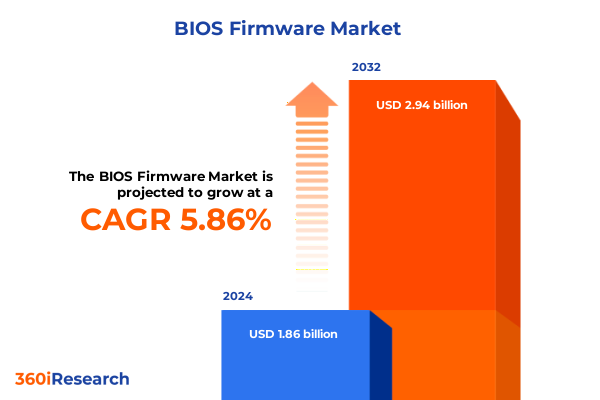

The BIOS Firmware Market size was estimated at USD 1.97 billion in 2025 and expected to reach USD 2.08 billion in 2026, at a CAGR of 5.89% to reach USD 2.94 billion by 2032.

Exploring the critical role of BIOS firmware as the backbone of modern computing infrastructure and its implications for performance and security

The evolution of BIOS firmware has transformed the fundamental process by which computers initiate and configure hardware, establishing itself as the unseen conductor of modern digital systems. Rooted in the legacy BIOS standard introduced by IBM in the 1980s, firmware architectures have progressively advanced, culminating in the Unified Extensible Firmware Interface (UEFI) specification managed by the UEFI Forum. Version 2.11 of UEFI, released December 16, 2024, underscores the industry’s commitment to enhancing boot performance, interoperability, and security at the platform level.

As software complexity has accelerated and hardware platforms have diversified-from desktop workstations to edge devices-the firmware layer has become a central focus for performance optimization and security hardening. Today’s firmware solutions encompass features such as Secure Boot, hardware root of trust, and advanced diagnostic tools, enabling manufacturers to meet stringent regulatory and compliance requirements while delivering seamless user experiences. Consequently, BIOS firmware stands at the nexus of innovation and protection, shaping the trajectory of computing performance and resilience in this era of accelerated digital transformation.

How emerging security threats and open source initiatives are reshaping BIOS firmware development towards automation and transparency in 2025

The BIOS firmware landscape is undergoing transformative shifts as security imperatives converge with demands for open source flexibility and automated management. Recent incidents, such as the discovery of four high-severity UEFI vulnerabilities in Gigabyte motherboards by Binarly, have underscored the need for more rigorous validation mechanisms within System Management Mode-from boot to sleep states-driving firms to re-examine firmware development lifecycles and upgrade protocols. Operators are now layering stringent code signing, component isolation, and runtime attestation to preempt stealthy firmware-level threats.

Concurrent with heightened security focus, open source initiatives have gained traction, empowering hardware vendors and end users alike to customize core platform code. For instance, AMD’s openSIL effort and partners such as AMI have enabled the flow of boot and BMC firmware through hybrid open source frameworks, fostering broader collaboration between vendors, integrators, and the Git-centric developer community. This shift toward transparency and extensibility is reshaping business models, as manufacturers integrate community-driven tooling and SBOM-based governance to streamline supply chain audits.

Driving these changes, the proliferation of IoT and embedded deployments-ranging from automotive sensor nodes to edge-optimized industrial controllers-has placed premium value on low-footprint, rapidly patchable firmware that can be updated securely over the air. These combined pressures are steering the BIOS firmware market toward hybrid solutions that seamlessly blend robust security, modular development, and open collaboration.

Analyzing the cumulative consequences of the 2025 United States tariff adjustments on BIOS firmware supply chains security and cost structures

In 2025, the United States government undertook significant adjustments to Section 301 tariffs on imports from China, notably increasing rates on semiconductors to 50%, effective January 1, 2025, up from 25% previously imposed in September 2024. These measures have reverberated across BIOS firmware supply chains, amplifying costs for critical components and prompting OEMs and ODMs to reassess sourcing strategies. While certain exclusions were extended through August 31, 2025, the overall duty structure underscores a shift toward on-shoring essential semiconductor manufacturing capacity.

As a direct consequence, manufacturers reliant on cross-border procurement have increasingly absorbed higher duty expenses or sought alternative fabrication hubs in Southeast Asia and Mexico. The surge in tariff burdens on electronic components has been met with accelerated commitments from leading foundries to expand U.S.-based fab projects and from major firmware providers exploring second-source agreements. Although some duties were temporarily paused for renegotiations, the cumulative impact has galvanized strategic investments in domestic and near-shore production, reshaping vendor roadmaps and contractual negotiations across the BIOS firmware ecosystem.

Looking forward, the combined effect of semiconductor levies and phased tariff escalations has created a dual narrative of cost pressure and opportunity. Firmware vendors are increasingly aligning with chipmakers to secure stable component pipelines, emphasizing value-added services such as security patch orchestration and remote management to mitigate supply chain volatility.

Uncovering segmentation-driven patterns across platform type application deployment model and licensing approaches in BIOS firmware adoption dynamics

Diverse platform types continue to influence firmware innovation and adoption patterns, with solutions ranging from lightweight open firmware implementations to industry-standard UEFI stacks. Coreboot and Open Firmware variants are prized where minimal overhead and auditability are paramount, whereas Legacy BIOS remains relevant in legacy compatibility scenarios. UEFI has become pervasive across consumer and enterprise systems due to its modular DXE driver architecture, integrated security features, and broad vendor support.

Applications further drive specialization, with desktop and notebook environments prioritizing rapid boot times and enhanced user interfaces, while server platforms emphasize centralized manageability and uninterrupted uptime. In the IoT and embedded sphere, distinct sub-verticals-automotive IoT controllers, consumer electronics devices, and industrial automation nodes-demand compact footprints, resilient update mechanisms, and real-time safety certifications for embedded firmware components.

End-user industries are charting unique firmware pathways. Automotive OEMs seek alignment with ISO 26262 guidelines, healthcare systems require HIPAA-compliant audit trails within firmware logs, IT and telecom operators integrate remote provisioning and hardware root of trust frameworks, and manufacturing sectors leverage firmware-driven predictive maintenance insights. Meanwhile, the choice between cloud and on-premises deployment models shapes provisioning strategies: cloud-based orchestration platforms offer centralized policy enforcement across hybrid, private, and public cloud instances, while on-premises implementations enable controlled air-gap scenarios. Moreover, licensing approaches span perpetual license options favored for one-time deployments and subscription models that deliver continuous updates and managed support.

This comprehensive research report categorizes the BIOS Firmware market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Operating System

- Licensing Model

- Deployment Mode

- Application

- End User

Highlighting regional variations in BIOS firmware adoption and strategic priorities across the Americas EMEA and Asia-Pacific landscapes

The Americas region remains at the forefront of BIOS firmware innovation, supported by robust semiconductor manufacturing ecosystems in the United States and Canada. Early adoption of advanced UEFI enhancements and Secure Boot customization has been driven by hyperscale data center demands and stringent federal cybersecurity directives, positioning North American vendors to shape global firmware security standards.

In Europe, Middle East, and Africa, regulatory frameworks such as GDPR and the NIS2 Directive have accelerated the integration of audit-ready firmware features and embedded reporting capabilities. Strong defense and automotive industries across Western Europe are embedding safety-certified firmware modules, while emerging markets in the Middle East and Africa are embracing cloud orchestration tools to streamline firmware management across distributed deployments.

Asia-Pacific presents a dynamic landscape, with established hubs in Taiwan, South Korea, and Japan leading high-volume platform production alongside rapid IoT proliferation in China, India, and Southeast Asia. Regional governments are prioritizing self-reliance strategies and investing in domestic foundry capacity, while firmware vendors collaborate with OEMs to localize solutions that meet diverse regulatory and performance requirements across this multifaceted market.

This comprehensive research report examines key regions that drive the evolution of the BIOS Firmware market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading BIOS firmware vendors and open source contributors driving innovation security and integration strategies in the ecosystem

Major BIOS firmware vendors continue to advance differentiated value propositions, with American Megatrends Inc. (AMI) leading in dynamic firmware solutions that power AI-optimized platforms, as evidenced by its Aptio V UEFI firmware integration on Radxa’s open-source Armv9 motherboard demonstration at COMPUTEX 2025. Insyde Software remains prominent with its slim UEFI stacks tailored for mobile and edge devices, while Phoenix Technologies focuses on secure management and IoT-ready firmware suites.

The UEFI Forum, representing key industry players including AMD, ARM, Apple, Dell, HPE, HP Inc., Insyde, Intel, Lenovo, Microsoft, and Phoenix, continues to guide specification enhancements and interoperability testing, ensuring firmware consistency across heterogeneous ecosystems. Meanwhile, the Coreboot Foundation and community-driven projects are gaining traction among hyperscale and security-minded organizations, offering open firmware variants that accelerate custom development and streamline audit processes.

Collaborations between firmware vendors and chipmakers are intensifying, as demonstrated by alliances such as AMI’s support for AMD openSIL platforms and AMI’s expansion into AI-centric supercomputing deployments. These partnerships underscore the strategic importance of firmware integration at the chipset level, driving performance optimization and security innovation across emerging compute environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the BIOS Firmware market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advantech Co., Ltd.

- American Megatrends, Inc

- ASUS

- Coretronic Reality Inc

- Dell Inc.

- Extreme Engineering Solutions, Inc

- Insyde Software

- Intel Corporation

- International Business Machines Corporation

- IRCONA

- Jiangsu Eazytec

- Kunlun Technology (Beijing) Co., Ltd.

- Nanjing Byosoft Co., Ltd

- Phoenix Technologies

- Super Micro Computer, Inc.

Implementing proactive measures to fortify BIOS firmware security governance supply chain resilience and organizational readiness against evolving threats

Organizations must embrace a security-first mindset by instituting governance frameworks that enforce least-privilege principles and component isolation within UEFI code modules. By applying rigorous software development best practices to firmware, teams can reduce attack surfaces and limit the scope of potential exploits through compartmentalized execution environments.

Firmware integrity should be validated continuously via software bills of materials and cryptographic verification processes. Administrators are advised to enable and customize Secure Boot across all endpoints-auditing firmware modules, bootloaders, and expansion devices-rather than disabling it for compatibility, to uphold a robust hardware root of trust. In parallel, establishing nonintrusive, standardized update pipelines will facilitate timely patch deployment and minimize operational disruption, addressing the persistent challenge of irregular firmware maintenance cycles.

Supply chain resilience can be enhanced by diversifying sourcing strategies, engaging in coordinated vulnerability disclosure programs with firmware vendors, and insisting on secure-by-design principles during hardware procurement. Collaborative security assessments and the integration of firmware monitoring telemetry into enterprise SIEM platforms will further bolster organizational readiness against evolving pre-boot threats.

Detailing the comprehensive research approach leveraging primary stakeholder insights secondary data analysis and rigorous validation protocols

This research synthesized insights from a comprehensive review of primary and secondary sources, including official U.S. Trade Representative announcements on Section 301 tariff exclusions, White & Case analysis of finalized tariff rates on semiconductors, and firmware policy advisories from CISA and NSA. Detailed company press releases-such as AMI’s Computex demonstration and UEFI Forum specifications-were incorporated to capture vendor-level innovation trajectories.

Technical vulnerability disclosures from Binarly and coordinated patch releases from major hardware vendors provided a real-time perspective on threat landscapes, while scholarly and industry-led publications guided best practice frameworks. Rigorous validation protocols ensured that data points were corroborated via multiple authoritative platforms, enhancing the credibility and relevance of the findings for decision makers across enterprise, embedded, and consumer computing segments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our BIOS Firmware market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- BIOS Firmware Market, by Type

- BIOS Firmware Market, by Operating System

- BIOS Firmware Market, by Licensing Model

- BIOS Firmware Market, by Deployment Mode

- BIOS Firmware Market, by Application

- BIOS Firmware Market, by End User

- BIOS Firmware Market, by Region

- BIOS Firmware Market, by Group

- BIOS Firmware Market, by Country

- United States BIOS Firmware Market

- China BIOS Firmware Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Summarizing the essential insights and strategic imperatives shaping the future trajectory of BIOS firmware utilization and innovation

The executive summary highlights how BIOS firmware has transcended its traditional role to become an essential vector for performance, security, and supply chain strategy. The confluence of advanced UEFI capabilities, open source firmware adoption, and stringent regulatory pressures is driving unprecedented collaboration among chipset vendors, firmware providers, and end-user industries.

Evolving tariff regimes have underscored the strategic importance of near-shore manufacturing and robust distribution networks, while continuous threat escalation at the firmware level has prompted organizations to adopt hardened secure boot and cryptographic validation across all platform types. The interplay of segmentation dynamics-from core UEFI implementations to embedded IoT controllers-and regional priorities is shaping a diverse yet interconnected ecosystem.

Moving forward, leaders must maintain a holistic perspective that encompasses governance frameworks, supply chain resilience, and security-driven development methodologies to harness the full potential of BIOS firmware innovations in delivering reliable, transparent, and secure computing experiences.

Connect directly with Ketan Rohom to acquire in-depth BIOS firmware market research tailored insights and personalized support for strategic growth initiatives

For tailored insights that align with your strategic objectives, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He will guide you through the breadth of our BIOS firmware market research, ensuring that you receive the precise data and expert analysis you need to underpin critical decisions. By partnering with Ketan, you will gain access to comprehensive findings, actionable trends, and dedicated support designed to accelerate your competitive advantage and inform your next moves in an evolving technology landscape.

- How big is the BIOS Firmware Market?

- What is the BIOS Firmware Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?