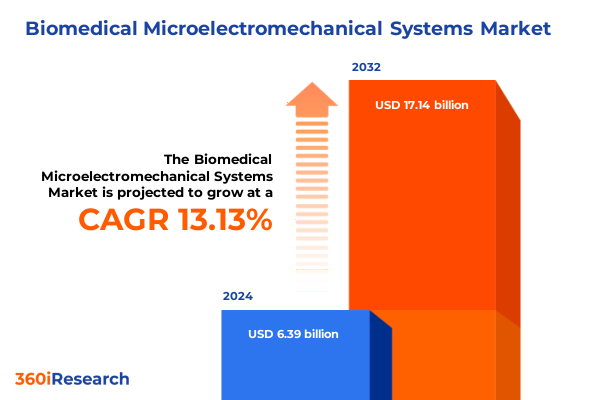

The Biomedical Microelectromechanical Systems Market size was estimated at USD 7.11 billion in 2025 and expected to reach USD 7.92 billion in 2026, at a CAGR of 13.38% to reach USD 17.14 billion by 2032.

Pioneering the Intersection of Microengineering and Medicine to Propel Next-Generation Biomedical Innovations for Enhanced Patient Outcomes

Biomedical microelectromechanical systems, often referred to as biomedical MEMS, represent the convergence of microscale engineering and life sciences to create devices capable of diagnosing, monitoring, and treating a wide array of health conditions with unprecedented precision. Over recent years, advancements in microfabrication, materials science, and biocompatible integration have accelerated the translation of MEMS technologies from conceptual prototypes to clinically validated solutions. Driven by the imperative to improve patient care, manufacturers are leveraging these miniature sensors and actuators to develop devices that are smaller, smarter, and more energy-efficient than ever before.

As the demand for point-of-care diagnostics and minimally invasive therapeutic systems continues to grow, the biomedical MEMS field has become a focal point for both established medical device corporations and emerging startups. Strategic partnerships between academic research institutes and industry have facilitated breakthroughs in areas such as microfluidic sample handling and implantable drug delivery, leading to more responsive and personalized interventions. In parallel, innovations in wireless communication and power management have enabled the development of wearable and ingestible devices that gather critical physiological data in real time, offering new pathways for remote patient monitoring and preventive care.

The following report delivers an in-depth examination of the transformative forces at play within the biomedical MEMS ecosystem. It outlines the regulatory, technological, and commercial drivers shaping the industry, uncovers the impact of recent policy changes, and provides a detailed analysis of market segments, regional dynamics, and competitive strategies. By synthesizing these insights, this executive summary equips decision-makers with the context and clarity needed to navigate a rapidly evolving landscape and to identify opportunities for differentiation and growth.

Unveiling Disruptive Technological Advances and Cross-Sector Collaborations Reshaping the Biomedical MEMS Ecosystem Beyond Conventional Boundaries

In the span of just a few years, the biomedical MEMS landscape has undergone profound changes fueled by the integration of artificial intelligence, the evolution of microfluidics, and the widespread adoption of advanced packaging techniques. These shifts have enabled devices to process complex biochemical signals on-chip, reducing latency and enhancing diagnostic accuracy. Concurrently, the emergence of novel materials-such as biocompatible polymers and silicon-based nanostructures-has expanded the performance envelope of sensors, allowing for greater sensitivity and reduced power consumption.

Furthermore, the collaborative convergence of semiconductor foundries with life science labs has accelerated prototyping cycles, enabling rapid iteration and customization of device features. This has been complemented by an increased focus on standardizing microfabrication workflows and validation protocols, which has helped to lower barriers to market entry for new players. As a result, the ecosystem is witnessing a democratization of technology, with startups and academic innovators now capable of bringing complex MEMS solutions to clinical readiness in shorter timeframes and at lower cost.

Alongside technological progress, the digital health movement has injected fresh momentum into the sector, as data-driven insights gleaned from wearable and implantable MEMS devices feed into predictive analytics platforms and electronic health records. This holistic integration is fostering a more proactive model of healthcare delivery, in which continuous monitoring and early warning systems help to preempt adverse events. As these transformative trends continue to unfold, the biomedical MEMS field is poised to redefine standards of patient care across multiple therapeutic areas.

Assessing the Comprehensive Repercussions of 2025 United States Tariff Adjustments on Biomedical MEMS Supply Chains and Regulatory Compliance Landscape

The enactment of new United States tariff measures in early 2025 introduced a complex set of challenges for manufacturers and suppliers operating within the biomedical MEMS supply chain. By imposing additional duties on critical wafers, substrates, and specialized packaging materials, these policy adjustments have shifted cost structures and prompted companies to reevaluate sourcing strategies. In response, many firms have accelerated efforts to localize production and build domestic partnerships, thereby reducing exposure to international trade fluctuations while maintaining supply chain integrity.

Simultaneously, regulatory authorities have signaled a willingness to provide expedited guidance and streamlined review processes for MEMS-based medical devices deemed critical for public health. This regulatory pragmatism has encouraged investments in U.S.-based pilot facilities, enabling faster clinical validation and market entry. However, the combined effects of increased input costs and evolving compliance requirements have underscored the importance of robust risk management frameworks. Organizations that swiftly adapted by diversifying supplier portfolios or renegotiating long-term contracts have been better positioned to mitigate margin pressures and maintain production continuity.

Looking ahead, the cumulative impact of these tariff measures is likely to catalyze a gradual reshaping of the global MEMS manufacturing landscape. While short-term cost headwinds are evident, strategic realignment toward resilient, geographically diversified operations is expected to yield long-term benefits in terms of supply chain reliability and regulatory alignment. In this context, agility and proactive policy engagement will be decisive factors in securing competitive advantage.

Deciphering Multifaceted Segment Dynamics through Device Typology Application Domains and End User Diversity within the Biomedical MEMS Arena

The biomedical MEMS market encompasses a diverse array of device types, each tailored to specific sensing or actuation functions. Within the accelerometer segment, capacitive designs dominate momentum sensing applications while piezoelectric and piezoresistive variants excel in dynamic impact detection and force measurement, respectively. Flow sensor technologies leverage principles of differential pressure, thermal conductivity, and ultrasound to deliver precise fluidic monitoring, whereas gyroscopic solutions utilize fiber-optic and vibratory mechanisms for angular rate detection in surgical navigation and motion-control tools. Microfluidic devices span droplet manipulation, lab-on-a-chip systems, and microneedle arrays, enabling refined sample handling and minimally invasive drug administration. Similarly, pressure sensors are engineered as absolute, differential, or gauge configurations, addressing requirements from intracranial monitoring to blood pressure surveillance.

Application domains further categorize opportunities, with diagnostic equipment ranging from high-resolution imaging modalities to laboratory analyzers and point-of-care testing kits. Drug delivery systems include implantable and insulin pumps as well as cutting-edge microneedle patches, each designed for controlled release and patient comfort. Monitoring devices, such as continuous glucose monitors, cardiac telemetry units, and cuffless blood pressure monitors, provide clinicians and patients with real-time physiological data. Beyond these, surgical tool integration and tissue engineering platforms leverage MEMS actuators and sensors to enhance procedural precision and support regenerative medicine workflows.

End-user segmentation captures the spectrum of market participants, from academic and research institutes driving early-stage innovation to diagnostic laboratories that validate performance under clinical conditions. Hospitals and clinics represent the primary channel for device implementation, while pharmaceutical and biotechnology companies apply MEMS technology in drug discovery, formulation, and delivery research. Understanding these nuanced segment dynamics is critical for stakeholders seeking to align product development roadmaps with the precise needs of each cohort.

This comprehensive research report categorizes the Biomedical Microelectromechanical Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Application

- End User

Exploring Regional Nuances and Strategic Opportunities across the Americas Europe Middle East Africa and Asia-Pacific Markets Regions Driving Innovation and Investment in Precision Medical Devices

Regional dynamics within the biomedical MEMS sector reflect a balance of research excellence, manufacturing capability, and evolving regulatory landscapes. In the Americas, a robust network of semiconductor foundries and medical device clusters has fostered a fertile environment for innovation, with government-backed grants and public-private partnerships stimulating the commercialization of lab-on-chip platforms and wearable diagnostics. North American regulatory bodies have adopted adaptive guidelines that facilitate accelerated submission pathways for microdevice applications deemed critical for patient safety.

Overlapping with Europe, the Middle East, and Africa, regulatory harmonization efforts and pan-regional testing standards have streamlined cross-border device approvals. European consortia emphasize sustainability in manufacturing, integrating green microfabrication techniques and recyclable materials into MEMS production. Meanwhile, Middle Eastern healthcare investments are channeling resources into large-scale clinical trials and demonstration centers, supporting adoption in emerging markets. Across Africa, collaborative networks between universities and global device manufacturers are bridging infrastructure gaps and accelerating local capacity building.

Asia-Pacific stands out for its expansive manufacturing ecosystems and cost-competitive supply chains. Leading economies have scaled microfabrication facilities to serve both domestic and export markets, with significant government incentives directed toward advanced packaging and wafer-level integration. In parallel, a surge of clinical research activity in this region is validating next-generation microneedle arrays and microfluidic point-of-care assays. The interplay between manufacturing prowess and clinical demand has positioned the Asia-Pacific region as a critical node in global biomedical MEMS innovation.

This comprehensive research report examines key regions that drive the evolution of the Biomedical Microelectromechanical Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leadership Strategies and Collaborations among Pioneering Corporations Shaping the Competitive Landscape of Biomedical MEMS Technologies

A select group of technology and medical device leaders has emerged at the forefront of the biomedical MEMS revolution by blending deep engineering expertise with strategic investments in clinical validation. Global semiconductor firms have extended their roadmaps to include biocompatible MEMS foundry services, partnering with healthcare organizations to co-develop tailored sensor arrays and microactuator modules. This trend has lowered the barrier for medical OEMs to integrate MEMS capabilities without incurring the full cost of in-house fabrication.

Concurrently, leading medical device companies have internalized MEMS competence by acquiring specialized startups, thereby gaining proprietary microfluidics platforms and advanced packaging processes. Such acquisitions have enabled rapid expansion of implantable and wearable product lines, while also providing established firms with nimble development teams versed in agile microfabrication techniques. Strategic alliances between research universities and industry players continue to play a pivotal role in advancing proof-of-concept devices through early clinical trials.

Beyond tier-one players, a network of mid-sized specialists and engineering consultancies offers bespoke MEMS design services, facilitating the translation of niche applications-such as precision surgical tools and tissue scaffold sensors-into viable prototypes. These companies excel at bridging market gaps, often pioneering disruptive solutions that are later adopted or acquired by larger corporations. Together, these diverse stakeholders are shaping a competitive landscape marked by collaboration, vertical integration, and open innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biomedical Microelectromechanical Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analog Devices, Inc.

- Analog Devices, Inc.

- Bluechiip Ltd

- Danaher Corporation

- Debiotech SA

- Flexpoint Sensor Systems, Inc.

- Honeywell International Inc.

- Illumina, Inc.

- Integrated Sensing Systems, Inc.

- Knowles Corporation

- MEMSCAP S.A.

- Micronit Microtechnologies B.V.

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors N.V.

- Omron Healthcare Co., Ltd.

- PerkinElmer, Inc.

- Redbud Labs, Inc.

- Robert Bosch GmbH

- Sensirion AG

- STMicroelectronics N.V.

- TDK Corporation

- Teledyne Technologies Incorporated

- uFluidix Inc.

- Zurich Instruments AG

Prescriptive Strategic Initiatives and Operational Best Practices to Advance Innovation Commercialization and Regulatory Readiness in Biomedical MEMS Development

Industry leaders seeking to capitalize on emerging opportunities in the biomedical MEMS domain should prioritize investments in modular design frameworks and platform standardization. By adopting reuse-oriented architectures and interoperable interfaces, organizations can accelerate iteration cycles and reduce validation overhead. Furthermore, establishing multi-tiered supply chain partnerships-ranging from raw wafer suppliers to specialized packaging houses-enables greater agility in responding to material shortages or policy changes. Continuous engagement with regulatory agencies ensures early alignment on device classification, risk mitigation strategies, and clinical endpoints.

In parallel, forging alliances with academic institutions and clinical research networks will be crucial for co-developing proof-of-concept devices and generating real-world evidence. Collaborative pilot programs can validate performance under diverse patient demographics, building a robust data package to inform regulatory submissions. Similarly, embedding data analytics and secure connectivity into MEMS platforms paves the way for remote monitoring services, enabling subscription-based care models and recurring revenue streams. Embracing digital twins and in silico modeling can further streamline product optimization, reducing prototyping costs and time to clinic.

Finally, cultivating a culture of cross-functional innovation-where engineering, regulatory, and clinical teams collaborate from project inception-will be a key differentiator. This integrated approach fosters holistic risk assessment, prioritizes user-centric design, and ensures that emerging technologies meet both technical specifications and patient needs. By aligning strategic initiatives with operational excellence, companies can secure a leadership position in the rapidly evolving world of biomedical MEMS.

Outlining Rigorous Research Protocols Frameworks Data Collection Techniques and Validation Criteria Underpinning the Biomedical MEMS Market Intelligence Report

The insights presented in this report are grounded in a rigorous multi-phase research methodology combining primary and secondary data sources. Initially, a comprehensive review of peer-reviewed journals, patent filings, and regulatory whitepapers provided foundational context on the latest materials science breakthroughs, microfabrication techniques, and clinical validation protocols. This literature review guided the development of structured interview guides and survey instruments.

Subsequently, in-depth interviews were conducted with a curated panel of industry stakeholders, including MEMS foundry executives, medical device R&D leaders, and regulatory consultants. These conversations yielded qualitative insights into supply chain challenges, regulatory priorities, and innovation roadmaps. Complementing these interviews, quantitative surveys collected feedback from end-users-such as hospital biomedical engineers and diagnostic laboratory directors-on device performance requirements and adoption barriers.

To ensure data integrity, all findings were subjected to triangulation and validation checks. Contradictory or outlier data points were examined through follow-up interviews and cross-referencing with secondary market reports. The final stage involved a peer review process by subject matter experts in microfluidics, sensor integration, and healthcare economics, resulting in a robust and unbiased synthesis of market intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biomedical Microelectromechanical Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biomedical Microelectromechanical Systems Market, by Device Type

- Biomedical Microelectromechanical Systems Market, by Application

- Biomedical Microelectromechanical Systems Market, by End User

- Biomedical Microelectromechanical Systems Market, by Region

- Biomedical Microelectromechanical Systems Market, by Group

- Biomedical Microelectromechanical Systems Market, by Country

- United States Biomedical Microelectromechanical Systems Market

- China Biomedical Microelectromechanical Systems Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1908 ]

Concluding Synthesis of Market Dynamics Technological Trends and Strategic Imperatives to Guide Stakeholder Decisions in Biomedical MEMS

This executive summary has presented a comprehensive view of the biomedical MEMS ecosystem, tracing the trajectory from foundational microengineering advances to the regulatory and commercial forces shaping today’s market. Transformative shifts, including the integration of smart analytics and microfluidic innovation, are redefining the roles that MEMS devices play in diagnostic, monitoring, and therapeutic applications. Meanwhile, the 2025 tariff adjustments have underscored the critical importance of supply chain resilience and domestic production capabilities.

A nuanced segmentation analysis reveals how device typologies-ranging from accelerometers and gyroscopes to pressure and flow sensors-align with diverse application areas such as diagnostic imaging, drug delivery, and continuous health monitoring. Regional insights highlight the strategic interplay between innovation hubs in the Americas, regulatory harmonization in Europe, and manufacturing scale in the Asia-Pacific. Leadership strategies observed among key players emphasize partnerships, acquisitions, and platform standardization as drivers of competitive advantage.

As the field continues to mature, stakeholders must balance rapid technological iteration with robust validation pathways, ensuring that next-generation MEMS devices meet both clinical requirements and patient expectations. The path forward lies in fostering integrations across engineering, data analytics, and regulatory domains, allowing for seamless translation of emerging microtechnologies into scalable healthcare solutions. This conclusion underscores the imperative for proactive strategy formulation, collaborative innovation, and a relentless focus on user-centric design.

Engage Directly with Associate Director of Sales and Marketing to Secure Comprehensive Insights and Customizable Solutions for Biomedical MEMS Research

For tailored guidance on harnessing the strategic insights and actionable intelligence presented in this report, engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, whose expertise spans the biomedical MEMS domain. Ketan can provide personalized demonstrations, discuss custom research packages, and facilitate executive briefings that align precisely with organizational priorities. Whether you seek deeper analysis of specific device segments, competitive benchmarking, or region-specific intelligence, his consultative approach ensures you receive the right data at the right time to drive critical business decisions. Reach out to explore licensing options, bundle inquiries, or to schedule a private workshop that will empower your team to leverage the full potential of biomedical microelectromechanical systems innovations.

- How big is the Biomedical Microelectromechanical Systems Market?

- What is the Biomedical Microelectromechanical Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?