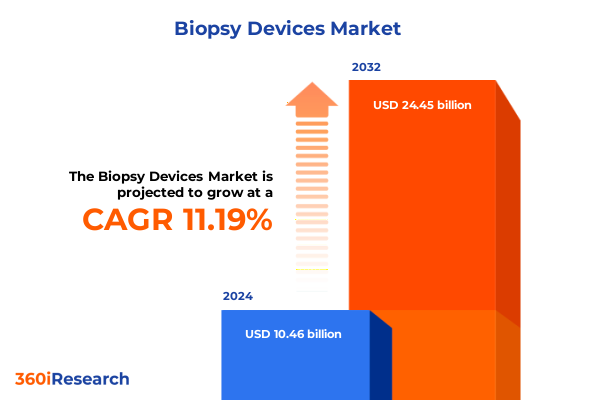

The Biopsy Devices Market size was estimated at USD 8.13 billion in 2025 and expected to reach USD 8.83 billion in 2026, at a CAGR of 9.43% to reach USD 15.30 billion by 2032.

Emerging Technologies and Patient-Centric Advances Redefine the Minimally Invasive Biopsy Device Landscape in Modern Diagnostic Medicine

The landscape of biopsy devices has undergone a profound transformation as technological innovations and patient-centric priorities converge to redefine diagnostic methodologies. Contemporary biopsy procedures increasingly rely on minimally invasive techniques, driven by growing clinical demand to reduce patient discomfort and procedural risk. Advances in image-guided robotics and real-time navigation systems have elevated procedural accuracy, enabling clinicians to target lesions with sub-millimeter precision and minimize repeat interventions. Moreover, integration of artificial intelligence into procedural workflows is streamlining preoperative planning and intraoperative guidance, fostering more consistent outcomes across varying clinical environments.

Transformative Shifts in Biopsy Procedures Driven by Robotics, Artificial Intelligence, and Personalized Medicine Revolutionize Diagnostic Precision and Efficiency

The biopsy device market is at the forefront of a paradigm shift as robotics, artificial intelligence, and personalized medicine converge to reshape clinical workflows. AI-driven robotic platforms now facilitate automated needle navigation and real-time feedback, reducing the dependency on operator experience and standardizing procedures across diverse anatomical sites. Concurrently, digital pathology solutions are enabling remote collaboration between pathologists and interventionalists, accelerating diagnostic turnaround times and optimizing treatment pathways. This synergistic fusion of hardware and software not only enhances clinical precision but also supports the transition toward value-based care models that prioritize efficiency and patient outcomes.

Evaluating the Cumulative Impact of United States Tariff Measures in 2025 on Biopsy Device Supply Chains, Manufacturing Costs, and Strategic Sourcing Decisions

In 2025, an evolving U.S. tariff regime has exerted multifaceted pressures on biopsy device supply chains, compelling industry stakeholders to reevaluate sourcing strategies and cost structures. Tariffs on semiconductor components and medical-grade alloys, including steel and aluminum, have risen to 25 percent, directly impacting precision electronic systems and needle manufacturing processes used in core and vacuum-assisted platforms. Additionally, proposed reciprocal tariffs on imports from China and the European Union, ranging from 20 to 65 percent, have created urgency around nearshoring initiatives and diversification of supplier bases. As manufacturers confront escalating input costs, many are adopting dual-sourcing models, pursuing U.S.-based partnerships, and exploring tariff exemptions to safeguard margins and maintain competitive pricing for healthcare providers.

Key Market Segmentation Insights Uncover How Product Types, Clinical Applications, and End-User Channels Shape Biopsy Device Development and Adoption

A nuanced analysis of biopsy device market segmentation reveals how product innovation, clinical demands, and healthcare delivery channels are interwoven. Core needle biopsy has bifurcated into automatic and semi-automatic mechanisms, accommodating diverse preferences for speed and tactile feedback, while endoscopic approaches leverage both rigid and flexible designs to address anatomical access challenges. Fine needle aspiration continues to balance aspiration and manual techniques to optimize sample integrity in cytological assessments, and the rise of vacuum-assisted systems-both console-based and handheld-underscores clinician demand for high-yield, minimally traumatic sampling. Parallel application-focused segmentation highlights differentiated procedural requirements across breast, kidney, liver, lung, and prostate biopsies, each with its own diagnostic imperatives and technique refinements. Finally, the continuum of end users-from ambulatory surgical centers and clinics to diagnostic laboratories and hospitals-drives tailored device configurations, service models, and training investments to align with specific operational workflows.

This comprehensive research report categorizes the Biopsy Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Guidance Technique

- Application

- End User

Key Regional Dynamics Illustrate How the Americas, EMEA, and Asia-Pacific Markets Shape Global Trends in Biopsy Device Demand, Innovation, and Access

Regional dynamics play a pivotal role in shaping the trajectory of the global biopsy device market. In the Americas, sustained healthcare spending, robust reimbursement frameworks, and a culture of early cancer screening have cultivated significant demand for cutting-edge biopsy technologies. Conversely, the Europe, Middle East & Africa region faces heterogeneous regulatory landscapes and variable healthcare budgets, prompting industry participants to navigate a complex web of CE marking requirements and national reimbursement schemes. Meanwhile, the Asia-Pacific market is witnessing accelerated adoption fueled by expanding healthcare infrastructure investments, rising oncology incidence, and government initiatives to foster medical device innovation. Each region’s unique economic, regulatory, and clinical factors compels device manufacturers to adopt region-specific strategies spanning manufacturing, pricing, and market access.

This comprehensive research report examines key regions that drive the evolution of the Biopsy Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Industry Players Reveal How Innovation, Acquisitions, and Partnerships Drive Competitive Advantages in the Biopsy Device Market

Industry leaders are charting distinct courses to secure competitive advantages in the biopsy device arena. Becton, Dickinson and Company has bolstered its breast biopsy portfolio with its EnCor Enspire and BD EleVation vacuum-assisted systems, integrating ergonomic design with real-time visualization to elevate procedural efficiency and tissue yield. Hologic’s strategic acquisitions, including the July 2024 purchase of Endomag and the 2025 acquisition of Gynesonics, have expanded its footprint in surgical guidance and ultrasound-based therapies. Medtronic is advancing its robotics-enabled biopsy platforms, exemplified by the Hugo™ system, which merges AI-driven navigation with modular imaging capabilities to streamline complex interventions. Devicor Medical Products continues to innovate vacuum-assisted breast biopsy systems while exploring lung and liver applications, and Boston Scientific’s EUS-FNB devices demonstrate robust tissue sampling for gastrointestinal oncology. Across the board, leadership strategies revolve around targeted R&D investments, collaborative alliances, and regulatory agility to accelerate product launches and clinical adoption.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biopsy Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Angiotech Pharmaceuticals, Inc.

- Argon Medical Devices, Inc.

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Cardinal Health, Inc.

- CONMED Corporation

- Cook Group Incorporated

- Danaher Corporation

- DTR Medical Ltd. by Innovia Medical

- Fujifilm Holdings Corporation

- Gallini Srl

- Hologic, Inc.

- INRAD, Inc.

- Intact Medical Corporation

- Integra LifeSciences Corporation

- Leica Biosystems Nussloch GmbH

- Medtronic PLC

- Merit Medical Systems

- Olympus Corporation

- Precision Biopsy, LLC

- Scion Medical Technologies, LLC

- Stryker Corporation

- TransMed7, LLC

- TSK Laboratory Europe BV

Actionable Recommendations Advise Industry Leaders on Supply Chain Resilience, Technological Innovation, and Strategic Partnerships to Navigate Market Challenges

To thrive amid evolving market dynamics, industry leaders should prioritize resilient supply chain architectures that minimize tariff exposure by diversifying component sourcing and establishing strategic nearshore partnerships. Concurrently, investing in modular, AI-enabled platforms will future-proof product portfolios, enabling seamless software updates and integration with emerging diagnostic ecosystems. Collaboration with regulatory agencies to expedite approvals and clarify tariff classifications can mitigate compliance risks, while co-development agreements with academic and clinical research centers will accelerate clinical validation and reimbursement support. Finally, cultivating digital training programs and remote support services can enhance customer loyalty, reduce service costs, and position organizations as indispensible partners in driving procedural excellence.

Robust Research Methodology Outlines the Combination of Primary Interviews, Secondary Data Analysis, and Triangulation Ensuring Comprehensive Biopsy Device Market Insights

This research employs a rigorous, multi-methodology approach combining primary interviews with key opinion leaders, including interventional radiologists, pathologists, and procurement executives, alongside secondary data analysis of peer-reviewed literature, regulatory filings, and public financial disclosures. Data triangulation techniques reconcile divergent estimates and validate critical assumptions, while scenario planning exercises assess the impact of tariff fluctuations and regional policy shifts. All findings are subjected to quality control protocols, including expert peer review and consistency checks against industry benchmarks, to ensure robustness and objectivity. This methodology provides a comprehensive foundation for strategic decision-making, delivering actionable insights tailored to the complex dynamics of the biopsy device market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biopsy Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biopsy Devices Market, by Product Type

- Biopsy Devices Market, by Guidance Technique

- Biopsy Devices Market, by Application

- Biopsy Devices Market, by End User

- Biopsy Devices Market, by Region

- Biopsy Devices Market, by Group

- Biopsy Devices Market, by Country

- United States Biopsy Devices Market

- China Biopsy Devices Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Conclusion Summarizes Key Findings Emphasizing Agility, Innovation, and Strategic Positioning as Critical for Success in the Evolving Biopsy Device Sector

In summary, the biopsy device sector stands at the intersection of technological innovation, shifting regulatory landscapes, and evolving clinical imperatives. Market leaders who embrace AI and robotics-driven platforms while proactively addressing tariff and supply chain vulnerabilities will gain disproportionate advantages. Tailored strategies that reflect regional nuances, coupled with strong collaborative networks, will underpin sustainable growth. As healthcare delivery models increasingly emphasize precision and cost-effectiveness, the ability to rapidly adapt products, navigate complex policies, and deliver integrated solutions will determine long-term success in this dynamic market.

Engage Directly with Our Associate Director to Secure Comprehensive Biopsy Device Market Intelligence Report and Empower Strategic Decision-Making in Your Organization

Are you ready to transform your strategic approach with unparalleled market intelligence on biopsy devices? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to access an in-depth, meticulously crafted report that equips you with the insights needed to outpace competitors and capitalize on emerging opportunities. Whether you require custom data cuts, targeted analysis, or direct advisory support, Ketan is poised to deliver the comprehensive guidance your organization needs. Contact him today to secure your copy and chart a precise course toward sustained growth and innovation in the biopsy devices sector.

- How big is the Biopsy Devices Market?

- What is the Biopsy Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?