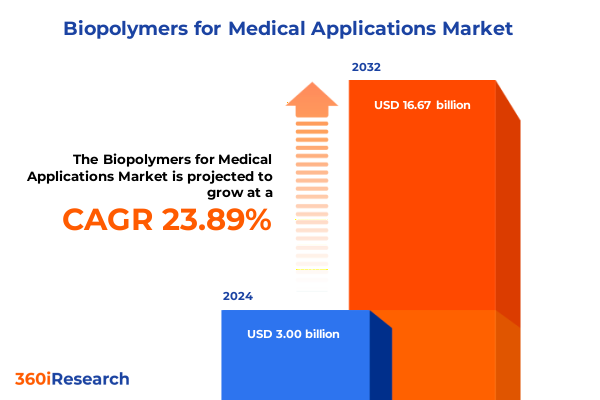

The Biopolymers for Medical Applications Market size was estimated at USD 3.73 billion in 2025 and expected to reach USD 4.55 billion in 2026, at a CAGR of 23.82% to reach USD 16.67 billion by 2032.

Unveiling the Catalysts Driving the Proliferation of Biopolymers in Medical Applications Under Emerging Technological and Regulatory Paradigms

Biopolymers are transforming the medical field by harnessing the inherent advantages of naturally derived polymers to meet the growing demand for sustainable, biocompatible materials. These advanced materials are distinguished by their ability to interact with biological systems without eliciting adverse immune responses, a feature that underpins their widespread adoption in implants, tissue scaffolds, and controlled release drug delivery platforms. As healthcare systems worldwide strive for safer, more effective therapies, biopolymers offer an intersection of performance and environmental stewardship that traditional synthetic polymers cannot match.

This evolution has been driven by continuous innovation across multiple fronts. Advances in purification, processing, and functionalization techniques have expanded the utility of polymers such as polylactic acid, chitosan, and collagen, enabling manufacturers to tailor mechanical strength, degradation rates, and cellular interactions. These capabilities have laid the foundation for next-generation medical devices that not only support healing but also actively participate in tissue regeneration and localized therapy delivery.

Amidst these technical strides, regulatory bodies have increasingly recognized the value of biopolymer-based solutions, streamlining pathways for approval and encouraging investment through initiatives aimed at reducing surgical complications and improving patient outcomes. As this landscape continues to mature, industry stakeholders must develop a nuanced understanding of the catalysts propelling biopolymer adoption, from sustainability mandates to the pursuit of personalized medicine.

Identifying the Pivotal Technological and Market Disruptions Reshaping the Biopolymer Landscape in Modern Medical Treatment

The biopolymers landscape is undergoing seismic shifts that are redefining material performance, manufacturing processes, and patient-centric design. At the forefront is the integration of advanced manufacturing methods, such as 3D bioprinting and nanofabrication, which enable the creation of complex, patient-specific implants and scaffolds with unprecedented precision. By depositing layers of cell-laden bioinks, clinicians can now fabricate structures that closely mimic native tissues, offering pathways to personalized regenerative therapies and organ models for drug testing.

Simultaneously, breakthroughs in nanoencapsulation techniques have elevated drug delivery platforms, allowing for sustained and targeted release profiles that improve therapeutic indices while minimizing systemic side effects. Polysaccharide-based carriers, such as alginate and chitosan nanospheres, are demonstrating exceptional performance in preclinical studies, facilitating controlled release of small molecules, peptides, and genetic material to specific tissue sites.

These innovations are coupled with evolving regulatory frameworks that are increasingly accommodating combination products and biomaterial-device synergies. The trend toward harmonized global standards has accelerated cross-border collaborations, while public–private partnerships are underwriting translational research aimed at bridging bench-to-bedside gaps. As a result, the biopolymer sector is transitioning from niche biomedical applications to mainstream adoption across cardiovascular, orthopedic, and ophthalmic markets.

Examining the Ripple Effects of 2025 Tariff Policies on Biopolymer Supply Chains and Cost Structures within United States Medical Sector

The imposition of new United States tariffs in 2025 has introduced significant pressure on the biopolymer supply chain, particularly for imported raw materials such as high-purity lactic acid and specialty polysaccharides used in medical-grade formulations. These cost headwinds have compelled manufacturers to reassess sourcing strategies, catalyzing a shift toward domestic production and vertically integrated supply models that offer greater buffer against geopolitical volatility.

In response to heightened import duties, several leading polymer producers have announced investments in new fermentation facilities within North America, targeting feedstocks like sugarcane and corn starch to ensure consistent access to critical monomers. This transition not only mitigates tariff exposure but also aligns with sustainability targets by reducing transportation-related carbon emissions. Moreover, the expanded domestic capacity is fostering regional clustering of expertise, where research institutions and contract development organizations collaborate to optimize fermentation yields and monomer purity.

While these initiatives help buffer cost increases, downstream medical device OEMs are experiencing compressed margins, prompting them to pursue cost-effective material grades and process efficiencies. The tariff-induced recalibration is thus reshaping the competitive hierarchy, benefiting suppliers who can leverage localized production capabilities and scalable purification technologies.

Illuminating Critical Market Dimensions through Type, Form, Production Pathways, Application Verticals, and End User Perspectives for Biopolymers

The biopolymer market for medical applications can be understood through multiple dimensions that reveal nuanced opportunities. When considering the core polymer types, materials such as alginate, chitosan, collagen, hyaluronic acid, polyhydroxyalkanoates, and polylactic acid each present distinct performance attributes and sourcing challenges. For instance, alginate and chitosan excel in hydrogel formation for wound dressings, whereas polylactic acid’s versatility supports both structural scaffolds and resorbable sutures.

Different physical forms, whether fibers, films, or hydrogels, further dictate application suitability. Fibrous formats enable membrane-based tissue engineering, films offer controlled release surfaces, and hydrogels accommodate cell encapsulation and injectable therapies, with each form demanding tailored downstream processing and sterilization protocols. Alongside these modalities, production pathways-spanning chemical synthesis, extraction, and fermentation-shape cost profiles and regulatory pathways, underscoring the importance of selecting methods that align with both performance targets and compliance requirements.

Applications encompass a broad spectrum, including cardiovascular devices, dental membranes, drug delivery platforms such as films, microspheres, and nanoparticles, ophthalmic implants, orthopedic implants, surgical sutures, tissue engineering for bone, cartilage, and skin, as well as wound dressings. The end user environment ranges from contract research organizations to hospitals and clinics, pharmaceutical companies, and research laboratories, and each stakeholder group imposes unique specifications related to material validation, batch consistency, and scalability of supply. Recognizing how these segments interplay offers a roadmap to prioritize investment and R&D focus areas.

This comprehensive research report categorizes the Biopolymers for Medical Applications market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Production Method

- Application

- End User

Comparative Regional Dynamics Driving Adoption Rates and Innovation in Biopolymers across Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional dynamics are shaping the pace and direction of biopolymer adoption in medical contexts. In the Americas, robust infrastructure for biomanufacturing, combined with clear regulatory guidelines and strong reimbursement frameworks, has accelerated deployment of PLA-based implants and chitosan wound care products. Meanwhile, Europe, the Middle East, and Africa benefit from stringent safety and sustainability mandates, such as the European Medical Device Regulation, driving the uptake of fully traceable biopolymers and incentivizing circular economy practices across the value chain.

In the Asia-Pacific region, rapid industrial growth and government-backed initiatives in China, India, and South Korea are underpinning large-scale investments in fermentation and monomer purification facilities. This surge has yielded cost advantages in key feedstocks like starch and sugarcane, enabling regional suppliers to compete on both price and localized support. Collaborative innovation hubs are emerging, where equipment manufacturers, research institutions, and contract development organizations coalesce to accelerate process optimization, further reinforcing Asia-Pacific’s role as a major export hub for medical-grade biopolymers.

These divergent regional strengths underscore the necessity of tailoring market entry and partnership strategies to the specific competitive, regulatory, and logistical realities of each geography.

This comprehensive research report examines key regions that drive the evolution of the Biopolymers for Medical Applications market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Showcasing Leading Biopolymer Innovators and Strategic Collaborations Accelerating Medical Device and Therapeutic Solutions Worldwide

Leading biopolymer companies are expanding their strategic footprints through targeted partnerships, capacity expansions, and product portfolio diversification. A prime example is NatureWorks, which recently announced the development of a new integrated PLA facility in Thailand to meet growing demand for low-carbon Ingeo grades, reflecting its strategy to secure feedstock proximity and enhance global supply resilience.

Evonik has concurrently reinforced its position in bioresorbable polymers through its RESOMER® portfolio, offering a wide spectrum of medical-grade lactide, glycolide, and caprolactone polymers tailored for applications ranging from orthopedic implants to parenteral controlled release. The company’s investments in high-purity polymer lines and custom formulation capabilities have positioned it as a trusted partner for device manufacturers seeking both standard and bespoke solutions.

Across the sector, other innovators are forging alliances with contract research organizations and academic institutions to accelerate pipeline development, while companies with strong fermentation capabilities are scaling up microbial platforms to deliver next-generation polyhydroxyalkanoates with tailored monomer ratios. These cumulative efforts illustrate a collective push to align material innovation with clinical demands and cost imperatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biopolymers for Medical Applications market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ashland Global Holdings Inc.

- BASF SE

- Biomerics, LLC

- Celanese Corporation

- Colorobbia Holding S.p.A.

- Corbion N.V.

- Corbion Purac

- Croda International Plc

- DSM-Firmenich AG

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Foster Corporation

- Groupe Gorge

- Lubrizol Corporation

- MedPlast, Inc.

- Merck KGaA

- Mitsubishi Chemical Group Corporation

- NatureWorks LLC

- Poly-Med, Inc.

- Raumedic AG

- Sekisui Chemical Co., Ltd.

- Starch Medical Inc.

- Teknor Apex Company

- Victrex plc

- Zeus Industrial Products, Inc.

Strategic Imperatives for Industry Pioneers to Capitalize on Emerging Trends and Mitigate Regulatory and Trade Barriers in Biopolymer Markets

To thrive in this evolving environment, industry leaders should prioritize integrated supply chain strategies that balance domestic production investments with global feedstock diversification. Establishing fermentation and purification clusters near key raw material sources can significantly reduce exposure to tariff fluctuations and transportation disruptions while satisfying sustainability objectives.

Furthermore, companies must accelerate their adoption of advanced manufacturing technologies, including additive manufacturing and nanoencapsulation, to differentiate product offerings and capture value in high-growth clinical segments such as personalized implants and targeted drug delivery systems. Co-development partnerships with contract research organizations and device OEMs can shorten development cycles and align polymer properties with emerging clinical protocols.

Finally, proactive engagement with regulatory authorities to shape harmonized standards and accelerate approval pathways will be critical. By contributing to guideline development for combination products and novel biopolymer-device integrations, industry stakeholders can ensure a favorable environment for innovation and maintain competitive advantage.

Detailing the Rigorous Multimodal Research Approach Employed to Deliver Comprehensive and Reliable Biopolymer Market Intelligence for Medical Applications

This report’s findings are underpinned by a structured, multimodal research framework. Extensive primary research included in-depth interviews with senior executives at polymer manufacturers, medical device OEMs, and regulatory agencies, complemented by discussions with key opinion leaders in tissue engineering and drug delivery.

Secondary research involved comprehensive analysis of peer-reviewed journals, patent filings, industry whitepapers, and publicly available financial statements. Data triangulation techniques were applied to validate market trends, supply chain developments, and regional regulatory updates, ensuring robust, unbiased insights.

Quantitative analysis utilized proprietary databases to examine production capacities, trade flows, and technology adoption rates, while qualitative analysis synthesized strategic initiatives, partnership announcements, and competitive positioning. This rigorous methodology provides a reliable foundation for informed decision-making and strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biopolymers for Medical Applications market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biopolymers for Medical Applications Market, by Type

- Biopolymers for Medical Applications Market, by Form

- Biopolymers for Medical Applications Market, by Production Method

- Biopolymers for Medical Applications Market, by Application

- Biopolymers for Medical Applications Market, by End User

- Biopolymers for Medical Applications Market, by Region

- Biopolymers for Medical Applications Market, by Group

- Biopolymers for Medical Applications Market, by Country

- United States Biopolymers for Medical Applications Market

- China Biopolymers for Medical Applications Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesis of Strategic Insights Demonstrating the Transformative Potential of Biopolymers in Shaping the Future of Medical Interventions and Care

Biopolymers are poised to redefine the medical landscape, offering a blend of sustainability, biocompatibility, and tailored functionality that traditional materials cannot deliver. The convergence of manufacturing innovations, evolving regulatory frameworks, and strategic investments is driving a new era of medical products designed for optimal patient outcomes.

As stakeholders navigate the complexities of tariff policies, regional dynamics, and competitive landscapes, a clear strategic roadmap emerges: leverage advanced production techniques, foster collaborative ecosystems, and maintain proactive regulatory dialogue. In doing so, industry leaders can harness the full potential of biopolymers to develop next-generation therapies and devices that address critical healthcare challenges.

This synthesis underscores the pivotal role of integrated market intelligence in guiding impactful decisions, illuminating pathways for growth, and catalyzing the translation of biopolymer innovations into clinical successes.

Engage with Ketan Rohom to Unlock In-Depth Biopolymer Market Insights and Propel Your Medical Innovation Initiatives to the Forefront of Industry

Ketan Rohom, Associate Director of Sales & Marketing, invites you to deepen your strategic understanding of the dynamic biopolymers landscape. His expertise can help align your innovation priorities with market realities, identifying the most promising application niches and guiding your investments in emerging production methods.

Connect directly with Ketan to explore tailored research packages that address your specific needs, whether that involves advanced segmentation insights, regulatory impact analyses, or competitive intelligence. Engage with his team to receive personalized consultations and unlock actionable intelligence that accelerates your product development timelines.

Reserve your comprehensive market research report today to gain the clarity and foresight required to navigate complex tariff environments, optimize regional strategies, and partner effectively with leading biopolymer innovators. Reach out to Ketan Rohom to secure the insights that will drive your next breakthrough in medical biopolymer applications.

- How big is the Biopolymers for Medical Applications Market?

- What is the Biopolymers for Medical Applications Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?