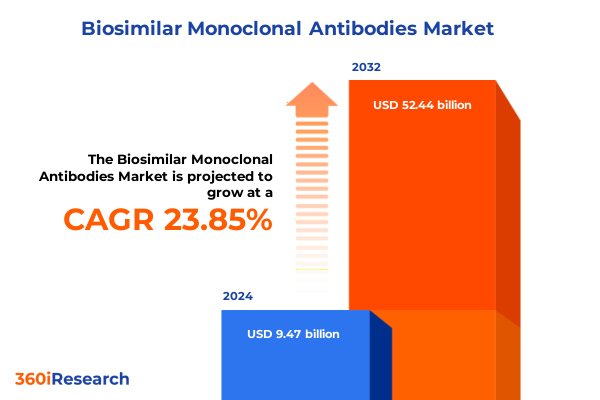

The Biosimilar Monoclonal Antibodies Market size was estimated at USD 11.60 billion in 2025 and expected to reach USD 14.22 billion in 2026, at a CAGR of 24.04% to reach USD 52.44 billion by 2032.

Understanding the Emergence of Biosimilar Monoclonal Antibodies and Their Critical Role in Addressing Healthcare Sustainability Challenges

The emergence of biosimilar monoclonal antibodies marks a pivotal evolution in biopharmaceutical innovation by offering more accessible therapeutic options while maintaining stringent efficacy and safety profiles. Grounded in the scientific advancements that underlie biologic development, these agents replicate originator monoclonal antibody structures through advanced expression systems. Consequently, they address critical healthcare challenges such as escalating treatment costs, mounting patient access barriers, and the necessity for sustainable reimbursement strategies. As patent protections for high-demand originators expire, the biosimilar sector is poised to deliver substantial clinical and economic benefits without compromising on therapeutic outcomes.

In recent years, regulatory agencies worldwide have introduced pathways to expedite biosimilar approvals, reflecting a commitment to diversifying treatment portfolios and alleviating financial pressure on healthcare systems. The United States Food and Drug Administration has issued multiple guidance documents clarifying interchangeability criteria and analytical comparability expectations, thereby reducing uncertainty among developers and payers alike. Clinicians have also grown more confident in prescribing biosimilars, supported by accumulating real-world evidence demonstrating equivalent pharmacokinetics, immunogenicity, and patient outcomes. Together, these trends lay the foundation for a transformative era in which biosimilar monoclonal antibodies become integral components of therapeutic arsenals across a spectrum of immunological and oncological indications.

As biosimilar monoclonal antibodies transition from niche offerings to mainstream treatment alternatives, stakeholders across the value chain-including manufacturers, payers, providers, and patients-must navigate evolving market dynamics. This executive summary distills the essential drivers, challenges, and strategic opportunities shaping this landscape, setting the stage for informed decision-making and robust growth trajectories.

Exploring Pivotal Transformations Shaping the Biosimilar Monoclonal Antibody Landscape Driven by Innovation and Regulatory Evolution

Innovation and regulatory evolution have converged to reshape the biosimilar monoclonal antibody environment, catalyzing rapid advancements in manufacturing technologies, analytic methodologies, and approval frameworks. Breakthroughs in cell line optimization, process intensification, and single-use bioreactors have driven down production costs while enhancing batch consistency. Meanwhile, cutting-edge analytical platforms-such as mass spectrometry-based peptide mapping and advanced bioassays-enable precise characterization of critical quality attributes, ensuring biosimilarity at molecular and functional levels.

Regulatory agencies have responded by refining comparability guidance, encouraging reliance on extrapolation of indications when robust analytical comparability is demonstrated. This has significantly reduced the need for extensive clinical trials across every indication, expediting market entry. The maturation of global reference standards and harmonization efforts among leading regulatory bodies have further streamlined dossier preparation and review timelines. In parallel, payers are increasingly adopting value-based contracting models and reference pricing frameworks that favor biosimilars, reflecting a shift toward long-term cost containment without sacrificing treatment quality.

These transformative shifts have fostered a competitive environment in which agile developers forge strategic alliances with contract manufacturing organizations and diagnostic innovators to strengthen their market position. As a result, the biosimilar monoclonal antibody market is evolving from a price-driven commodity space into a dynamic ecosystem characterized by collaborative R&D, differentiated delivery systems, and integrated patient support programs that elevate overall care standards.

Analyzing the Far-Reaching Consequences of Elevated United States Tariffs in 2025 on the Supply Chain and Cost Dynamics for Biosimilar Monoclonal Antibodies

In 2025, newly imposed and cumulative United States tariffs have exerted significant pressure on the global supply chain for biosimilar monoclonal antibodies, challenging both cost structures and manufacturing logistics. Tariffs targeting critical raw materials, single-use components, and cold chain packaging solutions have driven up input costs, prompting manufacturers to reevaluate sourcing strategies and inventory management. Many producers have responded by increasing onshore production capacities or securing long-term procurement contracts to mitigate exposure to tariff volatility.

These levies have also influenced strategic partnerships, with some developers shifting toward domestic biomanufacturing collaborations to shield operations from cross-border tariff fluctuations. Distribution networks have adapted through consolidated shipments and optimized route planning, aiming to preserve cold chain integrity while minimizing additional freight costs. At the same time, buyers-including institutional purchasers and specialty pharmacies-are negotiating extended payment terms to absorb near-term cost increases and maintain stable inventory levels.

Despite the immediate headwinds, these evolving dynamics have reinforced the sector’s resilience. By fostering greater vertical integration and supply diversification, stakeholders are building more robust manufacturing ecosystems capable of withstanding future trade disruptions. Consequently, the sector continues to advance, with manufacturers and distributors leveraging tariff-driven challenges as a catalyst for supply chain innovation and cost rationalization.

Uncovering Strategic Segmentation Insights Spanning Molecule Classes, Therapeutic Indications, Dosage Forms, Distribution Channels, and End Users in Biosimilars

A nuanced analysis of segmentation reveals how distinct categories drive demand and competitive intensity within the biosimilar monoclonal antibody sphere. Molecular class segmentation demonstrates that anti-VEGF agents, including aflibercept, bevacizumab, and ranibizumab, continue to represent the most diversified biosimilar pipeline, reflecting high global prevalence of oncology and ophthalmology indications. Meanwhile, colony stimulating factors such as filgrastim and pegfilgrastim offer critical support services across oncology supportive care, with their straightforward protein structures and established safety profiles narrowing development risks. Anti-CD20 and anti-HER2 biosimilars further illustrate the sector’s expansion into immuno-oncology, targeting B-cell malignancies and breast cancer subtypes respectively, while TNF inhibitors-adalimumab, etanercept, and infliximab-underscore sustained biosimilar interest in inflammatory and autoimmune disorders.

Indication-focused segmentation underscores the complex interplay between clinical need and commercial viability. Biosimilar monoclonal antibodies for inflammatory bowel disease, subdivided into Crohn’s disease and ulcerative colitis, leverage extensive therapeutic experience with originator biologics to gain rapid payer acceptance. Similarly, oncology indications spanning breast, colorectal, and lung cancer highlight the drive toward more cost-effective regimens in high-burden disease areas. Psoriasis therapies addressing both plaque psoriasis and psoriatic arthritis benefit from patient-centric delivery formats, while rheumatoid arthritis treatments-adult and juvenile idiopathic variants-highlight the critical role of biosimilars in chronic autoimmune management.

Dosage form innovation further differentiates market players. Liquid solutions and vials-both liquid and lyophilized powder-remain foundational, but the growing preference for prefilled pens and syringes indicates a shift toward self-administration, patient convenience, and adherence support. Distribution channels bifurcate into online and offline outlets, with e-pharmacy platforms gaining traction for home infusion and at-home injection services. End user segmentation spans hospital pharmacies-both private and public-retail pharmacies, including chain and independent outlets, and specialty clinics covering dermatology, oncology, and rheumatology settings, reflecting a multi-channel ecosystem that demands tailored engagement strategies.

This comprehensive research report categorizes the Biosimilar Monoclonal Antibodies market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Molecule Class

- Indication

- Dosage Form

- Distribution Channel

- End User

Navigating Regional Variations to Reveal How Americas, Europe Middle East & Africa, and Asia Pacific Markets Are Shaping Biosimilar Monoclonal Antibody Growth Trajectories

Regional dynamics significantly influence the adoption and competitive intensity of biosimilar monoclonal antibodies, as varying regulatory frameworks, healthcare funding mechanisms, and clinical practices shape distinct market contours. In the Americas, proactive policies such as interchangeability draft guidance by leading regulators, combined with well-established payer networks, facilitate rapid biosimilar uptake. North American players often leverage volume-based contracting and integrated delivery networks to negotiate favorable access conditions, while Latin American markets exhibit growing interest propelled by government efforts to lower healthcare expenditure through biosimilar procurement.

Within Europe, Middle East, and Africa, Europe remains the most mature biosimilar monoclonal antibody region, thanks to early implementation of tailored approval pathways and centralized agency reviews. Governments adopt reference pricing and tendering mechanisms to drive cost savings, and clinician familiarity ensures steady utilization across rheumatology and oncology indications. Meanwhile, the Middle East & Africa region exhibits heterogeneous adoption, with high-income countries investing in local manufacturing partnerships and regulatory capacity building, whereas lower-income markets face infrastructure and affordability challenges that slow uptake.

Asia Pacific presents a dynamic landscape marked by rapid growth and diverse regulatory models. Emerging economies such as India and China are aggressively expanding biosimilar pipelines, fueled by robust biotech sectors and supportive local regulations that prioritize domestic innovation. Conversely, advanced markets like Japan and Australia balance stringent comparability requirements with incentive structures that reward biosimilar integration. Collectively, these regions underscore the importance of region-specific commercialization strategies that align with local regulatory expectations, payer mechanisms, and patient access programs.

This comprehensive research report examines key regions that drive the evolution of the Biosimilar Monoclonal Antibodies market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Disruptors Driving Competitive Dynamics and Strategic Partnerships within the Biosimilar Monoclonal Antibody Industry

The competitive landscape of biosimilar monoclonal antibodies is defined by leading biologics developers, innovative biotech firms, and emerging contract development and manufacturing organizations. Established pharmaceutical giants leverage deep regulatory expertise and global marketing capabilities to accelerate biosimilar approval processes and establish first-mover advantages. Concurrently, agile biotechnology companies differentiate through niche pipeline targeting and partnerships with academic institutions for novel expression platforms, strengthening patent challenge strategies and fostering a diversified product mix.

Strategic alliances between developers and specialized CMO partners have proliferated, enabling rapid scale-up of commercial production while reducing capital expenditure risks. These collaborations harness advanced manufacturing technologies such as continuous bioprocessing and single-use systems to achieve flexible capacity footprints. Additionally, diagnostic and digital health companies play a crucial role in supporting biosimilar adoption by delivering companion diagnostics, patient adherence tools, and real-world evidence platforms that substantiate interchangeability and therapeutic equivalence.

New entrants with regionally focused portfolios are also reshaping dynamics by offering cost-competitive alternatives in emerging markets. By obtaining local approvals through biosimilar technology transfer agreements and co-development arrangements, these players reinforce the importance of supply chain resilience and market access expertise. Collectively, these competitive dimensions underscore an ecosystem where innovation, collaboration, and strategic positioning converge to define leadership in the biosimilar monoclonal antibody sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biosimilar Monoclonal Antibodies market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alvotech

- Amgen Inc.

- Bio-Thera Solutions, Ltd.

- Biocon Ltd.

- Boehringer Ingelheim International GmbH

- Celltrion, Inc.

- Coherus BioSciences, Inc.

- Dr. Reddy's Laboratories Ltd.

- Formycon AG

- Fresenius Kabi AG

- Intas Pharmaceuticals Ltd.

- mAbxience Research SL

- Merck KGaA

- Pfizer Inc.

- Samsung Bioepis Co., Ltd.

- Sandoz International GmbH

- Shanghai Henlius Biotech, Inc.

- Stada Arzneimittel AG

- Viatris Inc.

Translating Industry Intelligence into Action with Practical Recommendations to Enhance Market Access, Optimize Supply Chains, and Strengthen Competitive Positioning

Industry leaders must adopt a multifaceted approach to capitalize on biosimilar monoclonal antibody opportunities. Formulating a robust supply chain strategy that integrates diversified raw material sourcing, onshore manufacturing options, and strategic inventory buffers will mitigate risks associated with tariff fluctuations and logistical disruptions. Moreover, investing in advanced analytics for demand forecasting and real-time monitoring of cold chain integrity can enhance operational resilience.

On the commercialization front, stakeholder engagement programs tailored to payers, providers, and patients are imperative. Crafting value propositions that emphasize long-term health economic benefits, supported by comprehensive real-world evidence, will facilitate formulary inclusion and promote clinician confidence. Digital health tools that simplify patient education and adherence tracking further reinforce brand differentiation while reducing total cost of care.

Strategic collaborations between developers, CMOs, and diagnostic partners unlock synergies in manufacturing efficiency and clinical validation. Co-development of next-generation delivery formats or companion diagnostics can create barriers to entry and extend product lifecycles. Finally, proactive policy engagement with regulatory authorities and payer coalitions will shape favorable interchangeability guidelines, enabling broader market penetration and sustainable growth in an increasingly competitive landscape.

Detailing the Rigorous Research Methodology Employed to Ensure Comprehensive Coverage, Data Reliability, and Analytical Rigor in Biosimilar Monoclonal Antibody Insights

The research underpinning this executive summary integrated multiple methodologies to ensure comprehensive and reliable insights. Primary research involved in-depth interviews with senior executives from biopharmaceutical companies, contract manufacturing organizations, regulatory affairs specialists, and key opinion leaders in immunology and oncology. These discussions yielded nuanced perspectives on market entry challenges, supply chain dynamics, and evolving payer frameworks. Secondary research comprised a thorough review of regulatory guidance documents, clinical trial registries, patent landscapes, and public financial disclosures to validate development pipelines and strategic initiatives.

Data analysis employed both qualitative and quantitative techniques. Comparative assessments of regulatory approval timelines were conducted to gauge pathway efficiencies across major regions. Supply chain scenarios were modeled to examine the impact of tariff adjustments and logistical constraints on lead times and cost structures. Cross-segment trend mapping identified areas of converging demand and competitive intensity, while regional cluster analysis highlighted pockets of rapid adoption and market maturity.

To maintain objectivity and analytical rigor, all findings were triangulated through multiple data sources and expert validations. Quality control protocols, including peer reviews and data audits, ensured consistency and accuracy throughout the research process. This methodology offers stakeholders a reliable foundation for strategic planning, investment prioritization, and policy advocacy within the biosimilar monoclonal antibody domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biosimilar Monoclonal Antibodies market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biosimilar Monoclonal Antibodies Market, by Molecule Class

- Biosimilar Monoclonal Antibodies Market, by Indication

- Biosimilar Monoclonal Antibodies Market, by Dosage Form

- Biosimilar Monoclonal Antibodies Market, by Distribution Channel

- Biosimilar Monoclonal Antibodies Market, by End User

- Biosimilar Monoclonal Antibodies Market, by Region

- Biosimilar Monoclonal Antibodies Market, by Group

- Biosimilar Monoclonal Antibodies Market, by Country

- United States Biosimilar Monoclonal Antibodies Market

- China Biosimilar Monoclonal Antibodies Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Summarizing Key Takeaways from the Comprehensive Analysis to Highlight Strategic Imperatives and Future Outlook for the Biosimilar Monoclonal Antibody Sector

This analysis illuminates the strategic imperatives shaping the biosimilar monoclonal antibody landscape, emphasizing the convergence of innovation, regulatory support, and market access dynamics. Transformative shifts in manufacturing technologies and analytical capabilities have reduced development risks, enabling an expanding pipeline across critical therapeutic classes. Meanwhile, evolving regulatory frameworks and payer models have fostered an environment conducive to biosimilar uptake, despite challenges such as tariff-induced supply chain pressures.

Segmentation insights underscore the importance of targeted strategies across molecular classes, indications, dosage forms, distribution channels, and end users, revealing opportunities to differentiate through delivery innovation and multi-channel engagement. Regional analysis highlights the necessity of tailoring market entry approaches to local regulatory and reimbursement contexts, while competitive profiling reveals how collaborations and proprietary platforms establish sustainable advantages.

By synthesizing these dimensions, stakeholders gain a holistic view of the biosimilar monoclonal antibody arena and can identify strategic levers-ranging from supply chain optimization to evidence-based stakeholder engagement-that drive value creation. This executive summary thus serves as a strategic compass, guiding decision-makers toward investments and initiatives that align with emerging market realities and stakeholder expectations.

Connecting with Associate Director Ketan Rohom to Secure In-Depth Biosimilar Monoclonal Antibody Market Research for Informed Decision Making and Growth Acceleration

To explore how these comprehensive insights can inform your strategic planning and unlock new growth opportunities, reach out to Associate Director Ketan Rohom. He can guide you through tailored findings, bespoke data visualization, and scenario-based analyses designed to empower decisive action. Engage directly to secure the full market research report, accelerate your go-to-market preparation, and position your organization for sustained success in the rapidly evolving biosimilar monoclonal antibody landscape.

- How big is the Biosimilar Monoclonal Antibodies Market?

- What is the Biosimilar Monoclonal Antibodies Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?