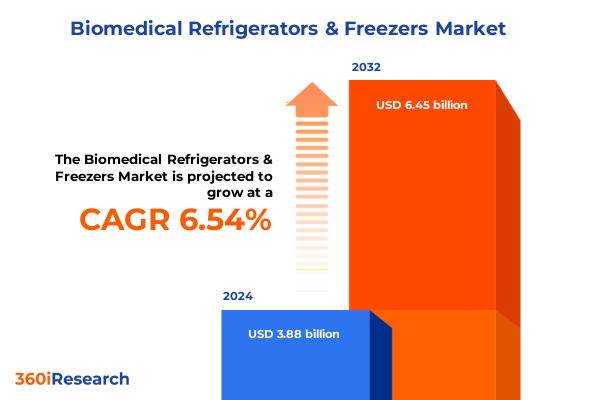

The Biomedical Refrigerators & Freezers Market size was estimated at USD 4.10 billion in 2025 and expected to reach USD 4.34 billion in 2026, at a CAGR of 6.67% to reach USD 6.45 billion by 2032.

Pioneering the Future of Biomedical Refrigeration with Unmatched Reliability, Precision Temperature Control, and Adaptable Storage Solutions

The biomedical refrigeration and freezer sector stands at a pivotal juncture as advances in healthcare and biotechnology coalesce with intensifying requirements for precision and reliability. Driven by an unprecedented surge in the development of biologics, vaccines, and cell- and gene-based therapies, stakeholders are demanding storage solutions that combine stringent temperature control with continuous monitoring. Against this backdrop, the conventional boundaries of cold chain logistics are being redefined, compelling manufacturers and end users to adopt sophisticated systems capable of mitigating risk across every stage of the storage cycle.

Amid mounting complexity, technological innovation is reshaping expectations for equipment performance. Cutting-edge diagnostic laboratories and research facilities now require integrated platforms that provide real-time data analytics, self-diagnostic functionality, and remote connectivity. These advancements not only streamline operational workflows, but also enhance regulatory compliance by ensuring traceability and audit readiness. As healthcare delivery models evolve toward decentralized and point-of-care applications, the flexibility and scalability of refrigeration units will determine the agility of clinical operations and research programs alike.

Moreover, sustainability considerations have gained prominence, prompting a shift toward greener refrigerants, energy-efficient compressors, and modular designs that optimize footprint utilization. Regulatory frameworks emphasizing environmental impact and safety standards are further catalyzing adoption of next-generation refrigeration technologies. Consequently, organizations across blood banks, diagnostic centers, pharmacies, and research laboratories are reexamining their cold storage strategies to align with emerging performance benchmarks, cost-efficiency targets, and compliance imperatives.

Revolutionary Technological Advancements are Redefining Temperature Management, Efficiency, and Data Visibility in Biomedical Storage Operations

Revolutionary breakthroughs in sensor miniaturization, Internet of Things (IoT) integration, and advanced insulation materials have fundamentally altered the landscape of temperature management within biomedical settings. These innovations enable predictive maintenance through continuous performance monitoring and analytics-driven alerts, effectively reducing unplanned downtime and safeguarding sample integrity. Furthermore, machine learning algorithms are being embedded to anticipate operational anomalies, ensuring proactive interventions that preserve both critical reagents and valuable biological specimens.

In tandem, the adoption of natural and low-global-warming-potential refrigerants marks a decisive step toward environmental stewardship. Manufacturers are leveraging novel compressor configurations and vacuum-insulated panels to achieve superior thermal efficiency, thereby lowering total energy consumption and carbon footprint. This shift not only meets burgeoning sustainability mandates, but also contributes to reduced operational costs over the lifecycle of equipment. As a result, end users are increasingly evaluating refrigeration and freezer systems through a dual lens of performance and ecological impact.

Meanwhile, the emergence of modular, plug-and-play architectures offers unprecedented flexibility in laboratory and clinical workflows. By enabling rapid reconfiguration of storage zones based on fluctuating volume needs or shifting temperature requirements, these adaptable platforms address the dynamic demands of contemporary healthcare and research environments. Consequently, the convergence of connectivity, sustainability, and modularity is setting new benchmarks for what constitutes a high-value refrigeration solution in the biomedical domain.

Escalating Trade Measures and Section 301 Tariffs are Reshaping Import Strategies, Supply Chain Resilience, and Cost Structures for Cold Chain Equipment

In 2025, the escalating scope of Section 301 tariffs and ancillary trade measures has underscored the fragility of global supply chains for biomedical refrigeration equipment. Manufacturers reliant on imported compressors, electronic controls, and specialized insulation materials have encountered elevated input costs, triggering a cascade of pricing adjustments across distribution channels. This environment has compelled both vendors and end users to recalibrate inventory strategies, favoring localized sourcing and just-in-time procurement to mitigate exposure to further tariff fluctuations.

Moreover, the cumulative impact of these tariffs has incentivized domestic production initiatives, with government agencies offering support programs aimed at bolstering manufacturing sovereignty and reducing critical dependencies. While such efforts promise to enhance supply chain resilience over the long term, the transitional phase has introduced complexities in lead times, quality assurance protocols, and component standardization. Consequently, organizations have adopted a more diversified supplier portfolio, balancing established global brands with emerging regional manufacturers capable of delivering responsive support and compliance with tariff regulations.

Furthermore, cost pressures stemming from elevated import duties are accelerating the adoption of advanced design-to-cost methodologies. Engineers and procurement teams are collaborating closely to optimize bill-of-materials configurations, streamline assembly processes, and prioritize materials that fulfill both performance and tariff-related criteria. As a result, the interplay between trade policy and engineering innovation is reshaping how refrigeration and freezer solutions are conceptualized, developed, and delivered across the biomedical sector.

Comprehensive Segmentation Analysis Illuminates Product Categories, Capacity Tiers, Temperature Ranges, and End-User Applications in Biomedical Cold Chain

A detailed examination of product-based segmentation reveals that blood bank refrigerators, chromatography refrigerators, cryogenic freezers, enzyme freezers, liquid nitrogen freezers, pharmacy refrigerators, and plasma freezers each present distinct value propositions and operational prerequisites. Differences in cooling mechanisms, sterile design considerations, and sample preservation protocols dictate the selection criteria for each category. For instance, the ultra-low temperatures required for cryogenic applications demand compressor technologies and insulation materials that differ substantially from those used in standard pharmacy refrigerators.

When evaluating capacity tiers, storage volumes spanning from below 50 liters to above 450 liters influence footprint requirements, energy consumption profiles, and scalability options. Smaller-capacity units offer agility for point-of-care settings and mobile labs, whereas mid-range volumes of 50 to 200 liters and 200 to 450 liters balance compact footprint with moderate throughput demands. Conversely, high-capacity solutions exceeding 450 liters cater to centralized facilities and large-scale biobanking operations where maximum storage density is paramount.

Temperature ranges further segment the market into zones of -150°C to -86°C, -85°C to -40°C, -39°C to 0°C, 1°C to 8°C, and 9°C to 15°C. Each band aligns with specific biological workflows: ultra-low ranges support long-term cryopreservation, mid-level subzero ranges accommodate vaccine and reagent storage, and positive ranges ensure the viability of refrigerated pharmaceuticals and laboratory consumables. Lastly, the diversity of end users-blood banks, diagnostic centers, hospitals, pharmacies, and research laboratories-introduces varying regulatory frameworks, maintenance protocols, and service expectations that shape procurement strategies and product roadmaps.

This comprehensive research report categorizes the Biomedical Refrigerators & Freezers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Capacity

- Temperature Range

- Configuration

- End User

- Sales Channel

Regional Dynamics Across the Americas, EMEA, and Asia-Pacific Reveal Geopolitical, Infrastructure, and Regulatory Factors Shaping Equipment Adoption Rates

Regional dynamics vary significantly across the Americas, EMEA, and Asia-Pacific, reflecting disparate healthcare infrastructures, economic development stages, and regulatory landscapes. In North America, stringent mandates for biopharmaceutical storage and robust reimbursement frameworks support the adoption of high-end refrigeration systems featuring advanced monitoring and environmental controls. By contrast, Latin American markets emphasize cost-effective refrigeration solutions with simplified maintenance requirements to navigate logistical challenges and limited technical service networks.

Within Europe, Middle East & Africa, regulatory harmonization efforts and environmental legislation are propelling the transition to low-emission refrigerants and energy-efficient compressor designs. Countries in Western Europe are pioneering laboratory automation and digital integration, whereas emerging markets in Eastern Europe and parts of the Middle East require tailored offerings that balance budget constraints with compliance needs. In Africa, infrastructure variability and fluctuating power supply drive demand for hybrid systems equipped with backup power capabilities.

Meanwhile, Asia-Pacific exhibits a heterogeneous landscape where advanced economies such as Japan, South Korea, and Australia prioritize precision engineering and integration with laboratory information management systems, while rapidly growing markets in Southeast Asia and India focus on modular, scalable refrigeration platforms that can be expanded as research and healthcare capacities evolve. Across these regions, strategic partnerships with local distributors and service providers play a pivotal role in ensuring equipment uptime and regulatory alignment.

This comprehensive research report examines key regions that drive the evolution of the Biomedical Refrigerators & Freezers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

In-Depth Competitive Landscape Examines Leading Manufacturers’ Strategic Alliances, Innovative Product Launches, and Methods for Differentiation in Cold Storage

Leading manufacturers in the biomedical refrigeration and freezer sector are forging strategic collaborations, pursuing targeted product enhancements, and refining distribution networks to secure competitive differentiation. Partnerships with sensor technology companies are enabling real-time condition monitoring and predictive analytics, while alliances with logistics providers streamline cold chain validation and compliance reporting. These cooperative endeavors underscore a broader industry shift toward holistic, end-to-end storage solutions that extend beyond standalone equipment offerings.

Simultaneously, companies are unveiling next-generation product portfolios that incorporate ultra-low vibration platforms for sensitive cell-based samples, antimicrobial interior surfaces to reduce contamination risk, and modular shelving systems designed for rapid reconfiguration. To bolster market presence, several players have expanded their service capabilities, establishing regional centers of excellence for calibration, maintenance, and validation support. This approach not only enhances customer satisfaction, but also fosters long-term service contracts that reinforce recurring revenue streams.

Moreover, competitive dynamics are further influenced by selective mergers and acquisitions aimed at augmenting technological capabilities and expanding geographic reach. Through these strategic transactions, market participants are integrating niche refrigeration technologies-such as magnetic cooling and phase-change materials-into their existing lines, while gaining access to specialized distribution channels in underserved markets. Collectively, these corporate strategies are driving a nuanced competitive landscape characterized by both consolidation and targeted innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biomedical Refrigerators & Freezers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accucold by Felix Storch, Inc.

- Aegis Scientific

- Alphatec Scientific E.I.R.L.

- Arctiko A/S by ICM Holdco III Corp.

- B Medical Systems S.à r.l. by Azenta, Inc.

- Binder GmbH

- Biobase Biodusty(Shandong), Co., Ltd.

- Cardinal Health, Inc.

- Dometic Group AB

- Eppendorf SE

- Ethicheck Ltd.

- F.lli Della Marca s.r.l.

- FIOCCHETTI SCIENTIFIC S.R.L.

- Haier Group Corporation

- Helmer Scientific Inc. by Trane Technologies, PLC

- ilShinBioBase Co Ltd.

- LEC Medical by Glen Dimplex Group

- Liebherr-International Deutschland GmbH

- Meditech Technologies India Pvt Ltd.

- Middleby Corporation

- Migali Industries Inc.

- PHC Holdings Corporation

- Powers Scientific, Inc.

- Qingdao Antech Scientific Co., Ltd.

- Qingdao Aucma Global Medical Co., Ltd.

- So-Low Environmental Equipment Co., Inc.

- Terumo Corporation

- Thermo Fisher Scientific Inc.

- tritec Gesellschaft für Labortechnik und Umweltsimulation m.b.H

- Vestfrost Solutions

- Zhongke Meiling Cryogenics Co.,Ltd.

Strategic Actions for Industry Leaders to Embrace Technological Innovation, Enhance Operational Resilience, and Capitalize on Biomedical Cold Chain Opportunities

Industry leaders should prioritize investment in IoT-enabled refrigeration solutions that unify environmental monitoring, predictive maintenance, and compliance management within a single digital platform. By doing so, organizations can minimize the risk of sample compromise, optimize maintenance schedules, and enhance audit readiness. Equally important is the pursuit of partnerships with refrigerant and compressor innovators to develop greener, energy-efficient systems that align with evolving sustainability regulations and corporate environmental goals.

In parallel, companies must diversify supply chains to balance localized production with global sourcing, thereby mitigating tariff-related disruptions and ensuring rapid access to critical spare parts. This requires the establishment of multidisciplinary teams that collaborate on vendor assessment, risk modeling, and supply continuity planning. In addition, cultivating a robust service ecosystem-comprising regional calibration, validation, and technical support centers-will be indispensable to delivering differentiated customer experiences and fostering enduring relationships.

Finally, decision-makers should adopt a modular design philosophy that accommodates fluctuating workload demands and evolving storage requirements. Such adaptability not only supports decentralized clinical workflows and emerging research modalities, but also enhances capital efficiency by allowing incremental capacity expansion. This proactive approach will empower organizations to navigate regulatory changes, technological shifts, and market uncertainties with greater agility and confidence.

Rigorous Research Methodology Combines Expert Interviews, Data Triangulation, and Comprehensive Secondary Analysis to Ensure Credibility and Actionable Insights

The foundation of this analysis rests on a rigorous research methodology that integrates both primary and secondary sources to ensure comprehensive coverage and credibility. Extensive interviews were conducted with senior executives, product engineers, supply chain managers, and end-user stakeholders to capture firsthand perspectives on current challenges, technology adoption drivers, and emerging trends. These qualitative insights were complemented by in-depth desk research encompassing peer-reviewed journals, industry whitepapers, regulatory documents, and product specification databases.

Data triangulation techniques were applied to reconcile disparate information streams and validate key findings against multiple reference points. Quantitative inputs-including tariff schedules, energy efficiency metrics, and certification standards-were systematically cross-referenced to ensure alignment with the most recent regulatory updates and industry benchmarks. Additionally, competitive intelligence tools were leveraged to map strategic alliances, product launches, and patent activity, enabling a nuanced understanding of market positioning and innovation trajectories.

Throughout the research process, stringent quality assurance protocols were observed to verify data integrity and analytical rigor. These included peer reviews by subject-matter experts, consistency checks across data sets, and iterative hypothesis testing to refine insights. The resulting framework combines empirical evidence with experiential knowledge, delivering a robust foundation for strategic decision-making in the biomedical refrigeration and freezer domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biomedical Refrigerators & Freezers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biomedical Refrigerators & Freezers Market, by Product

- Biomedical Refrigerators & Freezers Market, by Capacity

- Biomedical Refrigerators & Freezers Market, by Temperature Range

- Biomedical Refrigerators & Freezers Market, by Configuration

- Biomedical Refrigerators & Freezers Market, by End User

- Biomedical Refrigerators & Freezers Market, by Sales Channel

- Biomedical Refrigerators & Freezers Market, by Region

- Biomedical Refrigerators & Freezers Market, by Group

- Biomedical Refrigerators & Freezers Market, by Country

- United States Biomedical Refrigerators & Freezers Market

- China Biomedical Refrigerators & Freezers Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Key Insights to Underscore the Imperative of Innovation, Regulatory Compliance, and Strategic Collaboration in Advancing Biomedical Cold Storage Excellence

By synthesizing multifaceted insights into technology evolution, tariff influences, segmentation dynamics, regional variations, and competitive strategies, this executive summary underscores the necessity of a holistic approach to biomedical cold chain management. Organizations that proactively embrace advanced sensor integration, sustainable refrigerants, and modular design will be well-positioned to meet the stringent demands of biologics and high-value therapeutic workflows. In parallel, targeted supply chain diversification and localized manufacturing initiatives will offer critical insulation against geopolitical and trade-related disruptions.

Looking ahead, the interplay between regulatory compliance requirements and shifting end-user expectations will continue to drive innovation in refrigeration and freezer technologies. Stakeholders must therefore cultivate cross-functional collaboration between R&D, procurement, and validation teams to maintain alignment with evolving standards and performance benchmarks. Moreover, ongoing investments in service infrastructure and digital connectivity solutions will be pivotal in reinforcing operational resilience and ensuring uninterrupted sample integrity.

Ultimately, the organizations that achieve sustainable competitive advantage will be those that integrate strategic foresight with tactical execution-leveraging data-driven insights to refine product roadmaps, optimize resource allocation, and secure enduring customer partnerships. This confluence of innovation, compliance, and customer-centricity will define the next era of excellence in biomedical cold storage solutions.

Elevate Your Decision-Making with Exclusive Market Intelligence by Engaging Ketan Rohom to Access the Comprehensive Biomedical Refrigeration and Freezer Report

For a tailored exploration of strategic opportunities, industry trends, and critical supply chain considerations within the biomedical refrigeration and freezer landscape reach out to Ketan Rohom (Associate Director, Sales & Marketing) to secure exclusive access to the comprehensive market research report. Engage directly to discuss how the insights can be customized to support your organizational objectives, from product development roadmaps to regulatory compliance planning. By partnering with an experienced authority, you will gain an actionable blueprint for enhancing your competitive positioning and driving sustainable growth in an increasingly demanding environment. Connect today to transform data into decisive action and unlock the full potential of the biomedical cold chain sector.

- How big is the Biomedical Refrigerators & Freezers Market?

- What is the Biomedical Refrigerators & Freezers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?