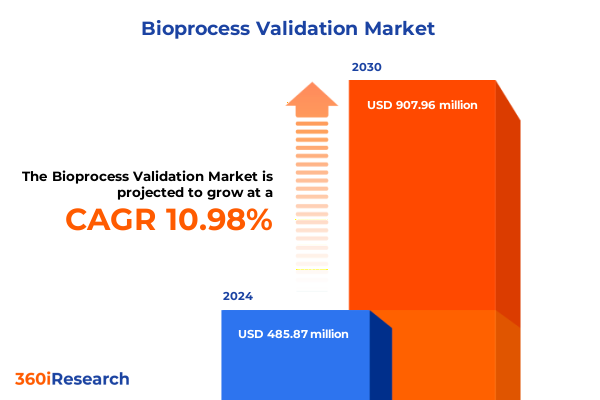

The Bioprocess Validation Market size was estimated at USD 485.87 million in 2024 and expected to reach USD 537.67 million in 2025, at a CAGR of 10.98% to reach USD 907.96 million by 2030.

Pioneering Quality Assurance in Bioprocess Validation Through Strategic Compliance, Advanced Technologies, and Industry-Driven Best Practices

Bioprocess validation has emerged as a foundational practice in the pharmaceutical and biotechnology sectors, ensuring that every stage of biologic production adheres to stringent quality and safety standards. Regulatory bodies such as the U.S. Food and Drug Administration and the European Medicines Agency require robust documentation and verification of critical processes, from raw material qualification to final product release. These mandates have driven companies to adopt comprehensive validation protocols that not only satisfy compliance demands but also foster continuous quality improvement across bioreactor operations, filtration systems, and downstream processing pipelines

Parallel to the intensifying regulatory environment, the industry is witnessing a digital transformation that enhances validation workflows with real-time analytics, cloud-based data management, and artificial intelligence. Digital validation software now automates routine tasks such as data capture, trend analysis, and audit trail management, reducing manual errors and accelerating protocol execution. As organizations integrate predictive analytics into their validation frameworks, they gain the ability to forecast process deviations, optimize performance parameters, and make informed decisions that shorten time-to-market for critical biologics

Furthermore, the rapid expansion of biologics manufacturing and the shift toward single-use and modular production platforms have created new demands for validation expertise. The surge in single-use bioprocessing systems, which minimize cross-contamination risks and improve operational flexibility, necessitates tailored validation approaches for extractables, leachables, and integrity testing. With single-use technologies projected to transform bioprocessing economics and scalability, organizations must develop innovative validation strategies that align with evolving production paradigms and quality expectations

Revolutionary Shifts Redefining Bioprocess Validation Including Digital Transformation, Single-Use Innovations, and Real-Time Monitoring Frameworks

The bioprocess validation landscape is undergoing a fundamental transformation driven by next-generation manufacturing models and digital innovation. Single-use bioreactors, modular facilities, and continuous processing platforms are now at the forefront of production strategies, requiring validation protocols that accommodate rapid changeovers and dynamic operational parameters. These flexible systems reduce downtime and contamination risks, but they also introduce unique challenges in extractables and leachables testing, filter integrity assessment, and environmental monitoring that must be addressed through adaptive validation frameworks

Simultaneously, artificial intelligence and machine learning are being leveraged to enhance predictive validation and quality assurance. AI-driven platforms analyze vast datasets generated during process execution to identify subtle trends, forecast potential failures, and recommend corrective actions in real time. This predictive capability allows validation teams to transition from retrospective compliance activities to continuous verification, significantly improving process robustness and reducing the risk of non-conforming batches. Organizations that embrace these technologies are finding that their validation cycles become more efficient, data-driven, and resilient to variability

Moreover, digital twins, process analytical technology, and robotic automation are streamlining validation workflows by simulating process conditions, enabling remote monitoring, and automating repetitive tasks. Digital twins recreate virtual replicas of production processes, facilitating “what-if” analyses that accelerate protocol development and lifecycle management. At the same time, advanced spectroscopic tools and automated sampling systems ensure consistent, high-resolution data collection that underpins real-time release strategies. Together, these innovations are redefining validation from a discrete project to an integrated, continuous quality assurance practice

Assessing the Far-Reaching Consequences of 2025 U.S. Trade Tariffs on Bioprocess Validation Supply Chains and Cost Structures

In 2025, newly imposed U.S. tariffs on pharmaceutical raw materials, equipment, and intermediates are reshaping the landscape of bioprocess validation by introducing additional cost pressures and supply chain complexities. A 25% duty on active pharmaceutical ingredients sourced from China and a 20% tariff on those from India have heightened production costs for both small molecules and biologics, impacting the budgeting and planning of validation protocols that depend on consistent access to high-purity inputs. Similarly, a 15% levy on medical packaging components and laboratory instruments has fueled inflationary pressures across fill–finish and analytical testing operations, challenging validators to maintain schedules and budgets in a volatile trading environment

Tariffs on large-scale pharmaceutical manufacturing equipment have further disrupted validation timelines and capital planning. The introduction of a 25% tariff on bioreactors, chromatography systems, and critical filtration units sourced from Europe and Asia has led to procurement delays and higher acquisition costs, compelling companies to reevaluate deployment schedules for new production lines. These shifts have also increased reliance on domestic service providers and contract manufacturers with local validation capabilities to avoid import duties and maintain timely qualification of processes

In response, several major biopharmaceutical firms have accelerated investments in U.S.-based manufacturing and validation infrastructure. Biogen’s announcement of a $2 billion expansion in its North Carolina facilities exemplifies this trend, as the company seeks to offset future tariff impacts by enhancing local production and fill–finish capacity. Such expansions include integrated automation and AI-based monitoring systems that streamline equipment qualification and batch release, offering a hedge against supply chain disruptions and import levies

At the same time, rising trade tensions have prompted sourcing shifts in Asia, where companies like WuXi AppTec are stockpiling materials and developing local testing solutions to mitigate tariff-driven uncertainties. These adaptations underscore the fragility of global supply chains for key reagents and instrumentation, emphasizing the need for agile validation strategies that balance regional self-sufficiency with cost optimization

In-Depth Insights Into Bioprocess Validation Market Segmentation Spanning Products, Validation Types, Technologies, and End-User Applications

The bioprocess validation market encompasses a diverse array of product offerings, each requiring targeted validation strategies to ensure process reliability. Equipment such as bioreactors, chromatography systems, fermenters, and filtration assemblies must undergo rigorous integrity tests and extractables assessments, driven by the need to confirm sterile operation and material compatibility. Cleaning agents and dedicated validation kits enable precise residue analysis, while end-to-end validation management software platforms facilitate protocol development, electronic batch recording, and data integrity checks, creating an integrated ecosystem for validation execution

Validation types range from cleaning and equipment qualification to process and software validation, each demanding specialized methodologies. Cleaning validation employs protein residue testing, swab analysis, and visual inspections to guarantee contaminant removal between batches. Equipment qualification progresses through IQ, OQ, and PQ phases that collectively verify installation accuracy, operational performance, and consistent output under real-world conditions. Process validation spans parameter optimization, scale-up evaluation, and yield maximization studies, ensuring that manufacturing operates within defined control limits throughout lifecycle management. Software validation focuses on data integrity and GxP compliance, confirming that digital systems adhere to regulatory standards and maintain audit-ready records

Technological segmentation highlights chromatography, PCR, and spectroscopy platforms as focal points for analytical validation. High-performance liquid chromatography, ion exchange chromatography, and UPLC methodologies require precise calibration and method ruggedness testing to achieve reliable separations. PCR-based assays, including qPCR and RT–PCR, demand exact thermal cycling controls and sensitivity verification to detect nucleic acid contaminants. Spectroscopic techniques such as FTIR and UV–Vis are validated through wavelength accuracy checks, photometric linearity assessments, and stray light evaluations, ensuring that real-time monitoring and PAT initiatives are built on a foundation of analytical rigor

End users across academic and research institutes, biopharmaceutical companies, contract research organizations, and pharmaceutical manufacturers drive distinct validation profiles. Academic laboratories emphasize method development and proof-of-concept studies, while biopharma firms focus on scale-up qualification and regulatory submission readiness. CROs and CDMOs bundle extractables, leachables, microbiological, and physical testing into turnkey validation services that support client pipelines, and pharmaceutical companies integrate validation planning into overarching quality systems that align with global GMP requirements. This diverse user base underpins a market that values both specialized expertise and comprehensive validation platforms

This comprehensive research report categorizes the Bioprocess Validation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Validation Type

- Biologic Type

- Process Component

- Work Flow Stage

- Scale

- Mode

- End User

Unlocking Regional Dynamics in Bioprocess Validation Through Comparative Analysis of Americas, EMEA, and Asia-Pacific Markets

The Americas region is characterized by widespread adoption of digital validation platforms and a mature regulatory environment that emphasizes data integrity and continuous monitoring. Approximately two-thirds of U.S. biopharma companies have implemented AI-driven in-process controls, reflecting a strong preference for advanced analytics that reduce batch deviations and accelerate protocol approvals. This region’s robust CDMO sector further consolidates validation expertise locally, enabling swift deployment of method development and equipment qualification services nationwide

Europe, Middle East, and Africa benefit from highly stringent regulatory frameworks that prioritize harmonization and environmental monitoring, particularly under revised Annex 1 guidelines. Western European firms lead in blockchain-enabled audit trails for GMP-compliant data tracking, while cleanroom qualification and advanced PAT methodologies are widely implemented to meet elevated regional standards. Multinational pharmaceutical companies in this territory frequently leverage local laboratories and certification bodies to expedite cross-border validation approvals, reflecting a cohesive quality ecosystem across the EMEA landscape

The Asia-Pacific market is the fastest-growing segment, spurred by government investments in biotechnology infrastructure and expanding local validation capabilities in India and China. Biotech parks and innovation hubs are integrating integrated validation services to support mRNA vaccine production and biosimilar manufacturing, reducing reliance on Western CMOs. Regional companies are also developing cost-effective analytical reagents and validation kits, enabling domestic players to perform high-quality cleaning and process qualification tests. This convergence of public–private funding and scalable facilities is catalyzing a rapid evolution in APAC validation standards and competencies

This comprehensive research report examines key regions that drive the evolution of the Bioprocess Validation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation and Service Excellence in Bioprocess Validation Solutions Worldwide

Thermo Fisher Scientific has demonstrated resilience in the bioprocess validation market by surpassing revenue expectations across its laboratory products and services segments. In Q2 2025, the company reported a 3% increase in overall revenue to $10.85 billion, fueled in part by strong adoption of its validation tools and software solutions within vaccine and therapeutic development pipelines. This performance underscores the sustained demand for integrated validation platforms that offer process improvement and supply chain efficiency, particularly in the face of trade-imposed cost pressures

Building on its core competencies, Thermo Fisher advanced its bioprocess filtration portfolio through the acquisition of Solventum’s purification and filtration business for $4.1 billion. This strategic move expands the company’s offerings into high-value filter integrity and extractables testing solutions, complementing its existing bioreactor and chromatography validation services. The deal is expected to be accretive by 2026, enhancing Thermo Fisher’s ability to deliver end-to-end validation workflows that meet evolving regulatory and operational demands

Key contract research organizations and CDMOs such as Danaher, Eurofins Scientific, and Sartorius are also capitalizing on the outsourcing trend by bundling comprehensive validation services. Recent earnings reports show Danaher and Medpace benefiting from stabilizing biotech and pharmaceutical spending, while IQVIA and ICON highlight growing demand for extractables, leachables, and microbiological testing. These collaborations, alongside targeted acquisitions and technology partnerships, position these players to address client needs across equipment qualification, process validation, and data integrity initiatives

This comprehensive research report delivers an in-depth overview of the principal market players in the Bioprocess Validation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Alcami Corporation

- Avantor, Inc.

- Bio-Rad Laboratories, Inc.

- Bio-Techne Corporation

- Bruker Corporation

- Charles River Laboratories International, Inc.

- Danaher Corporation

- Eppendorf SE

- Eurofins Scientific SE

- FUJIFILM Corporation

- GenScript Biotech Corporation

- Hamilton Company

- ICON plc

- Illumina, Inc.

- Intertek Group plc

- JSR Life Sciences, LLC

- KBI Biopharma, Inc.

- Lonza Group AG

- MabPlex International Co. Ltd.

- Merck KGaA

- Nelson Laboratories, LLC by Sotera Health Company

- PerkinElmer, Inc.

- Promega Corporation

- QIAGEN N.V.

- Repligen Corporation

- Sartorius AG

- SGS SA.

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- Waters Corporation

- WuXi AppTec

Strategic Roadmap for Industry Leaders to Enhance Resilience, Embrace Digitalization, and Optimize Bioprocess Validation Protocols

To maintain a competitive edge, industry leaders should accelerate investments in AI-powered validation frameworks and cloud-based platforms that automate data capture, trend analysis, and audit trail management. By leveraging machine learning algorithms for predictive deviation detection, organizations can shift toward continuous verification and real-time release models, minimizing downtime and compliance risks. Prioritizing digital integration also enhances cross-functional collaboration, ensuring that quality, manufacturing, and IT teams operate within a unified validation ecosystem

Given the growing complexity of global trade policies, companies must diversify their supply chains and explore nearshoring or regional sourcing strategies for critical equipment, reagents, and consumables. AI-driven procurement solutions can provide real-time visibility into tariff exposures, supplier performance, and logistical bottlenecks, enabling teams to reconfigure supplier networks swiftly and mitigate cost disruptions. This proactive approach safeguards validation timelines and ensures consistent access to validated materials

Forming strategic partnerships with CMOs and equipment manufacturers offers another pathway to bolster validation capacity and expertise. Collaborations that integrate advanced process analytical technology, digital twins, and robotic sampling systems can streamline qualification workflows and support rapid scale-up. By co-developing validation protocols tailored to emerging manufacturing platforms-such as continuous bioprocessing and single-use facilities-organizations can optimize resource allocation, reduce quality events, and accelerate product launches in targeted markets

Comprehensive Research Methodology Leveraging Robust Secondary Analysis, In-Depth Primary Interviews, and Rigorous Validation Procedures

This research study synthesized extensive secondary data drawn from public regulatory guidelines, industry publications, and corporate disclosures to construct a robust foundation for market analysis. Regulatory frameworks from the FDA and EMA were examined to ensure alignment with current GMP expectations, while white papers and technical bulletins informed our evaluation of emerging technologies and validation methodologies. In addition, we reviewed detailed tariff and trade policy reports to assess their impact on equipment and reagent supply chains within the validation sector

Complementing the secondary analysis, primary research was conducted through in-depth interviews with industry stakeholders, including quality assurance leaders, production managers, and validation engineers. A survey approach modeled on the PPD 2025 Biopharma Trends report enabled quantification of digital adoption rates, outsourcing preferences, and technology investment plans across leading biomanufacturing organizations. Qualitative insights from these engagements were triangulated with quantitative data to enhance the reliability and relevance of key market findings

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bioprocess Validation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bioprocess Validation Market, by Component

- Bioprocess Validation Market, by Validation Type

- Bioprocess Validation Market, by Biologic Type

- Bioprocess Validation Market, by Process Component

- Bioprocess Validation Market, by Work Flow Stage

- Bioprocess Validation Market, by Scale

- Bioprocess Validation Market, by Mode

- Bioprocess Validation Market, by End User

- Bioprocess Validation Market, by Region

- Bioprocess Validation Market, by Group

- Bioprocess Validation Market, by Country

- United States Bioprocess Validation Market

- China Bioprocess Validation Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2862 ]

Concluding Perspectives on the Evolving Bioprocess Validation Landscape Highlighting Future Opportunities and Preparedness Tactics

As the bioprocess validation landscape continues to evolve, companies that invest in integrated digital platforms and predictive analytics will be best positioned to meet escalating regulatory expectations. The convergence of single-use technologies, continuous manufacturing, and real-time monitoring has redefined quality assurance, requiring validation frameworks that are both flexible and data-driven. Organizations that adopt these advanced strategies can significantly reduce validation cycle times, minimize batch failures, and ensure consistent compliance across global operations

Looking ahead, the interplay between supply chain dynamics and technological innovation will shape future validation priorities. Companies must remain agile to address potential disruptions arising from trade policies and geopolitical shifts, while also capitalizing on next-generation analytical tools, digital twins, and automation. By cultivating cross-functional collaboration and fostering a culture of continuous improvement, organizations can transform validation from a static compliance exercise into a strategic enabler of operational excellence

Ultimately, the ability to navigate regulatory changes, integrate emerging technologies, and optimize global supply chains will determine market leadership in bioprocess validation. As biologics production expands and therapeutic modalities diversify, proactive validation planning and agile execution will be essential to deliver safe, effective, and high-quality products that meet the demands of patients worldwide

Secure Your Competitive Advantage with Tailored Bioprocess Validation Insights From an Expert in Market Intelligence and Strategic Growth

To obtain a comprehensive understanding of the bioprocess validation market, secure your copy of this meticulously researched report today. Ketan Rohom, Associate Director of Sales & Marketing, is ready to guide you through our in-depth analysis and answer any inquiries you may have about leveraging these insights for strategic growth. Reach out to Ketan to discuss customized solutions, unlock exclusive data, and ensure your organization stays ahead in this rapidly evolving landscape. Purchase the full market research report now to transform your validation strategies into a competitive advantage.

- How big is the Bioprocess Validation Market?

- What is the Bioprocess Validation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?