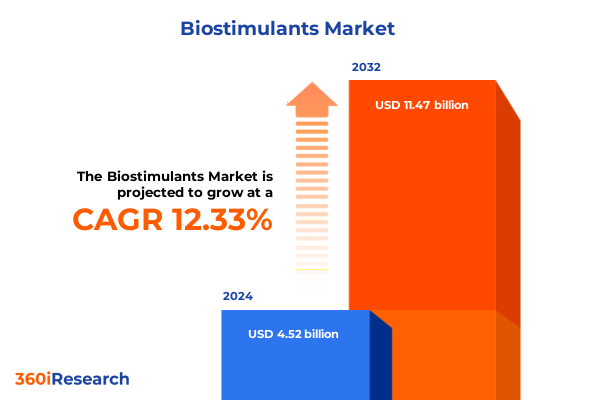

The Biostimulants Market size was estimated at USD 5.06 billion in 2025 and expected to reach USD 5.66 billion in 2026, at a CAGR of 12.40% to reach USD 11.47 billion by 2032.

Unveiling the Critical Role of Biostimulants in Modern Agriculture with Emphasis on Innovation Sustainability Market Drivers and Stakeholder Collaboration

The biostimulant sector has emerged as a pivotal component of modern agricultural practices, offering plant performance enhancements that extend beyond traditional nutrient supplementation. These naturally derived and synthetic products support plant vigor, resilience, and yield in an era defined by climate variability, resource constraints, and intensifying sustainability mandates. As regulatory frameworks evolve to recognize the unique role of biostimulants, industry stakeholders from seed companies to independent producers are racing to define new value propositions around crop health and environmental stewardship.

Against this backdrop, industry decision makers require an authoritative synthesis of emerging dynamics, competitive landscapes, and stakeholder expectations. The purpose of this analysis is to frame the current market environment, spotlighting how the intersection of technological innovation, regulatory advancement, and supply chain adaptation is reshaping opportunities for market entrants and established players alike. By tracing these converging forces, the report lays the groundwork for strategic responses that can harness the full potential of biostimulants as a cornerstone of sustainable agriculture.

Exploring the Pivotal Transformative Shifts Shaping the Biostimulants Landscape from Technological Advancements to Regulatory and Consumer Trends

Over the past several years, biostimulants have transcended niche adoption to become integral to precision farming strategies, driven by transformative shifts in formulation science, digital agronomy, and policy recognition. Breakthroughs in microbial consortia and protein hydrolysate technologies are enabling more consistent and targeted physiological improvements under stress conditions such as drought and salinity.

Meanwhile, digital agriculture platforms that integrate remote sensing and machine learning are refining application timing and dosage, bridging the gap between laboratory efficacy and field performance. Simultaneously, regulatory authorities in North America and Europe are establishing harmonized frameworks that clarify registration pathways, quality standards, and efficacy claims. This confluence of innovation and policy clarity has galvanized private investment and strategic partnerships, catalyzing scale-up initiatives and rapid market entry for companies with differentiated solutions.

Looking ahead, the critical shift will hinge on the ability of organizations to translate R&D advances into commercial-scale impact, leveraging data analytics to validate performance and sustain customer confidence. This era of evidence-based biostimulant adoption underscores the need for integrated strategies that align scientific rigor, market access, and end-user engagement.

Assessing the Comprehensive Impact of United States Tariff Policies Introduced in 2025 on Supply Chains Input Costs and Industry Viability

The introduction of new United States tariff measures in 2025 has introduced additional complexities to an already intricate supply chain, elevating the cost of key bioactive precursors and specialty ingredients sourced from global hubs. Manufacturers reliant on amino acid and seaweed extract feedstocks have faced incremental import duties, prompting a reassessment of supplier portfolios and logistic configurations. As a result, many producers have explored regional production partnerships and backward integration to mitigate margin pressures and maintain competitive pricing.

Moreover, fluctuations in input costs have accelerated the consolidation of smaller producers who lack the scale to absorb tariff-driven price increases. Mid-tier companies are intensifying collaboration with research institutions to optimize raw material usage and enhance formulation efficiency, thereby preserving product efficacy while reducing dependency on taxed imports. At the same time, distributors are reevaluating inventory strategies, prioritizing faster inventory turnover and near-shore warehousing to minimize duty liabilities and lead time disruptions.

While these adjustments pose short-term profitability challenges, they are also catalyzing a paradigm shift toward more resilient and localized supply networks. Firms that proactively adapt through strategic supplier diversification and process innovation are well positioned to thrive despite evolving trade policy constraints.

Revealing Actionable Insights from Form Formulation Source Application Method and Crop Type Segmentation to Guide Biostimulant Market Engagement Strategies

Insight into market segmentation clarifies pathways to tailored product development and targeted commercialization. Differentiation by form underscores unique application dynamics: granules support controlled release in soil treatment scenarios, liquids facilitate rapid foliar uptake, and powders offer concentrated dosing for localized seed treatment applications. Recognizing this, formulation specialists are investing in adjuvant research to improve adhesion and stability across varied environmental conditions.

Examining source-based segmentation reveals distinct innovation trajectories. A surge in microbial offerings, spanning bacteria, fungi, and actinomycetes, underscores a shift toward living biostimulants capable of rhizosphere modulation for nutrient acquisition. Concurrently, humic substances-divided into fulvic and humic acids-are gaining traction for their capacity to chelate micronutrients and enhance soil structure. Protein hydrolysates, whether plant- or animal-derived, demonstrate diverse bioactive peptide profiles that stimulate root development, while seaweed extracts remain prized for their broad spectrum of growth regulators.

Application method segmentation offers further granularity, with drip irrigation and furrow delivery optimizing soil treatment efficacy by aligning nutrient release with crop water uptake rhythms. Foliar sprays are increasingly refined through adjuvant synergies to maximize stomatal penetration, and seed treatments are incorporating microencapsulation technologies to protect formulations during storage and germination. Crop type segmentation illuminates differential adoption patterns: high-value fruit and vegetable growers are prioritizing foliar and microbial solutions to meet stringent quality standards, whereas cereal and grain producers leverage granules and soil-applied humic formulations to support large-scale acreage management.

This comprehensive research report categorizes the Biostimulants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Source

- Application Method

- Crop Type

Delivering Strategic Regional Perspectives across Americas Europe Middle East Africa and Asia Pacific to Optimize Biostimulant Market Initiatives

Regional dynamics in the Americas reflect a mature regulatory environment and high adoption of precision agriculture. Local producers benefit from established distribution networks and robust agronomic advisory services, enabling widespread foliar spray programs in fruit and vegetable sectors and expansive soil treatment initiatives for cereals and grains. Investment in on-farm trials and partnerships with extension services continues to reinforce end-user confidence in biostimulant efficacy.

In Europe Middle East & Africa, stringent environmental regulations and ambitious carbon neutrality goals are driving demand for products that deliver demonstrable sustainability benefits. This has fueled R&D collaboration across the region, particularly in the Mediterranean basin where seaweed extract applications are tailored to drought-prone conditions. Regulatory harmonization under EU directives is also streamlining cross-border product registration, opening opportunities for niche microbial and fulvic acid offerings.

Asia Pacific presents a diverse landscape shaped by smallholder predominance in Southeast Asia and large commercial farms in Australia and China. Government incentive programs in India and Southeast Asia have subsidized seed treatment and soil-applied biostimulants to bolster food security and improve nutrient use efficiency. Meanwhile, Australia’s well-established research institutions are at the forefront of microbial formulation innovation, integrating local biodiversity into product pipelines to address region-specific agronomic challenges.

This comprehensive research report examines key regions that drive the evolution of the Biostimulants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Dynamics and Strategic Moves by Leading Biostimulant Innovators Shaping the Future of Agricultural Inputs

Leading companies are differentiating themselves through integrated innovation pipelines and strategic collaborations. Multinational agribusiness firms have fortified their offerings by acquiring specialized microbial technology startups and forming joint ventures with biotech innovators. Meanwhile, mid-sized enterprises are carving out niche positions by focusing on proprietary fulvic formulations and high-throughput screening platforms for novel bioactive compounds.

Competitive intensity is heightened by the entry of specialty chemical companies expanding into biostimulants, leveraging existing distribution channels to accelerate market penetration. These players are investing in advanced R&D centers equipped with omics technologies and bioreactor capabilities, blurring traditional boundaries between crop protection and biostimulant sectors. At the same time, pure-play biostimulant manufacturers are doubling down on field validation trials, publishing peer-reviewed case studies to substantiate claims and foster customer trust.

This dynamic landscape underscores the importance of robust intellectual property strategies, as leaders seek to safeguard novel microbial strains, peptide sequences, and formulation methodologies. Organizations that excel in both product innovation and evidence-based marketing are poised to capture premium segments of the market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biostimulants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acadian Seaplants Limited

- Agricen by Nutrien

- AgriLife (India) Private Limited

- Agrinos

- Agritecno Fertilizantes SL

- Andermatt Group AG

- Apple Agro

- Atlántica Agrícola, S.A.

- Axeb Biotech SL

- BASF SE

- Bayer AG

- BioAtlantis Ltd.

- Biobest Group NV

- BIOIBERICA S.A.U.

- Biolchim S.p.A. by J.M. Huber Corporation

Formulating Actionable Recommendations to Propel Business Growth Regulatory Alignment and Innovation Adoption in the Biostimulants Sector

Industry leaders should prioritize cross-disciplinary R&D collaborations that integrate agronomic expertise with cutting-edge microbial science. By aligning product roadmaps with end-user pain points, companies can accelerate development cycles and tailor solutions for specific stress scenarios. Establishing strategic alliances with local distributors enhances market access, while co-developing demonstration plots fosters direct empirical validation and strengthens buyer confidence.

Supply chain resilience must be reinforced through dual sourcing strategies and investment in regional production hubs to mitigate the impact of trade policy fluctuations. Concurrently, leveraging digital agriculture platforms enables real-time performance tracking and data-driven optimization of application protocols. Engaging proactively with regulatory authorities will ensure alignment with evolving quality standards and claim substantiation requirements.

Finally, adopting an evidence-based marketing approach-rooted in peer-reviewed research and on-farm validation-will differentiate compelling value propositions and drive premium pricing. This multi-pronged strategy positions organizations to navigate market volatility, capitalize on emerging opportunities, and deliver sustained business growth.

Detailing the Comprehensive Research Methodology Underpinning Data Collection Analysis and Rigor Ensuring Credible Biostimulant Market Insights

This analysis synthesized insights from a rigorously designed research framework combining primary and secondary methodologies. Primary data collection included in-depth interviews with leading agronomists, R&D executives, and distribution partners, providing firsthand perspectives on technology adoption, regulatory challenges, and market priorities. Field trial case studies were reviewed to assess real-world product performance across diverse crop environments and climatic conditions.

Secondary sources encompassed scientific journals, regulatory databases, patent filings, and industry association publications. Data triangulation was employed to reconcile divergent information streams and ensure analytical consistency. Segmentation analysis leveraged both qualitative drivers-such as end-user decision factors-and quantitative indicators like application frequency and product penetration rates, enabling a multi-dimensional view of market dynamics.

Analytical rigor was maintained through cross-validation of findings, peer review by subject-matter experts, and sensitivity analyses to test underlying assumptions. While every effort was made to ensure accuracy and relevance, readers should note that rapidly evolving regulatory policies and emerging technological breakthroughs may warrant periodic reassessment of key insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biostimulants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biostimulants Market, by Form

- Biostimulants Market, by Source

- Biostimulants Market, by Application Method

- Biostimulants Market, by Crop Type

- Biostimulants Market, by Region

- Biostimulants Market, by Group

- Biostimulants Market, by Country

- United States Biostimulants Market

- China Biostimulants Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Concluding Strategic Imperatives Emphasizing the Transformative Role of Biostimulants in Advancing Sustainable Agriculture and Competitive Advantage

As the agricultural sector navigates mounting sustainability imperatives and resource constraints, biostimulants stand out as transformative enablers of crop performance and environmental stewardship. The strategic application of microbial formulations, humic substances, and protein hydrolysates has the potential to unlock significant agronomic benefits, from improved stress resilience to enhanced nutrient uptake.

In light of evolving trade policies, regulatory harmonization, and digital agriculture advancements, organizations that adopt an integrated approach-spanning innovation, supply chain resilience, and evidence-based marketing-will be best positioned to capture emerging growth opportunities. The convergence of these strategic imperatives underscores the need for agile decision making and proactive stakeholder engagement.

Ultimately, harnessing the full potential of biostimulants requires a balanced focus on scientific excellence, operational adaptability, and market insight. Decision makers who embrace this holistic framework will secure a competitive advantage and contribute meaningfully to the future of sustainable agriculture.

Driving Executive Engagement with Customized Offerings Connect Directly with Ketan Rohom for Exclusive Access to Comprehensive Biostimulant Market Intelligence

Unlock unparalleled industry knowledge by engaging directly with Ketan Rohom to secure your personalized copy of this comprehensive biostimulant market intelligence report that will equip your organization for future growth and resilience. By partnering with Ketan Rohom, Associate Director, Sales & Marketing, readers will gain tailored insights designed to align seamlessly with corporate objectives, ensuring the strategic application of findings across product innovation, supply chain optimization, and regulatory navigation. Reach out today to explore exclusive subscription options, bulk licensing, and value-added services that extend beyond the report’s core analysis, including bespoke briefings, ongoing market surveillance, and direct access to our expert advisory team. This proactive engagement model is crafted to accelerate informed decision making, reduce time to market, and reinforce your competitive edge within the dynamic biostimulants landscape

- How big is the Biostimulants Market?

- What is the Biostimulants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?