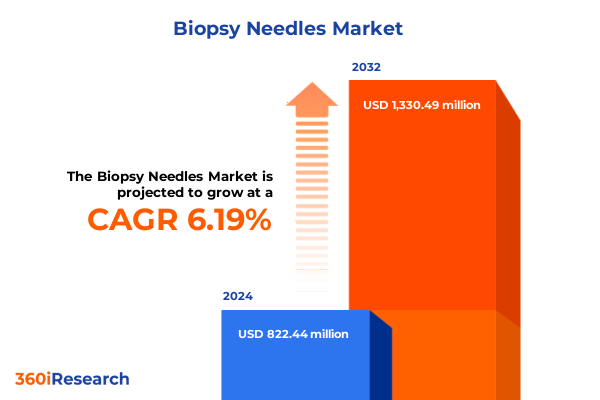

The Biopsy Needles Market size was estimated at USD 870.47 million in 2025 and expected to reach USD 922.52 million in 2026, at a CAGR of 6.24% to reach USD 1,330.49 million by 2032.

Navigating the Transformation of Biopsy Needle Technologies in Response to Rapid Diagnostic Precision Demands and Evolving Minimally Invasive Healthcare Paradigms

The global burden of cancer continues to escalate, with breast cancer alone accounting for over 2.3 million new cases worldwide in 2020 and projected to exceed 3 million by 2040 according to the International Agency for Research on Cancer. This pervasive trend underscores the critical role of biopsy procedures in enabling early detection and precise diagnosis. As diagnostic paradigms shift toward minimally invasive techniques, biopsy needles have emerged as indispensable tools, driving improvements in patient comfort, procedural efficiency, and sample integrity.

In today’s healthcare landscape, advancements in imaging modalities and tissue sampling technologies intersect to redefine diagnostic workflows. Clinicians demand devices that integrate seamlessly with ultrasound, computed tomography, and emerging real-time guidance systems, fostering accuracy even in challenging anatomical locations. Concurrently, regulatory bodies and reimbursement authorities emphasize quality and outcome-driven metrics, incentivizing needle designs that reduce repeat procedures, minimize complications, and support downstream molecular analyses.

This executive summary distills the transformative forces shaping the biopsy needle market, examines the cumulative impact of evolving trade policies on cost structures, and unpacks key segmentation and regional insights. It highlights the innovation trajectories led by industry frontrunners, offers strategic recommendations for stakeholders, and outlines the rigorous research methodology underpinning the analysis. Through this structured exploration, decision-makers can gain clarity on market dynamics and seize opportunities for sustainable growth.

Revolutionary Diagnostic Paradigms Driving the Shift Toward Advanced Minimally Invasive Biopsy Solutions Integrated with Real-Time Imaging and AI-Enabled Precision Workflows

Recent years have witnessed a profound transformation in biopsy needle design and deployment, spurred by an imperative to enhance diagnostic precision while reducing patient burden. Vacuum-assisted biopsy systems now leverage automated suction mechanisms to obtain larger and more consistent tissue cores, elevating diagnostic yield and reducing the need for multiple passes. Innovations such as tetherless vacuum-assisted devices further streamline workflows, eliminating cumbersome tubing and enabling more agile sampling in both hospital and outpatient settings.

Parallel to mechanical enhancements, the integration of advanced imaging guidance and artificial intelligence has redefined clinician-device interaction. Systems like the Ion by Intuitive Surgical utilize fiber-optic shape sensing to navigate tortuous bronchial pathways, granting access to peripheral lung nodules previously deemed unreachable and enabling real-time feedback through multi-modal imaging modalities. At the same time, strategic partnerships between device manufacturers and AI diagnostic software firms are fusing needle platforms with cloud-based analytics, fostering predictive insights that accelerate decision-making and optimize patient outcomes.

Beyond product innovation, workflow digitization and telehealth integrations are reshaping procedural landscapes. Remote case review, cloud-enabled image sharing, and AI-driven triage tools are converging to support multidisciplinary collaboration across geographically dispersed sites. This convergence promotes standardization of best practices, elevates clinician confidence, and expands access to high-fidelity biopsy procedures in diverse care settings, from tertiary hospitals to community diagnostic centers.

Assessing the Compounding Effects of 2025 United States Tariff Policies on Supply Chains, Pricing Dynamics, and Biopsy Needle Market Accessibility

In January 2025, new Section 301 tariffs enacted by the Office of the United States Trade Representative introduced a 100 percent duty on syringes and needles imported from China, effective September 27, 2024, alongside incremental tariff hikes on medical gloves, semiconductors, and other essential components. These measures, designed to protect domestic industries, have inadvertently imposed steep cost pressures on biopsy needle manufacturers, many of which rely on Chinese-origin materials or subassemblies.

As a direct consequence, supply chains are undergoing rapid restructuring. Companies face difficult choices: absorb higher duties, renegotiate contracts with alternate suppliers, or accelerate reshoring initiatives. The complexity of medical device manufacturing, which often involves dozens of precision-machined parts subject to varied Harmonized Tariff Schedule classifications, compounds the challenge of swift reconfiguration.

Financial markets have already registered the fallout. Medical device stocks, including major needle producers and broader equipment manufacturers, experienced pronounced declines amid investor concern over margin compression and potential reimbursement impasses. Providers, particularly in outpatient and ambulatory settings, anticipate downstream price increases, which could strain capital budgets and affect procedural access.

In response, industry stakeholders are pursuing multi-pronged strategies. Tariff exclusion petitions, diversification into duty-free sourcing regions, and vertical integration of precision component manufacturing have emerged as common tactics. Although these remedies require significant investment and lead time, they constitute essential steps for sustaining competitive positioning in a landscape defined by evolving trade policies and globalization headwinds.

Uncovering Strategic Opportunities Across Biopsy Needle Types, Procedural Innovations, Material Variations, and End User Applications for Targeted Market Penetration

The biopsy needle market’s complexity is underscored by its multi-dimensional segmentation, each presenting distinct opportunities and challenges. Needle type differentiations, such as the choice between fully automated Monopty systems and semi-automated Temno designs, influence procedural efficiency, diagnostic yield, and clinician preference. While Monopty needles demonstrate higher first-pass diagnostic accuracy in CT-guided lung biopsies, Temno variants offer cost-effective simplicity for routine sampling, underscoring the need for targeted product positioning.

Procedural segmentation further delineates market dynamics. Fine-needle aspiration remains indispensable for cytological evaluation in thyroid and superficial lesions, whereas core needle devices command prominence in breast and liver diagnostics due to their ability to procure intact tissue architecture. Vacuum-assisted approaches are accelerating adoption in breast care, where larger sample volumes mitigate the risk of inconclusive results and facilitate molecular testing.

Within the device category spectrum, the single-use disposable trend continues to gain momentum, driven by stringent infection control protocols and streamlined inventory management. Conversely, reusable systems retain relevance in resource-constrained environments, where sterilization capabilities offset upfront capital outlays. Material innovations, balancing metal alloys for structural rigidity with polymer composites for ergonomic tactile feedback, shape purchasing decisions across clinical settings.

Procurement channels are evolving, as hospital group GPOs and diagnostic clinic e-commerce platforms vie for share. Cost-containment pressures push stakeholders toward online purchasing for rapid fulfillment and transparent pricing, though established offline relationships remain vital for comprehensive training and service contracts. Application-based segmentation highlights breast biopsies as the market’s largest cohort, but rising demand for kidney, liver, lung, and prostate sampling signals broadening procedural portfolios. End-user stratification reveals hospitals as enduring staples for high-volume and complex biopsies, while ambulatory surgical centers emerge as growth engines by leveraging compact, pay-per-use needle systems tailored for outpatient workflows.

This comprehensive research report categorizes the Biopsy Needles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Needle Type

- Utility

- Tip Design

- Application

- End User

- Distribution Channel

Exploring Regional Dynamics Shaping Biopsy Needle Adoption and Growth Trajectories Across Americas, Europe Middle East Africa, and Asia Pacific Healthcare Markets

Regional market dynamics reflect divergent healthcare infrastructures, regulatory landscapes, and epidemiological profiles. The Americas maintain leadership, buoyed by high-income economies, broad insurance coverage, and an aging population driving sustained demand for breast, prostate, and lung biopsies. Rising incidence of early-onset breast cancer, particularly in northeastern U.S. states, amplifies focus on advanced needle platforms capable of precise sampling in younger cohorts.

In Europe, Middle East, and Africa, variability in healthcare expenditure and supply chain robustness shapes adoption curves. Western Europe’s rigorous single-use mandates and strong reimbursement frameworks favor disposable, high-yield vacuum-assisted solutions, while emerging markets across the Middle East and North Africa prioritize cost-effective manual and semi-automated systems. Regulatory harmonization initiatives, such as the EU Medical Device Regulation, impose stringent quality standards but also open pathways for cross-border device sales.

Asia-Pacific exhibits the fastest growth trajectory, fueled by expanding cancer screening programs, rising middle-class healthcare spending, and domestic manufacturing incentives. China’s shifting disease burden and India’s cancer prevalence increase emphasize localized production of both disposable and reusable needle systems. Simultaneously, countries like Japan, South Korea, and Australia demonstrate early adoption of AI-enabled biopsy technologies, underscoring the region’s role as both a major consumer and innovator in the global biopsy needle ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Biopsy Needles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Competitive Landscape Insights on Biopsy Needle Market Leaders, Highlighting Breakthrough Innovations, Strategic Partnerships, and Emerging Technological Capabilities

Industry leaders are actively jockeying for market share through differentiated innovation, strategic collaborations, and targeted geographic expansion. Hologic has solidified its position in the vacuum-assisted segment with its Vacora® VAB system, emphasizing patient comfort and imaging integration to streamline breast biopsy workflows. Cook Medical extended its global reach by launching ergonomic BiopsyPro Plus needles and deepening its presence in emerging markets through distribution partnerships.

Devicor Medical Products disrupted conventional paradigms with the FDA-cleared Mammotome Elite tetherless vacuum system, combining lightweight design with powerful TruVac technology for multi-sample acquisitions during single insertions. Intuitive Surgical entered the biopsy arena via the Ion endoluminal platform, which capitalizes on shape-sensing fiber optics and flexible needle architecture to access challenging pulmonary nodules with unprecedented precision.

Meanwhile, Medtronic’s Fusion Biopsy System leverages robotic assistance and MRI-ultrasound fusion to elevate prostate sampling accuracy, catering to growing demands for targeted oncologic interventions. Complementary offerings from Boston Scientific and Abbott Laboratories focus on gastrointestinal and core needle innovations, respectively, highlighting the continuing diversification of needle portfolios. Collectively, these efforts illustrate a competitive landscape defined by technological differentiation at the procedural, platform, and service levels.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biopsy Needles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Argon Medical Devices, Inc.

- B. Braun SE

- Becton, Dickinson and Company

- Biomedical Srl

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Cook Group Incorporated

- Danaher Corporation

- Doctor Japan Co., Ltd.

- Dr. Japan Co. Ltd.

- Freudenberg Medical, LLC

- Fujifilm Holdings Corp

- Geotek Medical

- Hologic, Inc.

- Inrad, Inc.

- IZI Medical Products

- Medax Srl

- Medi-Tech Devices Pvt. Ltd.

- Medtronic PLC

- Merit Medical Systems, Inc.

- Mermaid Medical Group

- Olympus Corporation

- Pajunk GmbH Medizintechnologie

- Point Blank Medical

- Remington Medical

- Stryker Corporation

- weLLgo Medical Products GmbH

Formulating Strategic Recommendations for Industry Leaders to Capitalize on Emerging Biopsy Needle Technologies, Regulatory Trends, and Optimized Market Expansion Tactics

To capitalize on evolving market dynamics, industry leaders should prioritize supply chain resilience by diversifying sourcing channels and pursuing tariff exemption opportunities. Implementing dual-source strategies for critical components, alongside regional manufacturing hubs, can mitigate risks associated with Section 301 duties and geopolitical uncertainties.

Investment in integrated digital ecosystems will be paramount. Manufacturers should forge alliances with AI diagnostic platform providers to embed real-time analytics into biopsy workflows, enhancing clinical value propositions for both hospitals and outpatient settings. Such collaborations can also expedite regulatory pathways by demonstrating combined software-hardware efficacy.

Expanding services to support emerging end users, particularly ambulatory surgical centers and mobile diagnostic units, will unlock new volume streams. Tailoring product configurations-lightweight devices, modular vacuum consoles, and single-use needle kits-to the operational needs of these settings can foster uptake and drive recurring revenue through consumable sales.

Finally, a regionally nuanced approach to market entry and pricing is essential. In high-income markets, emphasize advanced VAB and robotic platforms, while in cost-sensitive regions, focus on semi-automated and manual solutions supported by robust training programs. Adaptive commercial models, including value-based contracts and outcome-linked pricing, will further align stakeholder incentives and reinforce long-term partnerships.

Detailing Rigorous Research Methodology Combining Quantitative Analysis, Expert Interviews, Multi-Source Data Triangulation, and Quality Assurance Protocols

This analysis integrates a comprehensive research framework encompassing both primary and secondary data sources. Quantitative insights derive from tariff schedules, FDA and CE device approvals, patent filings, and clinical performance studies such as comparative evaluations of Monopty versus Temno systems under CT guidance. Secondary research includes peer-reviewed literature, government agency publications, and publicly available financial reports of leading device manufacturers.

Primary data collection involved in-depth interviews with key opinion leaders-interventional radiologists, pathologists, and ambulatory surgical center administrators-to validate emerging adoption trends and capture fit-for-purpose requirements across procedural applications. Supply chain experts and trade compliance specialists were consulted to elucidate the operational impact of 2025 tariff adjustments and associated mitigation strategies.

Market triangulation employed a multi-tier methodology that cross-verifies findings through complementary lenses: clinical efficacy, economic drivers, and regulatory influences. Quality assurance protocols included peer reviews of draft insights by medical device consultants and iterative validation workshops to ensure alignment with real-world stakeholder experiences.

This robust, multi-source approach ensures the reliability and relevance of our conclusions, equipping decision-makers with an authoritative foundation for strategic planning in the dynamic biopsy needle sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biopsy Needles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biopsy Needles Market, by Needle Type

- Biopsy Needles Market, by Utility

- Biopsy Needles Market, by Tip Design

- Biopsy Needles Market, by Application

- Biopsy Needles Market, by End User

- Biopsy Needles Market, by Distribution Channel

- Biopsy Needles Market, by Region

- Biopsy Needles Market, by Group

- Biopsy Needles Market, by Country

- United States Biopsy Needles Market

- China Biopsy Needles Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Drawing Comprehensive Conclusions on Biopsy Needle Market Evolution While Outlining Strategic Imperatives and Key Takeaways for Stakeholders Navigating Future Growth

Throughout this executive summary, the biopsy needle market emerges as a dynamic intersection of technological innovation, regulatory evolution, and global health imperatives. Minimally invasive techniques, exemplified by vacuum-assisted systems and shape-sensing navigation platforms, are redefining procedural precision while addressing clinician and patient demands for safety and convenience.

The imposition of 2025 U.S. tariffs on syringes and needles underscores the critical need for supply chain adaptability and cost management. Manufacturers successful in diversifying sourcing and accelerating nearshore production will be best positioned to maintain competitive pricing and margin stability.

Segmentation insights reveal targeted growth vectors: advanced core and vacuum-assisted devices in breast and prostate diagnostics, disposable single-use systems for stringent infection control, and compact molecular sampling tools for outpatient environments. Regional variations highlight high-income markets’ appetite for premium platforms, contrasted with emerging markets’ focus on affordability and localized manufacturing capacities.

Leading companies are investing heavily in R&D, strategic partnerships, and geographic expansion to capture share. Strategic recommendations emphasize digital integration, value-based contracting, and agile commercial models as essential levers for sustainable growth. By aligning innovation roadmaps with clinical workflows and reimbursement incentives, stakeholders can navigate complexities and capitalize on the profound opportunities within the evolving biopsy needle ecosystem.

Empower Your Strategic Decisions by Partnering with Associate Director Ketan Rohom to Acquire In-Depth Biopsy Needle Market Research Insights and Drive Success

Embarking on a data-driven journey toward deeper market understanding is now within reach. Connect directly with Associate Director Ketan Rohom to secure exclusive access to the comprehensive market research report on the global biopsy needle industry. This detailed analysis empowers stakeholders with actionable intelligence spanning technological innovations, tariff implications, regional dynamics, and competitive strategies. A single conversation with Ketan Rohom will unlock tailored insights, customizable data modules, and priority consultation, ensuring your organization capitalizes on emerging opportunities and navigates market complexities with confidence. Engage today to accelerate strategic decision-making, optimize investment plans, and gain a definitive competitive edge in the evolving world of biopsy needle technologies.

- How big is the Biopsy Needles Market?

- What is the Biopsy Needles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?