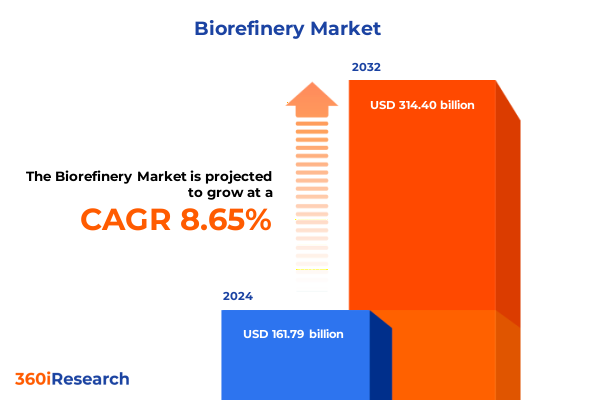

The Biorefinery Market size was estimated at USD 175.11 billion in 2025 and expected to reach USD 189.52 billion in 2026, at a CAGR of 8.72% to reach USD 314.40 billion by 2032.

Harnessing Nature’s Potential to Revolutionize Sustainable Resource Production and Drive the Future of Integrated Biorefinery Solutions

In an era where environmental stewardship and economic resilience converge, biorefinery stands at the forefront of sustainable innovation. By harnessing renewable biological resources, the industry seeks to replicate the success of traditional petroleum refineries, but with a transformative ecological and economic value proposition. This report delves into the synergistic utilization of diverse feedstocks, advanced conversion technologies, and emerging product portfolios that collectively redefine resource efficiency and circularity.

Amid mounting regulatory pressures and shifting consumer preferences toward greener solutions, stakeholders across the value chain are recalibrating strategies to align with decarbonization goals. The imperative for integrated biorefinery platforms spans from upstream feedstock procurement to downstream product diversification, underscoring the sector’s potential to deliver biofuels, biochemicals, and biomaterials at scale. This introduction sets the stage for a holistic examination of the drivers, challenges, and strategic inflection points shaping the biorefinery domain today.

Unprecedented Technological, Regulatory, and Market Convergence Reshaping the Biorefinery Value Chain

Over the past decade, the biorefinery landscape has undergone a series of paradigm shifts driven by breakthroughs in biotechnology, policy incentives, and evolving stakeholder expectations. Advances in enzymatic hydrolysis have unlocked cost efficiencies in processing lignocellulosic biomass, while innovations in gasification and pyrolysis have expanded the versatility of thermochemical pathways. These technical milestones have, in turn, facilitated the ascendance of drop-in biofuels and high-value biochemicals that can seamlessly integrate with existing industrial infrastructures.

Concurrently, sustainability frameworks such as the European Green Deal and the U.S. Renewable Fuel Standard have catalyzed investment flows and spurred collaborations across agribusiness, energy, and chemical sectors. The convergence of public and private capital has accelerated pilot-scale demonstrations, transitioning promising technologies from research laboratories to commercial deployment. Meanwhile, shifting consumer awareness and corporate net-zero commitments have amplified demand for biobased alternatives, prompting multinational enterprises to diversify supply chains and secure long-term feedstock partnerships. These converging trends are redefining traditional boundaries and forging resilient value networks that prioritize environmental, social, and governance considerations.

Examining the Comprehensive Economic and Operational Effects of Recent United States Tariff Measures on Biorefinery Feedstock Dynamics

The implementation of targeted import tariffs by the United States in early 2025 has introduced a new set of dynamics for feedstock imports and biorefinery operations. By imposing levies on specific biomass categories, the measures have influenced the cost calculus for international supply, prompting a recalibration of procurement strategies. Domestic producers of sugar and starch crops have benefited from a more level playing field, while import-reliant segments that source lignocellulosic residues have navigated margin pressures through strategic alliances and localized extraction initiatives.

In response to these fiscal adjustments, biorefinery operators have increased emphasis on feedstock diversification, leveraging algae cultivation and novel agricultural residues to mitigate exposure to tariff volatility. Furthermore, policy clarity has encouraged investment in upstream processing facilities, enabling greater control over raw material pipelines. The cumulative effect of these tariffs in 2025 underscores the interplay between trade policy and industrial resilience, illustrating how regulatory instruments can catalyze domestic innovation and foster more integrated supply ecosystems.

Revealing Actionable Insights through Integrated Analysis of Feedstocks, Processes, Development Stages, Products, and Applications

A nuanced understanding of the market emerges when considering the interplay between feedstock categories, conversion processes, development stages, product outputs, and end-use applications. The segmentation based on feedstock type illuminates the distinct processing requirements and value propositions associated with algae, lignocellulosic biomass, and sugar and starch crops. Each feedstock stream offers divergent chemical compositions, necessitating tailored pretreatment and extraction methodologies that influence overall operational efficiency.

When evaluating process typologies, the biochemical pathway subdivides into enzymatic hydrolysis and fermentation, enabling the production of high-purity biochemicals and second-generation bioethanol. Physicochemical conversion remains pivotal for pretreatment and fractionation, serving as a bridge between raw biomass and downstream reactions. Thermochemical conversion through gasification and pyrolysis unlocks syngas and bio-oil streams, expanding the portfolio of drop-in biofuels and advanced materials.

The progression through Phase I, Phase II, and Phase III underscores the maturation trajectory of biorefinery projects, from laboratory validation to pilot demonstrations and commercial rollouts. Product segmentation highlights the growing relevance of biochemicals, the diverse mix of biodiesel, bioethanol, and biogas within the biofuels spectrum, and the burgeoning market for biocomposites and fiber-based biomaterials. Finally, application-based segmentation spans energy generation, food and feed ingredients, household and personal care formulations, a range of industrial applications, pharmaceutical intermediates, and transportation fuels, illustrating the sector’s cross-industry impact and innovation potential.

This comprehensive research report categorizes the Biorefinery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Feedstock Type

- Process

- Generation

- Products

- Application

Comparative Examination of Regional Drivers Accelerating Biorefinery Adoption across the Americas, EMEA, and Asia-Pacific

Regional nuances play a pivotal role in shaping the adoption and scalability of biorefinery initiatives globally. In the Americas, abundant agricultural residues and robust policy frameworks have fostered a favorable environment for pilot projects and large-scale commercial plants. The region’s emphasis on renewable fuel mandates and research collaborations has propelled advancements in enzymatic hydrolysis and cellulosic ethanol production, positioning North and South America as leaders in feedstock innovation.

Across Europe, the Middle East, and Africa, stringent sustainability criteria and carbon reduction targets underpin a strong regulatory impetus toward biobased chemicals and advanced biofuels. European Union directives have incentivized partnerships between agritech firms and chemical manufacturers, driving the co-development of biocomposites and specialty biomaterials. In parallel, several Middle Eastern nations are exploring algae-based bio-oil extraction as part of broader diversification strategies, while select African markets leverage local biomass streams to address energy access challenges.

The Asia-Pacific region exhibits a dual momentum of rapid industrialization and heightened environmental awareness, fueling demand for biofuels and green chemicals. Countries with well-established agricultural sectors are scaling sugarcane-to-bioethanol pathways, whereas emerging economies invest in modular biorefinery units to serve remote communities. Collectively, regional markets demonstrate diverse evolutionary trajectories, all converging on the common objective of sustainable growth and circular resource utilization.

This comprehensive research report examines key regions that drive the evolution of the Biorefinery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Collaborations and Technological Leadership Defining Competitive Advantage among Top Biorefinery Companies

Leading organizations within the biorefinery sector have distinguished themselves through specialized capabilities in feedstock optimization, process engineering, and product innovation. Strategic partnerships between biotechnological pioneers and traditional chemical conglomerates are unlocking synergies in scaling advanced enzymatic processes. At the same time, firms with expertise in thermochemical conversion are establishing strategic offtake agreements for syngas and bio-oil derivatives, underpinning collaborative business models that de-risk technology deployment.

Investments in integrated demonstration facilities underscore the commitment of key players to validate end-to-end workflows, from feedstock handling to product separation. These assets serve as incubators for continuous process improvement, enabling faster cycle times and reduced capital intensity. In tandem, leading entities are diversifying their product portfolios, branching into high-demand segments such as biodegradable polymers and specialty solvents that cater to pharmaceutical and personal care industries.

Beyond technological prowess, market frontrunners are leveraging strategic acquisitions and joint ventures to secure access to novel biomass streams and expand geographical footprint. These corporate maneuvers not only enhance supply chain resilience but also foster cross-regional knowledge transfer, accelerating the global diffusion of best practices and sustainable biorefinery models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biorefinery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- Bangchak Corporation Public Company Limited

- Borregaard AS

- BP PLC

- Cargill Incorporated

- Chempolis Ltd.

- China Petrochemical Corporation

- Clariant AG

- DuPont de Nemours, Inc.

- Eni S.p.A.

- Godavari Biorefineries Ltd.

- Green Plains Inc.

- Honeywell International Inc.

- IES Biogas by Snam SPA

- LENZING AG

- Neste Oyj

- POET, LLC

- Renewable Energy Group by Chevron Corporation

- SEKAB Biofuels and Chemicals AB

- TotalEnergies SE

- UPM-Kymmene Corporation

- Valero Marketing and Supply Company

- Wilmar International Ltd.

Implementing Resilient Feedstock Strategies Adaptive Conversion Platforms and Proactive Sustainability Engagement for Operational Excellence

To navigate the complexities of the evolving biorefinery ecosystem, industry leaders should prioritize the development of resilient feedstock networks that span traditional crops, agricultural residues, and novel biomass sources. By forging long-term contracts with farming cooperatives and investing in on-site processing capabilities, organizations can minimize supply disruptions and optimize value chain integration.

In parallel, stakeholders must invest in adaptive conversion platforms capable of fluidly transitioning between biochemical and thermochemical pathways. Such flexibility will enable quicker responses to shifts in raw material availability and market demand, while also maximizing yield and reducing waste. Allocating resources to pilot-scale validation and modular plant designs will accelerate time-to-market and facilitate incremental capital deployment.

Moreover, engaging in proactive policy dialogue and sustainability certification initiatives will reinforce social license to operate and attract impact-oriented capital. By transparently tracking lifecycle emissions and carbon sequestration potential, companies can substantiate environmental claims and reinforce brand equity. Finally, cultivating multidisciplinary talent pools that bridge biotechnology, chemical engineering, and data analytics will be instrumental in driving continuous process optimization and fostering a culture of innovation.

Integrating Comprehensive Primary Interviews Quantitative Triangulation and Systematic Case Study Analysis to Ensure Research Rigor

The insights presented in this report are grounded in a methodical blend of primary and secondary research activities. Primary interviews with technology providers, biorefinery operators, and policy experts furnished firsthand perspectives on operational hurdles and emerging trends. Complementing these discussions, extensive secondary literature reviews of industry publications, regulatory filings, and scientific journals helped contextualize technological advancements and market developments.

Quantitative analysis was underpinned by a rigorous process of data triangulation, cross-referencing project announcements, patent databases, and annual reports to validate the trajectory of key innovations and corporate strategies. Case studies of flagship biorefinery installations worldwide were systematically evaluated to extract best-practice frameworks and performance benchmarks. Peer-reviewed environmental impact assessments informed the evaluation of sustainability outcomes across feedstock types and conversion pathways.

This multifaceted research methodology ensures that the findings and recommendations reflect both the strategic and technical dimensions of the biorefinery landscape, offering a robust foundation for decision-making and investment planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biorefinery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biorefinery Market, by Feedstock Type

- Biorefinery Market, by Process

- Biorefinery Market, by Generation

- Biorefinery Market, by Products

- Biorefinery Market, by Application

- Biorefinery Market, by Region

- Biorefinery Market, by Group

- Biorefinery Market, by Country

- United States Biorefinery Market

- China Biorefinery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Technological Innovation Regional Variations and Strategic Collaborations to Chart a Sustainable Biorefinery Future

As the global imperative for sustainable resource management intensifies, the biorefinery sector stands poised to redefine traditional production paradigms. Advances in feedstock diversification, breakthrough conversion technologies, and supportive policy frameworks coalesce to create fertile ground for scalable, circular solutions. The strategic interplay of public incentives, private capital, and cross-sector collaborations fosters a resilient ecosystem that can deliver biofuels, biochemicals, and biomaterials with enhanced environmental and economic credentials.

Moreover, the nuanced comprehension of regional variances and corporate capabilities underscores the importance of context-specific strategies, whether in the Americas, EMEA, or Asia-Pacific. By drawing on the actionable insights, segmentation analysis, and methodological rigor presented here, stakeholders are equipped to navigate uncertainties and capture emerging opportunities. Ultimately, the path forward lies in harmonizing technological innovation with sustainable market deployment, ensuring that biorefineries serve as keystones in the transition to a low-carbon, circular economy.

Unlock Comprehensive Strategic Intelligence and Propel Your Organization’s Leadership in the Evolving Biorefinery Landscape

The biorefinery market’s dynamic evolution presents a critical opportunity to translate strategic insights into tangible growth and sustainable impact. To explore the full potential of this transformative sector, decision-makers and innovators are encouraged to secure comprehensive access to an in-depth market research report. For a tailored consultation and to obtain proprietary data that will guide your strategic planning, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Engage with expert analysis and actionable intelligence that will empower your organization to lead in the burgeoning biorefinery landscape and unlock new pathways for value creation.

- How big is the Biorefinery Market?

- What is the Biorefinery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?