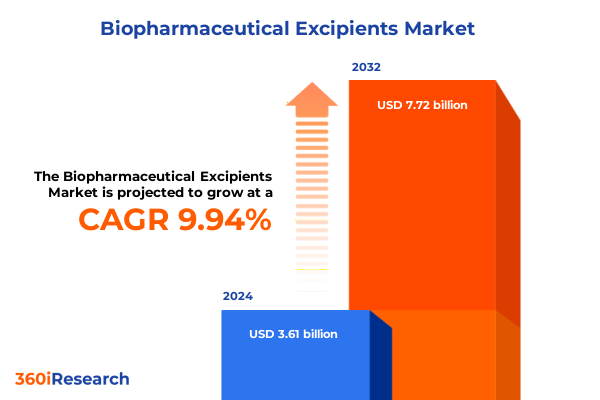

The Biopharmaceutical Excipients Market size was estimated at USD 3.92 billion in 2025 and expected to reach USD 4.25 billion in 2026, at a CAGR of 10.17% to reach USD 7.72 billion by 2032.

An authoritative overview of biopharmaceutical excipients highlighting market drivers innovation trends regulatory dynamics and competitive frameworks

An excipient is broadly defined as any substance intentionally formulated alongside an active pharmaceutical ingredient to aid in processing, stabilize the final drug product and enhance bioavailability. During drug development and manufacturing, excipients serve a myriad of functions-from improving solubility and flow properties to controlling release profiles-without exerting therapeutic effects at prescribed doses. Although regulatory bodies do not prescribe a single formal definition, the United States Pharmacopeia and FDA guidance underscore the importance of excipients’ safety evaluation, quality control and functional performance in ensuring drug efficacy and patient safety.

In the biopharmaceutical arena, the complexity of macromolecular drugs such as proteins, monoclonal antibodies and nucleic acid therapies places heightened demands on excipient functionality. Specialized excipients are required to maintain conformational stability, prevent aggregation, control tonicity and facilitate targeted delivery of sensitive biologics throughout manufacturing, storage and administration. Furthermore, emerging patient-centric trends-such as orally disintegrating tablets, pediatric formulations and self-administered injectables-are driving the development of novel excipient solutions tailored for ease of use, improved compliance and reduced dosage form complexity.

How evolving technological advances regulatory reforms and strategic collaborations are driving transformative shifts in the biopharmaceutical excipients landscape

The biopharmaceutical excipient landscape is undergoing transformative shifts driven by sustainability imperatives and product innovation requirements. Manufacturers are increasingly prioritizing natural and eco-friendly binder excipients derived from plant-based materials such as cellulose derivatives, starch and gums to meet both regulatory expectations and consumer demand for clean-label formulations. Simultaneously, the rise of co-processed multifunctional excipients has simplified formulation workflows by integrating binding, disintegration and lubrication functions into single ingredients, thereby enhancing process efficiency and final product consistency.

Technological advancements are reshaping excipient development through the application of artificial intelligence and digital tools for excipient-API compatibility prediction, stability modeling and solubility enhancement. Continuous manufacturing platforms and 3D printing technologies are accelerating the customization of excipient properties, enabling small-batch production of personalized dosage forms with precise release profiles. These digital innovations not only shorten development timelines but also unlock cost-savings across the formulation lifecycle.

In parallel, regulatory bodies are elevating quality standards and introducing novel excipient review frameworks to ensure the safety and reliability of new functional ingredients. The FDA’s Novel Excipient Review Pilot Program exemplifies this trend, fostering transparent data requirements and expedited qualification pathways for innovative excipients that support emerging biopharmaceutical modalities. This regulatory momentum is encouraging manufacturers to invest in rigorous excipient characterization, traceability systems and quality-by-design principles to maintain compliance and competitive differentiation.

Analyzing the cumulative effects of recent US tariff policies on biopharmaceutical excipient supply chains manufacturing costs and innovation incentives through 2025

In 2025, the United States implemented a series of tariff measures targeting active pharmaceutical ingredients (APIs), key drug intermediates and select excipient inputs imported from major suppliers such as China and India. A baseline global tariff of 10 percent on healthcare imports was established in April, followed by targeted duties of 25 percent on APIs sourced from China and 20 percent on those from India. Additional 15 percent tariffs on sterile packaging, lab equipment and pharmaceutical manufacturing machinery have further altered cost structures across drug supply chains.

These tariff policies have led to immediate supply chain disruptions, driving up production costs and prompting stockpiling of critical raw materials to mitigate volatility. Analysts warn that essential medicines-especially generic drugs with slim profit margins-may face price hikes or shortages as import costs are passed through to manufacturers and, ultimately, patients. Hospitals and insurance providers, initially absorbing these additional expenses, risk elevating out-of-pocket costs and insurance premiums for end users.

In response, industry leaders have accelerated domestic manufacturing investments and reshoring initiatives to reduce dependence on tariff-exposed imports. Major biopharma companies are leveraging government tax incentives to expand in-country API and excipient production facilities, although setup timelines of three to four years temper near-term impact on earnings. Meanwhile, uncertainties around World Trade Organization exemptions and reciprocal trade investigations underscore the evolving policy landscape and the need for strategic flexibility.

Gaining strategic insights into biopharmaceutical excipient market segmentation across product types sources formulation modalities and end user applications

The biopharmaceutical excipient market can be deconstructed along several dimensions to reveal nuanced performance drivers and opportunity pools. When examining product categories, binders, coatings, diluents, disintegrants, lubricants and glidants, polyols, preservatives, solubilizers and surfactants, and suspending and viscosity agents each play distinct roles in dosage form design and functionality. Within binders, options range from cellulosic polymers and hydroxypropyl methylcellulose to polyvinylpyrrolidone and modified starches; coatings span controlled-release, enteric and film technologies; and diluents include calcium phosphates, lactose and microcrystalline cellulose.

Source-based segmentation differentiates natural excipients-such as plant-derived gums and starches-from synthetic excipients including polymeric and lipid-based formulations, each offering unique safety, performance and regulatory attributes. Formulation type further delineates market demand across injectable, oral and topical modalities; injectable formats encompass intramuscular, intravenous and subcutaneous preparations, while oral forms cover capsules, powders and tablets, and topical applications include creams, gels, ointments and lotions. Finally, end users range from biopharmaceutical and pharmaceutical manufacturers to contract development and manufacturing organizations and research institutes, highlighting diverse purchasing motivations tied to innovation cycles, scale efficiencies and R&D imperatives.

This comprehensive research report categorizes the Biopharmaceutical Excipients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Source

- Formulation Type

- End User

Understanding regional dynamics shaping the biopharmaceutical excipient industry across Americas Europe Middle East Africa and Asia Pacific markets

Regional dynamics in the biopharmaceutical excipient sector reflect divergent growth drivers, regulatory environments and supply chain capabilities. In the Americas, the United States and Canada have prioritized domestic API and excipient manufacturing through targeted subsidies and tax credits, while Latin American markets are capitalizing on cost-effective production facilities and growing healthcare spending to attract contract manufacturing investments.

Europe, the Middle East and Africa present a heterogeneous landscape where EU-driven regulatory harmonization and intellectual property protections bolster high-value excipient development and quality standards. However, nations within EMEA also face pressures from Brexit-related trade realignment and the need to maintain competitiveness against low-cost producers in Asia.

Asia-Pacific remains the fastest-expanding region for biopharmaceutical excipients, fueled by robust pharmaceutical manufacturing growth in China and India, favorable government initiatives supporting API parks, and increasing R&D collaborations in Japan and South Korea. Investments in capacity expansion and technology transfer have accelerated local excipient production capabilities, creating new hubs for cost-efficient and assured supply continuity.

This comprehensive research report examines key regions that drive the evolution of the Biopharmaceutical Excipients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the competitive landscape and key company strategies fueling innovation investment and market expansion in the biopharmaceutical excipient sector

The competitive landscape of biopharmaceutical excipients is defined by a mix of global chemical conglomerates, specialty providers and regionally focused players. Companies such as DuPont (FMC Corporation), BASF, Evonik, Ashland, Roquette, JRS Pharma, Croda and Lubrizol command significant portfolios encompassing binders, fillers, coatings, solubilizers and advanced delivery excipients. Emerging firms and contract manufacturers are carving niches through tailored service models and integrated supply chain solutions that respond rapidly to customer R&D timelines.

Innovation strategies are central to competitive differentiation. Ashland’s introduction of co-processed multifunctional superdisintegrants and Lubrizol’s award-winning solubilizing polymers exemplify how new excipients address formulation challenges such as poor solubility and rapid disintegration in oral dosage forms. Evonik’s expansion of cellulose-based excipient capacity in Indiana underscores the importance of aligning production scale with emerging biologic demand and domestic supply requirements.

Mergers, acquisitions and strategic partnerships further redefine market boundaries. Leading chemical and pharmaceutical ingredient companies are augmenting their portfolios through targeted acquisitions of niche excipient specialists, while collaborative R&D consortia with academic institutions and contract research organizations accelerate the co-development of next-generation excipients to support biologics, gene therapies and personalized medicine workflows.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biopharmaceutical Excipients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABITEC Corporation

- Actylis

- Asahi Kasei Corporation

- Ashland Inc.

- Avantor, Inc.

- BASF SE

- Clariant International Ltd.

- Colorcon Ltd.

- Croda International PLC

- DFE Pharma GmbH & Co KG

- Eastman Chemical Company

- Evonik Industries AG

- Fuji Chemical Industries Co., Ltd.

- IMCD N.V.

- Innophos Holdings, Inc.

- International Flavors & Fragrances Inc.

- JRS PHARMA GmbH + Co. KG

- Kerry Group PLC

- Meggle Group GmbH

- Merck KGaA

- Mitsubishi Chemical Group Corporation

- NOF Corporation

- Novo Nordisk A/S

- Pfanstiehl, Inc.

- Roquette Frères S.A.

- Shin-Etsu Chemical Co., Ltd.

- Sigachi Industries Limited

- Spectrum Laboratory Products, Inc.

- SPI Pharma, Inc. By Associated British Foods

- The Archer-Daniels-Midland Company

- The Dow Chemical Company

- The Lubrizol Corporation

- Wacker Chemie AG

Actionable strategic guidance for industry leaders to navigate supply chain risks optimize innovation pathways and capitalize on emerging opportunities

To mitigate future supply chain disruptions and manage tariff uncertainties, industry leaders should implement dual-sourcing strategies for critical excipient inputs, leveraging onshore capacity and blockchain-enabled traceability solutions to ensure real-time visibility and risk management. Establishing collaborative procurement frameworks with strategic partners can streamline raw material flows and create scalable response mechanisms during policy shifts.

Investing in advanced manufacturing technologies-such as continuous processing, AI-driven quality analytics and 3D printing-will enhance production flexibility, reduce waste and accelerate time-to-market for novel formulations. Embracing digital platforms for predictive modeling of excipient-API interactions can optimize formulation development and minimize stability risks in high-value biologic therapies.

Sustainability must remain a strategic priority; organizations should expand natural excipient portfolios, adopt green chemistry principles and seek eco-friendly supply chains to meet escalating regulatory and corporate environmental, social and governance (ESG) mandates. Lifecycle assessments and renewable sourcing collaborations can reduce carbon footprints and enhance brand reputation among discerning stakeholders.

Active engagement with policymakers to clarify tariff scopes, secure transitional exemptions and advocate for aligned international standards will be vital. Industry associations and consortia should drive data-backed dialogues on trade policy design to minimize unintended drug shortages and facilitate equitable market access.

Finally, forging R&D and commercialization alliances-through mergers, co-development agreements and licensing partnerships-can accelerate the introduction of next-generation excipients tailored for complex modalities such as cell and gene therapies, ensuring sustained innovation pipelines and long-term competitive advantage.

Detailed explanation of rigorous research methodologies primary secondary data sources and analytical frameworks underlying this biopharmaceutical excipient study

This research synthesizes insights gathered through a rigorous multi-phased methodology encompassing both secondary and primary data collection. Secondary research involved the systematic review of regulatory documents, peer-reviewed journals, industry white papers, corporate disclosures and trade association publications to establish historical context, competitive landscapes and emerging technological trends.

Primary research entailed structured interviews with senior executives, formulation scientists, procurement leaders and regulatory experts at leading biopharmaceutical and specialty excipient firms. These qualitative insights were augmented by quantitative surveys targeting R&D, manufacturing and procurement functions to validate strategic priorities, investment drivers and operational challenges.

Data triangulation and validation procedures were applied through cross-referencing of key findings, ensuring consistency and reliability of conclusions. Analytical frameworks-including SWOT analysis, Porter’s Five Forces, supply chain risk mapping and technology adoption roadmapping-were employed to structure insights and derive actionable recommendations tailored for industry stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biopharmaceutical Excipients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biopharmaceutical Excipients Market, by Product

- Biopharmaceutical Excipients Market, by Source

- Biopharmaceutical Excipients Market, by Formulation Type

- Biopharmaceutical Excipients Market, by End User

- Biopharmaceutical Excipients Market, by Region

- Biopharmaceutical Excipients Market, by Group

- Biopharmaceutical Excipients Market, by Country

- United States Biopharmaceutical Excipients Market

- China Biopharmaceutical Excipients Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Concluding key takeaways summarizing strategic insights emerging trends and future outlook for the biopharmaceutical excipient market

The biopharmaceutical excipient market is transitioning from a traditional supply-driven commodity model toward a value-driven ecosystem defined by functional innovation, regulatory modernization and sustainability imperatives. Novel excipients designed for complex biologic therapies and patient-centric dosage forms are commanding strategic focus, while digital and continuous manufacturing technologies are unlocking new efficiency frontiers.

Tariff policies in 2025 have underscored the importance of supply chain resilience and domestic production capacity, prompting accelerated onshoring efforts and diversified sourcing strategies. Regional dynamics reveal that Americas, EMEA and Asia-Pacific markets each present unique growth drivers-from government incentives and regulatory harmonization to manufacturing cost arbitrage and R&D clustering.

Leading companies are leveraging M&A, R&D collaborations and capacity expansions to reinforce competitive positions and shape next-generation excipient offerings. As market participants navigate complex policy landscapes and evolving customer requirements, success will hinge on integrated strategies that balance innovation agility, operational resilience and sustainable practices.

Unlock comprehensive market intelligence and connect with Ketan Rohom to acquire the definitive biopharmaceutical excipient research report

To gain comprehensive insights into the evolving biopharmaceutical excipient market and access in-depth analysis across critical themes-from regulatory dynamics and tariff impacts to segmentation strategies and competitive benchmarking-connect with Ketan Rohom, Associate Director, Sales & Marketing. Unlock the full suite of actionable intelligence and equip your organization to navigate complex supply chain landscapes, harness emerging technological innovations, and make strategic investment decisions. Engage with an expert today and secure your access to the definitive market research report that will empower you to stay ahead of industry shifts and capitalize on future opportunities

- How big is the Biopharmaceutical Excipients Market?

- What is the Biopharmaceutical Excipients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?