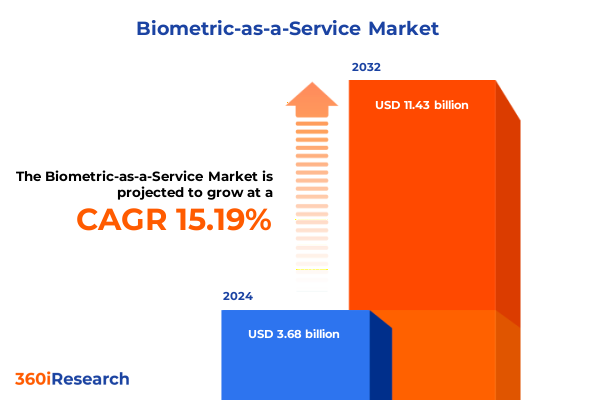

The Biometric-as-a-Service Market size was estimated at USD 4.18 billion in 2025 and expected to reach USD 4.74 billion in 2026, at a CAGR of 15.45% to reach USD 11.43 billion by 2032.

Driving the Future of Security and Convenience with Scalable Cloud-Enabled Biometric-as-a-Service Platforms Transforming Identity Verification and Access Management

As organizations navigate an increasingly complex security landscape, the adoption of Biometric-as-a-Service solutions has emerged as a pivotal enabler of seamless identity verification and access management. This service-oriented model transforms traditional hardware-centric deployments by offering cloud-hosted, subscription-based biometric capabilities that reduce upfront costs and accelerate time to deployment. Consequently, enterprises across sectors are leveraging these scalable platforms to unify authentication workflows and bolster fraud prevention measures without the burden of extensive on-premises infrastructure.

With cyber threats growing in sophistication and regulatory mandates tightening around data protection and user privacy, there is a pressing need for solutions that combine robust security with a frictionless user experience. Biometric-as-a-Service fulfills this need by integrating advanced machine learning algorithms that continually refine recognition accuracy while adhering to evolving compliance frameworks. Moreover, this paradigm shift aligns with broader digital transformation initiatives, empowering organizations to infuse identity intelligence across customer touchpoints and workforce environments.

Through on-demand provisioning and agile service management, these platforms enable organizations to rapidly pilot new modalities, expand to new regions, and adapt to emerging threat vectors. The result is an identity architecture that not only safeguards assets and information but also drives operational efficiency and elevates user satisfaction. As we embark on this executive summary, it becomes evident that Biometric-as-a-Service is not merely a technical offering; it represents a foundational shift in how identity and access are managed in the cloud era.

Navigating the Emergence of AI-Powered Recognition, Frictionless Authentication and Hybrid Deployment Models Revolutionizing the Biometric-as-a-Service Landscape

The landscape of identity management is undergoing profound transformation, driven by breakthroughs in artificial intelligence and the convergence of cloud computing, 5G connectivity, and application programming interfaces. In recent years, the introduction of AI-powered face, voice, and behavioral recognition engines has elevated the precision and resiliency of biometric systems, enabling continuous authentication scenarios that extend beyond one-time login checks. As a result, enterprises are prioritizing frictionless user journeys that maintain stringent security controls, thereby bridging the gap between user experience and risk mitigation.

Furthermore, the growing prevalence of hybrid deployment models has redefined the traditional boundaries between on-premises and fully cloud-native environments. Many organizations are opting for hybrid architectures that house sensitive data within private infrastructure while harnessing the elasticity of public cloud services for intensive compute workloads. This strategic balance not only addresses data sovereignty concerns but also accelerates innovation cycles, allowing service providers to introduce new features, such as passive liveness detection and multi-modal fusion, with minimal operational disruption.

In parallel, the maturation of identity orchestration frameworks has facilitated seamless integration of biometric services with identity and access management ecosystems. This holistic approach empowers security teams to orchestrate adaptive authentication policies, dynamically adjusting requirements based on real-time risk assessments. Collectively, these transformative shifts underscore a new era in which Biometric-as-a-Service is no longer an ancillary offering but a core pillar of modern identity architectures.

Unpacking the Layered Impact of Successive United States Section 301 and Reciprocal Tariffs on Biometric Components and Service Economics in 2025

The cumulative impact of successive United States Section 301 tariff adjustments and reciprocal measures has significantly reshaped the cost structure of biometric component procurement and service delivery in 2025. Beginning January 1, 2025, the Office of the United States Trade Representative elevated duties on imported polysilicon and semiconductor wafers to 50%, a move aimed at safeguarding domestic clean energy and critical technology supply chains under ongoing Section 301 reviews. Prior to this adjustment, semiconductor duties had already doubled to 50% as of August 1, 2024, encompassing a broad spectrum of chips essential for sensor modules and edge computing devices.

Compounding these measures, April 9, 2025 saw the imposition of steep reciprocal tariffs raising duties on China-origin goods by an additional 125%, on top of existing Section 301 and IEEPA levies. This action resulted in effective combined duty rates approaching 170% on select electronic components, critically impacting the price of fingerprint sensors, iris cameras, and voice recognition chips that are frequently sourced from cross-border suppliers. Although targeted exclusions were extended through August 31, 2025, for certain solar and manufacturing equipment, most sensor and microcontroller imports remained subject to the heightened levies, thereby elevating landed costs and compressing margins for as-a-Service offerings.

Amid these escalating trade barriers, service providers have pursued strategic supply chain diversification, redirecting production to Southeast Asia, Latin America, and India to mitigate exposure. They have also reengineered device architectures to leverage alternative materials and regional component ecosystems. Consequently, the incremental tariff burden has been partially absorbed through enhanced operational efficiencies, yet the overall effect remains a key consideration in contract negotiations and pricing models. By understanding these layered trade dynamics, industry stakeholders can anticipate cost trajectories and craft resilient sourcing strategies to sustain service quality and customer value.

Unearthing Critical Insights from Diverse End Users, Modalities and Service Tiers That Define Market Trajectories in Biometric-as-a-Service Applications

When examining market dynamics through the prism of end user adoption, financial institutions are increasingly deploying biometric-as-a-service solutions for customer authentication, while government agencies prioritize robust identity proofing in e-government initiatives. In healthcare, patient safety and regulatory compliance drive investments in touchless modalities, whereas IT and Telecom operators integrate biometric services to secure network access and enhance subscriber experiences. Retailers similarly embrace biometric payments to streamline checkout flows and reduce fraud, demonstrating how each vertical shapes service requirements and growth trajectories.

In parallel, the choice of biometric modality has become a strategic imperative. Facial recognition systems are favored for their versatility in high-traffic environments, and fingerprint authentication retains its appeal for affording strong accuracy at low cost. Iris recognition finds specialized use cases in secure facilities, while voice authentication is gaining traction for remote access and call center verification. Service providers now offer customizable modality bundles to address the nuanced demands of diverse use cases, thereby optimizing both performance and the user journey.

Deployment preferences further refine the market landscape. Organizations seeking rapid scale and minimal capital expenditure gravitate towards cloud-native biometric-as-a-service platforms. Others opt for hybrid frameworks to maintain control over sensitive data while leveraging public cloud compute elasticity during peak loads. Meanwhile, highly regulated enterprises continue to deploy on-premises solutions where data residency and auditability are paramount. These differentiated deployment strategies underscore the importance of flexible service architectures.

Beyond core functionality, the evolution of service offerings has introduced distinct service type tiers. Managed services, whether structured as pay-per-use or subscription models, enable clients to consume biometric capabilities on demand with predictable operational support. Conversely, support and maintenance packages, segmented into breakfix and upgrade tracks, ensure continuity and system evolution. These complementary offerings cater to a spectrum of enterprise sizes, from large organizations requiring full lifecycle management to small and medium enterprises seeking simplified adoption.

Finally, in the realm of authentication mode, continuous authentication delivers persistent risk monitoring, and single-factor methods offer streamlined access. Multi-factor frameworks, encompassing two-factor and three-factor configurations, bolster defense-in-depth strategies where high assurance is critical. By weaving together modality, deployment, service type, enterprise size, and authentication mode, solution providers craft differentiated value propositions that resonate across diverse customer segments.

This comprehensive research report categorizes the Biometric-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Biometric Modality

- Service Type

- Enterprise Size

- Authentication Mode

- End User

- Deployment Mode

Comparative Analysis of Americas, EMEA and Asia-Pacific Ecosystems Highlighting Regional Drivers, Regulatory Dynamics and Adoption Patterns in Biometrics

In the Americas, the biometric-as-a-service market is characterized by robust innovation driven by significant investments in cloud infrastructure and stringent data privacy regulations at state and federal levels. Financial services and retail sectors in North America lead early adoption, buoyed by consumer demand for secure digital interactions. Latin American economies, meanwhile, are forging partnerships with global service providers to modernize legacy identity systems, leveraging biometric services to extend financial inclusion and enhance public safety.

Across Europe, Middle East, and Africa, the regulatory environment presents both challenges and opportunities. The European Union’s comprehensive data protection framework imposes rigorous consent and privacy requirements, compelling service providers to invest heavily in privacy-by-design architectures. In the Gulf Cooperation Council states, government-led smart city and e-government programs are accelerating deployment of biometric authentication solutions at scale. Sub-Saharan Africa sees nascent adoption, with pilot programs in healthcare and banking powered by international development initiatives seeking to bolster identity verification and reduce fraud.

The Asia-Pacific region exhibits the most rapid growth trajectory, fueled by large-scale nationwide identity programs and supportive government policies. Countries such as India and Indonesia have launched ambitious digital identity initiatives that integrate biometrics into public services, fostering local ecosystem development. Meanwhile, advanced markets like Japan and South Korea prioritize multi-modal and continuous authentication use cases for corporate access management and high-security infrastructures. This regional mosaic underscores the necessity for service providers to tailor offerings to distinct regulatory frameworks, cultural nuances, and technology landscapes to capture emerging opportunities.

This comprehensive research report examines key regions that drive the evolution of the Biometric-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Biometric-as-a-Service Providers: Strategic Collaborations, Technology Investments and Portfolio Innovations Shaping Industry Competition

Leading players in the biometric-as-a-service domain are strategically forging partnerships to expand cloud footprint and enhance service portfolios. Key global innovators have invested in next-generation AI research labs and acquired niche technology vendors to bolster capabilities in passive liveness detection and deep learning-driven biometric fusion. These alliances ensure accelerated time to market for novel features such as behavioral analytics and cross-device identity continuity.

In parallel, tier-one technology providers are capitalizing on hybrid cloud partnerships to embed biometric services within broader security suites. Through joint go-to-market programs with major hyperscalers, they deliver integrated identity orchestration platforms that unify access management, governance, and analytics. Meanwhile, specialist biometric vendors have strengthened their global reach by establishing regional delivery centers and service hubs, ensuring local compliance and rapid support across time zones.

Moreover, mergers and acquisitions have reshaped competitive dynamics, as leading service providers secure complementary assets to address specialized vertical requirements. From healthcare regulatory frameworks to government e-ID mandates, these transactions accelerate capabilities in data privacy, accreditation, and large-scale deployment expertise. As a result, clients benefit from enhanced end-to-end service lifecycles, spanning initial integration through continuous optimization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biometric-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aware, Inc.

- BioEngagable Technologies Pvt. Ltd

- BioID Technologies Limited

- Clearview AI, Inc.

- Entrust

- Fujitsu Limited

- HYPR Corporation

- IDEMIA France SAS

- iDenfy

- ImageWare Systems, Inc.

- Jumio Corporation

- Leidos Holdings, Inc.

- LexisNexis Risk Solutions

- M2SYS Technology - KernellÓ Inc.

- Mobbeel Solutions, S.L.L.

- NEC Corporation

- SecureAuth Corporation

- Suprema Inc.

- Thales Group

- Veriff

Five Actionable Strategies for Industry Leaders to Accelerate Adoption, Enhance Service Flexibility and Strengthen Security Posture in Biometric-as-a-Service

To capitalize on the momentum in biometric-as-a-service, industry leaders should adopt flexible pricing architectures that align cost to value and encourage trial-based adoption. By blending pay-per-use and subscription tiers, service providers can lower entry barriers while offering premium features to high-volume clients. Additionally, expanding modular service catalogs allows customers to incrementally incorporate advanced modalities and analytics, thereby fostering upsell opportunities.

Investing in research and development to enhance AI-driven recognition accuracy and reduce bias will be essential for sustaining trust and regulatory compliance. Organizations should establish dedicated innovation centers that partner with academic institutions to pilot emerging algorithms and biometric fusion techniques. This proactive approach not only refines core technology but also positions providers as thought leaders in the evolving identity assurance domain.

Given the complexity of global supply chains and escalating tariff pressures, diversification of component sourcing is imperative. Service providers must forge relationships with alternative manufacturers in Asia, Latin America, and the United States, while exploring strategic inventory buffering to mitigate disruption risks. Parallel to this, embedding sustainability criteria in supplier selection can support corporate social responsibility objectives and strengthen brand reputation.

Finally, cultivating strategic alliances with cloud hyperscalers and security integrators will accelerate market penetration and streamline multi-regional rollouts. By participating in joint innovation programs and compliance certifications, biometric-as-a-service companies can ensure seamless interoperability and reassure enterprise clients of end-to-end security rigor.

Robust Research Methodology Integrating Primary Stakeholder Interviews and Secondary Data Triangulation to Ensure Rigor in Biometric-as-a-Service Analysis

This analysis draws upon a comprehensive research framework combining primary and secondary methodologies to ensure depth and rigor. Secondary research involved the systematic review of industry white papers, regulatory filings, technology patents, and expert commentaries to map the evolution of biometric services and identify key ecosystem players. Publicly available trade data and policy directives informed the assessment of tariff impacts and regional adoption dynamics.

Primary research comprised structured interviews with senior executives from telecommunications operators, financial institutions, healthcare providers, and government agencies across multiple geographies. These qualitative insights validated emerging use cases and revealed procurement criteria, deployment challenges, and success metrics. Furthermore, vendor assessments and executive roundtables provided granular perspectives on service architectures, pricing strategies, and go-to-market approaches.

To triangulate findings, data points were cross-verified through industry benchmarks and client case studies. An expert advisory panel consisting of biometric researchers, cybersecurity practitioners, and regulatory specialists reviewed draft conclusions to refine recommendations and ensure methodological consistency. This multilayered approach delivers a credible foundation for strategic decision-making, offering stakeholders confidence in the robustness of the analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biometric-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biometric-as-a-Service Market, by Biometric Modality

- Biometric-as-a-Service Market, by Service Type

- Biometric-as-a-Service Market, by Enterprise Size

- Biometric-as-a-Service Market, by Authentication Mode

- Biometric-as-a-Service Market, by End User

- Biometric-as-a-Service Market, by Deployment Mode

- Biometric-as-a-Service Market, by Region

- Biometric-as-a-Service Market, by Group

- Biometric-as-a-Service Market, by Country

- United States Biometric-as-a-Service Market

- China Biometric-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Strategic Imperatives and Future Pathways for Stakeholders Navigating the Rapid Evolution of Biometric-as-a-Service Solutions

The preceding insights underscore a seismic shift toward service-based biometric offerings that deliver enterprise-grade security, agility, and user-centric experiences. As organizations embrace cloud-first identity frameworks, biometric-as-a-service emerges as a critical lever for reducing complexity and accelerating digital transformation. The compounded effects of evolving AI capabilities, hybrid deployments, and immersive authentication use cases herald a new era of identity assurance.

Regional and tariff-driven dynamics further highlight the importance of strategic planning to navigate trade policy volatility and localization requirements. Stakeholders who proactively diversify supply chains and align service models with regional regulations will secure competitive advantage. Meanwhile, technology investments in bias mitigation, continuous authentication, and modality diversification will define market leadership.

Ultimately, the convergence of advanced biometric engines, finely tuned service tiers, and collaborative ecosystem partnerships establishes a resilient identity infrastructure. This foundation empowers organizations to maintain robust security postures, adhere to stringent compliance standards, and deliver seamless digital experiences at scale. For decision-makers seeking to chart a course in this dynamic landscape, the insights contained herein offer a roadmap to sustained growth and innovation.

Engage with a Senior Sales Leader to Secure Customized Biometric-as-a-Service Market Research and Strategic Guidance

To unlock unparalleled strategic clarity and competitive advantage in the rapidly evolving Biometric-as-a-Service arena, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His extensive expertise in market dynamics, combined with deep insights into customer pain points and emerging use cases, ensures that you will receive bespoke intelligence tailored to your organization’s goals. By connecting with Ketan, you gain access to a comprehensive market research report that distills complex data into actionable strategies, enabling confident decision-making and optimized investment planning. Reach out today to discover how detailed segmentation analyses, tariff impact assessments, and region-specific insights can inform your next moves. Elevate your strategic roadmap by partnering with an industry thought leader committed to delivering clarity, precision, and forward-looking recommendations that drive sustainable growth in Biometric-as-a-Service.

- How big is the Biometric-as-a-Service Market?

- What is the Biometric-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?