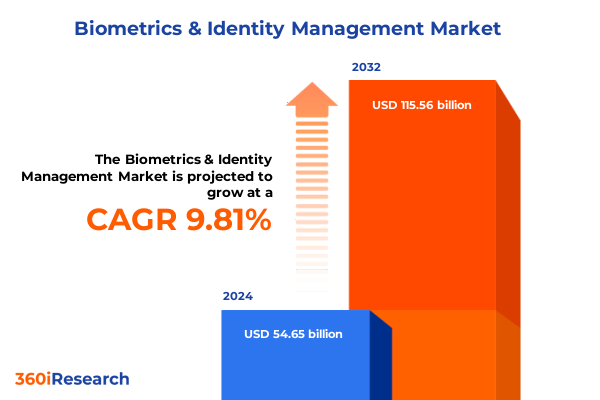

The Biometrics & Identity Management Market size was estimated at USD 59.51 billion in 2025 and expected to reach USD 64.79 billion in 2026, at a CAGR of 9.94% to reach USD 115.56 billion by 2032.

Unveiling the Next Frontier in Biometrics and Identity Management as Emerging Technologies Redefine Security and User Authentication Experiences

In today’s digital age, the need for robust identity verification and secure access has transcended traditional security perimeters, propelling biometric technologies into the mainstream across industries. No longer confined to niche applications, solutions such as facial recognition, fingerprint recognition, and iris scanning have become integral to environments where both security and user convenience are paramount. As data breaches and identity fraud escalate globally, organizations are under intensified pressure to deploy systems that not only authenticate users accurately but also maintain seamless experiences.

This executive summary distills critical developments shaping the biometrics and identity management sector. It highlights transformative shifts driven by artificial intelligence, Internet of Things integration, and evolving regulatory landscapes. Additionally, it examines the significant ramifications of U.S. tariff adjustments on component sourcing and cost structures, uncovers nuanced segmentation opportunities based on technology, components, end users, deployment modes, applications, and authentication types, and delineates regional dynamics that influence adoption across the Americas, Europe, Middle East & Africa, and Asia-Pacific. With a focus on leading companies’ strategies and a roadmap for industry leaders, this document sets the stage for actionable decision-making in a field experiencing rapid innovation and change.

Navigating Dramatic Paradigm Shifts in the Biometrics Ecosystem Driven by AI, IoT Convergence, and Heightened Compliance Demands

Over the past year, artificial intelligence and machine learning algorithms have matured to the point where biometric systems now deliver unprecedented accuracy in distinguishing genuine users from impostors. This leap in performance has encouraged broader adoption across sectors that demand both high security and frictionless access, such as healthcare and financial services. At the same time, the proliferation of Internet of Things devices has expanded the points of interaction, enabling continuous authentication through behavioral and physiological cues.

Concurrently, regulatory frameworks are tightening to safeguard user privacy and data integrity. Legislation in multiple jurisdictions now mandates stringent consent requirements and clear data retention policies, driving vendors to innovate privacy-by-design approaches. Furthermore, heightened compliance standards have spurred investment in edge computing solutions, allowing biometric data to be processed locally and minimizing potential exposure. As these forces converge, the landscape is being reshaped by a dual imperative: harness cutting-edge capabilities while ensuring robust governance to maintain user trust.

Assessing the Multifaceted Impact of the 2025 U.S. Tariff Regime on Biometrics Supply Chains, Technology Costs, and Industry Adaptation Strategies

In early 2025, the U.S. Trade Representative finalized a broad increase in Section 301 tariffs that directly impacts the import of semiconductors integral to biometric hardware. Effective January 1, 2025, tariff rates on semiconductors under HTS headings 8541 and 8542 doubled from 25 percent to 50 percent, significantly raising component costs for manufacturers and integrators relying on imported chips. These elevated duties underscore the strategic priority placed on strengthening domestic semiconductor supply chains but also introduce a layer of complexity for global system providers managing cost structures and procurement timelines.

Meanwhile, an Executive Order issued on April 29, 2025 decreed that overlapping tariffs imposed under various statutory authorities shall no longer “stack.” This directive, applied retroactively to all relevant entries as of March 4, 2025, aims to prevent cumulative duty burdens that exceed policy objectives. By establishing clear rules for determining which single tariff applies when multiple measures overlap, the order simplifies compliance but also adds interpretive challenges for importers navigating conflicting regulations. As a result, companies must invest in enhanced customs advisory services and robust trade compliance functions to avoid unexpected liabilities and ensure smooth cross-border operations.

Collectively, these tariff actions have compelled industry stakeholders to reassess global sourcing strategies. Some vendors have accelerated efforts to localize production or secure alternative non-Chinese sources for critical components, while others are exploring supply chain financing solutions to offset duty impacts. The combined effect is a recalibration of manufacturing footprints and distribution networks as businesses seek resilience against ongoing trade volatility.

Dissecting Critical Market Segmentation Layers Revealing Distinct Adoption Patterns across Technologies Components End Users and Deployment Models

A nuanced understanding of technology types reveals that facial recognition solutions continue to dominate high-traffic access control installations, while fingerprint recognition remains pervasive in mobile and consumer-grade authentication scenarios. Iris and vein recognition are finding specialized applications within high-security government and defense environments, and voice recognition is expanding into telehealth and call-center identification processes, leveraging advances in natural language processing. In terms of components, hardware investments comprise cameras, sensors, and processing units, whereas software platforms drive analytics, data management, and system integration layers, supported by both managed services and professional advisory engagements.

Examining end users, financial institutions remain early adopters due to stringent know-your-customer mandates, but large enterprises across multiple verticals are embracing biometrics for both cybersecurity and employee convenience. Government and defense agencies prioritize multi-modal systems for border control and secure facility access, while healthcare organizations emphasize touchless and hygienic solutions. Deployment modes span cloud architectures-ranging from public to hybrid and private configurations-to on-premises installations, balancing scalability with data sovereignty considerations. Across applications, access control solutions bifurcate into logical systems that secure digital networks and physical gateways safeguarding critical facilities. Border control, national ID and e-passport initiatives, and time and attendance tracking continue to drive large-scale implementations, with identification flows distinguished from verification checks to suit use-case specifics.

This comprehensive research report categorizes the Biometrics & Identity Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Type

- Component

- Authentication Type

- Application

- End User

- Deployment Mode

Uncovering Strategic Regional Dynamics Shaping the Biometrics Landscape across Americas Europe Middle East Africa and Asia Pacific Powerhouse Markets

In the Americas, demand for biometric enrollment at airports and corporate campuses has surged, driven by government initiatives to modernize travel infrastructure and by private organizations seeking to streamline facility access. The region’s robust technology ecosystem and regulatory support for digital identity frameworks have fostered pilot programs integrating multiple biometric modalities. Conversely, in Europe, Middle East and Africa, regulatory rigor around data protection has fueled adoption of on-premises deployments, particularly within the European Union, where GDPR compliance mandates stringent data governance. In the Middle East, large-scale national ID programs are under way, leveraging cloud-hosted biometric platforms under public-private partnership models.

Meanwhile, Asia-Pacific markets exhibit the most diverse technology penetration rates. Nations with large populations and burgeoning digital economies are scaling mobile-based biometric payments and social welfare distribution schemes. In parallel, cloud-native solutions are gaining traction in markets where data sovereignty rules remain nascent, allowing service providers to offer hybrid cloud models that balance performance and compliance. Across all regions, cross-border collaborations and technology transfer agreements continue to shape deployments, underscoring the interdependence of local market drivers and global innovation trajectories.

This comprehensive research report examines key regions that drive the evolution of the Biometrics & Identity Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Major Industry Players’ Competitive Strategies and Partnerships Driving Innovation Momentum in the Global Biometrics Sector

Leading technology vendors have forged deep alliances with chipset manufacturers and IoT platform providers to deliver end-to-end biometric solutions that address both performance and integration requirements. At the same time, partnerships between software providers and professional services firms have emerged to guide enterprise digital transformation initiatives, offering turnkey implementations from proof of concept to full-scale rollout. Legacy security incumbents are expanding portfolios through acquisitions of niche biometric startups, while emerging players differentiate by embedding AI-driven analytics into cloud-native platforms.

Competitive dynamics also reflect the rise of open-standards consortia collaborating on interoperability frameworks, enabling customers to avoid vendor lock-in and to orchestrate multi-modal systems seamlessly. Strategic investments in research and development are further reinforcing market positions, with companies allocating resources toward anti-spoofing technologies, liveness detection, and privacy-enhancing encryption methods to stay ahead of regulatory and threat-landscape shifts.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biometrics & Identity Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ASSA ABLOY AB

- Aware, Inc.

- BioCatch Ltd.

- CLEAR, Inc.

- CyberArk Software Ltd.

- Fujitsu Limited

- IDEMIA France SAS

- Jumio, Inc.

- Microsoft Corporation

- NEC Corporation

- Okta, Inc.

- Ping Identity Corporation

- SailPoint Technologies Holdings, Inc.

- Suprema Inc.

- Thales S.A.

Empowering Industry Leaders with Tactical Recommendations to Optimize Investments Enhance Capabilities and Capitalize on Emerging Biometrics Trends

Industry leaders should prioritize the development of modular, interoperable platforms that allow end users to tailor biometric modalities to specific risk profiles, enhancing flexibility while safeguarding future scalability. Building regional delivery centers and research hubs can mitigate geopolitical risks associated with supply chain disruptions and tariff fluctuations. Additionally, strengthening data governance capabilities-notably through privacy-by-design architectures and transparent user consent workflows-will be essential to meet tightening regulatory requirements and to cultivate trust among stakeholders.

To stay ahead, organizations must invest in ongoing talent development, nurturing cross-functional teams with expertise in AI, cybersecurity, and compliance. Proactive engagement with standards bodies and industry alliances will also help shape favorable interoperability guidelines and reduce integration complexity. Finally, establishing agile procurement frameworks-such as multi-sourcing agreements and supply chain financing partnerships-can provide greater resilience against cost volatility and help maintain continuity of operations during periods of trade uncertainty.

Outlining a Rigorous, Multi Dimension Research Methodology Combining Primary Interviews Secondary Analysis and Advanced Data Validation Techniques

This research employed a comprehensive, mixed-methodology approach combining primary and secondary data collection. In the primary phase, in-depth interviews were conducted with technology executives, solution integrators, and end-user decision-makers to capture real-time insights into deployment challenges and strategic priorities. A series of structured surveys supplemented these interviews, targeting a broad cross-section of verticals to validate technology adoption patterns and investment drivers.

Secondary analysis incorporated peer-reviewed journals, regulatory filings, and trade publications to contextualize market movements and legislative developments. Proprietary databases were leveraged to map partnership networks and track patent filings, while a triangulation process reconciled divergent data points to ensure that findings are robust and representative. Finally, all inputs underwent a rigorous validation procedure, including cross-reference checks with industry experts and scenario-based stress testing, to deliver actionable and reliable conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biometrics & Identity Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biometrics & Identity Management Market, by Technology Type

- Biometrics & Identity Management Market, by Component

- Biometrics & Identity Management Market, by Authentication Type

- Biometrics & Identity Management Market, by Application

- Biometrics & Identity Management Market, by End User

- Biometrics & Identity Management Market, by Deployment Mode

- Biometrics & Identity Management Market, by Region

- Biometrics & Identity Management Market, by Group

- Biometrics & Identity Management Market, by Country

- United States Biometrics & Identity Management Market

- China Biometrics & Identity Management Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Core Insights from Biometrics Trends and Strategic Implications to Forge a Clear Path Forward in Identity Management Innovation

Bringing together the insights from technology advancements, regulatory evolution, tariff impacts, segmentation analysis, and regional dynamics, it becomes clear that the biometrics and identity management market stands at an inflection point. Organizations that effectively balance innovation adoption with governance frameworks will unlock new efficiencies and security benefits. The confluence of AI-powered accuracy improvements and expanding deployment models underscores the sector’s growth potential, but also highlights the necessity for a strategic, adaptable approach.

As companies refine architectures and supply chains in response to trade policy shifts, the ability to pivot swiftly and to forge collaborative partnerships will define market leadership. Looking ahead, the most successful players will be those that seamlessly integrate multi-modal systems, uphold the highest standards of data privacy, and continuously evolve in tandem with emerging threats and regulatory landscapes, thereby charting a sustained path toward secure, user-centric identity management.

Engage with Ketan Rohom for Exclusive Access to In Depth Biometrics Market Insights and Secure Your Copy of the Definitive 2025 Executive Summary Report

To secure comprehensive insights into the evolving biometrics and identity management landscape, reach out to Ketan Rohom, whose expertise in sales and marketing bridges industry intelligence and actionable strategies. Engaging with Ketan offers you an exclusive, tailored walkthrough of the report’s key findings, enabling your organization to make informed decisions, mitigate emerging risks, and capitalize on tomorrow’s growth opportunities. By connecting with him, you gain priority access to in-depth data, bespoke analysis, and post-publication support-ensuring you stay ahead of market shifts. Don’t miss the opportunity to elevate your understanding of critical technology trajectories and competitive dynamics; contact Ketan to purchase your definitive 2025 market research report today and equip your team with the knowledge to lead in the age of advanced biometrics.

- How big is the Biometrics & Identity Management Market?

- What is the Biometrics & Identity Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?