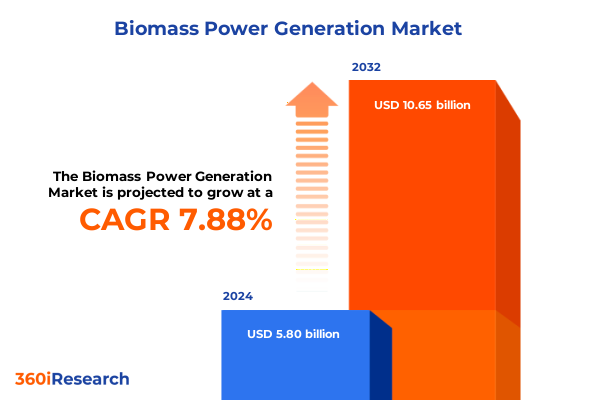

The Biomass Power Generation Market size was estimated at USD 6.21 billion in 2025 and expected to reach USD 6.66 billion in 2026, at a CAGR of 7.99% to reach USD 10.65 billion by 2032.

Understanding the Emergence and Significance of Biomass Power Generation in the Context of Global Energy Transformation and Sustainability Transitions

The global energy landscape is undergoing a rapid transformation driven by the imperative to decarbonize power systems and achieve net zero emissions. Within this shift, biomass power generation has emerged as a critical dispatchable resource that complements intermittent renewables, providing reliable baseload and peaking capacity. As electrification accelerates across transportation, heating, and industry, the ability to integrate biomass into the energy mix enhances grid resilience and energy security in regions with constrained renewable resources. Moreover, bioenergy’s classification as a renewable source under many regulatory frameworks underscores its strategic importance for policymakers and investors seeking both carbon reduction and energy reliability.

Recognized for its potential to leverage diverse organic feedstocks, biomass power has grown steadily over the past two decades. Global electricity generation from bioenergy more than quadrupled between 2000 and 2023, reaching 697 terawatt-hours (TWh) and accounting for 2.4% of global power output. This expansion has been supported by national policies such as feed-in tariffs and renewable portfolio standards, though deployment rates remain below the trajectory needed to double bioenergy contribution by 2030 in alignment with net zero scenarios. The pacing of capacity additions underscores the critical need for enhanced policy ambition and sustained investment to unlock bioenergy’s full potential.

Beyond its energy contribution, modern biomass power generation provides socio-economic benefits through rural job creation in feedstock cultivation, collection, and logistics. Advanced conversion technologies, including gasification with steam recycling and fast pyrolysis for bio-oil production, are expanding the technical envelope of biomass utilization, enabling co-production of electricity, heat, and fuels with improved efficiency and emissions performance. These innovations, underpinned by carbon capture, utilization, and storage (CCUS) pilots, position biomass as a potential negative emissions technology through bioenergy with carbon capture and storage (BECCS) in the medium term.

In this context, a comprehensive understanding of the biomass power generation ecosystem-which encompasses feedstock diversity, conversion pathways, capacity scales, end-use applications, regional dynamics, and competitive strategies-is essential for stakeholders seeking to navigate the complex interplay of technological, regulatory, and market forces shaping this critical sector.

Exploring the Fundamental Shifts Driving Technological, Policy, and Market Dynamics Reshaping the Biomass Power Generation Ecosystem

The biomass power generation landscape is being reshaped by converging technological breakthroughs, evolving policy frameworks, and dynamic market forces. On the technology front, the maturation of anaerobic digestion and gasification platforms has enabled power producers to tailor output profiles between baseload generation and flexible peaking services. Concurrently, advances in direct combustion technologies-ranging from fluidized bed reactors capable of handling heterogeneous feedstocks to pulverized combustion furnaces optimized for high throughput-have enhanced efficiency and reduced emissions intensity, elevating biomass’s role alongside wind and solar in modern grids.

Policy drivers have likewise undergone a transformation. In the United States, incentives have shifted from broad-based blender tax credits to performance-based credits tied to carbon intensity under the Cleaner Fuels Production Credit, altering the economics of biomass-based diesel and renewable diesel production and indirectly influencing feedstock availability for power applications. Internationally, proposals such as the Foreign Pollution Fee Act seek to levy import fees based on pollution intensity, signaling a potential paradigm shift toward carbon-adjusted tariffs that will further shape feedstock trade flows and supply chain resilience.

Market dynamics are responding in turn. Renewable diesel producers are recalibrating feedstock sourcing strategies in light of tariff fluctuations and credit adjustments, prompting greater interest in domestic agricultural residues, waste streams, and energy crops. This reorientation is driving increased investment in feedstock processing infrastructure and logistics, exemplified by novel partnerships between pellet producers and grid operators to secure stable wood residue supplies. Moreover, the decline in residual margins for conventional fuels and the projected scarcity of certain low-CI feedstocks are catalyzing the exploration of emerging biomass resources such as energy grasses and algal biowastes.

Taken together, these technological, policy, and market shifts are fostering an environment in which biomass power generation is both diversifying its feedstock base and evolving its technological portfolio. Stakeholders must therefore stay attuned to regulatory modifications, tariff adjustments, and innovation trajectories to capitalize on opportunities and mitigate risks in this rapidly maturing sector.

Assessing the Comprehensive Impacts of the 2025 United States Tariff Measures on Feedstock Costs, Supply Chains, and Project Viability in Biomass Power Generation

Throughout 2025 the United States implemented a series of tariff measures that have significantly elevated the cost structure and supply chain complexity for biomass power operators. In April 2025, the U.S. imposed a 125% import tariff on used cooking oil from China, abruptly halting a trade relationship that had supplied approximately 40% of China’s UCO exports valued at $1.1 billion in 2024. This action eliminated a low-cost feedstock option for renewable diesel producers and redirected demand toward higher-cost domestic oilseed and waste oils, increasing pressure on power producers reliant on lipid-based combustion fuels.

Simultaneously, the administration announced a 35% tariff on Canadian imports effective August 1, 2025, targeting a broad range of goods including forestry products used as biomass feedstock. The move has sparked uncertainties around cross-border pellet trade, disrupting pellet supply agreements critical for some large-scale power stations in the northeastern United States. With Canadian wood pellet producers now facing elevated market barriers, U.S. facility operators must reassess supply contracts and logistics to maintain consistent feedstock delivery.

Adding to this complexity, proposed legislation such as the Foreign Pollution Fee Act intends to impose fees on imports with higher embedded emissions, potentially influencing future tariff structures for biomass goods sourced from regions with less stringent environmental regulations. Although still under legislative consideration, its introduction underscores a trajectory toward carbon-adjusted trade policies that could further reshape global feedstock flows and project economics in the coming years.

These cumulative tariff and legislative developments have tightened feedstock availability, increased logistics costs, and introduced new compliance requirements for project financing. As a result, many operating facilities are revisiting feedstock diversification strategies and supply chain resilience plans to mitigate tariff-related risks and preserve project viability in an increasingly protectionist trade environment.

Unveiling Insights into Segmentation by Feedstock, Conversion Technology, Capacity Class, and End Use That Drive Competitive Differentiation in Power Generation

A nuanced understanding of the biomass power generation market emerges when segmentation is viewed through four interrelated lenses. First, by feedstock type, distinct value propositions arise from agricultural residues, which deliver cost-effective carbon credits; animal waste streams, which support circular economy goals; energy crops, which offer yield optimization through crop management; municipal solid waste, which addresses waste diversion mandates; and wood residue, which benefits from established forestry byproduct channels. Each feedstock category influences procurement strategies, carbon intensity profiles, and overall supply chain resilience.

The second segmentation dimension centers on conversion technology, where choice of pathway dictates operational efficiency and emissions performance. Anaerobic digestion, subdivided into dry and wet digestion, affords flexible biogas production with varying capital intensity. Direct combustion systems-ranging from fluidized bed reactors to grate furnaces and pulverized combustion units-enable scalable power output with mature technology readiness. Gasification processes, whether fixed bed or fluidized bed gasifiers, provide syngas for combined cycle applications, while pyrolysis platforms-fast or slow-produce bio-oil, biochar, and syngas blends for integrated energy and material applications.

Capacity class segmentation delineates large-scale installations, often exceeding 50 MW and serving utility grids, from medium-scale facilities typically in the 5–50 MW range configured for district heating or industrial co-generation, down to small-scale systems below 5 MW designed for remote or off-grid electrification. Each capacity class aligns with distinct financing models, permitting regimes, and off-take structures.

Finally, end-use segmentation highlights divergent value chains among commercial users requiring resilient power supply, industrial operations seeking process heat integration, and residential applications targeting decentralized energy solutions. This framework underscores the importance of aligning technology choice and feedstock sourcing with customer requirements and regulatory standards to optimize project performance and revenue streams.

This comprehensive research report categorizes the Biomass Power Generation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Feedstock

- Conversion Technology

- Capacity Class

- End Use

Delving into Regional Variations and Opportunities Across the Americas, Europe Middle East Africa, and Asia Pacific in Advancing Biomass Power Generation

Regional dynamics exert a profound influence on the evolution and adoption of biomass power generation. In the Americas, the United States continues to reshape its policy landscape through production credits and tariff realignments while Canada’s countermeasures on U.S. imports reverberate across cross-border feedstock channels. Latin American markets, notably Brazil, leverage abundant sugarcane bagasse and wood residues to supply both domestic and global renewable diesel producers, yielding synergies with power generation assets and reinforcing supply chain integration.

This comprehensive research report examines key regions that drive the evolution of the Biomass Power Generation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Key Industry Players Driving Innovation, Partnerships, and Strategic Initiatives to Shape the Competitive Landscape of Biomass Power Generation

Leading enterprises are advancing the competitive frontier in biomass power generation through strategic investments, technology partnerships, and market consolidation. Drax Group, having transitioned its coal fleet to biomass in the United Kingdom, reported a 5.5% increase in annual profit for 2024 driven by a 27% surge in biomass output and enhanced pellet production performance, even as subsidy levels were renegotiated to extend through 2031 at adjusted incentive rates. The company’s robust balance sheet supports expansion of BECCS trials and data center co-location options at its flagship power station.

Enel Green Power, a global renewables leader, recorded a 4% increase in core profits in 2024, underpinned by diversified generation from solar, wind, hydro, and biomass assets across Europe and the Americas. Its strategic plan allocates €12 billion through 2027 to expand capacity by 12 gigawatts, with a growing focus on dispatchable and hybrid solutions that include biomass cogeneration.

Reworld, formerly Covanta, has idled its biomass plants in response to low natural gas prices and mixed policy signals, leading to an $11 million revenue decline in its energy division in Q1 2025. The company’s rebrand underscores a shift toward advanced waste-to-resource services, yet reinforces the need for policy certainty and carbon credit alignment to sustain its bioenergy portfolio.

Germany’s RWE maintained its biomass generation at 798 MW of capacity in 2024, accounting for 3.1 TWh of output, while scaling battery energy storage integration at biomass sites to enhance grid services. Despite a 19% decline in biomass generation year-on-year, RWE’s broader renewable portfolio growth underscores biomass’s role within a diversified clean energy strategy.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biomass Power Generation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abengoa S.A.

- Acciona S.A.

- Ameresco, Inc.

- Babcock & Wilcox Enterprises, Inc.

- China Everbright International Limited

- Drax Group Plc

- E.ON SE

- Enel Green Power S.p.A.

- Engie SA

- EnviTec Biogas AG

- GCL-Poly Energy Holdings Limited

- General Electric Company

- GS EPS Co., Ltd.

- Hanwha Energy Corporation

- Hitachi Zosen Corporation

- Nippon Paper Industries Co., Ltd.

- RWE AG

- Siemens AG

- Statkraft AS

- SUEZ S.A.

- Sumitomo Corporation

- Vattenfall AB

- Veolia Environnement SA

- Wuhan Kaidi Holding Investment Co., Ltd.

- Xcel Energy Inc.

- Ørsted A/S

Providing Actionable Recommendations and Strategic Roadmap for Industry Leaders to Accelerate Growth, Optimize Operations, and Enhance Sustainability in Biomass Power Generation

To thrive amid evolving policy and market conditions, industry leaders must prioritize feedstock diversification strategies that mitigate tariff uncertainty and reduce cost volatility. Establishing collaborative sourcing agreements with agricultural cooperatives and municipal waste authorities can secure stable residues, while exploring emerging feedstocks such as energy crops and algal biomass enhances resilience against import restrictions.

Investing in flexible conversion assets forms a critical component of operational optimization. Deploying modular gasification units or compact pyrolysis platforms allows facilities to adjust output in response to grid signals and fuel price fluctuations. Incorporating battery energy storage at biomass sites can further enhance dispatch value, as demonstrated by installations adjacent to conventional biomass plants in Europe and the United States.

Strategic engagement with regulatory bodies to advocate for stable carbon pricing and performance-based incentives will fortify project economics. Industry leaders should participate in policy forums to shape next-generation credits tied to lifecycle emissions and to support the adoption of carbon capture technologies, thereby positioning biomass power as a credible negative emissions pathway in long-term decarbonization strategies.

Finally, forging cross-sector partnerships to integrate heat and fuel co-production can unlock new revenue streams. Collaborative ventures with chemical manufacturers for bio-oil feedstock and district heating networks for steam services can enhance asset utilization, strengthen community engagement, and deliver measurable sustainability outcomes.

Detailing Rigorous Research Methodology Incorporating Primary Interviews, Secondary Data Sources, and Analytical Frameworks Underpinning Insights on Biomass Power Generation

This research employs a rigorous, multi-tiered methodology to ensure comprehensive and unbiased analysis. Primary data was gathered through in-depth interviews with C-suite executives, technology providers, and policy experts across North America, Europe, and Asia-Pacific, capturing strategic perspectives on market drivers, regulatory shifts, and technology roadmaps.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biomass Power Generation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biomass Power Generation Market, by Feedstock

- Biomass Power Generation Market, by Conversion Technology

- Biomass Power Generation Market, by Capacity Class

- Biomass Power Generation Market, by End Use

- Biomass Power Generation Market, by Region

- Biomass Power Generation Market, by Group

- Biomass Power Generation Market, by Country

- United States Biomass Power Generation Market

- China Biomass Power Generation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Summarizing the Key Takeaways and Conclusive Reflections on the Current State, Challenges, and Future Prospects of Biomass Power Generation

In summary, biomass power generation occupies a pivotal role in the global energy transition, offering dispatchable renewable capacity, enhanced grid stability, and rural economic benefits. While its share of global electricity generation remains modest, steady growth and advancements in conversion technologies have positioned biomass as a versatile complement to intermittent wind and solar. However, tariff escalations and evolving policies underscore the importance of adaptive feedstock strategies and active regulatory engagement.

Engaging with Associate Director of Sales and Marketing to Secure Comprehensive Biomass Power Generation Market Report and Drive Informed Decision Making

Secure your strategic advantage in the biomass power generation sector by engaging directly with Ketan Rohom, Associate Director, Sales & Marketing. Tap into a comprehensive, actionable market research report designed to illuminate critical industry insights, emerging opportunities, and competitive intelligence tailored to your executive needs. Reach out today to obtain detailed analysis on transformative shifts, tariff implications, segmentation breakdowns, and regional dynamics to inform your investment decisions and operational strategies with unparalleled depth and clarity.

- How big is the Biomass Power Generation Market?

- What is the Biomass Power Generation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?