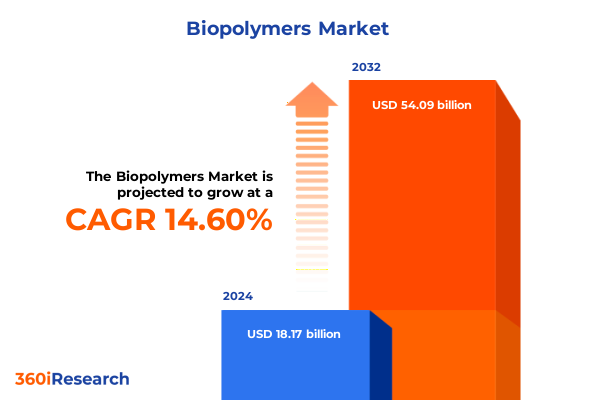

The Biopolymers Market size was estimated at USD 20.46 billion in 2025 and expected to reach USD 23.04 billion in 2026, at a CAGR of 14.89% to reach USD 54.09 billion by 2032.

Catalyzing a New Era of Eco-Conscious Materials by Exploring the Rapid and Fundamental Drivers of Biopolymer Adoption Worldwide

As global industries continue to seek alternatives to traditional petroleum-based plastics, the biopolymers landscape has emerged at the forefront of sustainable material innovation. Growing public and private commitments to reducing plastic pollution, coupled with increasingly stringent regulations on single-use plastics in major markets, have created a fertile environment for biodegradable and bio-based polymers to flourish. In this context, decision-makers across sectors are not only evaluating performance metrics such as tensile strength, thermal stability, and processability, but also considering full life-cycle impacts from feedstock cultivation through compostability and recyclability.

Against this backdrop, investment in research and development remains a key catalyst driving material breakthroughs and cost reductions. Advances in biotechnology, including enzymatic and microbial synthesis routes, are enabling the commercial viability of next-generation polyhydroxyalkanoates and novel polyester blends. Meanwhile, collaborations between petrochemical incumbents and emerging biopolymer specialists are expediting scale-up efforts and infrastructure development. Fundamentally, this section lays the groundwork by examining the convergence of environmental imperatives, policy frameworks, and technological achievements that collectively set the stage for an accelerating shift toward biopolymer adoption across global value chains.

Decoding the Paradigm Shifts Reshaping the Biopolymer Landscape as Sustainability and Innovation Drive Unprecedented Industry Transformation

Over the last decade, transformative shifts in consumer preferences, legislative mandates, and production technologies have dramatically reshaped the biopolymers market. Where early formulations struggled to match the performance of commodity plastics, emerging materials now exhibit comparable durability, clarity, and barrier properties. This evolution reflects not only improvements in polymer synthesis and compounding techniques, but also the development of proprietary additives and compatibilizers that enhance processing efficiency and end-use performance.

Simultaneously, sustainable supply chain strategies are gaining traction. Life-cycle analyses are guiding raw material sourcing toward second-generation feedstocks, reducing reliance on food crops and minimizing land-use change emissions. Pilot collaborations between agricultural cooperatives and polymer manufacturers have begun to demonstrate viable pathways for integrating non-food biomass, agricultural residues, and algae into commercial production. In parallel, digitalization of production processes-powered by data analytics and predictive modeling-is optimizing energy consumption and waste reduction. Together, these shifts signal a new era in which economic viability and environmental stewardship reaffirm biopolymers’ role as a cornerstone of the circular economy.

Examining the Impact of United States 2025 Tariff Measures on Biopolymer Trade Channels and Domestic Market Dynamics for Stakeholder Strategy

In 2025, a series of incremental tariff adjustments enacted by the United States government on select biopolymer imports has introduced novel dynamics into global trade flows and domestic market behavior. By raising duties on specific categories of cellulose-based and polyester-derived bioplastics, policymakers aimed to protect domestic producers from the influx of low-cost imports, particularly those leveraging economies of scale in Asia. While such measures have indeed bolstered sentiment among local manufacturers, they have also elevated price points for downstream processors, prompting procurement teams to reevaluate supply chain strategies.

Consequently, many U.S. converters have accelerated investments in domestic capacity expansions and backward integration to insulate against future tariff volatility. Collaborative ventures between regional resin producers and molders are now focusing on localized compounding hubs, enabling just-in-time delivery and reduced inventory carrying costs. At the same time, the tariff environment has incentivized off-shore partners to shift production toward emerging markets in Latin America and Southeast Asia, where preferential trade agreements offer duty-free or reduced rates. Taken together, these developments underscore the complex interplay between trade policy and market behavior that stakeholders must navigate in 2025 and beyond.

Unveiling Key Market Segmentation Insights to Navigate Biopolymer Demand across Types Processes Applications and End-Use Industries

Understanding the full spectrum of biopolymer market dynamics requires a detailed examination of segmentation across multiple dimensions. With respect to polymer types, the market encompasses cellulose-based resins and a range of aliphatic polyesters such as polybutylene adipate terephthalate, polybutylene succinate, polycaprolactone, polyhydroxyalkanoates, polylactic acid, and starch-blended formulations. Each type presents a distinct combination of mechanical properties and degradation profiles, guiding material selection for specific industrial applications.

Process-type segmentation reveals another layer of insight. Techniques including 3D printing, blow molding, compression molding, extrusion, film blowing, injection molding, and thermoforming each impose unique requirements on melt rheology, viscosity, and cooling rates. As such, some biopolymers are inherently better suited to additive manufacturing, while others excel in high-throughput film production. Application-based analysis further differentiates the market according to end-use needs: agricultural applications leverage controlled release systems and mulch films; automotive parts range from exterior bumpers to interior trims; consumer products span household cleaners and personal care packaging; electronics deployments include protective casings and electrical connectors; medical uses divide between drug delivery matrices and diagnostic devices; packaging categories cover films, flexible wraps, and rigid containers; textile innovations incorporate biodegradable fibers and nonwoven webs. Finally, end-use industry segmentation brings additional granularity, with agriculture, automotive, consumer electronics, consumer goods, food and beverage, healthcare, pharmaceutical packaging, and textiles each exhibiting distinct regulatory constraints and performance requirements.

This comprehensive research report categorizes the Biopolymers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Process Type

- Application

Illuminating Regional Dynamics Shaping the Biopolymer Market Trends in the Americas EMEA and Asia-Pacific for Strategic Decision-Making

Regional dynamics play a pivotal role in shaping market opportunities and competitive landscapes across the globe. In the Americas, a robust network of corn and sugarcane producers provides a steady supply of feedstocks for polylactic acid and starch-based polymers. Government incentives for onshoring sustainable manufacturing have further fueled capacity expansions in North America, while Brazil continues to pioneer second-generation biopolymers derived from sugarcane bagasse and ethanol byproducts. Meanwhile, regulatory momentum at state and federal levels has driven rapid adoption of compostable packaging solutions in retail and foodservice sectors.

In the Europe, Middle East & Africa region, regulatory harmonization under the European Union’s Circular Economy Action Plan has created a stringent framework for biodegradability standards and post-consumer waste collection. This has prompted leading polymer producers to invest in advanced recycling technologies that complement biodegradable offerings, ensuring full circle resource management. Simultaneously, collaborations between petrochemical incumbents and innovative startups are accelerating development of high-performance aliphatic polyesters for medical and specialty applications.

Across Asia-Pacific, the combination of rapidly growing domestic demand and targeted government subsidies has established the region as a manufacturing powerhouse. China’s capacity to scale production of polylactic acid and polyhydroxyalkanoates has lowered global price points, while the adoption of bio-film technologies in India and Southeast Asia responds to urgent municipal plastic bans. These regional insights highlight differentiated growth trajectories and strategic considerations that companies must address to align with local market drivers.

This comprehensive research report examines key regions that drive the evolution of the Biopolymers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Biopolymer Companies Driving Innovation Collaboration and Competitive Strategies in the Global Market Landscape

Leading companies across the biopolymers sector are leveraging diverse strategies-ranging from in-house polymer research to strategic alliances-to capture emerging opportunities. Major producers of polylactic acid and related esters have invested heavily in proprietary catalyst systems that improve polymerization rates and reduce energy consumption. Some global chemical corporations are pursuing joint ventures with agricultural cooperatives to secure long-term feedstock supply agreements, while others have acquired specialty resin blenders to enhance product portfolios with tailored formulations for packaging and fiber applications.

In parallel, vertically integrated players are differentiating themselves by offering end-to-end solutions, from monomer production through compounding and final product manufacturing. Collaborative research partnerships with academic institutions and national laboratories have accelerated material innovation, resulting in novel copolymer blends that bridge performance gaps between traditional plastics and biodegradable alternatives. At the same time, a wave of M&A activity has unfolded as established resin makers seek to incorporate biopolymer capabilities into their core offerings, thereby strengthening their ability to serve evolving customer requirements in high-growth sectors such as medical devices, consumer electronics, and sustainable packaging.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biopolymers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avient Corporation

- BASF SE

- Biome Bioplastics Limited

- Biotec Biologische Naturverpackungen GmbH & Co.

- Braskem S.A.

- Danimer Scientific, Inc.

- DuPont de Nemours, Inc.

- FKuR Kunststoff GmbH

- Kaneka Corporation

- Mitsubishi Chemical Holdings Corporation

- NatureWorks LLC

- Novamont S.p.A.

- Plantic Technologies Limited

- Solvay S.A.

- Tate & Lyle PLC

- TEIJIN Limited

- Toray Industries, Inc.

- Total Corbion PLA

- Trinseo S.A.

- WestRock Company

Offering Actionable Strategic Recommendations for Industry Leaders to Capitalize on Biopolymer Opportunities amidst Market Disruptions and Regulatory Changes

To capitalize on the rapid evolution of the biopolymers market, industry leaders must adopt a proactive and multifaceted strategic approach. First, prioritizing investment in research and development efforts that target both next-generation feedstocks and performance enhancements will be essential to maintaining a competitive edge. This includes exploring non-food biomass sources and advanced fermentation processes to diversify raw material pipelines and mitigate supply chain risks.

Second, forging strategic collaborations-whether through joint ventures, co-development agreements, or public-private partnerships-can expedite scale-up timelines and share the financial burden of infrastructure investments. Such alliances should be structured to align incentives across the value chain, ensuring that feedstock suppliers, polymer producers, compounders, and end users jointly pursue cost reductions and sustainability targets.

Finally, companies should focus on market segmentation strategies that align product development with high-growth end-use sectors. By dedicating resources to specialized applications-such as medical-grade films, agricultural mulch systems, or performance textiles-organizations can capture premium pricing and establish strong brand differentiation. Simultaneously, building agile supply chain capabilities that accommodate tariff fluctuations and evolving regulatory mandates will enable rapid response to shifting market conditions.

Detailing a Robust Research Methodology Combining Secondary Data Analysis Primary Research and Rigorous Validation to Ensure Data Integrity and Reliability

The research methodology underpinning this report integrates rigorous secondary data analysis with targeted primary engagement to ensure comprehensive and reliable market insights. The secondary phase involved a systematic review of industry publications, patent filings, regulatory filings, sustainability white papers, and trade association datasets. This provided a robust foundation for understanding historical trends, technology trajectories, and policy landscapes.

In parallel, primary research comprised in-depth interviews with a broad array of stakeholders, including polymer scientists, manufacturing engineers, supply chain experts, procurement executives, and policy advisors. These discussions offered firsthand perspectives on emerging challenges, investment priorities, and implementation hurdles. To maintain data integrity, responses were triangulated against independent data sources and cross-referenced with financial disclosures, conference proceedings, and corporate sustainability reports.

Finally, a rigorous validation process was employed, featuring iterative workshops with subject-matter experts and peer reviews by technical advisors. This multistage approach ensured that the conclusions and strategic insights presented in this report reflect both the current state of the biopolymers industry and the near-term horizon of technological and regulatory evolution.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biopolymers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biopolymers Market, by Type

- Biopolymers Market, by Process Type

- Biopolymers Market, by Application

- Biopolymers Market, by Region

- Biopolymers Market, by Group

- Biopolymers Market, by Country

- United States Biopolymers Market

- China Biopolymers Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1749 ]

Synthesizing Insights and Charting the Path Forward for Biopolymer Stakeholders to Drive Sustainable Growth and Competitive Advantage in an Evolving Market

The synthesized insights from this comprehensive analysis underscore a biopolymers market at a critical inflection point, where innovation and policy alignment converge to reshape material paradigms. Technological advancements have narrowed the performance gap with commodity plastics, while evolving trade policies and regional incentives continue to redefine competitive dynamics. Market segmentation analysis highlights focused opportunities across polymer types, processing methods, and end-use applications, underscoring the importance of strategic alignment with high-value sectors. Moreover, regional perspectives illuminate differentiated growth trajectories in the Americas, Europe, Middle East & Africa, and Asia-Pacific, each presenting unique enablers and challenges.

For stakeholders, the imperative is clear: embracing a forward-looking strategic posture will determine who leads in this dynamic environment. Companies that invest in next-generation feedstocks, forge collaborative value chain partnerships, and align product portfolios with specialty applications are positioned to capture premium market segments. Concurrently, agility in navigating tariff landscapes and regulatory frameworks will be vital to sustaining momentum.

In conclusion, the biopolymers market offers a compelling avenue for driving sustainable growth and competitive advantage. By leveraging the insights and recommendations within this report, decision-makers can chart a path that balances environmental stewardship with commercial success, ensuring resilience in an evolving market landscape.

Contact Ketan Rohom Today to Secure Your Customized Biopolymers Market Research Report and Gain Strategic Insights That Empower Your Business Growth

I invite you to reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive biopolymers market research report can address your organization’s strategic needs and support your growth ambitions. Ketan’s expertise in translating complex data into actionable strategies ensures you gain tailored insights that drive informed decision-making and competitive advantage. By engaging with Ketan, you will receive personalized guidance on report customization, licensing options, and value-added services that align with your unique priorities. Don’t miss the opportunity to secure access to cutting-edge intelligence on emerging trends, regulatory developments, and high-potential segments within the biopolymers landscape. Connect with Ketan Rohom today to transform market intelligence into sustainable business performance and propel your initiatives forward.

- How big is the Biopolymers Market?

- What is the Biopolymers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?