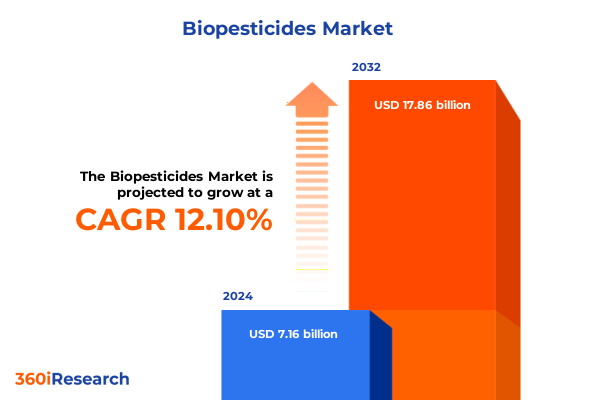

The Biopesticides Market size was estimated at USD 7.98 billion in 2025 and expected to reach USD 8.91 billion in 2026, at a CAGR of 12.19% to reach USD 17.86 billion by 2032.

Pioneering Sustainable Crop Protection Solutions Through Biopesticides to Meet Evolving Global Agricultural and Environmental Demands

Biopesticides are rapidly becoming a cornerstone of modern agriculture, offering a sustainable alternative to conventional chemical treatments. Originating from naturally occurring microorganisms, plant extracts, and biochemical derivatives, these products deliver targeted pest management while minimizing environmental and health risks. As global agricultural systems confront evolving pests, regulatory scrutiny, and growing consumer demand for residue-free produce, biopesticides have emerged as the solution that aligns economic feasibility with ecological responsibility.

Over the last decade, agricultural stakeholders-from farmers to multinational agribusinesses-have accelerated the adoption of biological control agents in field and post-harvest settings. This trend is fueled by an expanding body of scientific research demonstrating both efficacy and compatibility with integrated pest management programs. Moreover, policymakers worldwide are increasingly incentivizing bio-based solutions through streamlined registration pathways and subsidy programs, further reinforcing the role of biopesticides as a critical pillar in achieving sustainable food systems.

This executive summary presents a distilled overview of the transformative shifts redefining the biopesticide landscape. It encompasses the technological breakthroughs, tariff‐driven supply chain considerations, nuanced market segmentation, regional adoption patterns, and competitive dynamics. By synthesizing these insights, decision-makers will be equipped to navigate emerging opportunities, mitigate potential risks, and chart a growth trajectory that capitalizes on the unique advantages of biopesticide innovation.

Navigating the Evolution of Biopesticide Technologies Driven by Scientific Breakthroughs and Sustainability Imperatives in Modern Agriculture

The landscape of biopesticide development has undergone a profound metamorphosis, steered by groundbreaking advances in biotechnology and a collective global mandate for sustainable agriculture. Recent breakthroughs in genomic sequencing and bioinformatics have empowered researchers to identify and engineer potent microbial strains with highly specific modes of action. This precision has elevated efficacy levels while reducing off‐target impacts, marking a significant departure from broad-spectrum chemical pesticides.

Simultaneously, the convergence of digital agriculture and precision application technologies is reshaping how biopesticides are deployed. Remote sensing, data analytics, and variable rate application systems enable producers to apply bioagents only where and when they are needed, maximizing cost‐effectiveness and environmental stewardship. This integration of agronomic intelligence with biologically derived inputs underscores a new paradigm in crop protection that aligns agronomic performance with ecological balance.

On the regulatory front, major agricultural markets have introduced progressive frameworks that recognize the distinct safety profiles of biopesticides and accelerate their approval timelines. Regulatory agencies are refining risk‐assessment protocols to better reflect real-world exposure scenarios, fostering an environment where innovation can flourish without compromising consumer protections. These shifts collectively signify a transformative era in which biopesticides are no longer a niche offering, but a core component of holistic pest management strategies.

Assessing the Far-Reaching Implications of 2025 United States Tariff Policies on Biopesticide Trade Dynamics and Supply Chain Resilience

The implementation of new tariff measures by the United States in early 2025 has created a ripple effect throughout the global biopesticide supply chain. These tariffs, aimed at balancing domestic production objectives and geopolitical considerations, have led to increased import costs for key raw materials and finished formulations sourced from overseas manufacturers. As a result, procurement teams are reassessing supplier portfolios to offset higher landed costs and maintain competitive pricing.

Beyond immediate cost pressures, the tariff landscape has introduced complexities in logistics planning and inventory management. Extended lead times and fluctuating duty rates have compelled companies to adopt more agile sourcing strategies, including dual-sourcing agreements and incremental onshore manufacturing investments. These measures are designed to bolster supply chain resilience and reduce dependence on volatile cross-border shipments.

Looking ahead, organizations that anticipate tariff adjustments and proactively diversify their component sourcing stand to minimize margin erosion. By forging strategic partnerships with domestic bioproducts manufacturers and exploring raw material substitutions, market participants can navigate the evolving regulatory terrain with confidence. This adaptive approach not only safeguards product availability but also positions businesses to harness growth opportunities in an increasingly protectionist trade environment.

Unveiling Critical Market Segmentation Patterns Across Biopesticide Types, Crop Applications, Formulation Methods, Usage Modes, and Sales Channels

Insight into market segmentation reveals a multifaceted structure that must inform strategic planning at every organizational level. Market analysis by type highlights the differential performance of biofungicides, bioherbicides, bioinsecticides, and bionematicides, each category offering unique advantages against specific pest pressures. A crop-centric view underscores the varying adoption rates across cereals and grains-specifically maize, rice, and wheat-as well as fruits and vegetables like grapes, potatoes, and tomatoes, and oilseeds and pulses including canola, chickpea, and soybean. Consideration of formulation formats delineates preferences between dry powders and liquid concentrates, with application method segmentation spanning post-harvest treatments, seed treatment protocols, and soil interventions such as soil drench and soil fumigation. Distribution channels further diversify access, with traditional offline networks coexisting alongside rapidly growing online platforms, reflecting evolving procurement behaviors among end users.

This multi-layered segmentation framework illuminates growth pockets and informs tailored marketing strategies. By mapping adoption drivers and performance metrics within each segment, stakeholders can prioritize product development, optimize channel management, and refine value propositions to resonate with target audiences.

This comprehensive research report categorizes the Biopesticides market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Crop

- Formulation

- Application

- Sales Channel

Exploring Diverse Regional Dynamics Shaping the Biopesticide Market Across Americas, Europe Middle East Africa, and Asia-Pacific Territories

Regional analysis of the biopesticide market exposes unique dynamics across major territories, each shaped by regulatory, environmental, and agronomic priorities. In the Americas, robust policy incentives and a focus on integrated pest management have spurred widespread adoption, particularly in large-scale row crop operations that demand high-volume application solutions. Farmers in the region are increasingly leveraging biopesticides to meet sustainability commitments and comply with tightening residue regulations.

Across Europe, the Middle East, and Africa, harmonized regulatory frameworks and strong emphasis on environmental safety have positioned this region as a benchmark for biopesticide validation and stewardship. Collaborative research initiatives and public funding programs are facilitating the commercialization of novel bioagents. Meanwhile, smallholder farmers in select African markets are gaining access through targeted outreach and extension services, driving grassroots adoption.

Asia-Pacific represents a heterogeneous landscape where rapid agricultural modernization intersects with diverse ecological conditions. Key markets are witnessing escalating government support for bio-based inputs as part of national sustainability agendas. Concurrently, emerging economies in the region are balancing the need for yield optimization with stricter chemical pesticide curbs, creating fertile ground for biopesticide integration in both staple and specialty crop systems.

This comprehensive research report examines key regions that drive the evolution of the Biopesticides market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Competitive Advantage in the Global Biopesticide Industry Landscape

The competitive arena of biopesticides is defined by a mix of specialized biotech firms, diversified agrochemical giants, and innovative start-ups. Leading players are investing heavily in R&D to expand their microbial libraries and develop novel formulations that deliver superior shelf life, ease of handling, and consistent field performance. Strategic collaborations between biopesticide developers and academic institutions have accelerated the translation of laboratory discoveries into commercial offerings, enriching product pipelines with next-generation bioagents.

In parallel, mergers and acquisitions remain a critical lever for market consolidation and capability enhancement. Established pesticide companies are acquiring biotech innovators to bolster their portfolios and secure early-stage technologies. These transactions often focus on assets with proven greenhouse or controlled-environment efficacy, enabling acquirers to diversify risk profiles and complement existing chemical-based products with biological alternatives.

Distribution partnerships and licensing agreements further expand market reach, as global manufacturers tap into regional expertise and channel networks to accelerate market penetration. Through these strategic alignments, companies can leverage local regulatory know-how and field support infrastructure to drive adoption among key end users, from large commercial farms to smallholder operations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biopesticides market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AgBiome, Inc.

- Agri Life (India) Private Limited

- Algenex Inc.

- Andermatt Biocontrol AG

- Arysta LifeScience LLC

- BASF SE

- Bayer AG

- Biobest Group NV

- BioConsortia, Inc.

- Bionema Limited

- BioSafe Systems, LLC

- BioWorks, Inc.

- Certis U.S.A. LLC

- Eden Research PLC

- Emery Oleochemicals LLC

- Enviro Bio Chem (Pty) Ltd.

- FMC Corporation

- Ginkgo Bioworks, Inc.

- Gowan Company, LLC

- Hexa Agro Industries

- Innatrix Inc.

- Isagro S.p.A.

- Kimitec Group

- Koppert Biological Systems B.V.

- Lallemand Plant Care Inc.

- Marrone Bio Innovations, Inc.

- Marrone Bio Innovations, Inc.

- Novozymes A/S

- Nufarm Ltd.

- Plant Health Care, Inc.

- Procare Crop Science

- SEIPASA, S.A.

- Solvay S.A.

- STK Bio-AG Technologies

- Syngenta Crop Protection AG

- UPL Limited

- Valent BioSciences LLC

- Valent U.S.A. LLC

- Vegalab SA

- Vestaron Corporation

Implementing Strategic Initiatives to Capitalize on Biopesticide Growth Opportunities and Navigate Regulatory, Technological, and Market Complexities

Industry leaders can fortify their market position by embedding biopesticide integration into core R&D strategies, ensuring that new product pipelines address emerging pest resistances and regional crop requirements. Prioritizing collaborative research with universities and independent laboratories will streamline development timelines and enhance the credibility of novel biological modes of action among regulatory bodies.

Strengthening regulatory engagement is equally critical. By actively participating in policy consultations and harmonization efforts, organizations can advocate for clarifications that reduce registration burdens and align safety assessments with practical field use. Proactive dialogue with authorities will also help anticipate future compliance requirements and shape favorable evaluation frameworks.

To mitigate trade-related uncertainties, companies should diversify manufacturing footprints through joint ventures with local producers and targeted investments in domestic production capacities. This approach will minimize exposure to tariff volatility while enhancing responsiveness to fluctuating demand patterns across key markets.

Finally, investing in digital agriculture platforms to deliver precision application guidance and performance monitoring will differentiate offerings in a crowded marketplace. Providing end users with data-driven insights into application timing, dosage optimization, and efficacy tracking will reinforce the value proposition of biopesticides as both environmentally responsible and economically sound solutions.

Detailing the Comprehensive Multi-Phase Research Methodology and Data Validation Techniques Underpinning the Biopesticide Market Analysis

The research underpinning this analysis employed a rigorous multi-phase methodology designed to ensure data integrity and actionable insights. Primary data were gathered through in-depth interviews with industry veterans, including senior executives, R&D heads, regulatory specialists, and distribution partners. These conversations provided firsthand perspectives on product performance, market access challenges, and investment priorities.

Secondary research complemented these insights by drawing on peer-reviewed journals, patent databases, and public policy documents to chart the evolution of biopesticide technologies and regulatory frameworks. Trade association reports and conference proceedings offered additional context on emerging application techniques and regional adoption trends.

Data triangulation and validation processes were applied throughout, with quantitative market inputs cross-checked against multiple independent sources to minimize bias and reconcile discrepancies. Expert panels reviewed preliminary findings to refine assumptions and verify the practical relevance of strategic recommendations. This blended approach has resulted in a robust analytical foundation that reliably supports decision-making for stakeholders across the biopesticide ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biopesticides market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biopesticides Market, by Type

- Biopesticides Market, by Crop

- Biopesticides Market, by Formulation

- Biopesticides Market, by Application

- Biopesticides Market, by Sales Channel

- Biopesticides Market, by Region

- Biopesticides Market, by Group

- Biopesticides Market, by Country

- United States Biopesticides Market

- China Biopesticides Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Consolidating Key Findings and Strategic Perspectives to Empower Stakeholders in Advancing Sustainable Biopesticide Solutions

The collective insights presented in this executive summary underscore the pivotal role that biopesticides will play in shaping the future of sustainable agriculture. From scientific breakthroughs and tariff-driven supply chain adaptations to nuanced market segmentations and region-specific dynamics, the biopesticide sector is poised for continued maturation and integration into mainstream crop protection strategies.

Stakeholders that leverage these findings can more confidently navigate technological, regulatory, and commercial inflection points. By aligning internal capabilities with external market drivers, businesses will not only achieve regulatory compliance and operational resilience but also strengthen their competitive moats through targeted innovation and strategic partnerships.

As the global community intensifies its commitment to environmental stewardship and food security, the insights detailed herein serve as a strategic compass. They empower decision-makers to harness the inherent advantages of biopesticides, driving both agronomic success and long-term sustainability.

Engage with Associate Director Ketan Rohom to Unlock Exclusive Biopesticide Market Insights and Drive Informed Strategic Decisions Today

Engaging directly with Associate Director, Sales & Marketing Ketan Rohom provides an invaluable opportunity to secure a detailed market research report that delivers unparalleled clarity on biopesticide trends, regulatory developments, and strategic imperatives. By purchasing this comprehensive study, stakeholders will gain immediate access to meticulously validated data, actionable insights, and expert recommendations tailored to guide critical investment, product development, and go-to-market decisions. Reach out to schedule a personalized consultation with Ketan Rohom to discuss how this research can be customized to address your specific challenges and accelerate your pathway to leadership in sustainable crop protection.

- How big is the Biopesticides Market?

- What is the Biopesticides Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?