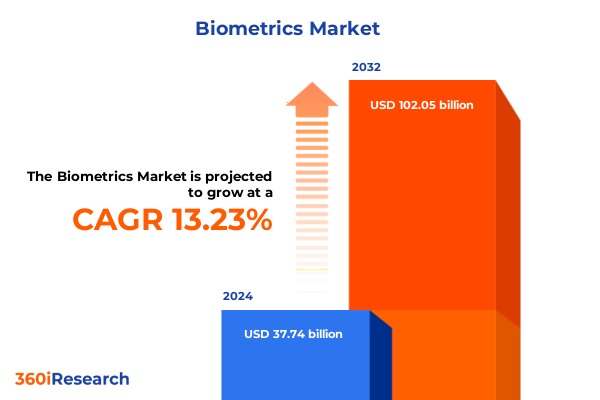

The Biometrics Market size was estimated at USD 42.44 billion in 2025 and expected to reach USD 47.84 billion in 2026, at a CAGR of 13.35% to reach USD 102.05 billion by 2032.

Understanding the Critical Role of Biometrics in Strengthening Security Frameworks Amidst Rising Digital Transformation and Privacy Concerns

In an era defined by digital transformation, biometric authentication has become a fundamental component of modern security architectures. Organizations across sectors from banking and finance to government and healthcare are deploying fingerprint, facial, and iris recognition at scale to ensure both robust security and user convenience. The need to balance stringent security requirements with seamless user experiences has driven rapid innovation in biometric modalities, reducing false acceptance and rejection rates through AI-driven feature extraction and deep neural network matching. According to industry analyses, AI-enhanced biometric systems have reduced false rejection rates to below 0.1% compared to traditional approaches, enabling reliable and frictionless authentication even in high-volume settings.

Identifying the Pivotal Technological and Market Disruptions Propelling Biometrics from Niche Applications to Ubiquitous Stateless and Edge-Enabled Solutions

Biometric technologies have undergone transformative shifts propelled by the integration of artificial intelligence and machine learning, enabling systems to extract and match unique biological features with unprecedented precision and speed. Deep neural networks power feature extraction in modalities ranging from palm vein scanners to facial recognition cameras, pushing false acceptance rates below 0.0001% in controlled environments and redefining the benchmarks for secure access. Concurrently, the adoption of multimodal biometric systems-combining facial, fingerprint, and voice recognition-has emerged as a critical strategy to mitigate spoofing risks and enhance user experience, as evidenced by recent deployments in aviation and border control that integrate liveness detection with multimodal fusion capabilities.

Furthermore, the shift toward edge-enabled and contactless biometric solutions has reshaped deployment models, reducing reliance on centralized processing and enhancing privacy by keeping sensitive data on-device. Edge AI accelerates authentication workflows to sub-second levels, while contactless modalities address hygiene concerns in retail, transportation, and healthcare environments. These technological advances are complemented by evolving privacy regulations that mandate stronger safeguards around biometric data storage and consent, prompting industry stakeholders to adopt privacy-by-design principles and encrypted biometric templates. Together, these disruptive developments are driving the biometrics market from niche applications toward ubiquitous, scalable solutions.

Assessing the Comprehensive Economic and Operational Repercussions of New U.S. Trade Tariffs on Biometric Hardware Components and Solutions in 2025

The introduction of sweeping U.S. trade measures in 2025 has imposed up to 25% tariffs on electronic components sourced from key manufacturing hubs, creating a ripple effect across biometric hardware supply chains. Tariffs targeting Japanese and South Korean imports, which include semiconductors vital to cameras, scanners, and sensors, threaten to elevate production costs and squeeze profit margins for device manufacturers. Concurrently, country-specific levies of 34% on Chinese-made cameras and up to 46% on goods from Vietnam underscore the complexity of navigating global tariffs, compelling firms to reassess sourcing strategies and diversify manufacturing footprints to mitigate exposure.

These tariff-induced cost pressures are catalyzing shifts toward reshoring initiatives and vendor partnerships in lower-tariff regions, yet the transition is neither immediate nor frictionless. Components relocation often entails capital-intensive facility expansions and rigorous regulatory approvals, delaying time-to-market for new biometric devices. In turn, many product developers are exploring design optimizations that reduce reliance on tariff-affected parts, while others are negotiating long-term supply agreements to stabilize pricing and secure inventory. As a result, procurement cycles have lengthened, and project timelines for large-scale biometric rollouts are adapting to account for potential customs delays and cost escalations.

Delving into Nuanced Segmentation Dynamics Reveals Distinct Opportunities and Challenges across Biometrics Product, Service, and Technology Categories

A thorough examination of market segmentation reveals the nuanced interplay of components, services, and software in shaping value propositions for biometric solutions. Hardware offerings span cameras, scanners, and sensors engineered for various environmental conditions, complemented by specialized services encompassing installation, integration, support, and maintenance. On the software front, platforms for biometric data processing coexist with authentication engines designed for identity verification, each tailored to meet specific performance and compliance requirements.

Technological segmentation highlights an array of modalities from facial and fingerprint recognition to emerging vein and voice-based systems, each with unique strengths in speed, accuracy, and user experience. Meanwhile, choices between contact-based, contactless, and hybrid offerings influence deployment preferences in sectors prioritizing hygiene, such as healthcare and retail. Authentication depth further diversifies solutions, spanning single-factor to multi-factor schemes that combine biometric traits for elevated security. Finally, deployment modes-ranging from cloud-hosted services to on-premise installations-intersect with mobility considerations for fixed and portable systems, while end-user needs across banking, consumer electronics, energy, government, healthcare, smart homes, telecom, and logistics drive tailored solution roadmaps.

This comprehensive research report categorizes the Biometrics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology Type

- Offering

- Authentication Type

- Mobility

- End-User Industry

Uncovering Regional Contrasts in Adoption, Innovation, and Growth Trajectories across Americas, EMEA, and Asia-Pacific Biometrics Ecosystems

The Americas continue to lead in large-scale biometric identity programs, driven by government initiatives like national ID enhancements and extensive adoption in financial services, where contactless authentication has become a standard for ATM and mobile banking security. North American and Latin American markets each exhibit strong demand for integrated hardware-software ecosystems, spurred by public-private collaborations to modernize border control and law enforcement workflows.

In Europe, Middle East, and Africa, regulatory frameworks are catalyzing the shift to advanced biometric border systems, as seen in the EU’s phased rollout of the Entry/Exit System for non-EU travelers and the integration of fingerprint and facial scans to replace manual passport stamping. Meanwhile, Asia-Pacific markets are characterized by rapid consumer electronics adoption, with mobile device manufacturers and e-commerce platforms embedding fingerprint and facial recognition into everyday transactions. Regional smart city initiatives and large-scale national programs further underscore the appetite for biometrics in public infrastructure and collaborative innovation.

This comprehensive research report examines key regions that drive the evolution of the Biometrics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Partnerships, Innovation Portfolios, and Competitive Differentiators of Major Biometrics Providers Shaping Industry Leadership Globally

Prominent industry players are leveraging strategic partnerships and R&D to enhance their competitive positioning. NEC, for example, has introduced a biometric-based digital signature technology that enables secure face recognition without storing raw facial data, a breakthrough that reduces privacy risks and simplifies compliance with data protection regulations. In tandem, NEC’s deployment of face recognition payment and admission systems at Expo 2025 in Osaka demonstrates how large public events can serve as innovation showcases for frictionless, contactless experiences.

IDEMIA has fortified its leadership in payment biometrics by launching smartphone-based fingerprint enrollment for biometric payment cards, enhancing user onboarding and positioning banks to capitalize on growing consumer demand, where over 60% of users express willingness to adopt these cards for everyday transactions. Concurrently, its collaboration with IATA on the Contactless Travel Directory underscores a commitment to enabling interoperable, airline-driven biometric travel services. HID Global, in turn, has unveiled its Integration Service platform to unify physical security components with digital identity management, streamlining the implementation of complex biometric systems and accelerating deployment timelines for integrators and end users alike.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biometrics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Accu-Time Systems, Inc.

- Amadeus IT Group, S.A.

- Assa Abloy AB

- Authsignal

- Aware, Inc.

- BIO-key International

- Bioenable Technologies Pvt. Limited

- Cognitec Systems GmbH by SALTO Group

- Daon, Inc.

- DERMALOG Identification Systems GmbH

- Fujitsu Limited

- GripID

- Hitachi, Ltd.

- Honeywell International Inc.

- IDEMIA Group

- IN Groupe

- Innovatrics, s.r.o.

- Integrated biometrics, inc.

- International Business Machine Corporation

- IrisGuard Ltd

- Leidos, Inc.

- M2SYS, Inc.

- Microsoft Corporation

- NEC Corporation

- Neurotechnology

- NEXT Biometrics Group ASA.

- Precise Biometrics

- Suprema, Inc.

- Thales Group

- Touchless Biometric Systems AG

- Unissey

Formulating Strategic Imperatives to Capitalize on Emerging Biometrics Innovations While Navigating Complex Regulatory and Competitive Challenges

Industry leaders should prioritize the integration of privacy-centric design principles and encrypted biometric templates to comply with evolving data protection regulations, such as the EU Entry/Exit System requirements and global privacy frameworks. By embedding privacy-by-design at the core of product development, organizations can build user trust and preempt regulatory challenges while sustaining innovation momentum.

Furthermore, executives are advised to diversify supply chains to mitigate tariff exposure, taking advantage of emerging manufacturing hubs with favorable trade conditions. Strategic investments in local assembly and component sourcing will not only protect margins against fluctuating duties but also strengthen resilience against future geopolitical disruptions. Collaborative partnerships with technology integrators and regional stakeholders enable more agile responses to market shifts and support scalable deployment across diverse end-user segments.

Detailing Rigorous Multimodal Research Methodology Combining Primary Interviews, Secondary Analysis, and Robust Validation Protocols to Ensure Data Integrity

This research combined extensive primary and secondary methodologies to ensure comprehensive and accurate insights. Primary research included in-depth interviews with over 25 industry executives, system integrators, and end-user representatives, complemented by a structured survey of technology adopters across key geographic regions. These engagements provided qualitative perspectives on adoption drivers, pain points, and future priorities.

Secondary research encompassed a thorough review of academic publications, patent filings, regulatory documents, and credible news sources to map technological advancements, trade policy developments, and regional regulatory frameworks. Data triangulation techniques were applied to cross-validate findings, while iterative stakeholder workshops refined the segmentation model and validated emerging themes. This rigorous approach underpins the integrity and reliability of the strategic recommendations presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biometrics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biometrics Market, by Component

- Biometrics Market, by Technology Type

- Biometrics Market, by Offering

- Biometrics Market, by Authentication Type

- Biometrics Market, by Mobility

- Biometrics Market, by End-User Industry

- Biometrics Market, by Region

- Biometrics Market, by Group

- Biometrics Market, by Country

- United States Biometrics Market

- China Biometrics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Critical Insights and Strategic Imperatives to Guide Decision-Makers in Navigating the Evolving Biometrics Landscape with Confidence

The biometrics landscape in 2025 is marked by converging trends in AI-driven accuracy, edge computing, and privacy-centric design, creating a dynamic environment of opportunity and complexity. Organizations that embrace multimodal authentication frameworks and invest in on-device processing capabilities will gain a competitive edge in both consumer and enterprise markets.

Heightened regulatory scrutiny and trade tariffs are reshaping supply chains and deployment strategies, underscoring the importance of diversified sourcing and compliance readiness. The interplay of regional initiatives-from the EU’s Entry/Exit System to Asia-Pacific smart city programs-demonstrates that collaborative engagement with policymakers and industry consortia is essential to drive standardization and interoperability.

Looking ahead, market leaders must balance innovation with ethical considerations, ensuring that biometric solutions not only deliver security and convenience but also uphold user privacy and societal trust. This strategic equilibrium will define the next wave of growth and adoption across global biometrics ecosystems.

Take the Next Step Toward Unparalleled Industry Vision and Secure Market Leadership with a Comprehensive Biometrics Market Research Report Tailored to Your Needs

Unlock the full value of your strategic planning and ensure leadership in the rapidly evolving biometrics arena by securing this comprehensive market research report. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how tailored insights into technology trends, regulatory impacts, and competitive dynamics can inform your investment decisions and innovation roadmaps. Reach out to discuss bespoke research packages and sample chapters that demonstrate the depth of analysis and actionable intelligence awaiting your organization.

- How big is the Biometrics Market?

- What is the Biometrics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?