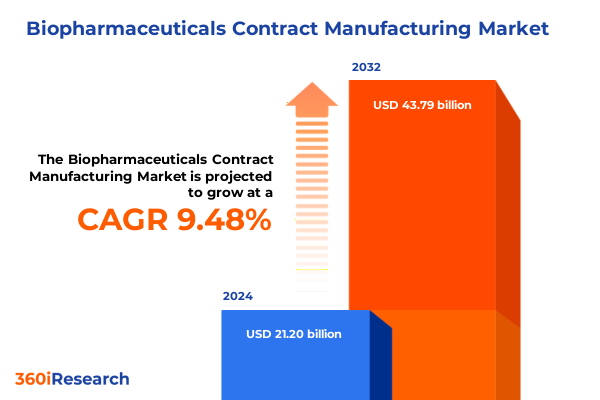

The Biopharmaceuticals Contract Manufacturing Market size was estimated at USD 23.11 billion in 2025 and expected to reach USD 25.23 billion in 2026, at a CAGR of 9.55% to reach USD 43.79 billion by 2032.

A concise orientation to why contract manufacturing has become mission-critical for biologics and advanced therapy sponsors navigating technical complexity and regulatory expectations

The executive summary opens by situating contract manufacturing for biologics and advanced therapies within a fast-evolving, high-stakes ecosystem where scientific complexity, regulatory scrutiny, and commercial timelines converge. Outsourcing partners are no longer purely tactical suppliers; they function as strategic extensions of sponsors’ development and manufacturing strategies, absorbing technical risk, enabling modality scale-up, and providing de-risked pathways to market. Consequently, commercial leaders must view manufacturing partnerships through a portfolio lens that balances scientific fit, capacity flexibility, and regulatory alignment.

Throughout the report, emphasis is placed on how quality-by-design principles, advanced analytics, and lifecycle-focused regulatory frameworks are driving closer integration between sponsors and manufacturing partners. This integration is shaping procurement decisions, influencing capital allocation for both incumbent and emerging contract manufacturers, and redefining expectations for end-to-end accountability. The introduction frames these dynamics as foundational: they inform the segmentation analysis, regional positioning, tariff sensitivity assessments, and recommended actions provided in subsequent sections.

How modality-specific regulatory clarity, technological adoption, and strategic capital deployment are reordering the competitive dynamics of biologics contract manufacturing

The landscape is undergoing transformative shifts driven by modality diversification, manufacturing technology, and strategic capital flows that together reconfigure competitive advantage across the contract manufacturing value chain. Cell and gene therapies have elevated demand for specialized capabilities-viral vector production, plasmid and mRNA supply, closed-system cell processing, and highly controlled aseptic fill-finish-prompting many CDMOs to invest in modular, multi-modal capacity and automation platforms. Regulatory agencies are also issuing modality-specific guidances to clarify chemistry, manufacturing, and control expectations, which accelerates routinization of previously bespoke processes and raises the bar for analytics and potency assays. These regulatory clarifications have a direct effect on the kinds of services sponsors seek from their manufacturing partners. The U.S. Food and Drug Administration has published multiple guidance documents and hosted industry-facing science series that explicitly address manufacturing changes, comparability, and modality-specific CMC considerations for cellular and gene therapies, underscoring the importance of lifecycle planning in manufacturing partnerships.

Technological adoption is another vector of change. Single-use systems, intensified and continuous processing approaches, and modular facilities enable faster campaign turnarounds, reduce cross-contamination risk, and lower near-term capital intensity for sponsors that prefer flexible capacity over greenfield construction. At the same time, investments by large CDMOs and strategic acquirers are expanding capacity for plasmid DNA, lipid nanoparticles, and viral vectors, making it more feasible for sponsors to progress advanced modalities without vertically integrating their own large-scale manufacturing. Industry consolidation and private capital inflows are reshaping the competitive set, with acquisitions and greenfield expansions being used to rapidly add modality-specific capabilities and geographic reach. These dynamics collectively compress time-to-clinic and time-to-commercial-readiness for new modalities, while creating a bifurcated supplier landscape made up of highly specialized providers and large, diversified CDMOs positioned to deliver integrated suites of services.

Assessing the practical, operational, and contractual implications of 2025 United States tariff actions on biologics contract manufacturing inputs and supply chains

By 2025, a set of U.S. tariff measures and trade policy shifts have increased the strategic importance of supplier geography, component sourcing strategies, and inventory posture for contract manufacturers and their customers. Broadly applied tariffs and country-specific reciprocal measures have raised the effective landed cost of imported consumables, single-use assemblies, and certain equipment classes, while also incentivizing sponsors and service providers to shorten or regionalize supply chains. The United States Trade Representative and other official trackers of tariff actions have documented adjustments that target specific product classes and sources, heightening procurement complexity for manufacturing inputs that are commonly sourced across multiple jurisdictions. This policy environment has produced a practical set of consequences for manufacturing operations, including tighter scrutiny of supplier qualification, selective onshoring of critical inputs, and revised contracting practices that allocate tariff and lead-time risk between sponsors and their manufacturing partners.

In practical terms for contract manufacturing, tariffs have compounded cost and lead-time pressures tied to single-use consumables, chromatography media, sensors, and specialized instrumentation. These items frequently cross borders during sourcing and repair cycles, so even modest tariff adjustments can disrupt established logistics patterns and compel higher working capital. For many sponsors, the cumulative trade measures have recalibrated the total-cost-of-ownership calculation for outsourcing versus in-house investment; they have also elevated the strategic value of CDMOs with localized supply networks or the ability to aggregate global procurement volumes to negotiate exemptions and long-term pricing. Moreover, tariff uncertainty has driven a greater emphasis on supply-chain resilience measures: dual-sourcing strategies, buffer inventories for critical lots, and contractual pass-through terms that explicitly address tariff liabilities and customs classification disputes. Legal and trade-advisory partnerships are increasingly part of vendor selection criteria when geopolitical risk is front-of-mind, because tariff applicability can hinge on nuanced product classification and certificate-of-origin documentation.

Integrated segmentation analysis revealing how service capabilities, modality nuances, production stage demands, therapeutic applications, and organisation size determine optimal outsourcing strategies

Meaningful segmentation insights require integrating service capabilities, product modalities, stage-of-production needs, therapeutic applications, and organisational scale to define pragmatic engagement models. When viewed through the lens of service type, sponsors are prioritizing partners that offer advanced analytical and quality-control testing alongside scalable biologics manufacturing services and process development expertise; the ability to transition seamlessly from process optimization into clinical supply manufacturing is often a decisive procurement criterion. For product types, the rise of cell and gene therapy, monoclonal antibodies, recombinant proteins, and an expanding set of vaccine platforms means that sponsors seek manufacturers with modality-specific track records-whether that entails CAR T ex vivo cell processing, viral vector production for gene-editing therapies, or lipid nanoparticle formulation for mRNA vaccines. The nuances within recombinant proteins-such as differential requirements for enzymes versus hormones-and vaccine subtypes-mRNA, protein subunit, and viral vector platforms-demand distinct upstream and downstream workflows, assay packages, and cold-chain strategies.

Production-stage segmentation further shapes required infrastructure and governance. Clinical-stage manufacturing, subdivided across Phase I, II, and III requirements, favors flexibility, rapid change control, and small-batch agility; commercial-stage operations demand validated, reproducible workflows, robust supply-chain contracts, and scale-ready fill-finish capability. Application-oriented differentiation intensifies supplier selection: oncology and neurology programs typically need highly specialized potency and stability testing regimes, whereas infectious-disease programs require surge capacity and rapid dose-downscaling for outbreak response or booster campaigns. Therapeutic area granularity-such as the split within infectious diseases into bacterial, parasitic, and viral contexts-alters sterility, biosafety, and regulatory dossier expectations. Finally, organisation size informs the balance between outsourcing breadth and control: large organizations often negotiate integrated, multi-site agreements to centralize risk management, while small and medium enterprises tend to prioritize short-term, modular engagements that limit capital exposure while preserving clinical agility.

This comprehensive research report categorizes the Biopharmaceuticals Contract Manufacturing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Product Type

- Production Stage

- Application

- Organisation Size

How regional differences across the Americas, Europe-Middle East-Africa, and Asia-Pacific shape capacity choices, regulatory alignment, and risk allocation in contract manufacturing networks

Regional dynamics materially influence where sponsors select manufacturing partners and how CDMOs prioritize capital and regulatory investments. Across the Americas, a persistent demand for localized capacity has been driven by sponsor priorities to shorten clinical supply timelines and reduce cross-border risk for high-value biologics and cell therapies. This regional focus has also been influenced by public and private investments that support domestic capacity expansion and workforce development, making North American sites attractive for late-stage and commercial production where time-to-market and regulatory alignment are paramount.

Within Europe, the Middle East, and Africa, regulatory sophistication and a deep-rooted biologics manufacturing base provide robust options for both clinical and commercial work, but firms must navigate a complex overlay of national regulations and cross-border logistics. The region remains an important center for biologics expertise, particularly for monoclonal antibodies and recombinant proteins, and it offers valuable redundancy for global manufacturing networks. In the Asia-Pacific region, rapid capacity expansion-particularly in East Asia-has increased available scale for commercial biologics and bulk drug substance production. Firms in this region are also investing in advanced modalities, but sponsors must weigh benefits such as cost and scale against considerations related to data integrity oversight, supply-chain traceability, and geopolitical policy shifts that can affect component sourcing and export controls. Taken together, these regional characteristics shape strategic choices about where to place clinical campaigns, qualifying sites for comparability work, and structuring master service agreements that anticipate cross-border contingencies.

This comprehensive research report examines key regions that drive the evolution of the Biopharmaceuticals Contract Manufacturing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Why capability integration, modality specialization, and strategic capital allocation are the primary determinants of which contract manufacturers will capture long-term partnerships

Leading companies and providers in the contract manufacturing space are differentiating through capability depth, modality specialization, and strategic capital deployment that accelerates time-to-clinic and commercial readiness. Firms that combine strong analytical platforms with end-to-end services-covering process development, GMP clinical manufacturing, aseptic fill-finish, and quality-release testing-are consistently positioned to win longer, higher-value engagements because they reduce the number of handoffs and the attendant process comparability risks. At the same time, specialist providers that focus on narrow but technically demanding niches-viral vector supply, plasmid and mRNA production, or high-potency aseptic fill-finish-remain essential partners for sponsors with complex modality requirements.

Market participants are also pursuing growth through M&A and greenfield investments to secure critical inputs and broaden their service mix. Strategic acquirers are integrating upstream capabilities like plasmid DNA and lipid nanoparticle formulation with downstream fill-finish to provide a contiguous value chain for advanced modalities. Additionally, private capital and strategic corporate investors have been instrumental in funding facility expansions and automation investments, enabling providers to offer both small-batch clinical supplies and large-scale commercial campaigns. From a governance perspective, companies with robust regulatory affairs functions and demonstrated success in comparability submissions attract sponsors who view regulatory predictability as a differentiator. Those that can combine technical excellence with transparent quality systems and resilient procurement practices will be best positioned to convert modality growth into durable commercial relationships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biopharmaceuticals Contract Manufacturing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3P Biopharmaceuticals

- AbbVie, Inc.

- Aenova Group GmbH

- AGC Biologics

- Ajinomoto Co., Inc.

- Aurobindo Pharma Limited

- Boehringer Ingelheim International GmbH

- Cambrex Corporation

- Catalent, Inc.

- Celonic AG

- FUJIFILM Diosynth Biotechnologies

- INCOG BioPharma Services, Inc.

- JRS PHARMA GmbH + Co. KG

- KBI Biopharma Inc

- Lonza AG

- Merck KGaA

- Pressure BioSciences, Inc. by Emergent Health Corp.

- ProBioGen AG

- Rentschler Biopharma SE

- Samsung Biologics

- Thermo Fisher Scientific Inc.

- Toyobo Co., Ltd.

- WuXi Biologics, Inc.

Actionable operational and strategic priorities that balance immediate supply resilience with targeted investments to secure modality readiness and competitive advantage

Industry leaders should pursue a dual-track response that balances near-term operational resilience with medium-term strategic positioning. In the near term, firms must perform immediate supply-chain stress tests focused on tariff exposure and single-sourced critical inputs, then codify supplier contingency plans that include validated alternate suppliers, pre-negotiated traceability documentation, and agreed escalation protocols. These measures should be accompanied by targeted increases in lot-level traceability and an elevated cadence of quality reviews for imported consumables that are tariff-sensitive or subject to export-control risk.

Strategically, companies should accelerate investments in modular and automation-enabled manufacturing footprints that reduce conversion time between campaigns and lower the marginal cost of modality transitions. This includes prioritizing investments in analytics and potency-assurance platforms that smooth comparability pathways, and forging long-term partnerships with suppliers of plasmid DNA, LNP formulation, viral vectors, and single-use consumables to secure prioritized capacity. Finally, commercial teams should renegotiate contracting terms to reflect shared tariff and geopolitical risk, incorporate staged pricing adjustments, and embed key performance indicators that align incentives across sponsor and manufacturer. Taken together, these actions will reduce operational fragility while creating durable, contractually supported pathways to scale.

A rigorous mixed-methods research approach combining primary expert interviews, vendor due diligence, regulatory review, and targeted legal inputs to produce action-focused analysis

The research methodology underpinning the report employs a mixed-methods approach that integrates qualitative expert interviews, primary vendor due-diligence, and secondary-source corroboration to ensure analytical rigor and practical relevance. Primary data was collected through structured interviews with senior manufacturing, quality, and procurement leaders across sponsors and contract manufacturers, focusing on capacity constraints, modality-specific technical risk, and procurement contractual norms. These interviews were synthesized to identify recurring operational themes and to validate segmentation boundaries that inform the report’s comparative analysis.

Secondary research drew on regulatory guidance documents, industry press on capital investments and M&A activity, and technical literature on manufacturing technologies-allowing triangulation between observed capital flows, regulatory evolution, and on-the-ground operational practices. Where relevant, legal and trade counsel inputs were incorporated to interpret tariff measures and their likely contractual impacts on manufacturing agreements. Throughout the methodology, care was taken to avoid extrapolative market-sizing or forecasting; the analysis instead emphasizes observed directionality, structural constraints, and decision-relevant trade-offs to support operational and strategic planning by industry leaders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biopharmaceuticals Contract Manufacturing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biopharmaceuticals Contract Manufacturing Market, by Service Type

- Biopharmaceuticals Contract Manufacturing Market, by Product Type

- Biopharmaceuticals Contract Manufacturing Market, by Production Stage

- Biopharmaceuticals Contract Manufacturing Market, by Application

- Biopharmaceuticals Contract Manufacturing Market, by Organisation Size

- Biopharmaceuticals Contract Manufacturing Market, by Region

- Biopharmaceuticals Contract Manufacturing Market, by Group

- Biopharmaceuticals Contract Manufacturing Market, by Country

- United States Biopharmaceuticals Contract Manufacturing Market

- China Biopharmaceuticals Contract Manufacturing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Final synthesis highlighting how procurement sophistication, supply-chain resilience, and capability integration determine successful biologics and advanced therapy programs

In conclusion, contract manufacturing for biologics and advanced therapies has moved from a cost-focused outsourcing decision to a central strategic lever that shapes product timelines, regulatory outcomes, and portfolio economics. The confluence of modality innovation, regulatory clarification for cellular and gene therapies, tariff-driven supply-chain friction, and targeted capital deployment by CDMOs means that sponsors must adopt more sophisticated procurement playbooks. These playbooks should prioritize partners with demonstrable modality experience, resilient and regionalized supply chains, and the analytical rigor required for comparability and potency assurance.

Leaders who integrate near-term supply-chain hardening with medium-term investments in flexible, automation-enabled capacity will create the optionality necessary to accelerate clinical programs and sustain commercial supply. As the ecosystem continues to mature, those firms that translate strategic insight into contractual alignment and operational resilience will capture the benefits of speed, quality, and regulatory predictability that define successful biologics and advanced therapy programs.

Contact the Associate Director of Sales & Marketing to secure a customized, expedited commercial brief and purchase pathway for the full market research report

For senior commercial and technical executives evaluating a strategic purchase of an in-depth market research report, connect directly with Ketan Rohom, Associate Director, Sales & Marketing to access tailored insights, licensing options, and expedited delivery. The report can be configured for enterprise licensing, single-use copies, or customizable briefing packages that align with your procurement cycles and internal decision timelines.

Engagement can be structured as a short briefing followed by a deep-dive workshop that highlights manufacturing risk exposure, tariff sensitivity, and segmentation-based opportunities across modalities, stages, and applications. This approach helps translate the report’s findings into immediate operational priorities-such as supplier qualification workstreams, onshoring assessments, and targeted capacity investments-so that leaders can convert insight into action within the quarter.

To proceed, request a formal proposal and a two-week sample brief that highlights the chapters most relevant to your organization’s strategic objectives. The proposal will outline deliverables, customization options, and confidentiality provisions for sensitive procurement or partnership negotiations. Early engagement enables priority scheduling for analyst calls and bespoke scenario modeling tailored to your portfolio and supply chain footprint.

- How big is the Biopharmaceuticals Contract Manufacturing Market?

- What is the Biopharmaceuticals Contract Manufacturing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?