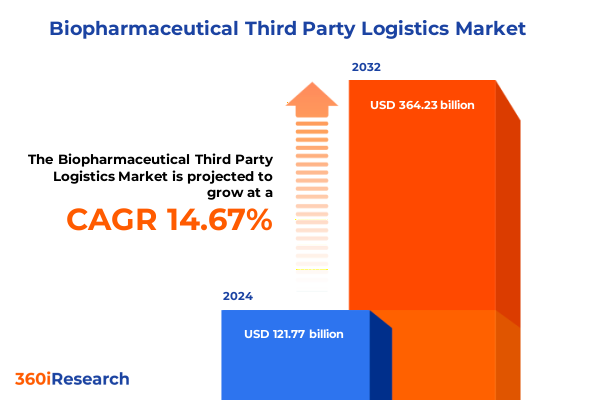

The Biopharmaceutical Third Party Logistics Market size was estimated at USD 140.03 billion in 2025 and expected to reach USD 161.04 billion in 2026, at a CAGR of 15.51% to reach USD 384.23 billion by 2032.

Setting the Stage for Next-Generation Biopharmaceutical Supply Chains in an Era of Growing Complexity and Critical Cold Chain Demands

In the face of accelerating innovation within the biopharmaceutical sector, the logistics that carry critical drugs from lab to patient have become both highly specialized and mission-critical. Groundbreaking therapies such as gene and cell treatments demand precise environmental controls and flawless handling at every juncture. Simultaneously, regulatory landscapes are intensifying, global trade networks are becoming more complex, and the stakes for maintaining product integrity have never been higher. Within this dynamic context, third party logistics providers play an essential role in ensuring that life-saving medicines reach their destinations safely and efficiently, while helping manufacturers navigate evolving compliance requirements and tariff fluctuations.

Against this backdrop, understanding the forces reshaping third party logistics is paramount. Companies must not only master temperature-sensitive distribution and warehousing, but also adopt digital solutions, sustainability measures, and robust risk management frameworks to stay competitive. Innovative packaging, real-time visibility, and flexible transportation options are now table stakes. As the industry transitions toward more patient-centric and on-demand manufacturing models, logistics partners must be agile, reliable, and forward-looking in their strategies.

By exploring the key transformative trends, tariff impacts, segmentation insights, regional nuances, and leading players in the market, this executive summary provides decision-makers with a clear roadmap for strategic planning. It synthesizes the critical factors driving performance in biopharmaceutical third party logistics, offering a holistic view of the current environment and actionable pathways to address upcoming challenges and opportunities.

Unveiling the Disruptive Forces Reshaping Biopharmaceutical Logistics with Digitalization, Sustainability, and Regulatory Evolution Driving Change

Over the past few years, a convergence of technological breakthroughs and shifting regulatory priorities has revolutionized how biopharmaceutical products are transported and stored. Digital platforms for end-to-end visibility now integrate Internet of Things sensors, blockchain-backed documentation, and artificial intelligence-driven analytics to predict demand fluctuations, optimize routing, and detect potential quality breaches before they occur. This level of connectivity and intelligence is empowering both providers and shippers to reduce waste, accelerate delivery timelines, and satisfy the stringent requirements of regulatory authorities overseeing patient safety.

Concurrently, sustainability considerations have moved from the margins to the mainstream of logistics decision-making. There is growing pressure to reduce carbon footprints through electrified fleets, reusable packaging, and eco-efficient warehousing designs. Third party logistics partners are investing in green technologies to both meet customer expectations and comply with emerging environmental regulations that penalize excessive emissions or non-recyclable materials. These efforts are reshaping facility layouts and transportation networks, requiring suppliers to rethink traditional hub-and-spoke models.

At the same time, regulatory frameworks in major markets are evolving rapidly. In the United States and Europe, stringent good distribution practices now demand comprehensive visibility and temperature monitoring for every shipment of investigational or approved therapies. Asia-Pacific regulators are also tightening guidelines, aiming to align local standards with international best practices for handling high-value biologics. As a result, third party logistics providers are expanding their compliance teams, enhancing audit readiness, and strengthening quality management systems to remain competitive and trusted partners for biopharmaceutical manufacturers.

Assessing the Ripple Effects of United States Tariff Adjustments on Biopharmaceutical Third Party Logistics Operations and Cost Structures in 2025

In early 2025, a series of tariff adjustments introduced by the United States government have begun to reverberate across global supply chains, directly affecting the cost base of third party logistics for biopharmaceutical products. The escalated duties on certain packaging materials, cold chain equipment components, and cross-border transportation services have introduced additional layers of complexity to pricing structures. Carriers and warehousing firms are now faced with recalibrating service fees, renegotiating supplier contracts, and identifying cost-saving alternatives to offset the increased duties.

These tariff shifts have also accelerated the adoption of nearshoring strategies. Companies are evaluating the feasibility of relocating production and packaging operations closer to end markets in North America to mitigate exposure to import duties. By forging strategic partnerships with domestic contract manufacturers and local packaging specialists, biopharmaceutical firms can reduce transit times, enhance supply chain resilience, and achieve better control over quality standards. However, nearshoring carries its own set of challenges in terms of capacity constraints, regulatory approvals, and infrastructure readiness.

Moreover, tariff-related cost pressures underscore the importance of collaborative risk-sharing models. Forward-thinking third party logistics providers are offering integrated service agreements that bundle warehousing, packaging, and transportation under a single tariff-inclusive fee. These models enable clients to lock in predictable costs, simplify administrative processes, and align incentives around joint performance objectives. As a result, companies that proactively adapt to the evolving tariff environment are better positioned to maintain competitive pricing and ensure reliable deliveries of life-saving therapies.

Deciphering Complex Service Time Temperature and End User Segmentation Layers to Uncover Biopharmaceutical Third Party Logistics Growth Drivers

A deep dive into market segmentation reveals the multifaceted nature of biopharmaceutical third party logistics and highlights the distinct requirements of different service, temperature, mode, end user, product, and packaging categories. When classifying by service type, distribution management emphasizes inventory optimization and order fulfillment, while packaging and labeling encompasses active solutions that include controlled atmosphere packaging and refrigerated containers alongside passive solutions such as insulated boxes and thermal blankets. Transportation services extend across air transport, with express air and standard air options, rail transport for large-volume transfers, road transport offering full truck load and less-than-truck-load flexibility, and sea transport accommodating full container loads and less-than-container loads. Warehousing capacities, in turn, must support both ambient storage and cold storage environments designed to preserve sensitive biologics.

Examining the market through a temperature range lens uncovers the criticality of maintaining specific conditions: ambient logistics demand robust monitoring systems, whereas chilled logistics distinguishes between monitored and standard chilled environments to meet diverse stability profiles. Controlled room temperatures require both monitored controlled room temperature and standard configurations, while frozen logistics differentiate standard frozen conditions from ultra-frozen environments needed for certain advanced cell therapies and vaccines.

Focusing specifically on modes of transportation, air freight remains the fastest yet most costly option, with express air suited to urgent shipments and standard air serving routine deliveries. Rail freight offers a balance of cost-efficiency and capacity for high-volume cargo, while road transport provides direct full truck load or less-than-truck-load solutions for flexible routing. Sea freight emerges as the most economical but slowest alternative, leveraging full container load and less-than-container load services for large and smaller consignments respectively.

Evaluating end users highlights distinct logistics demands: biopharmaceutical manufacturers require integrated end-to-end services, contract manufacturing organizations prioritize flexible packaging and transport, contract research organizations focus on secure handling of investigational materials, diagnostic laboratories depend on rapid turnaround, and hospitals and clinics-both community and research centers-demand reliable replenishment. From a product type perspective, logistics for cell therapies, encompassing dendritic and stem cell treatments, share similarities with gene therapies in cold chain stringency, while monoclonal antibodies and recombinant proteins require controlled room temperatures. Vaccines further split into inactivated and live attenuated categories, each imposing unique stability and security requirements.

Finally, by packaging type segmentation, active packaging solutions such as refrigerated containers and temperature-controlled shippers provide dynamic temperature regulation for the most critical shipments, whereas passive packaging, including insulated boxes and thermal blankets, offers reliable protection for standard biopharmaceutical products. Understanding these segmentation layers in concert allows industry leaders to tailor their operations and investments toward the most impactful service offerings and equipment capabilities.

This comprehensive research report categorizes the Biopharmaceutical Third Party Logistics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Service Type

- Temperature Range

- Mode Of Transportation

- Packaging Type

- End User

Examining Regional Variations in Third Party Logistics Demand across Americas EMEA and Asia Pacific to Inform Strategic Biopharma Investments

Evaluating regional dynamics in the biopharmaceutical logistics sector underscores the critical influence of market maturity, regulatory environments, and infrastructure development across the Americas, Europe, the Middle East and Africa (EMEA), and Asia-Pacific regions. In the Americas, robust pharmaceutical and biotech clusters in the United States and Canada drive high demand for advanced cold chain solutions, supported by an extensive network of specialized carriers and state-of-the-art warehousing facilities. Strict adherence to US Food and Drug Administration requirements and Health Canada guidelines has led providers to invest heavily in temperature monitoring systems and quality management certifications to ensure compliance and minimize product loss.

Within the EMEA region, diverse market conditions and cross-border trade complexities necessitate flexible logistics models. The European Union’s harmonized good distribution practice standards facilitate streamlined movement of biologics across member states, while burgeoning markets in the Middle East and Africa present both opportunities and challenges related to infrastructure constraints and regulatory fragmentation. Regional providers are expanding strategically, establishing cross-dock hubs in key logistics corridors and enhancing multimodal transport capabilities to address varying customer needs and mitigate geopolitical risks.

In Asia-Pacific, rapid growth in biopharmaceutical manufacturing and clinical trial activity-particularly in China, India, and Southeast Asia-has triggered significant investment in cold chain infrastructure. Emerging economies in the region are experiencing improvements in airport and port capacities, incentivizing global third party logistics providers to form joint ventures with local operators. Consequently, Asia-Pacific is poised to become a pivotal production and export hub, while also integrating more deeply with global distribution networks. Providers that can navigate diverse regulatory frameworks, scale operations swiftly, and uphold international quality standards will command a competitive advantage.

This comprehensive research report examines key regions that drive the evolution of the Biopharmaceutical Third Party Logistics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Third Party Logistics Providers Shaping the Biopharma Value Chain with Innovative Cold Chain Solutions and Strategic Partnerships

The biopharmaceutical third party logistics landscape is dominated by a mix of global integrators and specialized regional players, each bringing distinct capabilities to the value chain. Leading global carriers have leveraged their extensive networks and capital resources to establish state-of-the-art cold storage facilities, while offering integrated digital platforms that provide real-time visibility and predictive analytics. These providers have also pursued strategic partnerships and acquisitions to expand their end-to-end service portfolios, often incorporating value-added services such as clinical trial logistics and serialization support.

Simultaneously, nimble specialty logistics firms have carved out niches by developing highly customized solutions for complex biologics, including automation-driven picking systems for high-value therapies and portable temperature-controlled shippers for last-mile delivery in remote locations. Their expertise in handling ultra-frozen and controlled room temperature products positions them as preferred partners for innovative therapy developers with stringent handling requirements and tight delivery timelines.

Mid-sized regional operators are also stepping up, investing in warehouse expansions and technology upgrades to capture growing demand in emerging markets. By blending local market knowledge with alliances that extend global reach, these providers are bridging gaps between major hubs and peripheral geographies. Collaboration between large global carriers and specialized regional players is increasingly prevalent, forming hybrid networks that combine scale with agility to address the full spectrum of biopharmaceutical logistics needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biopharmaceutical Third Party Logistics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agility Public Warehousing Company K.S.C.P.

- Bolloré SE

- C.H. Robinson Worldwide, Inc.

- Cardinal Health, Inc.

- Cencora, Inc.

- CEVA Logistics AG

- Cryoport, Inc.

- DB Schenker Logistics Germany AG & Co. KG

- Deutsche Post AG

- DSV Panalpina A/S

- EVERSANA Life Science Services LLC

- Expeditors International of Washington, Inc.

- FedEx Corporation

- KLN Logistics Group Limited

- Kuehne + Nagel International AG

- LOGISTEED, Ltd.

- McKesson Corporation

- NIPPON EXPRESS HOLDINGS, INC.

- SF Holding Co., Ltd.

- Thermo Fisher Scientific Inc.

- United Parcel Service, Inc.

- XPO, Inc.

Crafting Actionable Strategies for Biopharmaceutical Supply Chain Leaders to Enhance Resilience Agility and Sustainability in Third Party Logistics

To navigate the evolving biopharmaceutical logistics landscape effectively, industry leaders must adopt a multi-pronged strategy focused on digital innovation, sustainability, risk mitigation, and strategic collaboration. First, investing in end-to-end visibility platforms that integrate real-time sensor data with predictive analytics will enable proactive quality control and dynamic route optimization, reducing waste and ensuring timely deliveries. Secondly, aligning operations with carbon reduction targets through electrified fleets, reusable packaging solutions, and energy-efficient storage facilities will not only meet emerging regulatory demands but also resonate with customers and stakeholders committed to environmental stewardship.

Equally important is the development of robust risk management frameworks that incorporate tariff scenario planning, nearshoring feasibility analysis, and dual-sourcing strategies to mitigate supply chain disruptions. Executing regular stress tests of logistics networks and establishing contingency protocols for critical nodes can safeguard against geopolitical volatility and infrastructure failures. Moreover, forging strategic alliances with local partners and specialized service providers can enhance market access and service flexibility, particularly in emerging economies.

Finally, fostering a culture of continuous improvement through talent development and cross-functional collaboration will be essential. Equipping teams with the skills to deploy advanced analytics, interpret regulatory changes, and manage complex stakeholder ecosystems will underpin sustained performance improvement and competitive differentiation. By integrating these actionable recommendations, biopharmaceutical companies and their logistics partners can build more resilient, scalable, and sustainable supply chains.

Outlining a Robust Research Framework Integrating Primary Expert Interviews Secondary Data and Rigorous Validation for Comprehensive Market Insights

This market analysis leverages a rigorous research framework that combines primary and secondary methodologies. Primary research included in-depth interviews with industry executives, cold chain specialists, regulatory authorities, and end users to capture firsthand insights on operational challenges, technology adoption, and service expectations. These qualitative interviews were complemented by surveys targeting supply chain managers and logistics decision-makers to quantify preferences around service capabilities and investment priorities.

Secondary research encompassed a comprehensive review of trade publications, regulatory filings, government reports, and whitepapers from leading logistics associations. Data aggregation from customs databases and shipping manifests provided macroeconomic context and shipment volume trends. All data points underwent triangulation through cross-validation with expert inputs and benchmark comparisons to ensure accuracy and consistency.

Proprietary analytical models were developed to map cost drivers across tariff scenarios and segmentation categories, enabling scenario-based sensitivity analyses. The research process also included validation workshops with select stakeholders to refine findings and test assumptions. Throughout the study, strict adherence to industry best practices for market research ethics and confidentiality protocols ensured the integrity of the data and the reliability of the conclusions drawn.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biopharmaceutical Third Party Logistics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biopharmaceutical Third Party Logistics Market, by Product Type

- Biopharmaceutical Third Party Logistics Market, by Service Type

- Biopharmaceutical Third Party Logistics Market, by Temperature Range

- Biopharmaceutical Third Party Logistics Market, by Mode Of Transportation

- Biopharmaceutical Third Party Logistics Market, by Packaging Type

- Biopharmaceutical Third Party Logistics Market, by End User

- Biopharmaceutical Third Party Logistics Market, by Region

- Biopharmaceutical Third Party Logistics Market, by Group

- Biopharmaceutical Third Party Logistics Market, by Country

- United States Biopharmaceutical Third Party Logistics Market

- China Biopharmaceutical Third Party Logistics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3657 ]

Drawing Insightful Conclusions on Biopharmaceutical Third Party Logistics Trends Challenges and Opportunities to Guide Informed Decision Making

The biopharmaceutical third party logistics sector stands at a pivotal juncture, shaped by rapid technological advancements, evolving regulatory frameworks, and shifting global trade dynamics. Digitalization is revolutionizing visibility and predictive planning, while sustainability imperatives are reshaping infrastructure investments and operational models. Tariff adjustments in 2025 are prompting supply chain diversification and nearshoring strategies, underscoring the importance of adaptable, cost-efficient service agreements that align incentives across stakeholders.

Segmentation analysis reveals that differentiated service offerings, from specialized temperature ranges to tailored packaging solutions, are critical for meeting the diverse needs of manufacturers, research organizations, and healthcare providers. Regional insights highlight the maturity of the Americas, the cross-border complexity within EMEA, and the growth potential of Asia-Pacific, each demanding bespoke approaches to regulatory compliance and infrastructure deployment. The competitive landscape underscores the value of strategic partnerships between global integrators and niche specialists to deliver end-to-end support for advanced therapies.

By synthesizing these findings, decision-makers can chart a pathway toward more resilient and sustainable logistics networks. Embracing digital platforms, green technologies, and collaborative risk-sharing models will be key to navigating future disruptions and capitalizing on emerging opportunities. Ultimately, the insights offered here equip industry leaders with the knowledge to enhance patient access, optimize cost structures, and drive innovation across the biopharmaceutical supply chain.

Engaging with Ketan Rohom to Unlock In-Depth Biopharmaceutical Third Party Logistics Market Intelligence and Propel Strategic Growth

To gain unparalleled insights and stay ahead of the rapidly evolving biopharmaceutical third party logistics landscape, connect with Ketan Rohom, Associate Director, Sales & Marketing. By securing this comprehensive market research report, you will unlock detailed intelligence on tariffs, segmentation, regional dynamics, and leading service providers. Engaging directly with Ketan provides personalized guidance on how to leverage the study’s findings to optimize supply chain resilience, streamline cost structures, and accelerate time-to-market for critical therapies. Elevate your strategic planning by partnering with an expert who can tailor recommendations to your organization’s unique needs, ensuring you capitalize on emerging opportunities and mitigate potential risks. Reach out today to secure your copy and transform how you navigate the complexities of global biopharmaceutical logistics

- How big is the Biopharmaceutical Third Party Logistics Market?

- What is the Biopharmaceutical Third Party Logistics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?