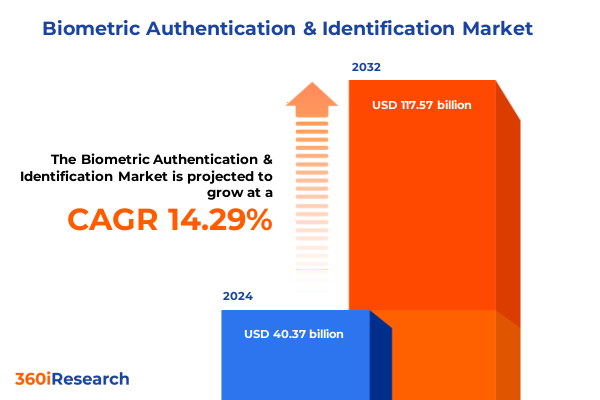

The Biometric Authentication & Identification Market size was estimated at USD 46.09 billion in 2025 and expected to reach USD 52.64 billion in 2026, at a CAGR of 14.31% to reach USD 117.57 billion by 2032.

Exploring the Evolution and Strategic Significance of Biometric Authentication in Modern Security and Identification Ecosystems

The emergence of biometric authentication and identification has redefined the contours of modern security frameworks, blending physical uniqueness with digital verification to forge unprecedented levels of trust. Once considered niche due to high costs and limited accuracy, biometric solutions now underpin critical infrastructures in both public and private sectors. Rapid advancements in sensor technologies and algorithmic precision have accelerated adoption across financial services, healthcare, government, and consumer electronics.

This introduction navigates the evolution from initial fingerprint scanners and basic voice recognition to sophisticated multimodal platforms that leverage facial, iris, vein, and voice biometrics concurrently. Organizations increasingly seek resilient security postures in response to escalating cyberthreats and regulatory pressures surrounding data protection. As digital ecosystems expand with the Internet of Things and remote work paradigms, robust identity assurance has become indispensable for safeguarding transactions, access control, and user privacy.

Against this backdrop, market participants must grasp the strategic significance of biometric technologies in modern identification ecosystems. Understanding core drivers-ranging from consumer demand for seamless experiences to corporate mandates for fraud reduction-enables stakeholders to align investments with growth trajectories. This section sets the stage for an in-depth exploration of the transformative shifts, policy impacts, segmentation nuances, regional dynamics, and actionable recommendations that follow.

Uncovering the Paradigm Shifts Reshaping Biometric Technologies from Technological Innovations to Ubiquitous Security Applications

Biometric authentication has experienced transformative shifts driven by leaps in deep learning, edge computing, and sensor integration. Algorithms once confined to academic research have matured into production-grade solutions capable of delivering near-instantaneous recognition with error rates measured in fractions of a percent. Parallel advancements in low-power, high-resolution sensors facilitate deployment across form factors-from mobile devices to access control readers-extending the reach of biometric systems into everyday interactions.

The convergence of cloud-native architectures and hybrid deployments has also reshaped implementation paradigms, enabling rapid scalability and centralized management of identity databases. Enterprises can now orchestrate global deployments that synchronize enrollment, analytics, and reporting in real time. Moreover, the shift toward decentralized identity frameworks is fostering innovative models where biometric templates remain locked within user devices, elevating privacy by design and minimizing centralized attack surfaces.

Interoperability standards and open APIs have further accelerated ecosystem growth, empowering software developers and integrators to weave biometric capabilities into legacy workflows and IoT environments. This democratization of access ensures that emerging use cases-such as biometric-based payments at kiosks or frictionless boarding at transport hubs-become viable at scale. As we proceed, it is crucial to recognize how these paradigm shifts are not only technological but also cultural, influencing end-user expectations and regulatory landscapes alike.

Analyzing the Aggregate Effects of US 2025 Tariff Policies on Biometric Authentication Supply Chains and Market Dynamics

The imposition of new tariff measures by the United States in 2025 has introduced a complex layer of cost consideration for vendors and end users of biometric authentication solutions. Duties on imported hardware components-particularly specialized sensors and high-precision optical modules-have increased the landed cost of entry-level and advanced readers. Concurrently, levies on semiconductor elements integral to capacitive and ultrasonic fingerprint sensors have influenced sourcing decisions, prompting manufacturers to reevaluate supply chain configurations.

Software vendors, while less directly affected by hardware tariffs, face secondary pressures as end users become cost-sensitive. This has triggered a strategic pivot toward software-as-a-service models that can amortize platform spending over subscription periods, reducing the upfront capital expenditure barrier. At the same time, multinational integrators are navigating the tariff landscape by diversifying manufacturing footprints, shifting assembly operations to tariff-exempt regions, or incorporating alternative sensor technologies with lower duty classifications.

These tariff dynamics extend beyond pure economics, impacting innovation pipelines and partnership strategies. Companies reliant on overseas research and development collaborations are examining the fiscal implications of onshore versus offshore testing facilities. Meanwhile, regional system integrators in the Americas are capitalizing on local production incentives to offer cost-competitive bundles. Understanding these cumulative policy effects is critical for stakeholders aiming to optimize total cost of ownership and maintain momentum in deploying secure identification solutions.

Delving into Core Segmentation Frameworks Revealing Critical Insights across Technology Types Components Authentication Modes Deployment and End Users

A nuanced segmentation framework unveils how the biometric authentication market is structurally organized and where key growth levers reside. Within the technology dimension, facial recognition leads adoption due to its nonintrusive user experience and broad applicability, further subdivided into two-dimensional techniques optimized for smartphones, three-dimensional mapping for secure point-of-entry systems, and infrared illumination methods suited for low-light environments. Fingerprint recognition remains a mainstay, supported by capacitive sensors embedded in consumer devices, optical sensors in high-throughput access controllers, and ultrasonic sensors offering enhanced spoof resistance. Iris recognition systems deliver high accuracy in controlled applications, while palm vein recognition emerges in specialized security contexts. Voice recognition rounds out the portfolio with text-dependent algorithms ideal for transactional authentication and text-independent models designed for continuous verification.

Examining the component segmentation, hardware elements such as controllers, readers, and sensors form the physical backbone, while software layers-comprising algorithmic engines, management platforms, and middleware integration-enable orchestration and analytics. Service offerings span from installation and customization to maintenance and managed operations, underscoring the need for holistic lifecycle approaches.

The split between multi-factor and single-factor authentication highlights shifting risk appetites: single-factor deployments predominate in consumer-grade applications, whereas enterprise and government programs increasingly mandate multi-factor schemes to bolster assurance levels. Deployment models range from on-premises installations for organizations requiring in-house data control to cloud-based services that deliver rapid scalability and remote management.

End-user segmentation underscores a diverse demand landscape. In financial services, biometric authentication secures banking transactions, capital market platforms, and insurance portals, helping combat identity fraud. Consumer electronics applications are anchored in smartphones, tablets, and wearable devices, where biometric convenience drives user retention. Government and defense agencies deploy biometrics for defense installations, immigration checkpoints, and law enforcement databases. Healthcare providers integrate biometric systems in clinics, hospitals, and laboratories to secure patient records and comply with privacy regulations. IT service providers and telecom operators leverage biometrics for secure access to networks and customer onboarding. Finally, retail environments-from brick-and-mortar stores to e-commerce platforms-embrace biometric payments and personalized shopper experiences to streamline checkout processes and gather behavioral insights.

This comprehensive research report categorizes the Biometric Authentication & Identification market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Authentication Mode

- Deployment Mode

- End User

Comparative Assessment of Regional Developments Driving Biometric Adoption Patterns in the Americas EMEA and Asia Pacific Landscapes

Geographic disparities in regulatory frameworks, infrastructure maturity, and investment appetites create distinct regional trajectories for biometric systems. Within the Americas, North American markets exhibit rapid adoption driven by stringent data protection laws and demand for seamless payment experiences. A robust network of integrators and local manufacturers offers tailored solutions, while Latin American countries are embracing biometrics to enhance financial inclusion and bolster public safety initiatives.

In Europe, the Middle East, and Africa region, regulatory alignment with data privacy standards such as GDPR has influenced deployment architectures, often favoring on-premises setups or privacy-preserving edge models. Strategic investments in border control and law enforcement modernization are propelling iris and facial recognition projects, particularly within immigration and critical infrastructure sectors. Africa’s emerging economies are leveraging mobile-based biometric authentication for digital identity programs, thereby fostering financial access and government service delivery.

Asia-Pacific stands out as a hotspot for large-scale biometric initiatives, fueled by government identity programs, smart city rollouts, and consumer electronics manufacturing hubs. China’s expansive facial recognition networks and India’s national identity program underscore the region’s scale and ambition. Meanwhile, Southeast Asian nations are prioritizing cloud-based biometric platforms to streamline digital governance, and Australia and Japan maintain a blend of on-premises and hybrid deployments in sectors demanding high security and reliability. These regional insights inform strategic priorities and highlight areas where technology providers and integrators can align their offerings to local market nuances.

This comprehensive research report examines key regions that drive the evolution of the Biometric Authentication & Identification market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants and Their Strategic Initiatives Shaping Competitive Dynamics in the Global Biometric Authentication Domain

Market leadership in biometric authentication is shaped by companies that combine technological innovation with strategic partnerships and global reach. Some participants concentrate on developing next-generation algorithmic cores, driving accuracy improvements through deep neural networks and synthetic data augmentation. Others excel in manufacturing precision sensors, investing in proprietary materials and fabrication processes to optimize signal fidelity and environmental resilience.

Several established corporations differentiate through end-to-end platform offerings that integrate hardware, software, and managed services. These full-stack solutions simplify deployment for large enterprises and government agencies by standardizing interfaces and support protocols. In parallel, agile solution providers target niche verticals, customizing biometric modalities-such as palm vein systems for healthcare or iris recognition for secure facilities-to meet specialized use case requirements.

Strategic alliances between technology vendors and systems integrators broaden market coverage, enabling combined expertise in domain-specific compliance requirements and infrastructure modernization. Joint ventures in regions facing tariff constraints facilitate localized production and reduce duty burdens. Meanwhile, acquisitions of AI startups and sensor innovators accelerate product roadmaps and infuse proprietary intellectual property into existing portfolios.

Recent competitive dynamics reveal a convergence of international players looking to enter underserved mid-tier markets, while regional champions leverage intimate knowledge of local regulations and customer preferences to defend their strongholds. This competitive tapestry underscores the importance of balanced strategies that fuse global best practices with regional adaptability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biometric Authentication & Identification market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services Inc.

- AT&T Inc.

- Avatier Corporation

- Aware, Inc.

- BIO-key International, Inc.

- BioCatch Ltd.

- Broadcom Inc.

- Cisco Systems, Inc.

- CyberArk Software, Inc.

- Daon, Inc.

- Dermalog Identification Systems GmbH

- Entrust Corporation

- Forgerock, Inc.

- Fujitsu Limited

- HID Global Corporation

- HP Development Company, L.P.

- Huawei Technologies Co., Ltd.

- HYPR Corp.

- IDEMIA SAS

- Intel Corporation

- International Business Machines Corporation

- Ivanti, Inc.

- Keyless Technologies S.R.L.

- Microsoft Corporation

- miniOrange Security Software Pvt Ltd.

- NEC Corporation

- Okta, Inc.

- OneLogin, Inc. by One Identity

- Open Text Corporation

- Optimal IdM

- Oracle Corporation

- Ping Identity Corporation

- Salesforce.com, Inc.

- Suprema Inc.

- Thales SA

Proposing Strategic Imperatives and Actionable Roadmaps for Industry Leaders to Capitalize on Emerging Opportunities in Biometric Security

To navigate the evolving biometric landscape, industry leaders must adopt multi-dimensional strategies that prioritize innovation, resilience, and customer-centricity. Companies should double down on algorithmic research, integrating explainable AI frameworks to enhance transparency and regulatory compliance. By deploying modular sensor architectures, manufacturers can accelerate time to market and cater to diverse environmental conditions without compromising performance.

Building robust, diversified supply chains is equally critical in mitigating the impact of tariff fluctuations and component shortages. Organizations should cultivate partnerships with regional assemblers and explore alternative sensor technologies to buffer against single-source dependencies. Concurrently, transitioning to subscription-based software models allows vendors to offset hardware cost pressures and foster recurring revenue streams, thereby improving economic predictability.

Collaboration with standards bodies and active participation in open API ecosystems will expedite interoperability and expand solution portfolios. Leaders must also tailor go-to-market approaches by aligning product roadmaps with regional regulations and cultural expectations. Investment in user-centric design principles-such as privacy-preserving enrollment processes and accessible user guides-will enhance adoption rates and minimize friction.

Finally, continuous engagement with end users through managed services or dedicated support channels will reinforce trust and ensure systems remain optimized post-deployment. By weaving these strategic imperatives into their planning, organizations can capitalize on emerging opportunities and maintain a competitive edge in the dynamic biometric authentication domain.

Detailing Rigorous Research Methodology and Analytical Approaches Underpinning Comprehensive Biometric Authentication Market Insights

The research methodology underpinning these insights is anchored in a rigorous blend of primary and secondary data acquisition, followed by robust triangulation techniques. Primary research encompassed in-depth interviews with senior executives, security architects, integrators, and regulatory experts across key geographic markets, ensuring firsthand perspectives on adoption drivers, pain points, and investment priorities.

Secondary data sources included corporate filings, technological white papers, academic publications, and public policy documents. Analytical frameworks such as SWOT and PESTLE were employed to contextualize strategic factors, while a detailed segmentation matrix captured the complexity of technology types, component categories, authentication modes, deployment approaches, and end-user verticals.

To validate findings, data points were cross-referenced with vendor press releases, patent filings, and industry consortium reports. Quantitative modeling leveraged historical adoption curves and tariff impact assessments to reconstruct plausible supply chain scenarios. Qualitative insights were further vetted through workshops with subject-matter experts, ensuring alignment with real-world implementation experiences.

Ethical guidelines and data privacy regulations were strictly observed throughout the research process. All proprietary insights were anonymized where necessary, and any forecasts or projections were excluded from the narrative to maintain an objective presentation of factual trends and strategic considerations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biometric Authentication & Identification market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biometric Authentication & Identification Market, by Component

- Biometric Authentication & Identification Market, by Technology

- Biometric Authentication & Identification Market, by Authentication Mode

- Biometric Authentication & Identification Market, by Deployment Mode

- Biometric Authentication & Identification Market, by End User

- Biometric Authentication & Identification Market, by Region

- Biometric Authentication & Identification Market, by Group

- Biometric Authentication & Identification Market, by Country

- United States Biometric Authentication & Identification Market

- China Biometric Authentication & Identification Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Synthesizing Core Findings and Strategic Implications to Guide Stakeholders in Navigating the Complex Biometric Authentication Ecosystem

The biometric authentication and identification landscape is characterized by rapid technological progression, shifting regulatory environments, and evolving end-user expectations. Key transformative forces-from AI-driven algorithmic enhancements to the emergence of hybrid deployment architectures-are redefining how organizations secure identities and manage access.

Macroeconomic factors such as the 2025 tariff adjustments in the United States have underscored the importance of supply chain agility and cost management, prompting vendors to innovate on both hardware design and commercial models. Segmentation analysis reveals that the convergence of multiple biometric modalities, integrated through cohesive software platforms, offers the greatest potential for balanced performance and user acceptance.

Regional analysis highlights differentiated growth paths in the Americas, EMEA, and Asia Pacific, each shaped by local regulatory landscapes, infrastructure maturity, and sector-specific imperatives. Competitive dynamics indicate a market in flux, with established global brands and regional specialists vying for leadership through partnerships, acquisitions, and technology collaboration.

Stakeholders equipped with a clear understanding of these dynamics will be best positioned to navigate complexity and capitalize on emerging opportunities. As biometric authentication continues to mature from a convenience feature to a foundational security element, proactive strategic planning and technology alignment become imperative for sustained success.

Engaging with Ketan Rohom to Leverage Expert Market Research and Unlock Strategic Benefits in Biometric Authentication and Identification

To explore deeper insights and purchase the full market research report on biometric authentication and identification, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging with Ketan provides a direct pathway to customized consulting, strategic briefings, and enterprise licensing options tailored to your organization’s unique objectives. This comprehensive report offers an unparalleled depth of analysis, and securing early access ensures your team stays ahead of industry shifts and competitive dynamics. Contact Ketan Rohom to unlock transformative intelligence that will inform critical decisions and drive innovation within your security and identification initiatives.

- How big is the Biometric Authentication & Identification Market?

- What is the Biometric Authentication & Identification Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?