generation end users seek cogeneration compatibility to maximize efficiency gains. Process heating customers in food, paper, and chemical industries demand robust fuel handling and automated feed systems to ensure uninterrupted operations. Distribution channel preferences-direct procurement for key accounts and distributor networks for broader geographic reach-underscore the need for adaptable sales models that balance technical consultation with logistical convenience.

This comprehensive research report categorizes the Biomass Boiler market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fuel Type

- Technology

- Capacity

- Pressure Type

- Application

- End Use

- Distribution Channel

Revealing Distinct Regional Patterns and Market Drivers Across Americas, Europe Middle East & Africa, and Asia Pacific Biomass Boiler Ecosystems

Regional drivers for biomass boiler adoption reflect the interplay of resource availability, policy frameworks, and infrastructure maturity. In the Americas, abundant forestry and agricultural residues combined with supportive emissions trading mechanisms have underpinned a diverse installation base. Renewable thermal incentives in select states promote retrofits in commercial and industrial facilities, while district heating pilot programs in urban centers have demonstrated the scalability of biomass networks.

Across Europe, the Middle East, and Africa, the regulatory landscape varies considerably. European nations lead with robust subsidy schemes and binding renewables targets that favor biomass integration in district heating and cogeneration. In contrast, Middle Eastern markets are exploring biomass as a diversification pathway to reduce reliance on hydrocarbons, with pilot projects focusing on date palm residues and other region-specific biomass sources. In Africa, decentralized biomass solutions address both energy access gaps and rural economic development, fostering collaborations between technology providers and local agricultural cooperatives.

The Asia Pacific region presents a dynamic growth environment shaped by rapid urbanization, industrial expansion, and ambitious climate commitments. Leading economies leverage biomass boilers to decarbonize heavy industries, while emerging markets tap into agro-residues to satisfy grid-adjacent thermal demand. Governmental partnerships and international funding programs facilitate technology transfer, training initiatives, and pilot installations, creating a fertile landscape for biomass boiler stakeholders to establish footholds and scale operations.

This comprehensive research report examines key regions that drive the evolution of the Biomass Boiler market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industrial Players Their Strategic Initiatives, Technological Innovations, Partnerships, and Competitive Positioning in the Biomass Boiler Sector

In the competitive biomass boiler arena, established engineering firms and specialized equipment manufacturers are intensifying efforts to differentiate through technology leadership and comprehensive service offerings. Strategic acquisitions and joint ventures have emerged as preferred pathways to expand global footprints, enhance product portfolios, and access novel feedstock supply chains. Advanced sensor integration and digital twins now serve as key differentiators, enabling the provision of subscription-based performance services that guarantee uptime and thermal output.

Meanwhile, a cohort of entrepreneurial technology providers is challenging incumbents with niche solutions targeting configurable modular designs and rapid deployment capabilities. These agile entrants emphasize streamlined commissioning processes and embedded IoT connectivity, appealing to customers seeking turnkey implementations with remote monitoring. Partnerships between traditional boiler manufacturers and software developers are also on the rise, aiming to deliver end-to-end digital ecosystems that span from fuel procurement analytics to emissions reporting dashboards.

Service network density and technical support excellence continue to influence customer loyalty. Leading players invest in localized maintenance hubs and virtual support platforms, reducing service response times and minimizing unplanned outages. Through these strategic imperatives-technology innovation, collaborative alliances, and superior customer care-companies are well positioned to navigate intensifying competition and reinforce their market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biomass Boiler market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Andritz AG

- Babcock & Wilcox Enterprises, Inc.

- Baxi Heating Ltd.

- Binder Energietechnik GmbH

- Bosch Industriekessel GmbH

- Cheema Boiler Industries Ltd.

- Froling Heizkessel- und Behälterbau GmbH

- Guntamatic Heiztechnik GmbH

- Hargassner Ges.m.b.H.

- Henan Fangkuai Boiler Co., Ltd.

- John Cockerill SA

- Maxtherm Boilers Pvt. Ltd.

- Mitsubishi Heavy Industries, Ltd.

- OkoFEN Forschungs- und Entwicklungs GmbH

- Schmid Energy Solutions AG

- Thermax Limited

- Treco A/S

- Valmet Oyj

- Viessmann Werke GmbH & Co. KG

- Walchandnagar Industries Ltd.

- Woodco Ltd.

- ZOZEN Boiler Co., Ltd.

Delivering Strategic Recommendations for Industry Leaders to Capitalize on Market Opportunities, Drive Operational Efficiency, and Navigate Regulatory Complexities

Industry leaders should prioritize strategic investments in digitalization to unlock operational efficiencies and deliver value-added service offerings. By deploying advanced analytics and remote monitoring capabilities, organizations can transition from transactional maintenance models to proactive performance guarantees that reduce downtime and optimize fuel utilization. Collaboration across the value chain-spanning feedstock suppliers, technology integrators, and end-users-will strengthen supply resilience and enable innovative contracting models that align incentives for all stakeholders.

Further, executives must engage constructively with policy makers to shape incentive frameworks that balance emissions reduction goals with practical deployment timelines. Through coordinated advocacy, the sector can influence trade policies and renewable heat incentives, ensuring that regulatory environments support both market competitiveness and decarbonization targets. Finally, companies should explore modular and hybridized solutions that integrate biomass boilers with complementary technologies like heat pumps and solar thermal. Such integrated approaches will bolster system flexibility, enhance return on investment, and reinforce biomass boilers as pivotal components of comprehensive sustainable energy strategies.

Outlining the Rigorous Multi-Source Research Methodology Employing Primary Interviews, Secondary Analysis, and Data Triangulation to Ensure Market Intelligence Accuracy

This research harnessed a rigorous, multi-source methodology to ensure comprehensive market intelligence. Primary insights were gathered through in-depth interviews with C-level executives, technical specialists, and procurement managers across key end-use verticals. These discussions provided firsthand perspectives on technology preferences, procurement hurdles, and service expectations.

A broad secondary research phase entailed systematic analysis of industry journals, regulatory filings, technology whitepapers, and trade association publications. Publicly available data from policy institutes, government agencies, and standards bodies complemented proprietary data sets to capture emerging policy frameworks and technical benchmarks. Data triangulation techniques validated findings by cross-referencing primary inputs with secondary sources, while thematic analysis distilled insights into actionable strategic recommendations. To maintain ongoing relevance, the study incorporated iterative feedback loops with industry advisors and subject matter experts, ensuring that evolving market dynamics were reflected throughout the research process.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biomass Boiler market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biomass Boiler Market, by Fuel Type

- Biomass Boiler Market, by Technology

- Biomass Boiler Market, by Capacity

- Biomass Boiler Market, by Pressure Type

- Biomass Boiler Market, by Application

- Biomass Boiler Market, by End Use

- Biomass Boiler Market, by Distribution Channel

- Biomass Boiler Market, by Region

- Biomass Boiler Market, by Group

- Biomass Boiler Market, by Country

- United States Biomass Boiler Market

- China Biomass Boiler Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Synthesizing Critical Findings, Industry Implications, and Future Outlook Considerations to Equip Decision Makers with Actionable Market Intelligence

The biomass boiler market is at a pivotal juncture, defined by a confluence of technological innovation, policy momentum, and evolving customer expectations. As sustainability imperatives drive greater adoption of renewable thermal solutions, the sector’s capacity to innovate and adapt will determine its trajectory. Leading practices in digitalization, modularization, and hybrid system integration are reshaping competitive dynamics, while shifting trade regulations and fuel supply strategies continue to influence cost structures and value propositions.

Stakeholders armed with in-depth segment and regional insights can capitalize on differentiated opportunities, whether by customizing offerings for agricultural end users, targeting urban district heating networks, or delivering specialized process heating solutions. By aligning strategic actions with the latest industry trends and regulatory landscapes, decision makers will unlock the full potential of biomass boilers in advancing decarbonization goals and sustaining energy security. This executive summary offers a foundational compass - now is the time to translate its insights into deliberate strategies that will define leadership in the renewable thermal arena.

Engage with the Associate Director of Sales & Marketing to Access Comprehensive Biomass Boiler Market Research, Unlock Insights, and Drive Strategic Growth Initiatives

If your team is ready to elevate strategic decision making with robust insights on biomass boiler market dynamics, reach out today to Ketan Rohom. As the associate director of sales and marketing, Ketan Rohom specializes in partnering with stakeholders to translate market intelligence into actionable growth plans. By engaging with Ketan, organizations can secure a tailored demonstration of the full breadth of data, analysis, and expert perspectives contained within our comprehensive biomass boiler research report. Take this opportunity to leverage specialized knowledge, deepen competitive understanding, and accelerate your strategic roadmap with confidence-connect now to explore subscription options, custom research add-ons, and advisory engagements that will empower your next phase of growth in the biomass boiler sector.

- How big is the Biomass Boiler Market?

- What is the Biomass Boiler Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?