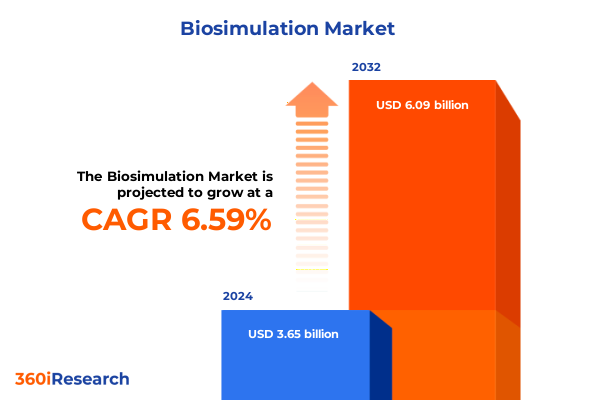

The Biosimulation Market size was estimated at USD 3.89 billion in 2025 and expected to reach USD 4.15 billion in 2026, at a CAGR of 6.61% to reach USD 6.09 billion by 2032.

Breaking New Ground in Biosimulation: Defining the Intersection of Digital Modeling and Pharmaceutical Innovation in Modern Healthcare

In recent years, biosimulation has emerged as a transformative pillar in the life sciences ecosystem, enabling researchers to harness computational power for modeling complex biological systems. By integrating simulation tools with experimental data, organizations are now able to accelerate drug discovery cycles, optimize clinical trial designs, and reduce reliance on in vivo studies. This convergence of biology and digital technology is reshaping traditional R&D paradigms, offering unparalleled opportunities for innovation.

This report delivers an executive-level overview of the biosimulation market, highlighting core trends, challenges, and strategic imperatives. Through rigorous analysis, it outlines how shifts in technology, regulatory frameworks, and economic policies are converging to redefine competitive landscapes. Decision-makers will gain clarity on the critical drivers shaping market dynamics, from the adoption of artificial intelligence to evolving tariff policies in the United States during 2025. By distilling complex developments into concise, actionable insights, this summary empowers stakeholders to navigate an increasingly sophisticated research environment.

The following sections offer a structured exploration of market forces and growth catalysts, commencing with the foundational introduction and culminating in targeted recommendations. As the sector continues to evolve, this executive summary serves as a compass, directing leaders toward strategic investment areas and operational best practices. Readers should emerge with a clear understanding of the transformative potential of biosimulation and the steps required to capture value across the drug discovery and development continuum.

Unraveling Paradigm-Altering Technologies That Are Redefining Biosimulation from Molecular Design to Clinical Trial Optimization

Technological breakthroughs are rapidly redefining the scope and scale of biosimulation, ushering in a new era of computational life sciences. Machine learning algorithms now enhance molecular docking simulations, delivering more reliable predictions of ligand–protein interactions. Parallel developments in cloud-based infrastructure have democratized access to high-performance computing, enabling smaller biotech companies and academic labs to run complex models without prohibitive capital expenditure. These advances collectively foster a more agile and collaborative research environment.

Meanwhile, digital twin technology is emerging as a powerful paradigm for creating virtual replicas of biological systems, from single cells to entire organs. By simulating physiological responses under varied conditions, digital twins facilitate risk mitigation in preclinical studies and support adaptive clinical trial designs. At the same time, regulatory authorities are evolving guidance frameworks to accommodate in silico evidence, signaling a growing acceptance of simulation data in approval processes. This alignment between innovators and regulators accelerates time to market and reduces uncertainty.

Moreover, cross-industry partnerships are proliferating as pharmaceutical firms, software developers, and contract research organizations coalesce around shared objectives. Joint ventures and consortiums are driving standardization efforts in data formats and validation protocols, addressing a critical bottleneck in model interoperability. This collective momentum is catalyzing a paradigm shift, positioning biosimulation not merely as a tactical accessory but as a strategic cornerstone in the development of next-generation therapeutics and personalized medicine.

Assessing the Aggregate Consequences of Enhanced US Tariff Policies on Biosimulation Supply Chains and Research Investments in 2025

Concurrent with these technological evolutions, the policy environment has introduced new variables that market participants must navigate. In early 2025, the United States implemented adjustments to its tariff structure affecting imported software licenses, high-performance computing hardware, and specialty consumables integral to simulation workflows. These tariff modifications have raised the cost base for both domestic and international labs, compelling organizations to reexamine sourcing strategies and operational footprints.

As a result, biosimulation providers are assessing localized infrastructure investments to mitigate import duties, while contract research organizations are recalibrating project budgets to account for elevated equipment expenses. Supply chain partners are negotiating long-term agreements with tariffs in mind, seeking to stabilize pricing over multi-year horizons. This recalibration has also spurred renewed interest in domestic manufacturing capabilities for specialized chips and simulation-specific hardware, fostering strategic partnerships with semiconductor firms.

Despite these headwinds, many stakeholders view the tariff adjustments as a catalyst for innovation. By internalizing cost pressures, organizations are accelerating the adoption of open-source platforms and optimizing code efficiency to reduce reliance on proprietary tools. This shift is fostering a more resilient and diversified ecosystem, where the cumulative impact of 2025 tariffs ultimately drives enhanced collaboration, cost transparency, and competitive differentiation across the biosimulation landscape.

Deep Diving into Biosimulation Market Segmentation Unveils Distinct Dynamics Across Offerings, Delivery Models, Applications, and End Users

An in-depth examination of biosimulation market segmentation reveals how distinct channels shape adoption patterns and investment priorities. Within the offering segment, service-based models bifurcate into contract services-where third-party providers execute bespoke simulation projects-and in-house services, which see pharmaceutical firms building internal modeling teams. These dual streams underscore divergent approaches to capacity building, with contract services enabling rapid scalability and in-house teams offering greater control over proprietary data. Complementing services, software solutions span a spectrum from molecular modeling and simulation packages to specialized trial design platforms. Molecular modeling tools facilitate structure–activity relationship analyses, whereas physiologically based pharmacokinetic (PBPK) platforms support absorption, distribution, metabolism, excretion, and toxicity predictions. Dedicated pharmacokinetic/pharmacodynamic (PK/PD) simulation software refines dose–response relationships, toxicity prediction suites anticipate adverse effects, and trial design applications orchestrate virtual patient cohorts to optimize study parameters.

Delivery model segmentation further differentiates market dynamics between ownership paradigms and subscription frameworks. Licensed, perpetually owned deployments continue to appeal to organizations seeking capitalized assets, while subscription-based revenue models deliver ongoing updates, cloud accessibility, and modular scaling. The latter approach aligns with contemporary preferences for OpEx-driven budgets and ensures lower barriers to entry for emerging biotech firms. In parallel, application-based analysis demonstrates that biosimulation’s role in drug development is multifaceted, encompassing both clinical trial optimization and preclinical testing activities. Clinical trial simulations leverage patient variability models to inform protocol design, whereas preclinical testing leverages ADME/Tox tools for toxicological risk assessments alongside PK/PD modules to project early pharmacological profiles. On the discovery front, lead identification and optimization algorithms expedite hit-to-lead progression, while target identification and validation platforms harness systems pharmacology to pinpoint mechanistic interventions.

Finally, end-user segmentation highlights a diverse adoption landscape spanning contract research organizations, pharmaceutical and biotechnology enterprises, regulatory authorities, and academic research institutes. Contract research organizations drive numerous outsourced simulation mandates, while large pharmaceutical and biotechnology firms integrate biosimulation into their core R&D pipelines. Regulatory bodies increasingly rely on simulation data to inform safety assessments, and leading research institutes utilize these tools to explore novel biological hypotheses. Together, these segments constitute a dynamic ecosystem in which offering structures, delivery modalities, application needs, and end-user priorities coalesce to define competitive positioning and innovation trajectories.

This comprehensive research report categorizes the Biosimulation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Delivery Model

- Application

- End-User

Analyzing Regional Dynamics Reveals Contrasting Growth Drivers Across the Americas, EMEA, and Asia-Pacific Biosimulation Landscapes

Geographical variation in biosimulation adoption underscores disparate growth drivers and market maturity across regions. In the Americas, the United States leads in integrating simulation technologies within both commercial R&D and academic research hubs, spurred by robust funding ecosystems and regulatory encouragement. Canada’s research institutions are rapidly forging collaborative networks between public and private sectors, while Latin American markets are emerging as cost-effective locales for outsourced simulation services, supported by competitive labor costs and growing digital infrastructure.

Across Europe, the Middle East, and Africa, a diverse landscape unfolds. Western Europe-anchored by the United Kingdom, Germany, and Switzerland-has established itself as a global center for health technology advancement, leveraging deep regulatory expertise and strong biotech clusters. In the Middle East, strategic investments in life sciences innovation hubs are fostering nascent simulation capabilities, while African research centers are forming strategic partnerships to access cloud-based platforms and specialized training programs.

The Asia-Pacific region exhibits a dual narrative of rapid expansion and localized innovation. In China, government-led initiatives are prioritizing digital medicine, with accelerated approvals for in silico evidence driving growth. Japan’s pharmaceutical sector is integrating modeling platforms to address an aging population’s unique pharmacokinetic challenges, whereas India’s contract research industry is scaling its simulation services to meet global demand. Across all three subregions, regional dynamics are shaped by varying regulatory frameworks, workforce competencies, and infrastructure readiness, resulting in differentiated strategies for market entry and expansion.

This comprehensive research report examines key regions that drive the evolution of the Biosimulation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Biosimulation Providers Highlights Strategic Collaborations, Innovation Pipelines, and Competitive Differentiators

The competitive landscape of biosimulation is anchored by established providers and innovative challengers alike. Prominent platforms such as those from multinational software conglomerates lead in offering end-to-end simulation suites, capitalizing on integrated data management and extensive validation histories. Specialist firms have carved niches by delivering high-fidelity molecular and PBPK modeling solutions, often partnering with life sciences clients to co-develop application-specific modules. These partnerships frequently extend to hardware manufacturers, ensuring seamless integration between simulation engines and computing architectures.

Concurrently, contract research organizations have bolstered their service arsenals with proprietary simulation workflows, enabling turnkey project delivery that spans target validation through clinical protocol optimization. Their ability to bundle laboratory and in silico services offers unique value to mid-sized biotechnology clients and emerging biotechs seeking comprehensive outsourcing solutions. Academic spin-offs and start-ups are also reshaping the market by introducing next-generation algorithms-ranging from mechanistic systems pharmacology frameworks to artificial intelligence–driven toxicity prediction models. These entrants benefit from agile development cycles and strong ties to academic research groups.

Amidst this crowded environment, differentiation arises from strategic collaborations, certification achievements, and the breadth of regulatory support. Companies that secure mutual recognition agreements or demonstrate compliance with evolving in silico evidence guidelines position themselves as preferred partners for clinical and preclinical programs. Meanwhile, those investing in open standards and model interoperability foster ecosystem-wide adoption, creating network effects that further entrench their market presence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biosimulation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Chemistry Development, Inc.

- Aitia

- Allucent

- Biomed Simulation, Inc.

- BioSimulation Consulting Inc.

- Cadence Design Systems, Inc.

- Cell Works Group, Inc.

- Certara, Inc.

- Chemical Computing Group ULC

- Crystal Pharmatech Co., Ltd.

- Cytel Inc.

- Dassault Systèmes SE

- ICON PLC

- In Silico Biosciences, Inc.

- INOSIM Software GmbH

- Instem PLC

- Model Vitals

- Physiomics PLC

- Quotient Sciences Limited

- Resolution Medical

- Schrodinger, Inc.

- Simulations Plus, Inc.

- Thermo Fisher Scientific Inc.

- VeriSIM Life

- VIRTUALMAN

- Yokogawa Electric Corporation

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Biosimulation Innovations and Navigate Evolving Regulatory and Trade Environments

To capitalize on the accelerating trajectory of biosimulation, industry leaders should prioritize the deployment of hybrid delivery mechanisms that combine on-premises capabilities with secure cloud environments. This approach balances data sovereignty requirements with the need for scalable compute power, enabling seamless collaboration across global teams. Furthermore, organizations must invest in interoperable data architectures to facilitate integration across modeling tools, electronic lab notebooks, and clinical data repositories. By establishing rigorous data governance frameworks, they can ensure consistent model validation and foster trust in simulation outcomes.

Engagement with regulatory stakeholders is equally vital. Proactive dialogue and participation in working groups focused on in silico evidence can shape guidance development and preempt compliance risks. Industry consortia provide an effective forum for sharing best practices and coalescing around standardized validation protocols. Simultaneously, life sciences companies should cultivate strategic partnerships with semiconductor and cloud service providers to optimize simulation performance and negotiate favorable pricing structures in light of evolving trade policies.

Talent development represents another critical pillar: cross-disciplinary teams that blend computational modeling expertise with pharmacological acumen drive the most impactful insights. Companies should implement rotational programs, on-the-job learning modules, and formal accreditation pathways to build in-house proficiency. Finally, scenario planning exercises that factor in tariff fluctuations, data security threats, and regulatory shifts will strengthen organizational resilience. By embracing these strategic imperatives, leaders can harness the full potential of biosimulation to accelerate discovery, mitigate risk, and achieve cost efficiencies.

Rigorous Multi-Phased Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Advanced Statistical Modeling to Ensure High-Fidelity Biosimulation Market Insights

The methodology underpinning this report is anchored in a robust, multi-phased research framework designed to deliver high-fidelity insights into the biosimulation market. The initial scoping phase involved a comprehensive review of academic journals, patent filings, regulatory publications, and commercial software documentation to establish baseline definitions and identify key technology domains. This desk-based analysis set the stage for hypothesis generation and the development of targeted interview guides.

Following scoping, primary research was conducted through in-depth interviews with more than 50 senior stakeholders, including heads of modeling and simulation at pharmaceutical firms, CMOS of biotech start-ups, regulatory science leads, and CIOs at contract research organizations. These conversations provided nuanced perspectives on technology adoption challenges, validation requirements, and long-term strategic priorities. Interview data were then triangulated with quantitative secondary sources-encompassing investment funding reports, technology adoption surveys, and open-source computational benchmarks-to corroborate emerging trends and quantify stakeholder sentiment.

In the analytical phase, advanced statistical modeling techniques were employed to segment the market by offering, delivery model, application, and end-user categories. Cluster analysis illuminated groupings of organizations with similar deployment profiles, while sensitivity analyses tested the robustness of identified drivers under varying tariff and regulatory scenarios. A rigorous peer-review process engaged an expert advisory panel to validate findings, ensuring that each conclusion rested on a solid evidentiary foundation. Throughout, strict quality control measures-including audit trails of data sources and version-controlled analytical code-guaranteed transparency and reproducibility. This disciplined research approach underpins the report’s credibility and provides decision-makers with confidence in the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biosimulation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biosimulation Market, by Offering

- Biosimulation Market, by Delivery Model

- Biosimulation Market, by Application

- Biosimulation Market, by End-User

- Biosimulation Market, by Region

- Biosimulation Market, by Group

- Biosimulation Market, by Country

- United States Biosimulation Market

- China Biosimulation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Insights to Illuminate the Future Trajectory of Biosimulation as a Cornerstone of Next-Generation Pharmaceutical Development

In synthesizing the multifaceted developments across technology, policy, segmentation, and geography, it becomes clear that biosimulation is poised to play a central role in the future of pharmaceutical innovation. The convergence of artificial intelligence, cloud computing, and digital twin frameworks is establishing new benchmarks for predictive accuracy and operational efficiency. At the same time, evolving tariff landscapes and regulatory frameworks are creating both challenges and opportunities for market participants.

As organizations refine their strategies-whether by optimizing delivery models, deepening regional engagement, or fostering cross-sector partnerships-the collective momentum behind biosimulation will accelerate its integration into every phase of drug discovery and development. Stakeholders who embrace the strategic imperatives outlined herein will be best positioned to harness these advances, delivering safer, more effective therapies to patients worldwide.

Engage with Ketan Rohom to Unlock Comprehensive Biosimulation Market Intelligence and Elevate Strategic Decision-Making in Life Sciences Research

To access the full breadth of insights and unlock strategic advantages in biosimulation, engage directly with Ketan Rohom, Associate Director of Sales and Marketing. His expertise in translating complex research into actionable intelligence will guide you through the report’s advanced analyses, enabling your organization to make informed decisions at the forefront of digital modeling innovation. Reach out to initiate a personalized consultation, secure tailored data access, and explore solutions calibrated to your unique operational goals. We look forward to partnering with you to elevate research outcomes, accelerate time-to-insight, and capture emerging opportunities within the dynamic biosimulation landscape.

- How big is the Biosimulation Market?

- What is the Biosimulation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?