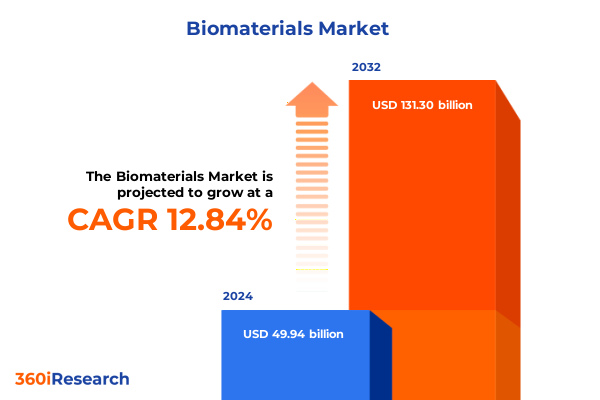

The Biomaterials Market size was estimated at USD 56.07 billion in 2025 and expected to reach USD 63.02 billion in 2026, at a CAGR of 12.92% to reach USD 131.30 billion by 2032.

Exploring the Vital Role and Dynamic Evolution of Biomaterials in Transforming Modern Healthcare and Medical Technology for Strategic Growth

The biomaterials sector stands at the convergence of science and medicine, evolving rapidly to meet the growing demand for advanced medical solutions. As healthcare systems grapple with aging populations and rising incidences of chronic diseases, biomaterials are crucial for developing implantable devices, regenerative therapies, and drug delivery platforms. This intersection of demographic trends, technological breakthroughs, and heightened patient expectations has transformed biomaterials into a strategic focus for R&D in both public and private sectors. Continued investment in this field underscores its pivotal role in addressing complex medical challenges.

International collaboration among research institutions, manufacturers, and healthcare providers has expanded the scope of biomaterials applications. Innovative partnerships have driven significant progress in tailoring materials’ biocompatibility, mechanical properties, and degradation profiles to specific clinical needs. In turn, these advances have accelerated regulatory approvals and fostered the adoption of novel solutions in cardiovascular, orthopedic, dental, and wound healing specialties. By bridging the gap between laboratory findings and real-world outcomes, the industry is poised for exponential growth amidst evolving clinical demands.

Unveiling the Revolutionary Technologies and Interdisciplinary Collaborations Driving the Biomaterials Industry into a New Era of Patient-Centric Solutions

Biomaterials innovation has ushered in a new era of regenerative medicine, where the combination of stem cell science and tissue engineering enables the restoration of damaged tissues and organs. Breakthroughs in 3D bioprinting now allow for the fabrication of patient-specific scaffolds that guide cellular growth and mimic natural extracellular matrices, enhancing integration and clinical success rates. These capabilities extend across orthopedics, cardiovascular, and dental applications, fundamentally reshaping treatment paradigms by prioritizing restoration over replacement.

Parallel to regenerative strides, nanotechnology is redefining biomaterials’ functional potential. By incorporating nanoparticles and nanoscale surface modifications, developers can achieve targeted drug delivery, controlled release kinetics, and enhanced bioactivity. Such precision-engineered constructs improve therapeutic outcomes while minimizing systemic side effects. For instance, nanocarriers embedded within hydrogels facilitate localized, sustained release of growth factors, accelerating wound healing and tissue regeneration processes.

Sustainability has also become central to biomaterials research, as environmental considerations drive the adoption of biodegradable and renewable materials. Innovations in molecular design and green bioprocessing aim to reduce carbon footprints and medical waste, aligning material lifecycles with circular economy principles. Plant-derived polymers and microbial fermentation techniques are emerging as viable alternatives to petrochemical-based inputs, enabling safer, eco-friendly solutions for both implantable and disposable medical products.

Moreover, the integration of artificial intelligence and data-driven methodologies is accelerating material discovery and optimization. Predictive algorithms analyze complex datasets to identify promising molecular structures and predict biocompatibility, biodegradation rates, and mechanical performance. This digital transformation not only streamlines R&D timelines but also enhances the reproducibility and reliability of novel biomaterials, paving the way for next-generation medical technologies.

Assessing the Far-Reaching Effects of 2025 U.S. Tariff Policies on Biomaterials Supply Chains Innovation and Cost Structures

In early 2025, the U.S. government’s announcement of phased tariffs on pharmaceutical imports and critical raw materials has introduced new considerations for biomaterials supply chains. Under this policy, active pharmaceutical ingredients (APIs) and key drug intermediates sourced from China are subject to a 25% duty, while those from India face a 20% levy. Packaging materials and lab instruments imported from leading manufacturing hubs incur a 15% tariff, further elevating production expenses for biologics and advanced therapies.

Industry surveys reveal that this tariff structure could precipitate widespread operational shifts. A Biotechnology Innovation Organization membership poll found nearly 90% of U.S. biotech companies rely on imported components for at least half of their FDA-approved products, signaling significant vulnerability to import duties. Furthermore, 94% of firms anticipate increased manufacturing costs if tariffs on European Union imports take effect, and half report they may need to rework regulatory submissions to accommodate new sourcing strategies.

Beyond immediate cost pressures, the implementation timeline underscores logistical challenges. Companies typically require 12 to 24 months to qualify alternative suppliers and adjust production workflows. Experts caution that the phased approach-starting with modest tariff rates and scaling to potentially 200% over the next year-may incentivize reshoring of key manufacturing nodes, yet the transition could disrupt R&D pipelines and delay product launches. Ultimately, these measures aim to stimulate domestic capacity, but they also demand robust risk mitigation and strategic sourcing initiatives within the biomaterials sector.

Deciphering the Multifaceted Segmentation Framework That Defines Biomaterials Market Dynamics Across Types Classifications End Users and Applications

The market’s complexity is best understood through a granular examination of material types, where ceramics, metals, natural polymers, and synthetic polymers each play distinct roles. In the ceramics segment, innovation has centered on alumina for load-bearing implants, bioglass for bone regeneration, hydroxyapatite coatings to enhance osseointegration, and zirconia for dental prosthetics. Metallic biomaterials-ranging from titanium alloys to stainless steel-offer robust mechanical strength for orthopedic and cardiovascular devices. Natural polymers such as collagen and chitosan provide biocompatible scaffolds, while synthetic polymers like Polycaprolactone, Polyglycolic acid, Polylactic acid, Polylactic-co-glycolic acid, Polyethylene, Polypropylene, Polyurethane, and Polyvinyl alcohol enable precise control over degradation rates and mechanical properties, supporting applications from drug carriers to tissue engineering matrices.

Classification-based segmentation further clarifies material functionalities, distinguishing bioactive materials that actively promote tissue repair, biocompatible materials designed to minimize immunogenic responses, and bioinert materials that maintain structural integrity without eliciting biological reactions. This delineation informs both regulatory pathways and clinical deployment, guiding developers in selecting the optimal substrate for targeted therapeutic outcomes.

End-user perspectives shed light on market adoption patterns, as biotechnology companies drive early-stage research and product development, hospitals integrate biomaterials into surgical and interventional procedures, research laboratories validate novel constructs, and specialty clinics offer niche applications such as ophthalmic implants and advanced wound care. Each stakeholder group exerts unique demands, from precision-engineered devices to customizable, point-of-care solutions, shaping the evolution of biomaterials portfolios.

Application-driven insights highlight the diverse clinical domains supported by biomaterials. Cardiovascular innovations span guidewires, implantable defibrillators, pacemakers, sensors, stents, and vascular grafts; dental solutions encompass bone graft substitutes, dental implants, membranes, and regenerative scaffolds; orthopedic products include resorbable fixation devices, joint replacement materials, orthobiologics, spinal implants, and viscosupplements; urinary devices address reconstructive needs; and wound healing leverages adhesion barriers, fracture healing technologies, internal tissue sealants, skin substitutes, and surgical hemostats. This multifaceted framework underscores biomaterials’ centrality across medical specialties and treatment modalities.

This comprehensive research report categorizes the Biomaterials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Classification

- End User

- Application

Analyzing Regional Market Nuances Highlighting Americas Europe Middle East Africa and Asia-Pacific Opportunities and Challenges

Regional dynamics reveal distinct drivers and challenges. In the Americas, strong healthcare infrastructure, robust R&D funding, and a mature regulatory environment facilitate rapid adoption of advanced biomaterials. Leading academic and commercial institutions collaborate closely to translate bench research into clinical innovations. Conversely, pricing pressures and reimbursement complexities in the U.S. create a cautious landscape for novel product launches, prompting strategic alliances and value-based contracting models.

Europe, Middle East & Africa presents a heterogeneous market where regulatory harmonization under the European Medical Device Regulation (MDR) supports cross-border commercialization, yet varying healthcare budgets and procurement policies across member states and emerging economies influence adoption rates. Germany and the UK serve as innovation hubs, while Gulf Cooperation Council countries invest in medical infrastructure to address rising chronic disease burdens.

Asia-Pacific offers dynamic growth opportunities fueled by expanding healthcare access, government incentives for local manufacturing, and rising patient demand for minimally invasive treatments. China, Japan, and Australia lead in R&D investments, while Southeast Asian markets prioritize cost-effective solutions and partnerships with global OEMs. Regulatory frameworks continue to evolve, balancing patient safety with the need to accelerate market entry for breakthrough technologies.

This comprehensive research report examines key regions that drive the evolution of the Biomaterials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Demonstrating Strategic R&D Investments and Partnership Models Shaping the Global Biomaterials Competitive Landscape

Market leadership is characterized by companies that blend deep clinical expertise with agile R&D capabilities. Medtronic distinguishes itself through extensive investments in biomaterials for cardiac and neurological implants, leveraging proprietary polymers and coatings to optimize device performance and longevity. Johnson & Johnson applies its surgical and pharmaceutical heritage to develop advanced biocompatible materials, particularly in orthopedics and dental applications, ensuring robust safety profiles and streamlined regulatory pathways.

Stryker Corporation focuses on bioresorbable materials and surface coatings, improving implant integration and reducing the need for secondary procedures. Zimmer Biomet advances bone graft substitutes and bioactive coatings, with strategic partnerships extending its presence in personalized joint replacement and spinal therapies. Evonik Industries leads in high-performance polymers, driving new frontiers in drug delivery matrices and resorbable implants through sustainable production processes.

Beyond established players, innovative specialty firms are reshaping the landscape. DSM Biomedical harnesses biotechnology to engineer collagen-based scaffolds for soft tissue repair, while Corbion advances polylactic acid biomaterials for controlled drug release. Terumo Corporation and Invibio Ltd. introduce novel PEEK-based materials for cardiovascular and spinal applications, respectively, reflecting the ongoing convergence of materials science and clinical insights.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biomaterials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aroa Biosurgery Limited

- BASF SE

- Berkeley Advanced Biomaterials Inc.

- Bezwada Biomedical, LLC

- Carpenter Technology Corporation

- Celanese Corporation

- CoorsTek, Inc.

- Corbion N.V.

- Covestro AG

- Dentsply Sirona Inc.

- DSM-Firmenich AG

- Evonik Industries AG

- Exactech, Inc.

- Heraeus Holding GmbH

- Invibio Limited

- Medtronic plc

- Modern Meadow, Inc.

- MycoWorks, Inc.

- Noble Biomaterials, Inc.

- Smith & Nephew plc

- Stryker Corporation

- TissueForm, Inc.

Implementing Strategic Imperatives to Optimize Supply Chains Enhance Sustainability and Accelerate Innovation in the Biomaterials Sector

Industry leaders must prioritize supply chain resilience by diversifying sourcing strategies and engaging in nearshoring initiatives where feasible. Building relationships with multiple raw material suppliers across geographies reduces exposure to similar tariff regimes and geopolitical disruptions. Concurrently, establishing long-term procurement agreements can stabilize input costs and secure consistent quality, enabling uninterrupted production cycles.

Advancing sustainability requires integrating life cycle assessments early in material development. Companies should adopt biodegradable and bio-derived feedstocks while implementing circular design principles to minimize waste. Partnering with academic institutions and green technology startups can accelerate access to cutting-edge processes such as Bioprocessing 4.0, enhancing manufacturing efficiency and reducing environmental impact.

To harness digital acceleration, organizations must embed AI and machine learning tools across R&D and quality control workflows. Predictive modeling with advanced analytics can optimize material formulations, expedite regulatory submissions, and improve batch-to-batch consistency. Investing in digital twins and simulation platforms enables scenario planning for cost, performance, and supply chain variables, ensuring rapid adaptation to evolving market and policy landscapes.

Detailing Rigorous Research Methodology Leveraging Primary Interviews Secondary Data Analysis and Triangulation to Ensure Insightful Market Intelligence

This report synthesizes insights from extensive primary research conducted with senior executives across leading biomaterials manufacturers, healthcare providers, and academic centers. Over 50 in-depth interviews illuminated decision-making processes, innovation drivers, and market barriers. Secondary research encompassed analysis of peer-reviewed journals, regulatory filings, patent databases, and trade publications to validate trends and benchmark best practices.

Data triangulation techniques were employed to reconcile qualitative input with quantitative indicators, ensuring robustness and reliability. Segmentation frameworks were developed to capture the nuances of material types, classification categories, end-user segments, and application areas. Regional analyses draw on government statistics, healthcare expenditure reports, and import-export data to contextualize market dynamics. Rigorous validation rounds with industry experts further refined the findings and strengthened the report’s strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biomaterials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biomaterials Market, by Type

- Biomaterials Market, by Classification

- Biomaterials Market, by End User

- Biomaterials Market, by Application

- Biomaterials Market, by Region

- Biomaterials Market, by Group

- Biomaterials Market, by Country

- United States Biomaterials Market

- China Biomaterials Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Perspectives Emphasizing the Strategic Imperatives and Future Trajectories Shaping the Next Phase of Biomaterials Market Evolution

In conclusion, the biomaterials industry is undergoing a profound transformation driven by technological convergence, sustainability imperatives, and evolving healthcare demands. The interplay of regenerative medicine, nanotechnology, and digital methodologies is creating unprecedented opportunities to develop safer, more effective, and patient-tailored solutions. Market participants that successfully navigate tariff challenges, optimize supply chain strategies, and capitalize on regional growth pockets will secure leadership positions in this dynamic environment.

As competition intensifies and regulatory landscapes evolve, agility and innovation remain paramount. Organizations must foster interdisciplinary collaboration, invest in next-generation materials, and embrace data-driven R&D paradigms to sustain momentum. The strategic insights and actionable recommendations presented herein provide a comprehensive roadmap for stakeholders aiming to drive growth and deliver transformative clinical outcomes.

Take Action Today Engage with Ketan Rohom to Access In-Depth Biomaterials Market Insights and Secure Your Competitive Advantage

Harness in-depth insights, strategic analysis, and comprehensive benchmarking data to guide your organization’s growth trajectory. Reach out to Associate Director, Sales & Marketing, Ketan Rohom, to unlock tailored intelligence that aligns with your goals and enables you to navigate the complexities of the biomaterials landscape with confidence. Secure your copy of the full report today and position your team at the forefront of innovation and market leadership.

- How big is the Biomaterials Market?

- What is the Biomaterials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?