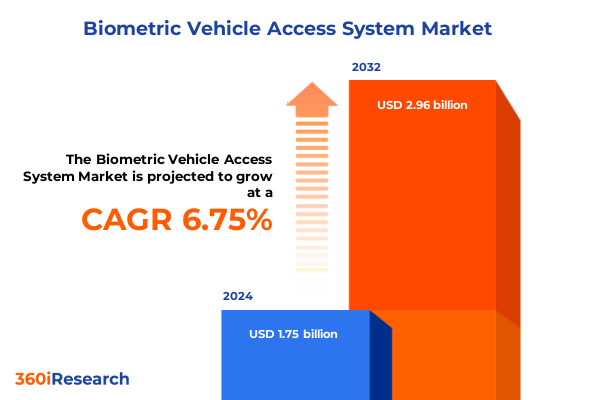

The Biometric Vehicle Access System Market size was estimated at USD 1.86 billion in 2025 and expected to reach USD 1.99 billion in 2026, at a CAGR of 6.81% to reach USD 2.96 billion by 2032.

Setting the Stage for Seamless Vehicle Entry Through Cutting-Edge Biometric Authentication Technologies That Redefine Automotive Security

The increasingly complex demands of modern transportation security have given rise to a new era of vehicle access control, one that transcends traditional keys and remote fobs. As consumers and fleet operators seek frictionless yet foolproof solutions, biometric authentication emerges as a cornerstone for future-proof automotive security architectures. In this executive summary, we set the stage by exploring how biometric identification methods-ranging from fingerprint scanning to iris recognition-are redefining baseline expectations for vehicle entry and driver safety.

In this introduction, we position the biometric vehicle access system within the broader context of cybersecurity, convenience, and personalization. By integrating physiological or behavioral characteristics, manufacturers can not only thwart unauthorized access but also deliver a bespoke user experience. This shift aligns with the digitalization trend already underway in the automotive industry, where connected vehicles and IoT ecosystems demand augmented security layers. Establishing the foundational landscape here ensures that stakeholders appreciate both the immediate value propositions and the long-term strategic imperatives associated with these advanced access technologies.

Exploring the Paradigm Shifts Accelerating Adoption of Biometric Vehicle Access Through Convergence of Mobile Connectivity and Enhanced Security Protocols

The landscape of vehicle access has undergone a profound transformation over the last decade. What began as basic keyless entry systems has rapidly evolved into sophisticated biometric frameworks that leverage facial recognition, fingerprint detection, and voice analysis. This convergence of technologies has been fueled by exponential enhancements in sensor accuracy, algorithmic precision, and machine learning capabilities. As a result, the barrier between driver expectation and technological possibility continues to shrink.

Moreover, the shift toward mobile integration has become a defining trend. Drivers now expect their smartphones to serve as digital keys, seamlessly communicating with vehicle systems to authenticate access through encrypted channels. This mobile-centric approach has catalyzed partnerships between automotive OEMs and technology providers, driving co-development of secure platforms that can withstand evolving cyber threats. Consequently, the market for biometric vehicle access is experiencing dynamic growth, supported by advanced connectivity, robust encryption protocols, and an unwavering emphasis on user convenience.

Unpacking the Ripple Effects of United States Tariffs in 2025 on Biometric Vehicle Access System Supply Chains and Cost Structures Across Key Segments

Recent tariff adjustments in the United States have introduced new cost considerations for automotive component manufacturers and system integrators. Duties imposed on semiconductor sensors, specialized optical components, and certain hardware modules have incrementally increased production expenses. While some original equipment manufacturers have partially mitigated these increases through strategic sourcing of domestic suppliers, the tariffs have nonetheless elevated costs across critical segments of the biometric access supply chain.

In parallel, the trade measures have prompted companies to evaluate near-shore manufacturing options, aiming to maintain price competitiveness while ensuring supply continuity. This strategic pivot has led to a recalibration of logistics networks and the exploration of alternative distribution channels. These emerging procurement models, coupled with localized assembly facilities, help attenuate the financial impact of tariffs. As a result, system developers are balancing cost pressures with the imperative to maintain stringent quality standards, ensuring that biometric access solutions remain both reliable and economically viable in the current regulatory environment.

Unveiling Distinct Market Patterns Through Technology, Vehicle Type, and Sales Channel Segmentation to Inform Strategic Positioning

When examining market segmentation through a technology lens, distinct usage patterns emerge across facial recognition modules that prioritize high-resolution imaging, fingerprint scanners designed for rapid validation, and emerging multifactor solutions that combine vein pattern recognition with iris scanning. Similarly, voice-based systems are gaining traction in scenarios where hands-free operation is critical, such as commercial delivery fleets and ride-hailing vehicles.

Considering vehicle type segmentation reveals divergent adoption rates between passenger cars and commercial vehicles. Passenger car manufacturers have actively integrated biometric modules into luxury and premium lineups, leveraging hatchback and sedan form factors to showcase fingerprints and facial scanners within sleek interiors. Conversely, heavy and light commercial vehicles prioritize ruggedized hardware that withstands harsh environmental conditions while enabling streamlined fleet management. The varying usage contexts underscore unique design requirements and user expectations.

Finally, sales channel segmentation highlights that the aftermarket domain continues to drive retrofit applications for existing vehicles, whereas OEM partnerships facilitate factory-installed biometric solutions in new model rollouts. While aftermarket service providers emphasize ease of installation and minimal system disruption, OEM channels focus on seamless integration with vehicle electrical architectures and over-the-air update capabilities. These differentiated pathways shape both product development and go-to-market strategies for system developers.

This comprehensive research report categorizes the Biometric Vehicle Access System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Application

- Vehicle Type

- Sales Channel

Illuminating Regional Dynamics in the Americas, Europe Middle East & Africa, and Asia-Pacific That Shape Biometric Vehicle Access Adoption Trends

Across the Americas region, the appetite for vehicle personalization and enhanced security has fueled rapid uptake of biometric access systems in both North and South America. In the United States, advanced regulatory frameworks and strong consumer awareness have accelerated adoption rates, leading to strategic alliances between domestic automakers and technology vendors. Meanwhile, in Latin American markets, retrofit demand is driven by fleet operators seeking to reduce key management overhead and improve driver accountability.

Shifting focus to Europe, the Middle East and Africa region reveals a tapestry of divergent regulatory environments and infrastructure maturity. Western European countries have prioritized stringent data privacy regulations, compelling system providers to invest in robust encryption and on-device processing to comply with GDPR requirements. In contrast, Middle Eastern collaborative ventures emphasize high-end hospitality fleets and smart city initiatives, embedding biometric access as part of broader urban mobility frameworks.

In Asia-Pacific, rapid urbanization and digital infrastructure investment have positioned major economies such as China, Japan and South Korea at the forefront of biometric adoption. Local manufacturers are pioneering cost-effective sensor development, while Southeast Asian markets showcase strong aftermarket activity driven by ride-sharing platforms. Regional supply chain clusters in East Asia also support high-volume module production, enabling swift technology deployment across both passenger and commercial vehicle segments.

This comprehensive research report examines key regions that drive the evolution of the Biometric Vehicle Access System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Players Driving Progress in Biometric Vehicle Access Through Strategic Partnerships and Technological Breakthroughs

Innovation in the biometric vehicle access arena is spearheaded by both emerging specialists and established technology giants. Leading semiconductor manufacturers have unveiled custom sensor arrays optimized for vehicular environments, featuring automotive-grade resilience and low power consumption. These advancements enable system integrators to embed high-fidelity facial recognition cameras and vein scanners without compromising cabin design.

Simultaneously, software companies have developed advanced machine learning algorithms capable of differentiating authorized users from potential intruders, even under challenging lighting or environmental conditions. Collaborative ventures between these software houses and hardware suppliers have yielded end-to-end platforms that simplify integration and accelerate time to market. Furthermore, strategic partnerships with tier-one automotive OEMs have facilitated early adoption within premium vehicle lineups, establishing proof points that validate both performance and user acceptance.

Emerging players are also exploring differentiated approaches, such as multimodal systems that combine behavioral biometrics with physical characteristics, enhancing security through layered authentication. Together, these companies are forging the competitive landscape, driving continuous innovation and elevating the overall performance standards for biometric vehicle access solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biometric Vehicle Access System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anviz, Inc.

- Apple Inc.

- ASSA ABLOY AB

- Aware, Inc.

- Aware, Inc. by Mimecast Services Limited

- BioCatch Ltd.

- BioConnect Inc.

- BioEnable Technologies Pvt. Ltd.

- BioID GmbH

- Cognitec Systems GmbH

- Continental AG

- Daon

- Denso Corporation

- Fingerprint Cards AB

- Freevolt Technologies Limited

- FRESH USA, Inc.

- Fujitsu Ltd.

- Fulcrum Biometrics, LLC

- GRUPO ANTOLIN IRAUSA, S.A.

- HID Global Corporation

- Hitachi Ltd

- JMN Infotech Pvt. Ltd.

- Lear Corporation

- Methode Electronics, Inc.

- Miaxis Biometrics Co., Ltd.

- Mitsubishi Electric Corporation

- Nuance Communications by Microsoft Corporation

- Nymi, Inc.

- Robert Bosch GmbH

- Safran S.A

- Suprema Inc.

- Synaptics Incorporated

- TECH5 SA

- Thales Group

- Valeo SA

- VOXX International Corporation

- ZKTeco Co., Ltd.

Delivering Targeted Strategic Imperatives for Industry Leaders to Capitalize on Emerging Opportunities in Biometric Vehicle Access Markets

To navigate this dynamic market, industry leaders should prioritize cross-industry collaborations that marry expertise in sensor manufacturing, data security, and automotive integration. By forging alliances with semiconductor suppliers, software developers, and OEMs, companies can accelerate product development cycles and reduce integration risks. In parallel, focusing on modular system architectures will enable rapid customization for diverse vehicle platforms and regional regulatory requirements.

Investing in customer experience design is equally essential. Understanding end-user preferences for enrollment processes, fallback authentication, and onboarding flows can differentiate solutions in a crowded market. Companies that proactively gather feedback from fleet operators and private-owner cohorts will gain critical insights that inform iterative enhancements. Additionally, piloting solutions in controlled environments-such as corporate shuttle services or ride-hailing fleets-can generate valuable use-case data and performance metrics under real-world conditions.

Finally, addressing data privacy and compliance head-on through transparent policies and localized data processing will bolster stakeholder trust. By embedding privacy-by-design principles into system architectures and collaborating with local regulators, solution providers can mitigate legal risks while fostering broader market acceptance.

Outlining a Rigorous Multi-Method Research Framework Combining Primary Interviews, Secondary Data Analysis, and Validation Protocols

This study employs a comprehensive research design, beginning with primary interviews conducted with key executives spanning vehicle OEMs, sensor manufacturers, and aftermarket service providers. These qualitative insights were supplemented by in-depth discussions with technology partners and cybersecurity specialists to validate technical feasibility and market assumptions.

Secondary research encompassed the analysis of proprietary patent databases, trade publications, and regulatory filings to chart the evolution of biometric modalities and compliance landscapes. Market participants were systematically profiled to understand strategic partnerships, product roadmaps, and competitive positioning. Data triangulation was achieved by cross-referencing interview findings with secondary intelligence, ensuring consistency and reliability.

Finally, a rigorous validation protocol engaged an advisory panel of industry veterans to review interim findings and provide critical feedback. This iterative process refined assumptions, identified potential blind spots, and grounded recommendations in actionable realities. Together, these methodologies ensure that the findings offer both depth and strategic relevance for stakeholders aiming to navigate the biometric vehicle access space.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biometric Vehicle Access System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biometric Vehicle Access System Market, by Component

- Biometric Vehicle Access System Market, by Technology

- Biometric Vehicle Access System Market, by Application

- Biometric Vehicle Access System Market, by Vehicle Type

- Biometric Vehicle Access System Market, by Sales Channel

- Biometric Vehicle Access System Market, by Region

- Biometric Vehicle Access System Market, by Group

- Biometric Vehicle Access System Market, by Country

- United States Biometric Vehicle Access System Market

- China Biometric Vehicle Access System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Reflections on the Evolving Landscape of Biometric Vehicle Access and Imperatives for Stakeholder Success and Innovation Continuity

As the automotive industry continues its digital transformation, biometric vehicle access systems will occupy an increasingly central role in the convergence of security, convenience and personalization. Stakeholders must remain agile, adapting to shifting regulatory landscapes while harnessing rapid innovations in sensor design and machine learning algorithms. Through targeted partnerships and modular architectures, solution providers can deliver scalable, compliant systems that resonate with both commercial fleets and private-owner segments.

Looking ahead, the maturation of multimodal biometrics and on-device processing promises to further diminish latency and enhance privacy protections. Early movers that integrate these advancements will set the benchmark for user experiences and operational robustness. Ultimately, the convergence of cutting-edge authentication technologies with automotive connectivity will redefine how drivers interact with their vehicles, ushering in a new era of secure, seamless mobility.

Engaging Directly with Ketan Rohom to Secure Comprehensive Insights and Proprietary Data Through Acquisition of the Full Market Research Report

To explore the full breadth of insights, including detailed analyses, expert interviews, and proprietary data, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, for a personalized discussion on how this market research report can address your specific strategic needs. His deep understanding of biometric vehicle access technologies and market dynamics ensures that you gain tailored recommendations and actionable intelligence. Engage now to secure your competitive advantage and leverage the most up-to-date findings and forecasts in your decision-making process. Reach out to initiate a comprehensive partnership that will drive informed growth and innovation for your organization.

- How big is the Biometric Vehicle Access System Market?

- What is the Biometric Vehicle Access System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?