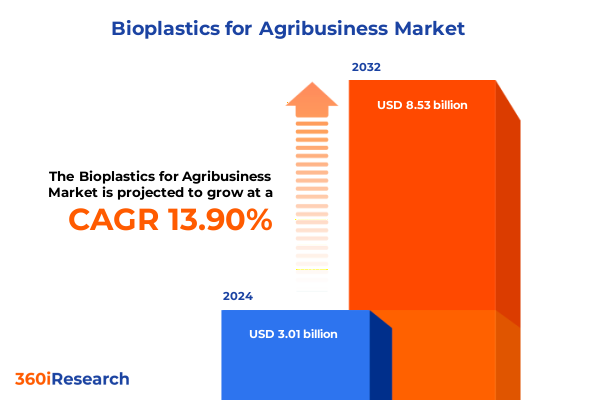

The Bioplastics for Agribusiness Market size was estimated at USD 3.42 billion in 2025 and expected to reach USD 3.90 billion in 2026, at a CAGR of 13.91% to reach USD 8.53 billion by 2032.

Introducing the dynamic convergence of sustainable materials with agribusiness objectives set to reshape agricultural practices and drive ecological resilience nationwide

In an era where environmental imperatives intersect with agricultural productivity, bioplastics have emerged as a pivotal component in transforming how agribusinesses manage packaging, waste, and resource efficiency. Introducing these sustainable polymers into farming operations goes beyond mere substitution of conventional plastics; it signifies a fundamental shift toward regenerative agricultural systems that harmonize ecological resilience with economic viability. The growing urgency to reduce plastic pollution, coupled with evolving consumer and regulatory expectations, has catalyzed a surge of innovation in biodegradable and compostable materials tailored for agricultural use.

The integration of bioplastics in agribusiness encapsulates a convergence of technological advancement, policy evolution, and market demand. Recent breakthroughs in polymer science have expanded the performance profile of bioplastics, enabling them to withstand the demanding conditions of outdoor applications such as mulch films, silage storage, and greenhouse covers. Concurrently, strengthened regulatory frameworks at federal and state levels in the United States are incentivizing both producers and end users to adopt materials that meet stringent end-of-life requirements. As a result, stakeholders across the value chain-from feedstock suppliers to equipment manufacturers and farm operators-are reevaluating traditional processes in favor of solutions that deliver both environmental benefits and operational efficiencies.

This executive summary lays the foundation for understanding the multifaceted dynamics driving bioplastics adoption in agribusiness. The subsequent sections will delve into transformative shifts, tariff impacts, segmentation insights, regional patterns, company profiles, actionable recommendations, and research methodology, culminating in a cohesive outlook on the opportunities and challenges that lie ahead. Through this analytical narrative, decision makers will gain clarity on how to strategically position themselves at the forefront of sustainable agriculture.

Exploring the transformative shifts propelling the bioplastics agribusiness landscape as regulatory pressures, technological breakthroughs, and market demands converge

The bioplastics landscape for agribusiness is undergoing transformative shifts as multiple forces converge to redefine sustainable agriculture. On the regulatory front, a wave of policy updates designed to curb plastic pollution has accelerated the transition toward biodegradable and compostable materials. Federal initiatives emphasizing circular economy principles have introduced incentives for using renewable feedstocks, while state-level mandates are phasing out conventional plastics in single-use agricultural applications. These policy changes have spurred research investments and public-private collaborations that seek to optimize performance, cost, and environmental impact simultaneously.

Technological breakthroughs are further amplifying this momentum. Advancements in polymer engineering have yielded aliphatic polyesters with enhanced strength and degradation profiles, broadening their applicability across irrigation tubing, greenhouse films, and mulching solutions. Innovations in biopolyethylene derived from sugarcane and starch-based bioplastics engineered for controlled breakdown under field conditions are enabling agribusinesses to tailor material lifecycles to specific crops and climates. These developments are complemented by digital tools that simulate degradation pathways and environmental interactions, empowering decision makers to validate material choices before large-scale deployment.

Market demand is responding accordingly, with farm operators and distributors increasingly prioritizing sustainability credentials alongside traditional metrics such as cost, durability, and supply reliability. As a result, collaboration between polymer producers, agricultural equipment manufacturers, and growers has intensified, giving rise to pilot programs that demonstrate real-world efficacy and economic benefits. These collective efforts are not only reshaping procurement strategies but also redefining value chains through integrated solutions that align product design with agronomic practices and end-of-life management.

Assessing the cumulative impact of newly enacted United States tariffs in 2025 on bioplastics supply chains, production costs, and agribusiness stakeholder strategies

The enactment of targeted United States tariffs in 2025 has introduced a complex array of effects on bioplastics supply chains and agribusiness economics. Designed to protect emerging domestic producers of key biopolymers, these tariffs have primarily affected imports of polylactic acid and polyhydroxyalkanoates, altering price dynamics for downstream users. Initial responses from domestic manufacturers include accelerated capacity expansions and investment in feedstock diversification, aiming to absorb incremental demand and mitigate potential supply shortages.

For farm operators and distributors, the tariff-driven cost adjustments have necessitated recalibration of procurement strategies. While higher landed costs for imported materials have put upward pressure on expenses, the tariffs have also stimulated innovation in local feedstock sourcing, particularly for starch-based bioplastics derived from corn, wheat, and cassava. Agribusinesses are now exploring collaborative agreements with regional growers to secure consistent raw materials and ensure compliance with both federal incentives and sustainability objectives.

Despite the short-term challenges of adjusting to new cost structures, the cumulative impact of the tariffs is catalyzing a more localized and resilient supply network. By encouraging domestic production and fostering symbiotic relationships between polymer manufacturers and agricultural communities, these measures are laying the groundwork for long-term stability. As domestic capacities come online, stakeholders can leverage scale efficiencies and vertical integration models that not only buffer against international price fluctuations but also reinforce transparency and traceability across the value chain.

Uncovering critical insights derived from diverse segmentation of bioplastics by type, raw materials, end-of-life profiles, and application scenarios in agribusiness

Examining the bioplastics market through a segmentation lens reveals a nuanced landscape shaped by material type, feedstock origin, end-of-life performance, and application context. The type segmentation encompasses aliphatic polyesters, biopolyethylene, cellulose-based bioplastics, protein-based bioplastics, and starch-based bioplastics. Within the aliphatic polyester category, polymers such as polybutylene adipate terephthalate, polybutylene succinate, polyhydroxyalkanoates, and polylactic acid each offer unique mechanical and degradation profiles suited to specific agricultural uses. This diversity of polymer chemistry underpins efforts to match material performance with field conditions and crop cycles.

When viewed by raw material, the market is driven by the availability and sustainability of feedstocks spanning cassava, corn starch, potato, sugarcane, switchgrass, and wheat. Each source presents distinct advantages in terms of geographic abundance, land use implications, and carbon footprint, guiding decisions around supply chain localization and lifecycle analysis. End-of-life characteristics further refine these choices, as stakeholders evaluate biodegradable, compostable, and photodegradable options to align with soil health objectives and waste management infrastructures.

Application segmentation underscores the versatility of bioplastics across greenhouse coverings, irrigation components, mulching films, packaging solutions, silage storage formats, and tunnel systems. This broader contextualization of use cases highlights the importance of a holistic approach to material selection, one that considers agronomic performance, environmental compliance, and operational convenience. By integrating these segmentation dimensions, agribusiness leaders can craft tailored solutions that optimize every phase of the product lifecycle, from feedstock procurement to post-harvest disposal.

This comprehensive research report categorizes the Bioplastics for Agribusiness market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Raw Material

- End-of-Life

- Application

Delivering comprehensive regional insights into bioplastics adoption patterns across the Americas, Europe, Middle East & Africa, and Asia-Pacific agribusiness sectors

Regional dynamics play a pivotal role in shaping the adoption and innovation of bioplastics within agribusiness. In the Americas, a combination of federal incentives and state-level sustainability mandates has driven early adoption, particularly in the United States and Brazil. Producers in North America are leveraging corn and wheat feedstocks while exploring partnerships with grain cooperatives to establish vertically integrated supply models. Meanwhile, Brazil’s emphasis on sugarcane-derived polymers reflects the country’s abundant renewable resources and established agro-industrial infrastructure.

Across Europe, the Middle East & Africa, policy alignment under the European Green Deal has set a high bar for plastic pollution reduction, creating robust markets for compostable and biodegradable agricultural films. Advanced waste collection and composting systems in EU member states provide a reliable end-of-life framework, incentivizing agribusinesses to adopt materials that comply with stringent environmental standards. In parallel, Middle Eastern nations are investing in R&D centers focused on cellulose-based and protein-based bioplastics adapted to arid climates, while select African markets are piloting bioplastic products through agricultural development programs.

In the Asia-Pacific region, rapid growth in farming intensity and a rising awareness of plastic pollution have spurred demand for alternative materials. China’s expanding policy support for circular economy initiatives is catalyzing local production of polyhydroxyalkanoates and starch-based films, whereas India and Southeast Asian markets are evaluating a mix of imported and domestically produced bioplastic solutions. These varied regional landscapes underscore the necessity for agribusiness stakeholders to tailor market entry and expansion strategies to distinct regulatory environments, resource availabilities, and infrastructure capabilities.

This comprehensive research report examines key regions that drive the evolution of the Bioplastics for Agribusiness market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the leading companies driving innovation, collaboration, and competitive positioning within the rapidly evolving bioplastics for agribusiness ecosystem

The bioplastics for agribusiness ecosystem is increasingly influenced by a cohort of forward-thinking companies that are forging new pathways in material innovation, strategic partnerships, and market development. These organizations are investing heavily in R&D to enhance polymer properties, improve cost competitiveness, and validate performance under diverse agronomic conditions. Joint ventures between chemical producers and agricultural equipment manufacturers have emerged, enabling integrated solutions that seamlessly incorporate bioplastic films and components into existing farming systems.

Key players are also distinguishing themselves through their approach to sustainability credentials and transparency. Some firms are investing in blockchain-enabled tracking systems to document feedstock origins, processing methods, and end-of-life outcomes, catering to traceability requirements of major food and beverage brands. Others are establishing circular supply initiatives that collect used films directly from farms for industrial composting or controlled environmental degradation, thus closing the loop on material lifecycles. Collaborative research partnerships with universities and government agencies further strengthen their market positioning by driving third-party validation of performance claims.

Competitive strategies extend beyond product innovation to include geographical expansion and targeted market segmentation. Many leading companies are scaling production facilities in strategic regions to leverage local feedstocks and regulatory incentives. Simultaneously, they are customizing product portfolios to address niche applications-from high-barrier packaging for sensitive crops to biodegradable mulch films designed to decompose within a single growing season. Through these multifaceted efforts, industry leaders are shaping the trajectory of bioplastics adoption while positioning themselves as trusted partners in the pursuit of sustainable agriculture.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bioplastics for Agribusiness market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Bio-On SpA

- Biome Bioplastics Limited.

- Carbios

- Danimer Scientific

- Eastman Chemical Company

- FKuR Kunststoff GmbH

- Futamura Group.

- GC International by PTT Global Chemical PLC

- Good Natured Products Inc.

- Green Dot Bioplastics, Inc.

- Kuraray Co., Ltd.

- Mitsubishi Chemical Group Corporation

- Natur-Tec by Northern Technologies International Corporation

- NatureWorks LLC by Cargill, Incorporated

- Novamont S.p.A. by Versalis SpA

- Polymateria Ltd.

- Roquette Frères

- TIPA Corp Ltd.

- TotalEnergies Corbion bv

- UrthPact, LLC

Empowering agribusiness leaders with actionable recommendations to integrate bioplastics solutions, optimize sustainability outcomes, and foster strategic growth

To capitalize on the momentum surrounding bioplastics in agribusiness, industry leaders must adopt a series of actionable strategies that balance innovation with operational feasibility. First, investing in diversified feedstock partnerships enables flexibility and resilience. By forging alliances with local agricultural cooperatives and exploring alternative crops such as switchgrass and cassava, stakeholders can mitigate supply chain risks while meeting sustainability criteria. This feedstock diversification also lays the foundation for vertical integration models that can reduce raw material costs over time.

Second, proactive engagement with policymakers and regulatory bodies is essential for shaping a conducive operating environment. Organizations that participate in industry coalitions or consultative forums can influence the development of standards around biodegradability, labeling, and end-of-life collection systems. This collaborative approach ensures alignment between business objectives and evolving policy requirements, reducing compliance risks and fostering innovation incentives.

Third, integrating digital tools to monitor material performance and environmental impact enhances decision-making throughout the product lifecycle. Data analytics platforms can track degradation rates under field conditions, identify optimization opportunities in polymer formulations, and quantify carbon footprint reductions. These insights support evidence-based conversations with stakeholders, from farm managers assessing cost-benefit trade-offs to sustainability officers validating corporate reporting metrics.

Finally, educational outreach and demonstration projects are critical for driving adoption at scale. Pilot programs that showcase the agronomic benefits of bioplastic applications-such as reduced soil contamination and minimized labor for film removal-help build confidence among end users. Engaging distributors and industry associations to disseminate case studies and best practices ensures that the value proposition of bioplastics resonates across the agribusiness community.

Illuminating the rigorous research methodology applied, including data triangulation and expert validation, to ensure authoritative insights into bioplastics for agribusiness

The findings presented in this analysis are grounded in a robust research methodology that combines data triangulation with iterative expert validation. Primary research efforts included conducting in-depth interviews with polymer scientists, agronomists, supply chain executives, and regulatory specialists. These conversations provided qualitative insights into performance criteria, feedstock challenges, and policy implications, forming the conceptual framework for subsequent analysis.

Secondary research entailed a comprehensive review of technical journals, trade association publications, patent filings, and government databases related to polymer chemistry, agricultural plastics use, and environmental standards. Cross-referencing these sources ensured that quantitative observations-such as feedstock availability trends and application adoption rates-were corroborated by multiple data points. In addition, proprietary industry databases informed the competitive landscape assessment, allowing for accurate profiling of key players and their strategic initiatives.

To enhance the validity of our conclusions, an expert panel comprising representatives from leading agrochemical firms, academic institutions, and sustainability consultancies was convened to review preliminary findings. Feedback from these subject matter experts guided refinements to the segmentation framework, tariff impact assessment, and regional analysis. Throughout the process, adherence to methodological rigor and transparency was maintained, ensuring that the insights presented are both actionable and defensible.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bioplastics for Agribusiness market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bioplastics for Agribusiness Market, by Type

- Bioplastics for Agribusiness Market, by Raw Material

- Bioplastics for Agribusiness Market, by End-of-Life

- Bioplastics for Agribusiness Market, by Application

- Bioplastics for Agribusiness Market, by Region

- Bioplastics for Agribusiness Market, by Group

- Bioplastics for Agribusiness Market, by Country

- United States Bioplastics for Agribusiness Market

- China Bioplastics for Agribusiness Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Concluding insights spotlighting the future trajectory of bioplastics in agribusiness toward resilient, regenerative, and economically viable agricultural systems

As bioplastics continue to gain traction within agribusiness, their role in fostering circular, regenerative agricultural systems becomes increasingly evident. The convergence of supportive policies, technological innovations, and market readiness has created a fertile environment for scaled adoption. From enhancing soil health through biodegradable mulch films to reducing post-harvest waste with compostable packaging, these materials are redefining conventional farming practices and delivering tangible ecological benefits.

Looking ahead, continued advancements in polymer customization and feedstock diversification will drive broader application across diverse crop and climate contexts. The maturation of localized supply networks-spurred in part by the 2025 tariff landscape-will strengthen resilience and enable more agile responses to evolving environmental and economic pressures. Moreover, the integration of digital monitoring tools and stakeholder collaboration platforms will further optimize material performance and end-of-life management, bridging the gap between innovation and real-world impact.

Ultimately, the trajectory of bioplastics in agribusiness is one of convergence: aligning stakeholder incentives, technological capabilities, and ecological stewardship. By embracing these materials and the systemic shifts they represent, agribusinesses can chart a path toward sustained profitability and environmental resilience, ensuring that future generations inherit a productive landscape that is both economically vibrant and ecologically sound.

Connect with Ketan Rohom to seize your comprehensive bioplastics for agribusiness market research report and drive informed strategic decisions today

Engaging with Ketan Rohom offers you direct access to unparalleled expertise and a fully detailed bioplastics for agribusiness market research report designed to inform critical decisions. As Associate Director of Sales & Marketing, Ketan brings deep knowledge of emerging trends, competitive dynamics, and regulatory shifts that are shaping the sustainable materials landscape. By reaching out, you ensure your organization leverages actionable intelligence to optimize supply chains, align product development with end-user needs, and anticipate policy changes that can affect both cost structures and market opportunities.

Securing this report grants you a strategic advantage through a precisely curated presentation of insights ranging from tariff impacts and segmentation nuances to regional adoption patterns and leading company profiles. The comprehensive analysis not only benchmarks performance but also recommends pathways for innovation, partnership, and investment that can drive both profitability and environmental stewardship. By partnering with Ketan Rohom, you tap into a consultative resource committed to guiding you through the complexities of bioplastics adoption in agribusiness, helping you translate data into tangible initiatives that resonate with stakeholders.

Act today to access a repository of expertise that can accelerate your path to sustainable growth. Engage with Ketan Rohom now to secure the detailed market research report that will inform your strategic planning, support business development efforts, and position your organization at the forefront of the bioplastics revolution within agribusiness.

- How big is the Bioplastics for Agribusiness Market?

- What is the Bioplastics for Agribusiness Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?