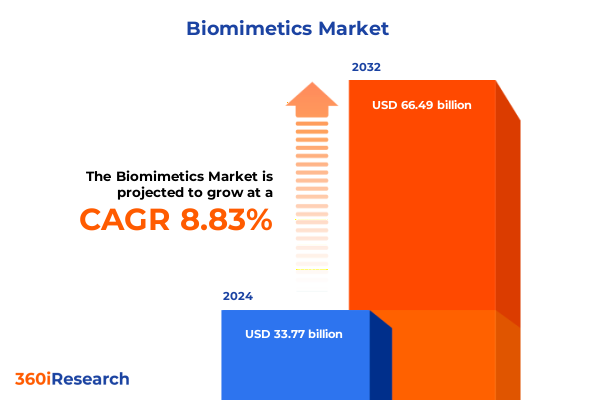

The Biomimetics Market size was estimated at USD 43.58 billion in 2025 and expected to reach USD 46.92 billion in 2026, at a CAGR of 7.87% to reach USD 74.06 billion by 2032.

Unveiling Biomimetics Fundamentals to Illuminate the Pathway for Disruptive Engineering Solutions Inspired by Nature’s Sustainable Design Principles

Biomimetics, the interdisciplinary study of nature’s design principles and processes, has emerged as a pivotal driver in modern engineering and materials science. By examining how biological systems achieve exceptional performance through efficiency, adaptability, and resilience, researchers and manufacturers are unlocking pathways to create innovative products and processes that leverage these insights. From self-healing polymers inspired by cellular repair mechanisms to lightweight structural components modeled after bone architecture, biomimetics is redefining conventional approaches across industries.

At its core, this approach draws upon principles such as hierarchical structuring, responsive adaptation, and energy minimization, which nature has refined over millions of years. Unlike traditional R&D paradigms that often rely on incremental improvements, biomimetics offers the promise of transformative design breakthroughs by fundamentally rethinking the interaction between form, function, and environment. Consequently, organizations embracing biomimetic methodologies are strategically positioned to outperform competitors by delivering sustainable solutions with superior performance and lower resource consumption.

This executive summary presents a comprehensive overview of the biomimetics market, highlighting key drivers, segmentation insights, regional dynamics, and competitive landscapes. It synthesizes the latest trends in technology adoption, examines the impact of recent policy changes such as tariffs, and offers actionable recommendations for industry leaders seeking to capitalize on nature-inspired innovation. By the conclusion, readers will possess the strategic intelligence necessary to navigate this rapidly evolving domain with confidence and foresight.

Mapping the Pivotal Shifts Reshaping Biomimetic Technology Adoption Across Sectors in Response to Global Innovation and Sustainability Drivers

Over the past decade, biomimetics has transitioned from niche academic inquiry to a mainstream innovation strategy powering developments in sectors ranging from consumer electronics to aerospace. This shift reflects a confluence of factors, beginning with the maturation of advanced manufacturing techniques such as additive manufacturing and nanofabrication. These enabling technologies allow scientists to replicate intricate biological structures at micro and nano scales, yielding materials and devices with unprecedented mechanical, thermal, and functional properties. As a result, companies are now integrating nature-inspired designs into high-performing components that were previously inconceivable under traditional fabrication constraints.

Simultaneously, the global imperative for sustainability has intensified demand for materials and processes that minimize environmental footprints. Biomimetic solutions, which often prioritize resource efficiency and life-cycle optimization, align closely with corporate sustainability targets and regulatory requirements. Notably, product developers are harnessing bio-inspired surface engineering techniques to reduce energy consumption in fluid transport and to enhance corrosion resistance, thereby extending service life and lowering maintenance costs.

Furthermore, the advent of artificial intelligence and computational modeling has supercharged the biomimetics ecosystem. By leveraging AI-driven topology optimization and bio-inspired algorithmic design tools, engineers can now simulate and refine complex geometries before committing to expensive prototyping phases. This digital transformation not only accelerates time-to-market but also reduces R&D expenditure, enabling organizations of all sizes to experiment with nature-inspired architectures and materials. Collectively, these transformative shifts are redefining the competitive contours of the biomimetic landscape, driving rapid innovation and broadening application horizons.

Examining the Cumulative Impact of 2025 United States Tariff Measures on Biomimetic Component Supply Chains, Cost Structures, and Innovation Investments Across Industries

In 2025, the United States government implemented a series of tariff adjustments targeting imported materials and critical components integral to the biomimetics supply chain. These measures, aimed at fortifying domestic manufacturing, have generated multifaceted impacts on cost structures, supplier relationships, and investment strategies across the biomimetics value chain. Notably, tariffs on specialty alloys and synthetic polymers have elevated input costs for companies reliant on imported feedstocks, prompting many to reassess their procurement strategies or accelerate domestic sourcing initiatives.

The cumulative effect of these trade policies has been a realignment of regional supply networks. Organizations facing elevated import duties have shifted production and procurement toward North American suppliers, stimulating investment in local manufacturing capacity and raw material production. While this trend has enhanced supply chain resilience and regional job creation, it has also introduced upward cost pressures that companies must absorb or pass on to end users. In response, some market participants are renegotiating supplier contracts and engaging in co-development partnerships to share risk and drive down unit costs through scale.

Despite these challenges, the tariffs have also catalyzed innovation by incentivizing firms to explore alternative materials and process efficiencies. R&D efforts have increasingly focused on developing biohybrid composites and engineered ceramics that either evade tariff classifications or deliver superior performance at comparable cost points. Consequently, the policy environment has fostered a wave of targeted research collaborations and pilot programs, underscoring the adaptability of the biomimetics sector in the face of evolving trade dynamics.

Extracting Strategic Insights from Application, Material, Technology, and End User Segmentation to Uncover Growth Drivers in Biomimetic Markets

The biomimetics market’s diversity is most apparent when examining its segmentation by application. In the automotive sector, nature-inspired body panels imbued with hierarchical lattice structures are reducing vehicle weight while enhancing crash performance. Cooling systems modeled after leaf venation and capillary action are improving thermal management in electric vehicles, whereas sensors drawing from electroreceptive mechanisms found in marine life are delivering breakthrough levels of sensitivity. In construction, bio-inspired coatings derived from lotus leaf microstructures are imparting self-cleaning properties, and insulation materials emulating animal fur architectures are achieving superior thermal retention. Surface textures in consumer electronics that mirror shark skin patterns are reducing drag and microbial adhesion, while flexible displays leverage organic architectures to balance flexibility with durability. In defense, camouflage materials that replicate cephalopod chromatophore dynamics are offering adaptive concealment, and surveillance systems based on compound eye designs are enhancing situational awareness. The healthcare arena is witnessing rapid uptake of drug delivery systems modeled on pollen grain exine structures, while medical implants adopt bone-mimicking porosity to foster osseointegration. Tissue engineering scaffolds replicate the gradient structures of natural extracellular matrices to facilitate bone regeneration and skin repair. Industrial applications capitalize on biomimetic adhesives inspired by gecko setae, leading to robust yet reversible bonding solutions.

Material type segmentation further refines strategic focus. Biohybrids, which blend engineered tissue with living materials, are emerging in smart packaging and dynamic architectural systems. Engineered bio ceramics reproduce the mineralized frameworks of mollusk shells, delivering high strength-to-weight ratios, while inorganic ceramics offer thermal stability in high-temperature environments. Fiber-reinforced composites leverage nature’s fiber architectures for superior tensile performance, and particle-reinforced composites draw on nacre-like brick-and-mortar arrangements for impact resistance. Coated metals emulate protective exoskeleton layers to enhance corrosion resistance, and shape memory alloys mimic plant tendril actuation for adaptive structural applications. Polymers derived from polyhydroxyalkanoates are being piloted in biodegradable packaging, while thermosetting resins incorporate plant-based crosslinkers to boost sustainability.

Technology type segmentation reveals that actuators utilizing electroactive polymers, inspired by muscle fibers, are driving soft robotics advancements, and pneumatic systems modeled on insect respiration are enabling lightweight, efficient motion. Self-healing systems adopt intrinsic repair chemistries derived from mollusk shell regeneration, and microcapsule-based approaches replicate human wound healing. Chemical sensors mimicking olfactory receptor functions, optical sensors reflecting butterfly wing nanostructures, and tactile sensors recreating mammalian mechanoreceptor networks are expanding detection capabilities. Gradient structures in load-bearing architectures draw from bamboo’s functionally graded design, while lattice architectures emulate diatom shells to combine rigidity with lightness. Surface engineering techniques that prevent marine biofouling borrow from shark skin microtopography, and anti-reflective coatings echo moth eye nanostructures to optimize optical performance.

The end user industry segmentation underscores how adoption rates vary by sector. In automotive, body panels featuring biomimetic honeycomb cores and advanced cooling sensors are achieving commercial deployment. Construction firms are trialing self-cleaning coatings and adaptive insulation in smart buildings. Defense integrators are incorporating adaptive camouflage textiles and compound eye-inspired surveillance optics. Electronics manufacturers are embedding flexible circuits with nature-inspired interconnects and thermal management layers modeled on penguin plumage. Medical device companies are advancing implant portfolios that mimic vascular networks to improve implant integration and deploying robotic-assisted surgical instruments guided by insect vision algorithms. Textile innovators are weaving smart fabrics with shape memory yarns for responsive apparel and developing camouflage textiles that replicate cephalopod color-shifting capabilities. Collectively, this segmentation analysis highlights the market’s heterogeneous nature and underscores high-value opportunities at the intersection of multiple application, material, technology, and end-user dimensions.

This comprehensive research report categorizes the Biomimetics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Technology Type

- Application

Revealing Distinct Regional Dynamics Across the Americas, EMEA, and Asia-Pacific That Shape Adoption Patterns in Biomimetic Innovations

Regional dynamics in the biomimetics field reflect distinct innovation ecosystems, regulatory frameworks, and industry priorities. Throughout the Americas, research institutions and technology clusters in North America are collaborating closely with automotive and aerospace OEMs to accelerate the commercialization of bio-inspired materials and components. Canada’s advanced manufacturing hubs are pioneering additive manufacturing of hierarchical structures, while Latin America’s focus on natural resource sustainability has inspired pilot projects evaluating bio-based polymers in agricultural and packaging applications. Cross-border initiatives are strengthening supply chain resilience, and regional trade agreements are facilitating the exchange of raw materials and intellectual property.

Within Europe, the Middle East, and Africa, European Union sustainability mandates and circular economy directives are driving aggressive investment in biodegradable biomimetic materials and large-scale structural applications. Germany’s automotive sector continues to lead in deploying thermal management systems based on plant transpiration principles, whereas the United Kingdom’s medical research centers are commercializing tissue engineering scaffolds for orthopedic and dental regeneration. In the Middle East, resource-scarcity challenges have spurred development of self-healing surface coatings for infrastructure, and African innovation centers are exploring textile applications of natural fiber composites for cost-effective and climate-resilient solutions.

The Asia-Pacific region represents a rapidly expanding market characterized by robust government support, dynamic manufacturing capabilities, and escalating private investment in R&D. China’s major universities and industrial partners are scaling up production of shape memory alloys and biohybrid materials for consumer electronics and automotive applications. Japan’s precision engineering expertise is enhancing bio-inspired actuator technologies and sensor miniaturization, while South Korea is integrating biomimetic surface engineering into semiconductor cooling systems. Emerging economies in Southeast Asia are focusing on cost-effective, bio-based polymers to address packaging waste, signaling a broadening of applications and innovation pathways in the region.

This comprehensive research report examines key regions that drive the evolution of the Biomimetics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Landscapes by Highlighting Leading Biomimetics Innovators, Strategic Partnerships, and Technology Diversification Trends

The competitive landscape of biomimetics is defined by a blend of established global corporations, specialized mid-sized innovators, and agile startups that collectively drive technological progress. Traditional chemical and materials companies have augmented their portfolios with bio-inspired offerings, leveraging deep R&D capabilities and extensive distribution networks. Meanwhile, specialized firms focusing exclusively on biomimetic solutions have carved out niches by concentrating on high-value applications such as medical implants, adaptive coatings, and sensor integration.

Strategic partnerships between materials producers and original equipment manufacturers are increasingly common, reflecting a co-innovation model that accelerates market entry. Several leading entities have established joint development agreements to refine fabrication processes and validate performance under real-world conditions. Additionally, investment activity from venture capital and corporate venture arms is fueling a wave of M&A that enriches the competitive field with next-generation platforms, including AI-driven design tools and scalable biomanufacturing systems.

In parallel, collaborative ecosystems comprising universities, national labs, and incubators have become instrumental in bridging early-stage research to commercial readiness. These alliances provide access to specialized fabrication facilities, pilot production lines, and regulatory guidance, thereby mitigating risks for companies entering the biomimetics domain. Consequently, market competition hinges not only on proprietary technologies but also on the ability to orchestrate multi-stakeholder ecosystems that deliver end-to-end solutions.

Looking forward, differentiation will depend on the integration of digital twins, life-cycle analyses, and customized service models that enable rapid iteration and demonstrable sustainability benefits. Firms that cultivate these capabilities while maintaining agile governance and cross-sector partnerships will secure leadership positions in the next wave of biomimetics innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biomimetics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D AG

- 3M Company

- ALCIMED SAS

- BASF SE

- Boston Scientific Corporation

- Corning Incorporated

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Koninklijke DSM N.V.

- Medtronic plc

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

Empowering Industry Leaders with Targeted Strategies to Capitalize on Biomimetic Advancements and Strengthen Market Positioning in a Rapidly Evolving Field

Industry leaders seeking to maintain competitive advantage in the biomimetics space should initiate targeted collaborations with academic laboratories and specialized research institutes to gain early access to emerging design methodologies and fabrication techniques. By co-developing prototypes within shared innovation hubs, organizations can validate performance parameters in parallel environments, substantially reducing time and cost associated with product development cycles. Simultaneously, companies should invest in digital infrastructure, such as computational modeling platforms and AI-enabled material screening tools, to scale design exploration across a broader range of natural analogues and accelerate the translation from concept to proof-of-concept.

Supply chain resilience remains paramount given recent tariff disruptions and evolving geopolitical landscapes. To mitigate risk, firms should pursue multi-sourcing strategies for critical feedstocks and engage in vertical integration initiatives that secure domestic production lanes. Establishing strategic alliances with regional suppliers and exploring bio-based material alternatives can both insulate operations from trade fluctuations and reinforce sustainability commitments. Moreover, embedding flexibility into manufacturing processes through modular production lines will enable rapid adaptation to shifting tariff regimes and demand profiles.

From a market positioning standpoint, organizations must articulate clear value propositions that emphasize quantified sustainability outcomes, such as reductions in lifecycle carbon emissions or improvements in recyclability. Leveraging third-party certifications and transparent reporting frameworks will bolster credibility among stakeholders and facilitate alignment with emerging regulatory requirements. Lastly, to capture underserved market segments, leadership teams should conduct targeted pilot programs in sectors like healthcare and consumer electronics, where end users are increasingly receptive to premium-priced, high-performance biomimetic products. A disciplined approach to prioritizing high-impact use cases, coupled with rigorous performance validation and iterative refinement, will secure long-term growth trajectories.

Detailing the Robust Research Framework Combining Qualitative and Quantitative Techniques to Ensure Reliability and Transparency of Findings

This report’s findings are grounded in a robust, multi-method research framework designed to deliver both depth and reliability. The primary research component encompassed extensive interviews with subject-matter experts, including materials scientists, process engineers, procurement managers, and sustainability directors across key industries. These discussions provided firsthand insights into technology adoption drivers, supply chain vulnerabilities, and emerging application priorities, ensuring that qualitative observations are rooted in real-world experiences.

Complementing these interviews, a comprehensive secondary research effort scanned peer-reviewed journals, patent databases, conference proceedings, and trusted industry publications. This phase enabled triangulation of data points, validation of technological milestones, and identification of evolving regulatory landscapes. Analytical methodologies such as technology readiness level (TRL) assessments and value chain mapping were applied to evaluate the maturity and commercial viability of identified innovations.

Quantitative data streams, sourced from publicly available corporate filings, government trade statistics, and regional economic indicators, were integrated to contextualize cost structures and investment trends. A rigorous quality control process, involving multiple rounds of data verification and cross-functional peer review, ensured consistency and accuracy. In addition, scenario analysis techniques were employed to model the potential impact of policy shifts, supply chain disruptions, and breakthrough advancements, delivering strategic foresight into how the biomimetics market may evolve under varying conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biomimetics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biomimetics Market, by Material Type

- Biomimetics Market, by Technology Type

- Biomimetics Market, by Application

- Biomimetics Market, by Region

- Biomimetics Market, by Group

- Biomimetics Market, by Country

- United States Biomimetics Market

- China Biomimetics Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 3975 ]

Summarizing Core Discoveries and Forward-Looking Perspectives to Guide Stakeholders in Navigating the Evolving Biomimetics Ecosystem with Confidence

This executive summary has illuminated the evolving dynamics of the biomimetics sector, highlighting how nature-inspired design principles are catalyzing innovation across diverse applications and industries. By examining transformative shifts in manufacturing practices, sustainability imperatives, and digital design paradigms, readers gain a clear understanding of the forces driving biomimetic adoption. The analysis of 2025 United States tariff measures sheds light on the intricate interplay between trade policy and innovation investment, underscoring both challenges and adaptive strategies that firms employ to maintain resilience.

A deep dive into segmentation by application, material, technology, and end user reveals the multifaceted opportunities embedded within the market, from automotive body panels with hierarchical structures to medical implants that promote tissue regeneration. Regional insights further contextualize innovation ecosystems in the Americas, EMEA, and Asia-Pacific, outlining distinct regulatory, commercial, and cultural factors influencing adoption rates. Competitive analysis underscores the importance of strategic partnerships, digital capabilities, and ecosystem orchestration as differentiators in a crowded landscape.

Ultimately, industry leaders equipped with this strategic intelligence can navigate the biomimetics ecosystem with heightened confidence, making informed decisions that balance performance, sustainability, and cost. By embracing the recommendations provided-ranging from collaborative R&D models to supply chain diversification-organizations will be well-positioned to harness the full potential of biomimetic innovations and achieve sustained growth.

Engaging with Ketan Rohom to Secure Comprehensive Biomimetics Market Intelligence and Propel Strategic Decisions Through Customized Research Solutions

To gain unparalleled visibility into the evolving biomimetics landscape and empower your strategic decisions with robust data, connect directly with Ketan Rohom, Associate Director of Sales & Marketing at our firm. By partnering with Ketan, you will access tailored research solutions that align precisely with your organizational goals, whether you seek in-depth component-level analysis, customized regional deep dives, or specialized technology assessments. His expertise in translating complex market dynamics into actionable business intelligence will streamline your purchasing process and ensure rapid delivery of insights critical to driving innovation. Engage with Ketan today to explore bespoke report packages, flexible licensing options, and hands-on support designed to maximize the value of your investment. Secure your competitive edge by scheduling a consultation to discuss your unique requirements and learn how our comprehensive market study can catalyze growth in the biomimetics sector

- How big is the Biomimetics Market?

- What is the Biomimetics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?