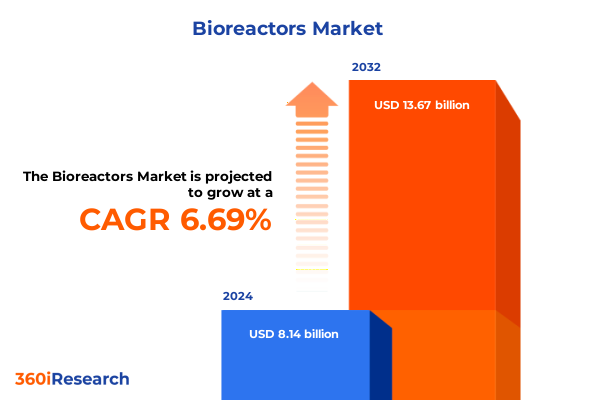

The Bioreactors Market size was estimated at USD 8.64 billion in 2025 and expected to reach USD 9.19 billion in 2026, at a CAGR of 6.77% to reach USD 13.67 billion by 2032.

Exploring the Fundamental Role and Growing Strategic Significance of Bioreactor Platforms in Enabling Diverse Biofabrication Processes

The global landscape of bioreactor technologies is experiencing unprecedented dynamism, driven by the convergence of biopharmaceutical innovation and sustainability imperatives. Bioreactors serve as the core platform for cultivating cells, microbes, and enzymes, enabling production processes that underpin vaccines, biologics, biofuels, and wastewater treatment. As life sciences organizations strive to enhance yield, shorten development timelines, and meet rigorous regulatory standards, investments in advanced bioreactor designs have reached new heights. Within this context, the market environment is shaped not only by technological advancements but also by evolving end-user requirements and shifting geopolitical conditions.

Against a backdrop of intensifying R&D activities and scaling production capacities, stakeholders across biopharmaceutical companies, contract research and manufacturing organizations, food and beverage manufacturers, and academic institutions are realigning their strategies. Airlift, bubble column, and continuous stirred tank reactors coexist alongside specialized fluidized bed, membrane, packed-bed, and photobioreactor systems, each optimized for distinct processes. Concurrently, modular single-use platforms are gaining traction, offering operational flexibility and reduced cross-contamination risks compared to traditional stainless-steel vessels. This report delivers a structured overview of these dynamics, equipping decision-makers with strategic foresight to navigate a competitive environment where agility and innovation are paramount.

Identifying Cutting-Edge Technological and Sustainability-Driven Paradigm Shifts Shaping the Future of Bioreactor Innovations

Over the past decade, the bioreactor field has undergone transformative shifts as digitalization and automation have been woven into every stage of the bioprocess lifecycle. Real-time sensor integration now enables continuous monitoring of critical parameters such as pH, dissolved oxygen, and biomass concentration, reducing batch failures and accelerating process optimization. Artificial intelligence–driven control algorithms further enhance reproducibility by dynamically adjusting impeller speeds, aeration rates, and temperature set points, effectively democratizing best-practice protocols across facilities.

Simultaneously, sustainability concerns are prompting a transition toward energy-efficient designs and eco-friendly materials. Membrane-based bioreactors and photobioreactors harness novel approaches to reduce water usage and enable carbon capture through algal cultivation. The adoption of continuous and fed-batch modes is also on the rise, delivering higher volumetric productivity and smaller footprints compared to traditional batch processes. This shift is fueling the development of hybrid systems that seamlessly integrate single-use fermenter vessels, advanced aeration systems, and modular manifolds, thereby driving both cost efficiency and regulatory compliance.

Analyzing How Recent United States Tariff Measures Introduced in 2025 Are Reshaping Supply Chains and Cost Structures in Bioreactor Ecosystems

Trade policy developments in 2025 have introduced significant complexities to global supply chains for bioreactor equipment and consumables. The imposition of new United States tariffs on key components imported from several Asian and European manufacturing hubs has led organizations to reassess sourcing strategies. As a result, the cost basis of fermenter vessels, impellers, and sealing assemblies has risen, prompting many end users to explore regional manufacturing alliances or to vertically integrate critical fabrication processes.

Despite these headwinds, domestic producers of heating and cooling apparatus, aeration systems, and baffles have scaled capacity, supported by government incentives designed to strengthen onshore biotechnology manufacturing. Contract research and manufacturing organizations have particularly felt the impact, as margin pressures intensified while fulfilling fixed-price agreements. In response, many have renegotiated supplier contracts and accelerated adoption of modular, single-use platforms to mitigate tariff-induced cost escalations. These adaptive strategies underscore the market’s resilience and its ability to absorb policy-driven shocks without jeopardizing the continuum of bio-based product pipelines.

Uncovering Multifaceted Market Segmentation Insights Across Bioreactor Configurations Components Operation Modes and End-User Applications

Diverse product types such as airlift bioreactors, bubble column systems, continuous stirred tank reactors, fluidized bed units, membrane-integrated designs, packed-bed configurations, and photobioreactors each address specific process needs. The selection of aeration systems, baffles, fermenter vessels, heating and cooling apparatus, impellers, and sealing assemblies further refines performance, reliability, and scalability. Moreover, the choice between batch, continuous, and fed-batch operation modes governs throughput and flexibility, with batch processes favoring R&D applications, continuous systems optimizing large-scale production, and fed-batch designs balancing productivity with process control.

Decision makers must also evaluate reusable versus single-use platforms, weighing lower total cost of ownership against reduced cleaning validation and maintenance overhead. Scale considerations-from benchtop volumes of 1 to 20 liters, through pilot and clinical scales of 20 to 200 liters and 200 to 1,500 liters, up to large-scale capacities above 1,500 liters-demand careful alignment with bioprocess objectives. The application spectrum spans bioremediation and wastewater treatment, cell culture endeavors including animal and plant cell cultivation, microbial fermentation modalities encompassing bacterial, fungal, and yeast processes, and foundational research and development. Finally, end users ranging from biopharmaceutical enterprises and contract research organizations to food and beverage producers and academic research laboratories bring distinct regulatory and operational imperatives that guide system configuration and service models.

This comprehensive research report categorizes the Bioreactors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- Operation Mode

- Category

- Scale

- Application

- End-User

Revealing Regional Dynamics Highlighting Innovation Hubs Supply Chain Shifts and Adoption Patterns Across Major Global Territories

In the Americas, innovation hubs in North America lead with advanced single-use reactor adoption, driven by a concentration of biopharmaceutical and cell therapy developers. The United States remains a focal point, underpinned by robust R&D funding, supportive regulatory frameworks, and established contract manufacturing networks. Latin American markets, while nascent, demonstrate growing interest in microbial fermentation for bioethanol production and wastewater remediation, attracting regional suppliers to expand their presence.

Europe, the Middle East, and Africa exhibit heterogeneous adoption trends. Western European nations emphasize membrane bioreactor applications in wastewater treatment, supported by stringent environmental regulations and infrastructure investments. Central and Eastern Europe are emerging as competitive manufacturing bases, leveraging lower labor costs and EU-backed grants. Meanwhile, in the Middle East and Africa, government-driven sustainability agendas are fostering pilot deployments in photobioreactor technologies for carbon sequestration and downstream processing equipment for pharmaceuticals.

Asia-Pacific stands out as a rapidly evolving arena where both established and emerging economies invest heavily in bioprocess capacity expansion. China’s push for self-reliance has accelerated domestic fabrication of fermenter vessels, impellers, and sealing assemblies, while Japan and South Korea focus on precision-engineered fluidized bed and continuous stirred tank reactors. Across Southeast Asia, rising demand for food and beverage fermentation applications is driving uptake of airlift and bubble column bioreactors, with local OEMs tailoring component assemblies to regional specifications.

This comprehensive research report examines key regions that drive the evolution of the Bioreactors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Distilling Key Competitive Strategies and Collaborative Innovations Employed by Leading Bioreactor Equipment Providers

Leading industry participants are expanding their technology portfolios through targeted acquisitions, strategic partnerships, and collaborative R&D alliances. Major players specializing in bioprocess equipment are investing in digital twin capabilities and advanced sensor platforms to differentiate their offering. Some have initiated joint ventures with automation and software firms to deliver integrated process control solutions, while others have collaborated with academic institutions to validate novel bioreactor systems under GMP conditions.

Companies with established single-use expertise are broadening their footprint by developing modular manifolds and cross-compatible connection interfaces, aiming to capture a greater share of the contract manufacturing sector. Meanwhile, suppliers of reusable stainless-steel reactors are enhancing their cleaning-in-place and sterilization-in-place protocols to align with evolving regulatory standards and sustainability targets. Across the landscape, service providers are bundling predictive maintenance offerings with lifecycle management contracts, enabling end users to optimize uptime and reduce total cost of operations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bioreactors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Biotek LLC

- ABEC, Inc.

- ABEC, Inc.

- Adolf Kühner AG

- Alfa Laval AB

- Aquatech International

- Azbil Corporation

- BBI-biotech GmbH

- bbi-biotech GmbH

- Beijing OriginWater Technology Co., Ltd.

- Belach Bioteknik AB legal

- Bioengineering AG

- Bionet Servicios Técnicos, SL

- BioprocessH2O

- Broadley-James Corporation

- Broadley-James Corporation

- Cell Culture Company, LLC by Biovest International, Inc.

- Cellexus Limited

- Cellexus Ltd.

- CerCell A/S

- Cytiva by Danaher Corporation

- DH Life Sciences, LLC.

- Distek, Inc.

- DuPont de Nemours, Inc.

- DuPont de Nemours, Inc.

- Electrolab Biotech Limited

- EnviroChemie GmbH

- Envirogen Technologies

- Eppendorf SE

- ESCO BIOENGINEERING CO., LTD.

- Esco Micro Pte. Ltd.

- FiberCell Systems Inc.

- G&G Technologies, Inc.

- GEA Group AG

- General Electric Company

- Getinge AB

- H2O Innovation Inc.

- Helapco Bioprocess Group

- Hitachi, Ltd.

- Hitachi, Ltd.

- IKA-Werke GmbH & CO. KG

- Infors AG

- Integrated Water Services, Inc.

- Kubota Corporation

- Kuhner AG

- Lonza Group AG

- Merck KGaA

- Mitsubishi Corporation

- Newterra Corporation

- Nijhuis Industries Holding B.V. by Saur

- Nova Biomedical

- Ovivo, Inc.

- Pall Corporation

- PBS Biotech, Inc.

- Pentair PLC

- Pentair PLC

- Pierre Guerin SAS

- Praj Industries Limited

- Repligen Corporation

- Repligen Corporation

- Sartorius AG

- Shanghai LePure Biotech Co., Ltd.

- Siemens AG

- Siemens AG

- Solaris Biotechnolgy Srl by Donaldson Company, Inc.

- Solida Biotech GmBH

- Terumo Corporation

- Thermo Fisher Scientific Inc.

- Toray Industries, Inc.

- Toray Industries, Inc.

- Veolia Environnement SA

- WuXi Biologics (Cayman) Inc.

- Xylem Inc.

- Xylem Inc.

- ZETA GmbH

Outlining Proactive Strategic Initiatives to Enhance Resilience and Drive Growth in a Shifting Bioreactor Market Environment

Industry executives should prioritize diversification of their component supply base to hedge against further tariff fluctuations, exploring local fabrication partnerships and alternative sourcing corridors. Embracing modular designs that support hybrid single-use and stainless-steel configurations can enhance operational flexibility and reduce capital outlays. Organizations are advised to accelerate digital transformation initiatives, leveraging real-time analytics and AI-driven control systems to drive process intensification and quality by design.

Partnerships with specialized contract research and manufacturing organizations can unlock scale-up efficiencies and risk-sharing arrangements, particularly for next-generation cell culture and microbial fermentation applications. Additionally, aligning product roadmaps with sustainability targets-such as water recycling in membrane bioreactors and energy-efficient impeller designs-will resonate with both regulatory bodies and end-users committed to environmental stewardship. Finally, continuous investment in cross-disciplinary talent, spanning bioprocess engineering, data science, and regulatory affairs, is essential to maintain a competitive edge in a rapidly evolving market.

Detailing the Integrated Multi-Source Research Framework Employed to Generate Reliable Insights on Bioreactor Market Trends

This analysis blends qualitative insights from in-depth executive interviews with primary stakeholders, including process engineers, procurement leaders, and R&D heads, alongside quantitative data gathered from proprietary supplier databases. A comprehensive review of industry whitepapers, regulatory filings, and peer-reviewed studies provided a foundational understanding of technology roadmaps and best practices. Market dynamics were further validated through vendor surveys capturing product launch timelines, pricing structures, and service offerings.

Regional adoption trends were mapped using shipment volume data and trade intelligence, while tariff impact assessments leveraged import/export statistics and published policy documents. All findings underwent triangulation to ensure consistency across sources and to mitigate bias. The result is a robust, multi-layered methodology that yields both high-level strategic viewpoints and granular operational recommendations, empowering stakeholders to make informed decisions backed by rigorous analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bioreactors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bioreactors Market, by Type

- Bioreactors Market, by Component

- Bioreactors Market, by Operation Mode

- Bioreactors Market, by Category

- Bioreactors Market, by Scale

- Bioreactors Market, by Application

- Bioreactors Market, by End-User

- Bioreactors Market, by Region

- Bioreactors Market, by Group

- Bioreactors Market, by Country

- United States Bioreactors Market

- China Bioreactors Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Summarizing the Strategic Imperatives and Forward-Looking Perspectives Driving Future Growth in Bioreactor Ecosystems

As bioprocessing continues its ascent as a cornerstone of modern manufacturing and environmental remediation, the bioreactor market stands poised for further innovation and expansion. The interplay of technological advancement, shifting trade policies, and evolving end-user requirements underscores the need for adaptive strategies that balance cost efficiency, regulatory compliance, and sustainability. Organizations that successfully integrate digitalization, modular design philosophies, and diversified supply chains will be best positioned to capture emerging opportunities across therapeutic, industrial, and environmental applications.

Looking ahead, the convergence of continuous processing, AI-driven control systems, and eco-centric reactor designs will redefine operational benchmarks and accelerate time to market. With robust research methodology underpinning this analysis, stakeholders have access to actionable intelligence that informs capital investments, product development roadmaps, and partnership strategies. The journey toward smarter, greener, and more efficient bioproduction is well underway, and now is the moment for industry leaders to chart their course with confidence.

Unlock Personalized Strategic Intelligence on Bioreactor Markets by Connecting with Ketan Rohom for Comprehensive Research Insights

To secure comprehensive insights into the evolving bioreactors market and to leverage actionable strategies tailored to your organization’s needs, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Engage in a personalized consultation to explore how this report can enable you to navigate market shifts, optimize supply chains in the face of trade fluctuations, and capitalize on emerging growth opportunities. Connect today to discuss custom data solutions, volume licensing, or enterprise-wide access, ensuring your team gains the competitive intelligence required for sustained innovation and success.

- How big is the Bioreactors Market?

- What is the Bioreactors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?