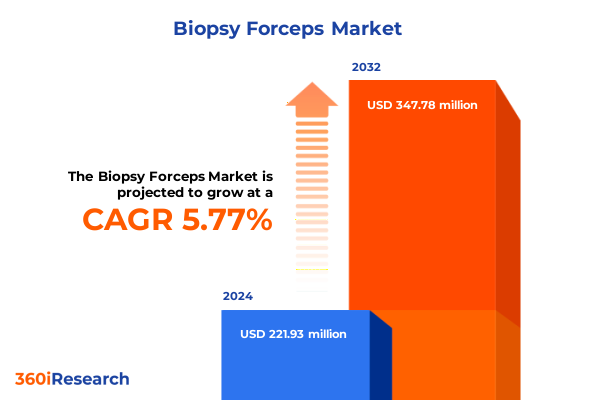

The Biopsy Forceps Market size was estimated at USD 234.78 million in 2025 and expected to reach USD 249.36 million in 2026, at a CAGR of 6.20% to reach USD 357.78 million by 2032.

Pioneering the Path of Precision Tissue Sampling with Advanced Biopsy Forceps: A Concise Overview of Key Concepts and Driving Forces

Biopsy forceps serve as indispensable instruments in modern minimally invasive diagnostics, enabling clinicians to harvest tissue samples with precision and safety. By navigating delicate anatomical structures across pulmonary, gastrointestinal, gynecological, and urological systems, these devices facilitate accurate histopathological analysis and inform treatment decisions. As the demand for early disease detection and personalized medicine intensifies, the evolution of forceps technology has kept pace through ergonomic design enhancements, advanced metallurgy, and sterilization compatibility. Consequently, stakeholders spanning device manufacturers, clinical end users, and procurement specialists must remain attuned to emerging clinical needs, regulatory landscapes, and supply chain dynamics to maintain both procedural efficacy and patient safety.

Looking ahead, the confluence of surgical robotics, digital integration, and stringent infection control imperatives signals continued transformation. Digital visualization modalities and instrument tracking capabilities are being introduced to streamline workflow efficiency and reduce procedural variability. In parallel, heightened scrutiny of reprocessing standards and single-use alternatives has reshaped value propositions by balancing sustainability concerns with cost pressures. This introductory overview sets the stage for a deeper exploration of the market’s transformative trends, regulatory shifts, segmentation nuances, and actionable strategies that underpin the current and future state of biopsy forceps.

Recognizing the Paradigm Shift in Biopsy Forceps Through Technological Advancements and Evolving Clinical Practices Across Specialties

The biopsy forceps market has undergone a series of transformative shifts driven by both technological breakthroughs and evolving clinical protocols. First, the infusion of advanced materials science has yielded ultra-fine, shape-memory alloys that enable forceps to maintain consistent jaw articulation even through tortuous anatomical pathways. Coupled with ergonomic handle designs, these instruments now deliver enhanced tactile feedback and procedural precision, reducing sampling variability.

Simultaneously, the integration of digital platforms has accelerated the adoption of smart forceps equipped with embedded sensors. These devices leverage force feedback analytics to provide real-time data on tissue resistance, improving operator confidence and reducing the risk of inadvertent tissue damage. Furthermore, the convergence of endoscopic visualization systems with high-definition imaging and AI-driven pattern recognition has optimized sample targeting, thereby improving diagnostic yield.

Clinical practice guidelines have also catalyzed change by endorsing less invasive sampling techniques and encouraging broader utilization of forceps across diverse procedural contexts. The expansion of endobronchial ultrasound in pulmonary diagnostics, alongside the proliferation of advanced endoscopic procedures in gastrointestinal and gynecological care, highlights the imperative for adaptable, multifunctional forceps solutions. As these transformative shifts continue to unfold, manufacturers and healthcare providers must collaborate to align innovation roadmaps with emerging procedural standards and reimbursement frameworks.

Assessing the Ripple Effects of the 2025 United States Tariff Measures on the Supply Chain Dynamics and Cost Structures of Biopsy Forceps

In 2025, the United States implemented targeted tariff adjustments affecting a subset of medical instrument imports, including biopsy forceps and related components. These measures, enacted under trade policies aimed at bolstering domestic manufacturing resilience, imposed incremental duties on select instruments and subassemblies primarily originating from overseas manufacturing hubs. The direct consequence has been a recalibration of cost structures across the procurement of forceps, prompting many downstream stakeholders to reexamine sourcing strategies.

Procurement teams have responded by pursuing dual pathways. On one hand, strategic partnerships with domestic manufacturers have been cultivated to mitigate exposure to import duties and reduce lead-time risks. On the other hand, select importers have absorbed or partially passed through increased costs, adjusting contract terms and exploring volume-based rebates to maintain budgetary alignment. This balancing act underscores the complexity of navigating tariff-induced price fluctuations while adhering to stringent quality and regulatory requirements.

Moreover, the tariff landscape has spurred innovation in local tooling and assembly capabilities, as manufacturers seek to repatriate critical production processes. By investing in automated machining and precision fabrication within domestic facilities, some OEMs anticipate long-term cost efficiencies and enhanced supply chain agility. Whereas short-term price pressures have posed challenges, the cumulative impact of these tariff measures has also accelerated strategic initiatives that promise to strengthen the resilience and competitiveness of the domestic biopsy forceps sector.

Unveiling Critical Segmentation Nuances Across Product Type Application End User and Distribution Channel in the Biopsy Forceps Arena

Critical segmentation analysis reveals the divergent value propositions across both reusable and single-use biopsy forceps. Within the reusable category, the market separates into instruments designed for autoclavable processing and those intended for chemical sterilization, each reflecting distinct reprocessing workflows and life-cycle cost considerations. Conversely, single-use variants have proliferated in sterile and non-sterile formats, catering to acute infection control mandates and offering turnkey convenience without the need for reprocessing infrastructure.

Application segmentation further delineates the market’s complexity, as biopsy forceps are employed in bronchoscopy, gastrointestinal endoscopy, gynecology, and urology. Bronchoscopic sampling itself bifurcates into conventional techniques and endobronchial ultrasound-guided interventions, while gastrointestinal procedures encompass both colonoscopy and esophagogastroduodenoscopy, each demanding instrumentation with tailored jaw profiles and flexural characteristics. Meanwhile, gynecological and urological applications impose their own design constraints to facilitate precise sampling within reproductive and urinary tract anatomies.

End-user segmentation underscores distinct procurement and utilization patterns across ambulatory surgical centers, clinics, and hospitals, reflecting variability in procedural volumes, capital budgets, and sterilization capabilities. Distribution channels are likewise diverse, spanning traditional medical distributors, centralized hospital procurement departments, and an expanding footprint of online retail portals, each presenting unique logistical, contractual, and regulatory considerations for market participants.

This comprehensive research report categorizes the Biopsy Forceps market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

- Distribution Channel

Deciphering Regional Market Dynamics Across Americas Europe Middle East Africa and Asia Pacific for Strategic Biopsy Forceps Deployment

Regional dynamics in the Americas exhibit mature purchasing infrastructures, well-established regulatory pathways, and advanced hospital networks that prioritize both reusable and single-use forceps based on volume efficiency and infection control standards. In North America, the convergence of stringent FDA guidelines with capital expenditure cycles has driven selective adoption of next-generation instruments featuring advanced imaging compatibility. Meanwhile, South American markets are characterized by incremental shifts towards disposable solutions as clinics and ambulatory centers seek to balance cost constraints with sterilization capabilities.

In Europe, the Middle East, and Africa, heterogeneity across regulatory frameworks and healthcare funding models shapes procurement strategies. Western European healthcare systems, supported by robust reimbursement mechanisms, have embraced premium diagnostic tools, including sensor-enabled forceps. Gulf countries and South Africa are increasingly investing in specialized endoscopy suites, fueling demand for both reusable autoclavable instruments and presterilized single-use alternatives that align with emerging standards of care.

Across the Asia-Pacific region, rapid expansion of hospital networks in China, India, and Southeast Asia has generated significant volume potential for biopsy forceps. High-growth markets are investing in domestic manufacturing capabilities while also importing advanced instruments to meet urgent diagnostic needs. Simultaneously, government-led initiatives to enhance rural healthcare access are driving procurement of versatile, cost-effective forceps solutions suited to diverse clinical settings, from tier-one urban hospitals to community health centers.

This comprehensive research report examines key regions that drive the evolution of the Biopsy Forceps market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Leading Innovators and Established Players Driving Competitive Differentiation in the Global Biopsy Forceps Industry

The competitive landscape of the biopsy forceps industry is defined by the interplay between global conglomerates, specialized medtech innovators, and emerging domestic manufacturers. Leading multinational firms leverage extensive R&D portfolios to introduce next-generation forceps with enhanced material formulations and digital integration, often forming strategic alliances with surgical robotics companies or endoscopy platform providers. These partnerships enable co-development of integrated diagnostic suites that blend forceps sampling precision with real-time imaging and analytics.

At the same time, niche players have carved out specialized footholds by focusing on single-use sterile instruments, emphasizing rapid market entry and streamlined regulatory pathways. Their agility in addressing infection control imperatives and localized sterilization challenges has enabled rapid uptake among ambulatory surgical centers and smaller clinics. In parallel, domestic manufacturers in key markets have invested in automated fabrication lines to support both reusable and disposable forceps, reducing lead times and offering cost-competitive alternatives to import-dependent suppliers.

Collaborative initiatives between OEMs and key opinion leaders have further accelerated innovation cycles by aligning product design with emerging procedural techniques and clinician feedback. These cooperative efforts underscore the importance of cross-functional collaboration in driving differentiation, optimizing device performance, and ensuring alignment with evolving clinical guidelines.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biopsy Forceps market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACE Medical Devices Pvt. Ltd.

- Anrei medical (hz)co.,Ltd.

- Argon Medical Devices

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Cardinal Health, Inc.

- CONMED Corporation

- Cook Group Incorporated

- FUJIFILM Corporation

- Integer Holdings Corporation

- Integra LifeSciences Corporation

- KARL STORZ SE & Co. KG

- MedGyn Products, Inc.

- Medi-Globe GmbH

- Medline Industries, Inc.

- Medorah Meditek Pvt. Ltd.

- Medtronic PLC

- MICRO-TECH (Nanjing) Co., Ltd,

- Olympus Corporation

- Omnimed Ltd.

- PENTAX Medical by Hoya Corporation

- Scanlan International, Inc.

- Sklar Surgical Instruments

- STERIS Corporation

- Wilson Instruments (SHA) Co., Ltd.

Translating Market Insights into Strategic Initiatives and Partnership Opportunities for Biopsy Forceps Industry Leadership and Growth

To capitalize on market momentum, industry leaders should prioritize modular product platforms that accommodate both reusable and disposable forceps, enabling rapid adaptation to shifting regulatory and clinical demands. By investing in flexible manufacturing capabilities, companies can seamlessly toggle between autoclavable instrument lines and presterilized single-use options, ensuring resilience against tariff fluctuations and supply chain disruptions.

Strategic alliances with digital health and imaging technology providers will be essential for differentiating offerings through integrated analytics and procedural guidance tools. Embedding sensor-based feedback within forceps and coupling these data streams with AI-driven visualization platforms can enhance diagnostic accuracy and operator training, establishing a compelling value proposition for high-volume end users. Concurrently, targeted pilot programs in emerging markets will enable iterative product refinement while building early adoption momentum among key opinion leaders and healthcare institutions.

Finally, commercial strategies should emphasize consultative engagement with end users and procurement teams, offering tailored service models that encompass instrument lifecycle management, reprocessing support, and predictive maintenance. By aligning product roadmaps with clinical workflows and total cost-of-ownership considerations, manufacturers can forge deeper partnerships and secure long-term contracts that underpin sustainable growth.

Detailing a Robust Research Framework Integrating Qualitative Interviews Quantitative Surveys and Secondary Source Triangulation for Reliability

This analysis integrated a multi-phase research methodology to ensure comprehensive coverage and reliability. Primary research encompassed in-depth interviews with clinical specialists across pulmonology, gastroenterology, gynecology, and urology, procurement directors at hospitals and ambulatory centers, and R&D executives at leading instrument manufacturers. These insights illuminated procedural requirements, sterilization preferences, and purchasing criteria, underpinning the segmentation and innovation narratives.

Secondary research involved systematic review of regulatory filings, patent databases, and clinical trial registries, alongside peer-reviewed literature on tissue sampling efficacy and instrumentation advancements. Trade association publications and government procurement reports were scrutinized to track tariff developments and regional policy shifts. These sources provided contextual grounding for the tariff impact analysis and regional market dynamics.

Data synthesis was guided by triangulation of qualitative and quantitative inputs, ensuring alignment across diverse information streams. Validation workshops with external experts confirmed the relevance of key findings and recommendations. Throughout, reporting adhered to rigorous quality controls, including cross-verification of data points and transparent documentation of research assumptions to support reproducibility and stakeholder confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biopsy Forceps market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biopsy Forceps Market, by Product Type

- Biopsy Forceps Market, by Application

- Biopsy Forceps Market, by End User

- Biopsy Forceps Market, by Distribution Channel

- Biopsy Forceps Market, by Region

- Biopsy Forceps Market, by Group

- Biopsy Forceps Market, by Country

- United States Biopsy Forceps Market

- China Biopsy Forceps Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesis of Core Findings Highlighting Market Evolution Technological Inflection Points and Strategic Imperatives for Stakeholders

The investigation into the biopsy forceps domain reveals a market at the intersection of precision engineering, digital transformation, and strategic supply chain reconfiguration. Technological inflection points, such as sensor-augmented forceps and AI-integrated imaging, are redefining clinical workflows and enhancing diagnostic yield. Concurrently, the bifurcation of reusable and single-use instruments underscores a nuanced value debate that balances infection control, economic efficiency, and environmental considerations.

Trade policy adjustments in 2025 have catalyzed domestic manufacturing investments and prompted hybrid sourcing strategies that blend local production with strategic imports. Regional market dynamics further highlight the diversity of adoption curves, from the mature infrastructures of North America and Western Europe to the rapid growth trajectories of Asia-Pacific and select Middle Eastern markets. Competitive intensity remains high as global leaders and agile innovators vie for clinician loyalty and procurement contracts through differentiated product portfolios and integrated service offerings.

Taken together, these findings underscore the imperative for stakeholders to adopt a forward-looking posture-one that combines flexible manufacturing, digital partnerships, and consultative customer engagement to navigate evolving clinical standards, regulatory landscapes, and cost pressures. This synthesis of core insights lays the groundwork for strategic decision making and sustained competitive advantage.

Engagement Invitation with Associate Director of Sales Marketing to Secure Comprehensive Biopsy Forceps Research Intelligence Tailored to Your Needs

If your organization seeks to harness actionable market intelligence and gain a competitive advantage in biopsy forceps innovations and commercial strategies, contact Ketan Rohom, Associate Director, Sales & Marketing, to secure a bespoke research package tailored to your specific needs. Engage directly to receive comprehensive insights, interviews with key opinion leaders, and data-driven guidance that will enable confident decision making in procurement, product development, and strategic partnerships. Position your team at the forefront of the evolving biopsy forceps landscape by accessing this in-depth report designed to support executive-level planning, streamline go-to-market activities, and unlock new growth opportunities through curated market analysis and forward-looking recommendations

- How big is the Biopsy Forceps Market?

- What is the Biopsy Forceps Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?