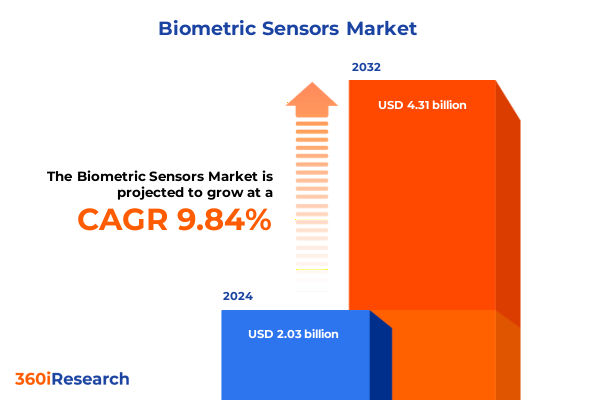

The Biometric Sensors Market size was estimated at USD 2.20 billion in 2025 and expected to reach USD 2.38 billion in 2026, at a CAGR of 10.09% to reach USD 4.31 billion by 2032.

How Rapid Innovations in Materials Science and AI Are Redefining Biometric Sensor Authentication for Modern Applications

Biometric sensors have emerged as critical enablers of secure authentication, powering applications that span from mobile devices and access control to banking and healthcare. Fueled by rapid advances in materials science, microelectronics and artificial intelligence, these sensors now provide unprecedented levels of accuracy and convenience. In recent years, organizations have increasingly adopted fingerprint and facial recognition modules within consumer electronics, while enterprises leverage multimodal solutions to balance user convenience with stringent security requirements.

In parallel, regulatory frameworks and user expectations around privacy and data protection have intensified, prompting sensor developers to incorporate encryption and on-device processing. Consequently, the industry has transitioned away from cloud-centric architectures toward hybrid models that blend local inference with selective cloud analytics. As a result, developers are able to reduce latency, mitigate cyber risks and deliver seamless user experiences. Together, these trends are converging to transform the ways industries conceive and deploy biometric authentication.

Unveiling the Confluence of AI-Driven Edge Computing and Multimodal Integration That Is Reshaping Biometric Sensor Solutions

The biometric sensor market is undergoing transformative shifts as artificial intelligence and edge computing converge to unlock new capabilities. Machine learning algorithms embedded at the sensor level now enable real-time pattern recognition and adaptive thresholding, improving both speed and accuracy while minimizing power consumption. Furthermore, advancements in sensor modalities have given rise to contactless solutions for facial and iris recognition, reflecting growing demand for hygiene-conscious interfaces in public and healthcare environments.

Moreover, the integration of multiple sensing technologies within a unified module is driving the emergence of multimodal authentication systems. These platforms dynamically combine fingerprint, vein and facial data to thwart spoofing attempts and address use cases that no single modality can manage alone. In addition, the adoption of standardized communication protocols and software development kits is fostering an ecosystem of interoperable devices, thereby accelerating enterprise deployments. Consequently, industry participants are shifting strategies to focus on end-to-end solutions rather than standalone components, underscoring the move toward comprehensive identity management frameworks.

Examining the Ripple Effects of 2025 US Tariffs on Procurement Costs Supply Chain Diversification and Manufacturing Strategies in Biometrics

Cumulative US tariffs introduced in 2025 have materially impacted the cost structure and supply chain strategies of biometric sensor vendors. As levies on imported semiconductor components rose, manufacturers faced increased procurement costs for fingerprint imaging chips and optical modules, prompting a reassessment of global sourcing models. In turn, many organizations began to diversify their supplier base beyond traditional East Asian hubs, exploring partnerships with domestic foundries and alternative offshore sites to mitigate tariff exposure.

Furthermore, the imposition of tariffs accelerated the push toward vertical integration, leading several device makers to internalize sensor fabrication capabilities or secure long-term agreements that include tariff pass-through clauses. This shift has also spurred investment in automation and yield optimization, counterbalancing higher per-unit expenses. Consequently, end customers have experienced modest price adjustments, while vendors prioritize strategic cost management through lean manufacturing practices. Looking ahead, the tariff landscape will remain a key variable in shaping capital allocation and partnership decisions across the biometric sensor industry.

Deep Dive into Fingerprint Ultrasound Optical Face 3D Iris Contactless Voice Architectures and Vein NIR Thermal Differentiators

Insight into segmentation highlights reveals distinct growth drivers and technology preferences across fingerprint, face, iris, voice and vein recognition. Within fingerprint sensing, capacitive modules continue to be the mainstay for consumer electronics, while optical units-especially those leveraging multi-LED arrays-offer enhanced spoof detection in high-security installations. Ultrasonic sensors, although commanding a premium, are gaining traction in smartphone applications for their ability to capture sub-dermal ridge details.

Turning to facial recognition, two-dimensional detection remains prevalent for cost-sensitive deployments, whereas 3D structured light and time-of-flight systems deliver superior depth perception and usability under challenging lighting. Thermal imaging further bolsters liveness detection in critical environments. In the iris segment, contactless approaches powered by near-infrared illumination have become the de facto standard for enterprise door-entry, complemented by emerging visible light techniques that streamline user onboarding. Voice recognition continues to bifurcate across speaker dependent and independent architectures, with text-dependent systems favored in financial authentication and text-independent models optimized for consumer voice assistants. Lastly, vein recognition technologies differentiate through finger, hand and palm implementations, with near-infrared finger vein sensors leading clinical access control and thermal variants promising expanded use in shared-asset environments.

This comprehensive research report categorizes the Biometric Sensors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fingerprint

- Face Recognition

- Iris Recognition

- Voice Recognition

- Vein Recognition

- End Use

Illuminating How Regional Regulations Consumer Electronics Demand and Smart City Initiatives Drive Biometric Sensor Adoption

Regional dynamics underscore differentiated adoption patterns and growth opportunities across the Americas, Europe Middle East and Africa and Asia-Pacific. In the Americas, the convergence of stringent financial sector regulations and corporate security mandates is fueling uptake of multimodal systems, particularly within banking and retail. Moreover, public sector initiatives aimed at strengthening border control and law enforcement applications continue to drive government procurement.

Meanwhile, Europe Middle East and Africa markets benefit from progressive data protection laws that pressure organizations to adopt advanced authentication to safeguard user privacy. Healthcare institutions in Western Europe are increasingly deploying contactless face and iris recognition to manage patient flows, while Gulf Cooperation Council nations invest heavily in smart city programs that leverage biometric sensors for secure access control. In the Asia-Pacific region, the proliferation of smartphone hardware embedded with optical fingerprint and 3D facial modules has cemented mobile payments as a primary growth vector. Concurrently, manufacturing centers across Southeast Asia are ramping up capacity to support global demand, reinforcing the region’s prominence in the supply chain.

This comprehensive research report examines key regions that drive the evolution of the Biometric Sensors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Strategic Collaborations Acquisitions and Integrated SoC Deployments That Are Redefining the Competitive Landscape

Key industry players are executing diverse strategies to cement their competitive positions. Leading fingerprint sensor specialists have broadened their portfolios from capacitive to ultrasonic and optical variants, deepening customer relationships through integrated chip modules and software stacks. Simultaneously, global semiconductor firms are leveraging scale to deliver system-on-chip solutions that bundle AI-accelerated inference engines alongside sensor interfaces.

In parallel, software-centric companies are forging partnerships with hardware vendors to embed advanced liveness detection and anti-spoofing algorithms directly at the sensor driver level. Mergers and acquisitions activity has intensified as firms seek to acquire niche technology startups in areas such as thermal imaging and vein pattern analysis. Moreover, several players have initiated cross-industry consortiums to establish interoperability standards, reducing integration friction for enterprise customers. Overall, competitive advantage is increasingly determined by the ability to offer turnkey, certified authentication suites rather than discrete sensor modules.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biometric Sensors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amphenol Corporation

- Apple Inc.

- Aware, Inc.

- Egis Technology Inc.

- Fingerprint Cards AB

- Fujian Joyusing Technology Co., Ltd.

- IDEMIA

- Maxim Integrated Products, Inc. (now part of Analog Devices)

- O-Film Group Co., Ltd.

- Panasonic Corporation

- Qualcomm Technologies, Inc.

- ROHM Co., Ltd.

- Samsung Electronics Co., Ltd.

- Secukey Technology

- Shenzhen Goodix Technology Co., Ltd.

- Suprema Inc.

- Synaptics Incorporated

- Texas Instruments Incorporated

- Thales Group

- Vivo Mobile Communication Co., Ltd.

Actionable Roadmap for Prioritizing Edge-AI Integration Supply Chain Resilience and Privacy-By-Design in Biometric Sensor Development

Industry leaders should prioritize investment in multimodal sensor research and development to stay ahead of converging security and convenience demands. By advancing edge-AI capabilities, organizations can embed adaptive algorithms that continuously learn from user interactions and detect anomalies in real time. In addition, diversifying the supply chain to include both domestic and offshore contract manufacturers will hedge against future trade policy shifts and mitigate cost volatility.

Moreover, embedding privacy-by-design principles within sensor firmware and data management frameworks will become a non-negotiable requirement as regulatory scrutiny intensifies. Establishing strategic alliances with software providers can accelerate time-to-market for advanced anti-spoofing features while reducing in-house development burdens. Lastly, participating in standardization bodies and open API initiatives will enhance interoperability and foster broader ecosystem adoption, laying the groundwork for next-generation biometric platforms.

Rigorous Multi-Source Framework Leveraging Expert Interviews Patent Analysis and Supply Chain Data to Uncover Biometric Sensor Trends

The research methodology combined extensive desk analysis with primary interviews from senior executives, sensor architects and procurement leads across multiple verticals. Initially, secondary sources such as academic journals, patent filings and public financial disclosures were reviewed to map technological evolution and identify emerging capabilities. This was followed by a series of structured interviews with subject matter experts to validate the technical feasibility and commercial viability of cutting-edge sensor approaches.

Subsequently, data was triangulated by comparing supply chain records with trade compliance filings to assess the tangible impact of tariffs and regulatory changes. A rigorous scoring framework was applied to evaluate vendor offerings across dimensions of accuracy, latency, power efficiency and integration ease. Finally, findings were peer-reviewed by an internal advisory panel to ensure consistency and reliability. The resulting insights offer a robust, evidence-based foundation for informed strategic decision-making in the biometric sensor domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biometric Sensors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biometric Sensors Market, by Fingerprint

- Biometric Sensors Market, by Face Recognition

- Biometric Sensors Market, by Iris Recognition

- Biometric Sensors Market, by Voice Recognition

- Biometric Sensors Market, by Vein Recognition

- Biometric Sensors Market, by End Use

- Biometric Sensors Market, by Region

- Biometric Sensors Market, by Group

- Biometric Sensors Market, by Country

- United States Biometric Sensors Market

- China Biometric Sensors Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesis of Key Technological Drivers Geopolitical Impacts and Strategic Imperatives Shaping the Future of Biometric Sensors

In conclusion, the biometric sensor sector stands at a pivotal juncture where technological breakthroughs and geopolitical shifts converge. The maturation of edge-AI, coupled with the proliferation of multimodal solutions, is unlocking applications that extend beyond traditional security use cases into areas such as workforce management and personalized healthcare. However, sustained growth will hinge on industry participants’ ability to navigate cost pressures driven by tariffs and complex regulatory landscapes.

Looking forward, those organizations that can strike the optimal balance between innovation, compliance and supply chain agility will secure leadership positions. By embracing privacy-by-design, forging strategic partnerships and contributing to interoperability standards, vendors can accelerate adoption and deliver compelling value to end users. Ultimately, proactive adaptation and strategic foresight will distinguish the winners in this dynamic, high-growth market.

Drive Strategic Growth Through Personalized Consultation with Ketan Rohom to Uncover Comprehensive Biometric Sensor Market Research Insights

If you are seeking to deepen your understanding of the evolving biometric sensor landscape and translate these insights into concrete competitive advantages, reach out to Ketan Rohom, Associate Director of Sales & Marketing. By engaging with him, you can secure a tailored overview of the comprehensive research findings, explore customized data relevant to your strategic objectives, and schedule a detailed briefing to discuss how these insights can be applied to your organization’s growth trajectory. His expertise will ensure you access the right level of detail and actionable intel to optimize your decision-making process and realize the full potential of biometric sensor innovations.

- How big is the Biometric Sensors Market?

- What is the Biometric Sensors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?