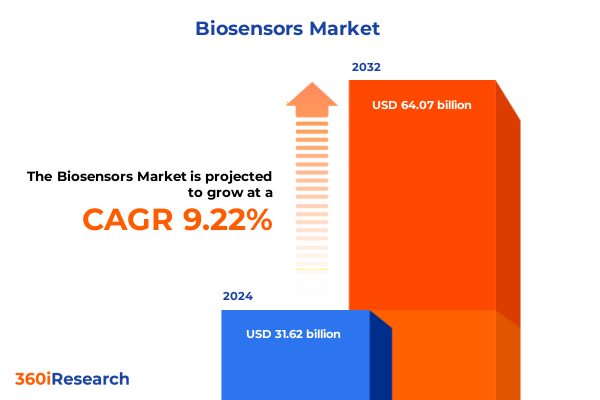

The Biosensors Market size was estimated at USD 31.62 billion in 2024 and expected to reach USD 34.43 billion in 2025, at a CAGR of 9.22% to reach USD 64.07 billion by 2032.

Setting the Stage with an Overview of Biosensor Innovations Catalyzing Rapid Growth Across Healthcare Environmental and Food Monitoring

The biosensors market has evolved from a niche scientific curiosity into a critical pillar supporting healthcare diagnostics, environmental monitoring, and food safety applications across the globe. At its core, a biosensor integrates a biological recognition element with a physicochemical transducer to detect analytes with remarkable sensitivity and specificity. This foundational capability has grown in relevance as the demand for rapid, point-of-care testing and real-time data analytics has surged. In recent years, miniaturization, integration with digital platforms, and the imperative for decentralized testing have accelerated innovation, driving investment from both established industry leaders and agile startups.

Today, biosensor technologies are pivotal to addressing complex public health challenges, from pandemic preparedness to chronic disease management. They deliver on the promise of personalized medicine by enabling continuous monitoring of biomarkers and facilitating early intervention. Concurrently, regulatory frameworks in major markets are adapting to accommodate these innovations, fostering an environment where novel sensor modalities can achieve rapid clinical adoption and scalability. As we transition from proof-of-concept studies to high-volume manufacturing, supply chain resilience and strategic partnerships have emerged as fundamental priorities. This introduction provides the contextual groundwork for understanding the disruptive forces reshaping the biosensors ecosystem and framing the strategic imperatives for market participants.

Highlighting Emerging Nanomaterial Advances and AI-Driven Data Analytics Revolutionizing the Biosensors Landscape

The biosensors landscape is undergoing transformative shifts driven by advances in materials science, data science, and connectivity. Innovations in nanomaterials and novel biorecognition elements, such as aptamers and molecularly imprinted polymers, have expanded detection capabilities beyond traditional electrochemical and optical modalities. This evolution has enabled developers to address new analytes, improve limits of detection, and reduce reaction times. At the same time, the proliferation of the Internet of Things and advances in low-power electronics have paved the way for wearable and implantable sensors that deliver continuous, real-time physiological data to healthcare providers and end users.

Furthermore, the integration of artificial intelligence into biosensor platforms is unlocking predictive diagnostics and automated decision support. By applying machine learning algorithms to complex biosignal datasets, stakeholders can identify patterns indicative of disease onset or environmental contamination with unprecedented accuracy. Collaboration between device manufacturers, software developers, and cloud service providers is central to this ecosystem shift. As a result, the market is transitioning from standalone instruments toward comprehensive solutions that combine sensor hardware, analytics software, and connectivity services to deliver actionable insights at the point of need.

Analyzing the 2025 United States Tariffs on Sensor Components and Their Cumulative Effects on Supply Chains and Pricing Dynamics

In 2025, newly implemented tariffs on critical sensor components have imposed significant cost pressures across the biosensor value chain. Import duties on semiconductors, specialty chemicals, and precision optics have prompted manufacturers to reassess sourcing strategies and renegotiate supplier contracts. Consequently, some producers have accelerated localization of production in domestic facilities to mitigate exposure to fluctuating tariffs. This reshoring trend, while enhancing supply security, has also introduced higher capital expenditures and extended lead times as firms expand or retool manufacturing sites.

Meanwhile, distributors and end users have begun passing through increased operational costs, influencing procurement decisions and contract renewals. In response, value-added resellers are emphasizing total cost of ownership by bundling maintenance, consumables, and software support to justify premium pricing. The net effect has been a slowdown in price erosion for high-end benchtop instruments, even as portable solutions retain competitive pricing dynamics. Overall, the cumulative impact of U.S. tariffs in 2025 underscores the importance of agility in supply chain management, strategic supplier diversification, and proactive cost mitigation to sustain profitability in a shifting regulatory environment.

Deriving Core Market Insights from Portability Sensor Technologies Applications End Users and Distribution Channel Segmentation Dynamics

Market behavior across benchtop and portable devices reveals contrasting growth trajectories, with rack-mounted and tabletop systems commanding premium applications in clinical laboratories and research institutes, while handheld and wearable formats drive point-of-care adoption outside traditional settings. Advances in electrochemical sensing remain a mainstay for routine biomarker analysis due to their low cost and high throughput, while optical, piezoelectric, and thermal sensor innovations address niche applications requiring label-free detection and multiplexing capabilities. The intersection of substrate engineering and microfluidics in optical sensors has particularly expanded environmental monitoring use cases, such as real-time air and water quality assessments.

Application segmentation highlights the critical role of environmental monitoring, where air, soil, and water testing laboratories rely on continuous sampling platforms to detect pollutants and pathogens. In food safety, rapid on-site assays enable detection of contaminants at processing facilities, reducing recalls and downtime. Diagnostic labs and hospitals continue to invest in high-precision biosensors for clinical diagnostics, whereas environmental agencies and research institutes drive demand for specialized handheld and wearable devices for fieldwork. Across all channels, offline distribution remains dominant in regulated environments, whereas online platforms have emerged as key avenues for purchasing portable biosensors in decentralized settings.

This comprehensive research report categorizes the Biosensors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Biomolecule Target

- Detection Method

- Form Factor

- Application

- Distribution Channel

Unpacking Regional Variations in Clinical Diagnostics Environmental Monitoring and Point-of-Care Adoption Across Global Markets

The Americas region leads in clinical diagnostics adoption, underpinned by a robust healthcare infrastructure and supportive reimbursement frameworks that have accelerated the integration of advanced biosensors in hospitals and reference laboratories. Meanwhile, environmental monitoring initiatives driven by stringent air and water quality regulations continue to elevate demand for portable sensors in North America. In Latin America, emerging economies are gradually embracing cost-effective, point-of-care solutions to bridge healthcare access gaps, creating pockets of growth for handheld and wearable technologies.

Europe, the Middle East, and Africa present a heterogeneous landscape where Western Europe drives high-end benchtop demand through government-funded research and environmental monitoring programs. The Middle East’s investment in smart city initiatives fosters adoption of biosensors for infrastructure monitoring and public health surveillance. In sub-Saharan Africa, NGOs and public health agencies are deploying portable platforms to enable field diagnostics, particularly in resource-limited regions. The Asia-Pacific region exhibits the fastest growth rates, fueled by government mandates for food safety testing and environmental monitoring in China and India. Moreover, mature markets in Japan, South Korea, and Australia prioritize innovation, integrating biosensor networks into industrial IoT ecosystems to support predictive maintenance and remote healthcare models.

This comprehensive research report examines key regions that drive the evolution of the Biosensors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Leading Biosensor Firms Are Leveraging Collaborations and Modular Platforms to Drive Sustainable Competitive Advantage

Leading companies are intensifying their focus on strategic collaborations, product differentiation, and vertical integration to secure competitive advantage. Major diagnostics firms are partnering with information technology providers to co-develop integrated biosensing platforms that streamline data management and regulatory compliance. Simultaneously, sensor component specialists are expanding their capabilities through acquisitions of microfluidics startups and nanomaterials innovators to broaden their technology portfolios.

In the portable segment, new entrants are disrupting traditional models by offering subscription-based access to biosensor devices coupled with cloud analytics services. This shift toward recurring revenue models reflects an industry move from transactional sales toward long-term customer engagement. Established players are responding by launching modular sensor architectures that can be upgraded with software enhancements, thereby extending product lifecycles and fortifying customer retention. Across the value chain, companies that balance R&D investment with disciplined supply chain optimization are best positioned to capitalize on evolving market requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biosensors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Acon Laboratories, Inc.

- Agilent Technologies, Inc.

- Analog Devices Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Danaher Corporation

- Dexcom, Inc.

- EKF Diagnostics Holdings plc

- F. Hoffmann-La Roche AG

- Johnson & Johnson Services, Inc.

- LifeSignals, Inc.

- Linxens Group

- MASIMO CORPORATION

- Medtronic PLC

- Nix Biosensors

- Nova Biomedical Corporation

- Resonetics, LLC

- Sartorius AG

- SD Biosensor, INC

- Senseonics, Incorporated

- Sensirion AG

- Siemens Healthineers AG

- STMicroelectronics Group.

- Thermo Fisher Scientific Inc.

Actionable Strategies for Biosensor Leaders to Enhance Supply Chain Resilience and Accelerate Data-Driven Innovation Priorities

Industry leaders should prioritize the diversification of their supplier base to reduce tariff exposure and strengthen supply chain resilience. By cultivating relationships with alternative vendors in tariff-free jurisdictions and investing in in-house component manufacturing, companies can mitigate cost volatility and ensure production continuity. Furthermore, roadmaps for next-generation biosensors must incorporate robust data integration frameworks, including scalable cloud architectures and AI-driven analytics pipelines, to enhance diagnostic accuracy and user experience.

In parallel, organizations should explore partnerships with digital health providers to develop comprehensive solutions that integrate biosensors into telemedicine platforms and remote monitoring services. This not only expands addressable markets but also unlocks recurring revenue streams through subscription models. Finally, targeted investment in regulatory affairs expertise will accelerate time-to-market for novel sensor modalities, enabling swift adaptation to evolving compliance requirements and fostering stronger customer trust.

Describing the Multi-Stage Research Approach Including Data Triangulation Primary Interviews and Scenario Analysis to Ensure Analytical Rigor

This research combines extensive secondary data analysis with primary market validation to deliver rigorous, triangulated insights. Initially, public filings, patent databases, and regulatory approvals were reviewed to map technological developments and competitive activity. Concurrently, industry journals and conference proceedings were analyzed to identify emerging academic and commercial innovations. This foundational research informed the development of a targeted survey instrument distributed to C-suite executives, R&D managers, and procurement specialists across key segments.

Insights garnered from over 50 in-depth interviews were synthesized and cross-validated with quantitative data points drawn from government agencies and trade associations. Data integrity was further ensured through reconciliation of supplier shipment volumes with financial disclosures. The research framework also incorporated scenario analysis to assess potential tariff trajectories and regulatory shifts. Collectively, these methodological steps ensure that the findings reflect not only the current market landscape but also the strategic inflection points shaping the future of biosensors.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biosensors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biosensors Market, by Type

- Biosensors Market, by Biomolecule Target

- Biosensors Market, by Detection Method

- Biosensors Market, by Form Factor

- Biosensors Market, by Application

- Biosensors Market, by Distribution Channel

- Biosensors Market, by Region

- Biosensors Market, by Group

- Biosensors Market, by Country

- United States Biosensors Market

- China Biosensors Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3021 ]

Summarizing How Technological Integration Tariff Responses and Regional Dynamics Create a Roadmap for Future Biosensor Market Growth

The convergence of innovations in materials science, data analytics, and connectivity is irrevocably transforming the biosensors industry. While tariffs in 2025 have tested the agility of supply chains, they have also catalyzed strategic shifts toward localization, diversification, and value-added service models. Segmentation analysis reveals that each technology and application vertical presents unique opportunities, from high-precision benchtop instruments to wearable point-of-care devices. Regional dynamics further underscore the importance of tailored strategies to align with diverse regulatory and infrastructure landscapes.

As leading firms invest in modular platforms, AI-enabled analytics, and strategic partnerships, the biosensors ecosystem is poised for sustained growth and deeper market penetration. Organizations that effectively integrate these insights into their strategic planning will be best equipped to navigate competitive pressures and capitalize on emerging use cases. The insights contained in this report offer a comprehensive foundation for making informed decisions and defining actionable roadmaps in a rapidly evolving marketplace.

Begin a Personalized Consultation with Ketan Rohom to Obtain Full Market Analysis and Practical Recommendations for Biosensors Success

Securing comprehensive insights and empowering decision-making is just a conversation away with Ketan Rohom. Reach out today to discuss how this report can transform your strategic planning, overcome your biosensors challenges, and guide your next critical investments. Whether you aim to unveil untapped growth opportunities, mitigate tariff-related risks, or refine segmentation approaches, Ketan Rohom (Associate Director, Sales & Marketing) will tailor a consultative briefing that addresses your organization’s unique needs. Engage with an expert dedicated to delivering actionable intelligence and unparalleled market clarity to accelerate your competitive advantage. Connect now to obtain full access to the in-depth analysis and practical recommendations essential for thriving in today’s dynamic biosensors landscape.

- How big is the Biosensors Market?

- What is the Biosensors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?