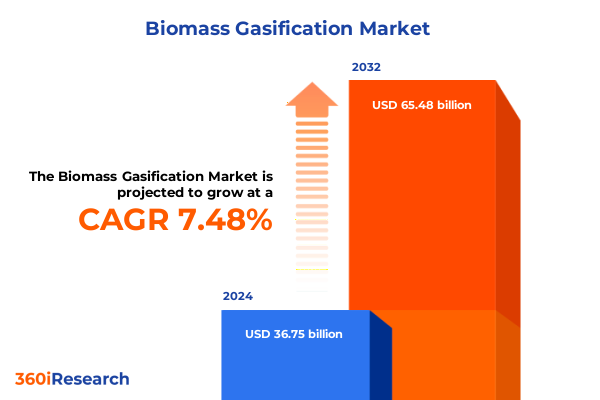

The Biomass Gasification Market size was estimated at USD 39.53 billion in 2025 and expected to reach USD 42.31 billion in 2026, at a CAGR of 7.31% to reach USD 64.80 billion by 2032.

Exploring the Evolution and Potential of Biomass Gasification Technologies to Drive Renewable Energy and Sustainable Resource Utilization Worldwide

Biomass gasification stands at the nexus of renewable energy innovation and global sustainability imperatives, offering a pathway to convert organic waste into syngas, heat and power. Through controlled thermochemical processes, a diverse array of biomass feedstocks undergoes partial oxidation at elevated temperatures, yielding a versatile fuel stream that can displace fossil fuels across power generation, chemical production and thermal applications. This technology not only addresses waste management challenges but also aligns with decarbonization targets established by governments and corporate sustainability agendas worldwide.

Amid tightening carbon emission regulations and mounting pressure to transition energy portfolios, stakeholders are increasingly prioritizing biomass gasification as a strategic solution for achieving circular economy goals. Advances in reactor design, process intensification and feedstock pretreatment have boosted overall conversion efficiencies, while digital monitoring systems enhance operational reliability. As a result, the sector has witnessed growing investment from project developers, technology providers and institutional backers seeking to capitalize on the dual benefits of renewable energy generation and waste valorization.

This executive summary presents a concise yet comprehensive overview of the biomass gasification landscape. It outlines transformative market shifts, evaluates the cumulative impact of 2025 US tariffs on critical supply chains, elucidates segmentation insights spanning feedstock types through end users, highlights regional dynamics, examines leading technology providers, and offers actionable recommendations. The goal is to equip decision-makers with the strategic intelligence required to navigate emerging opportunities and mitigate challenges in this rapidly evolving industry.

Exploring Transformative Shifts in Biomass Gasification Through Technological Breakthroughs, Regulatory Evolutions and Emerging Market Drivers

The biomass gasification industry is experiencing a wave of transformative shifts driven by breakthroughs in reactor configurations, integrated process designs and digital optimization tools. Thermochemical reactor innovations, such as advanced fluidized bed designs and plasma-enhanced systems, have substantially increased syngas yield and feedstock flexibility, enabling more consistent performance across moisture-rich agricultural residues and heterogeneous municipal solid waste streams. Concurrently, hybridization strategies that couple gasifiers with carbon capture and storage or biochar production modules are generating additional revenue streams and carbon credit opportunities, reshaping project economics.

Moreover, supportive regulatory frameworks are playing a pivotal role in accelerating adoption. Subsidies, tax incentives and renewable identification number programs in key markets have improved project bankability by de-risking capital investments and guaranteeing off-take contracts for green energy outputs. Policy evolution at both national and state levels is also fostering standardized permitting pathways and environmental compliance mechanisms, reducing development timelines and lowering entry barriers for new market entrants.

Finally, market innovation is evident in the emergence of digital twins, advanced process controls and predictive maintenance platforms tailored to gasification operations. These digital layers enhance real-time monitoring, optimize feedstock blending strategies and minimize downtime, thereby boosting overall operational uptime and lifecycle performance. As these transformative shifts coalesce, biomass gasification is poised to become a cornerstone of the sustainable energy transition.

Evaluating the Cumulative Impact of 2025 United States Tariffs on Biomass Gasification Supply Chains, Costs and Technology Adoption

In 2025, a series of tariff escalations has exerted tangible pressure on the biomass gasification value chain, with United States trade measures impacting steel and specialized gasifier components imported from key manufacturing hubs. Levies imposed under Section 232 on steel and aluminum have driven up raw material costs for reactor vessels and piping systems, while Section 301 duties on advanced machinery from certain export markets have increased the price of customized gasifier modules and high-precision control instruments. These additional cost burdens have tested project budgets and prompted developers to reassess procurement strategies.

Consequently, project timelines have been stretched as organizations seek alternative supply channels and negotiate revised manufacturer agreements. Some technology providers have responded by localizing component fabrication or forging strategic partnerships with domestic steel mills to circumvent tariff-driven cost fluctuations. At the same time, smaller-scale gasification initiatives, particularly those within the commercial and residential sectors, have faced deferral as capital expenditure requirements exceeded initial feasibility thresholds.

However, this tariff environment has also catalyzed positive developments. By incentivizing on-shore production, it has spurred investments in local manufacturing capabilities, fostering a more resilient supply chain. Moreover, organizations that pivoted to domestic suppliers have reported shorter lead times and enhanced collaboration on design customization. While the near-term financial implications remain challenging, these cumulative shifts may ultimately strengthen the long-term competitiveness and agility of the US biomass gasification industry.

Revealing Critical Insights into Biomass Feedstocks, Gasifier Technologies, Component Roles, Application Domains and End User Dynamics

The biomass gasification landscape reveals intricate dynamics across multiple dimensions. Feedstock choice influences reactor design and operational regimes, with agricultural residues typically requiring lower pretreatment compared to forestry residues or animal waste, while municipal solid waste demands robust sorting and contaminant removal. Each biomass category presents unique moisture content, ash behavior and energy density characteristics, shaping technology selection and process optimization.

Reactor configuration further differentiates market offerings. Entrained flow gasifiers excel at producing consistent syngas quality but favor finely milled feedstocks, whereas fixed bed systems deliver simpler operations suited to woody biomass. Fluidized bed reactors balance versatility and efficiency, accommodating varying particle sizes, and plasma gasifiers introduce high-temperature ionized zones that break down complex organics at speeds unattainable by conventional designs.

Within each gasification platform, component architectures such as control systems, gas engines, gasifier cores and power evacuation systems determine integration ease and performance reliability. Advanced control platforms enable precise temperature and pressure regulation, while modular power evacuation solutions facilitate grid synchronization or off-grid deployment. Downstream, syngas utilization options range from chemical intermediates production to combined heat and power, thermal applications and specialized waste treatment, each unlocking distinct value propositions for commercial, industrial and residential end users. Together, these segmentation lenses underscore the versatility of biomass gasification and its capacity to tailor solutions to diverse industry requirements.

This comprehensive research report categorizes the Biomass Gasification market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Gasifier Type

- Feedstock Type

- Capacity

- Technology

- Installation Type

- Application

- End User

Examining Regional Dynamics in Biomass Gasification Across the Americas EMEA and Asia-Pacific Regions to Illuminate Growth Opportunities

Across the Americas, biomass gasification has gained traction as governments in North America and Latin America intensify renewable energy targets and seek alternatives to landfill-bound organic waste. The United States and Canada have introduced updated renewable portfolio standards and renewable natural gas incentives that reward syngas-derived electricity and pipeline injection. Meanwhile, Brazil’s extensive sugarcane agriculture supports large-scale cogeneration plants, demonstrating how agricultural residues can drive regional deployment at scale.

In Europe, Middle East and Africa, fragmented policy landscapes present both challenges and opportunities. The European Union’s circular economy action plan and stringent landfill diversion goals have stimulated interest in municipal solid waste gasification projects, particularly in Western Europe, where high tipping fees make waste-to-energy economically compelling. Meanwhile, in the Middle East, nascent pilot initiatives are exploring gasification to valorize date palm residues and agricultural byproducts, and African markets show potential for decentralized power solutions in off-grid communities with high biomass availability.

Asia-Pacific exhibits the highest growth momentum, anchored by China’s commitment to carbon neutrality by mid-century and India’s rural electrification drive. Rapid urbanization and regulatory support have accelerated investments in both small-scale village energy systems and large industrial gasifiers. Japan and South Korea, with their focus on hydrogen blending, are integrating biomass gasification with renewable hydrogen production pathways, showcasing cross-sector synergies that could redefine regional energy portfolios.

This comprehensive research report examines key regions that drive the evolution of the Biomass Gasification market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering the Strategic Positioning and Competitive Strengths of Leading Biomass Gasification Companies Driving Technology and Market Evolution

Several established and emerging players are shaping the biomass gasification sector through differentiated strategic approaches. Leading energy technology companies invest heavily in R&D to develop next-generation gasifier cores that improve feedstock flexibility and reduce tar formation. Some have integrated digital monitoring suites that leverage machine learning algorithms to optimize syngas yield in real time and predict maintenance needs, raising the bar for operational efficiency.

At the same time, specialized engineering firms are focusing on modular gasifier platforms that can be factory-built and rapidly deployed, catering to decentralized power generation and process heat applications. These modular designs appeal to industrial users seeking plug-and-play solutions that minimize site construction risks. Partnerships between component manufacturers and software providers are also on the rise, creating end-to-end packages that cover control systems, gas engines and grid interconnection equipment under single-vendor warranties.

Meanwhile, project developers are differentiating by forming strategic alliances with agricultural cooperatives, waste management companies and local utilities. These collaborations secure long-term feedstock supply agreements, streamline waste logistics and guarantee offtake, de-risking project financing. Collectively, these competitive maneuvers are driving continuous improvement in capital efficiency, system reliability and value capture across the biomass gasification ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biomass Gasification market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Valmet Corporation

- ANDRITZ AG

- thyssenkrupp AG

- EQTEC PLC

- Shell PLC

- L’AIR LIQUIDE S.A.

- Mitsubishi Heavy Industries, Ltd.

- NTPC Limited

- Honeywell International Inc.

- Babcock & Wilcox Enterprises, Inc.

- Vow ASA

- ENERKEM Inc.

- Sierra Energy

- Sumitomo SHI FW

- Chanderpur Works Pvt. Ltd.

- DP CleanTech Group

- Infinite Energy Pvt. Ltd.

- Spanner Re² GmbH

- Enersol Biopower Private Limited

- Nexterra Systems Corp.

- Aries Clean Technologies

- A.H.T. Syngas Technology N.V.

- Ankur Scientific Energy Technologies Pvt. Ltd.

- Bellwether Recuperative Gasification Ltd.

- Beltran Technologies, Inc.

- Burkhardt GmbH

- Flex Technologies Limited

- Frontline BioEnergy, LLC

- HAFFNER ENERGY

- KASAG Swiss AG by Raff + Grund GmbH

- Kawasaki Heavy Industries, Ltd.

- LiPRO Energy GmbH & Co. KG

- SunGas Renewables Inc.

- SynCraft Engineering GmbH

- SYNCRAFT GmbH

- Volter Oy

- Yosemite Clean Energy

Offering Actionable Strategic Recommendations for Industry Leaders to Navigate Complexity and Capitalize on Emerging Biomass Gasification Opportunities

Industry leaders should prioritize forging cross-sector partnerships to access critical feedstock streams, especially in regions where agricultural residues and forestry byproducts are abundant. By engaging directly with producers and waste management entities, developers can secure favorable long-term supply contracts that stabilize input costs and ensure consistent reactor performance. Furthermore, integrating modular manufacturing approaches will expedite project timelines and reduce on-site labor requirements, enhancing scalability.

To navigate tariff-related challenges, organizations should evaluate opportunities for localizing component production and bolstering domestic supply networks. In doing so, they can mitigate exposure to import duties while cultivating in-country expertise in reactor fabrication. Concurrently, investing in digital twin technology and predictive maintenance platforms will optimize operational uptime, reduce unscheduled downtimes and extend equipment life cycles, delivering immediate returns in reliability.

Finally, decision-makers must align project development with evolving regulatory incentives and carbon credit frameworks. Demonstrating robust lifecycle emissions reductions through biochar integration or carbon capture can unlock additional revenue streams. By adopting a portfolio approach that spans power generation, thermal applications and chemical intermediates, stakeholders can diversify revenue and strengthen resilience against market fluctuations, positioning their enterprises for sustained success.

Detailing Robust Research Methodology Combining Primary Research Expert Interviews Secondary Data Collection and Rigorous Data Triangulation Processes

This research employs a multi-tiered methodology combining both primary and secondary data sources to ensure robust and credible insights. Primary research consisted of in-depth interviews with key industry stakeholders, including technology providers, project developers, feedstock suppliers and regulatory experts. These conversations provided nuanced perspectives on operational challenges, emerging technology adoption patterns and evolving policy landscapes.

Secondary research drew upon publicly available data from government publications, academic journals, patent filings and industry white papers to contextualize primary findings. Technical specifications from leading gasifier manufacturers and peer-reviewed studies enabled comparison of reactor performance metrics, while trade databases and customs records informed the assessment of tariff impacts on component flows. Data triangulation techniques were applied to reconcile discrepancies across sources, ensuring analytical rigor.

Quantitative data points were validated through cross-checking with financial reports, project databases and press releases, while qualitative inputs were synthesized to identify overarching trends and strategic imperatives. This blended methodology supports a comprehensive analysis of the biomass gasification market, providing stakeholders with both empirical evidence and actionable insights to guide decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biomass Gasification market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biomass Gasification Market, by Gasifier Type

- Biomass Gasification Market, by Feedstock Type

- Biomass Gasification Market, by Capacity

- Biomass Gasification Market, by Technology

- Biomass Gasification Market, by Installation Type

- Biomass Gasification Market, by Application

- Biomass Gasification Market, by End User

- Biomass Gasification Market, by Region

- Biomass Gasification Market, by Group

- Biomass Gasification Market, by Country

- United States Biomass Gasification Market

- China Biomass Gasification Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Summarizing Key Insights and Future Imperatives to Capitalize on Biomass Gasification’s Role in Achieving Sustainable Energy and Environmental Objectives

In summary, biomass gasification has emerged as a versatile solution that leverages organic waste resources to produce clean energy, chemical precursors and thermal outputs. Technological breakthroughs in reactor design, controls and hybrid integration, combined with supportive policy measures and evolving market dynamics, have positioned this sector for accelerated growth. While 2025 tariffs have introduced near-term cost pressures, they have simultaneously catalyzed domestic manufacturing investments and supply-chain resilience.

Deep insights into feedstock characteristics, gasifier configurations, component architectures, application domains and end user needs reveal a market marked by operational diversity and customization potential. Regional dynamics underscore the heterogeneity of growth trajectories across the Americas, EMEA and Asia-Pacific, each driven by distinct regulatory climates and resource endowments. Leading companies are staking their competitive positions through R&D, modular system designs and strategic alliances, while actionable recommendations emphasize partnership formation, digital optimization, local content strategies and carbon credit integration.

As stakeholders navigate this complex landscape, a strategic, data-driven approach is essential to unlock the full potential of biomass gasification. By aligning technological, policy and investment decisions with evolving market signals, organizations can harness this transformative technology to meet sustainability targets, drive cost efficiencies and secure long-term competitive advantage.

Engage with Associate Director Sales & Marketing Ketan Rohom to Unlock Detailed Biomass Gasification Market Research Insights for Informed Strategic Decisions

To access the in-depth analysis, detailed segmentation breakdowns, proprietary data insights and comprehensive competitive intelligence your organization needs to make strategic decisions, reach out directly to Ketan Rohom, Associate Director Sales & Marketing. He will guide you through customizing the report to your requirements, arrange a live demonstration of our key findings and facilitate secure delivery of all analytical deliverables. Initiating this conversation ensures you obtain the nuanced market understanding essential for advancing your biomass gasification initiatives and achieving sustainable growth objectives.

- How big is the Biomass Gasification Market?

- What is the Biomass Gasification Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?