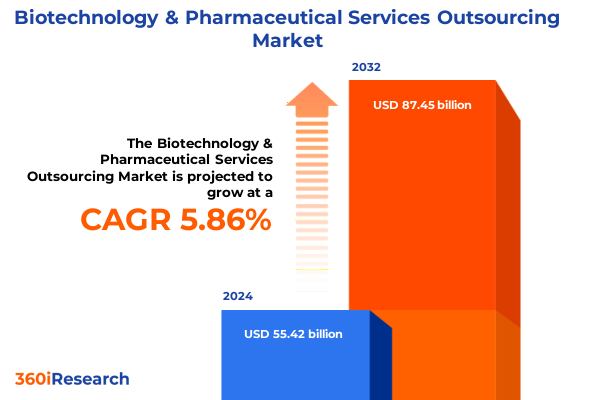

The Biotechnology & Pharmaceutical Services Outsourcing Market size was estimated at USD 58.54 billion in 2025 and expected to reach USD 61.86 billion in 2026, at a CAGR of 5.89% to reach USD 87.45 billion by 2032.

Exploring the dynamic intersection of evolving biotech innovations and outsourcing strategies that are redefining service partnerships in pharmaceutical development

The biotechnology and pharmaceutical services outsourcing landscape is witnessing unparalleled evolution as industry participants pursue greater efficiency, agility, and innovation. Over the past decade, organizations have redefined the nature of collaboration between sponsors and external service providers, embracing digital solutions, risk-sharing arrangements, and integrated delivery models. This transformation reflects not only the growing complexity of drug development programs but also the need to contain costs, accelerate timelines, and comply with increasingly stringent regulatory requirements.

In recent years, breakthroughs in cell and gene therapies, immuno-oncology, and precision medicine have placed new demands on outsourced capabilities. The emergence of decentralized trial technologies, real-world evidence platforms, and advanced analytics has reshaped the scope of partner engagements. Consequently, stakeholders are reimagining traditional outsourcing contracts to include end-to-end risk governance, dynamic budgeting frameworks, and performance-based incentives. These changes underscore the strategic importance of external collaboration in enabling breakthrough therapies to reach patients more efficiently.

Against this backdrop, this executive summary offers a concise yet comprehensive overview of the key drivers, challenges, and opportunities that define the current state of biotechnology and pharmaceutical services outsourcing. It highlights critical shifts in market dynamics, regulatory environments, and technological innovation, setting the stage for deeper analysis in the sections that follow.

Uncovering the pivotal technological, regulatory, and business-model shifts fueling accelerated transformation within biotech and pharmaceutical service outsourcing networks

The outsourcing landscape has undergone seismic transformation driven by converging forces of digitization, advanced therapeutics, and regulatory modernization. The proliferation of artificial intelligence and machine learning tools has enabled service providers to streamline data-intensive tasks such as biomarker discovery, patient recruitment modeling, and safety signal detection. This technology infusion has elevated expectations for predictive insights and end-to-end transparency, prompting providers to invest in cloud-native platforms and interoperable data ecosystems.

Meanwhile, the expansion of complex modalities-ranging from cell and gene therapies to antibody-drug conjugates-has created novel outsourcing requirements. Traditional contract research organizations have expanded or partnered to offer specialized cell therapy manufacturing modules, while pharmacovigilance firms have adapted their safety monitoring frameworks to handle long-term follow-up and genetic risk profiling. As a result, many providers are reconfiguring their operating models to deliver modular service suites capable of accommodating both conventional small-molecule programs and next-generation biologics.

Concurrently, regulatory authorities in key markets are streamlining review pathways and embracing risk-based approaches. The integration of real-world evidence in regulatory submissions and the advent of rolling review mechanisms have incentivized service partners to offer submission-ready dossiers and adaptive monitoring services. This regulatory flexibility has fostered a more collaborative ethos between sponsors and outsourcers, where shared accountability for milestone achievement and risk mitigation is becoming the norm. By synthesizing these technological, therapeutic, and regulatory shifts, the outsourcing sector is evolving from a transactional marketplace into a strategic ecosystem of co-innovation and integrated delivery.

Analyzing the wide-ranging effects of 2025 U.S. tariff adjustments on cross-border procurement, cost management, and partnerships in outsourced biotech services

The introduction of new U.S. tariffs on select pharmaceutical intermediates and equipment in early 2025 has reverberated across the outsourcing ecosystem, altering cost structures and strategic sourcing decisions. Although the tariff rates vary by product category, most APIs and specialized reagents now face levies ranging from 10 to 15 percent. For many contract development and manufacturing organizations, these incremental costs have been absorbed in the short term, but sponsors are increasingly scrutinizing total landed expenses and supplier diversification strategies.

As a consequence, some service providers have accelerated their investments in domestic manufacturing capabilities or relocated high-value operations to tariff-exempt jurisdictions. In particular, firms offering fill-finish services and scalable tech transfer have adapted by building regional sites closer to end-markets, thereby mitigating customs duties and shortening supply chains. Sponsors, too, are revisiting contractual clauses to introduce shared tariff-absorption clauses, enabling a more equitable distribution of unanticipated cost burdens.

Moreover, the tariff environment has intensified partnerships between outsourcing enterprises and free trade zone operators. By leveraging bonded warehousing and duty deferral programs, providers can offer more predictable cost profiles to their clients. These strategic adjustments demonstrate the market’s resilience in the face of policy shifts, reflecting a broader trend toward supply chain flexibility and geographic diversification that will likely endure beyond the immediate tariff cycle.

Delving into segmentation perspectives that highlight nuanced service types, outsourcing modes, company scales, therapeutic areas, and provider categories shaping the market

The outsourcing market can be understood through multiple segmentation lenses that reveal where demand is most pronounced and where strategic investments are concentrated. When viewed by service type, Clinical Trial Services continues to dominate, supported by robust Phase I through Phase IV programs that are increasingly decentralized and data-driven. Consulting Services have evolved beyond traditional strategic advisory to include M&A advisory, comprehensive market access and reimbursement consulting, portfolio optimization, and strategic consulting that aligns with emerging regulatory frameworks. In Manufacturing Services, a proliferation of capabilities from API production and full-scale CDMO offerings to specialized fill-finish, formulation development, packaging and labeling, as well as scale-up and tech transfer, speaks to sponsors’ desire for end-to-end development pathways.

Parallel to these, Preclinical Services comprise animal studies, bioanalytical testing, DMPK assessments, pharmacology studies, and toxicology testing, each gaining importance as sponsors seek rapid proof-of-concept and safety profiles. Quality Management Services underpin all phases of development, ensuring compliance, audit readiness, and continuous improvement across the product lifecycle. Regulatory Affairs Services have expanded to cover agency communication and representation, dossier preparation, labeling and packaging compliance, pharmacovigilance and safety monitoring, and strategic submissions planning. The Research & Development Services segment, encompassing assay development, biomarker discovery, lead identification and optimization, as well as target validation, underscores the critical role of early-stage innovation.

Turning to outsourcing modes, the Full-Service Outsourcing model remains the preferred choice for large-scale, end-to-end programs, while the Functional Service Provider model gains traction for targeted expertise in discrete areas. Tactical and project-based arrangements offer sponsors agility for one-off or supplemental initiatives that fall outside core partnerships. When assessing company size, large enterprise sponsors continue to leverage deep pockets for multi-region, multi-phase engagements, and small to medium enterprises prioritize cost efficiency and specialized support, often selecting niche providers for targeted activities. Therapeutic area segmentation highlights Oncology and Rare Diseases as high-growth focus areas, while Cardiovascular, Immunology, Neurology, Infectious Diseases, and Metabolic Disorders maintain significant activity. Pediatrics, Dermatology, Gastroenterology, and Respiratory segments round out the therapeutic portfolio, reflecting broad-based R&D pipelines.

Finally, looking at service provider types, Consulting Firms differentiate on thought leadership and strategic advisement, CDMOs and CMOs offer scalable manufacturing and development resources, CROs deliver comprehensive trial management and data analysis, Data Management and IT Service Providers enable cloud-based platforms and advanced analytics solutions, and Regulatory Affairs Firms bring specialized expertise in navigating global compliance landscapes. This multifaceted segmentation framework reveals how sponsors and providers align capabilities to meet the evolving demands of the biotech and pharmaceutical services outsourcing market.

This comprehensive research report categorizes the Biotechnology & Pharmaceutical Services Outsourcing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Mode of Outsourcing

- Company Size

- Therapeutic Area

- Service Provider Type

Examining regional dynamics across the Americas, Europe, Middle East, Africa, and Asia-Pacific driving differential growth trajectories in outsourced biotech services

Distinct regional dynamics are influencing growth trajectories in the outsourcing industry. In the Americas, North America leads with robust investment in R&D infrastructure, proximity to regulatory agencies, and a thriving ecosystem of biotechnology hubs. Sponsors leverage local contract research and manufacturing capabilities for rapid program initiation, while nearshore markets in Latin America provide cost-effective clinical trial sites and specialized back-office services.

Europe, the Middle East, and Africa present a mosaic of regulatory frameworks and market maturities. Western Europe continues to benefit from established manufacturing clusters and harmonized regulatory standards, while emerging markets in Eastern Europe, the Middle East, and North Africa provide access to diverse patient populations and favorable cost structures. Strategic collaborations between regional CROs and global sponsors have enabled proof-of-concept studies that capitalize on these emerging geographies.

In the Asia-Pacific region, rapid expansion is fueled by growing government incentives for biotech innovation, improving regulatory harmonization, and the emergence of world-class service providers. China, India, Japan, and Australia have built comprehensive outsourced capabilities across trial management, small molecule production, and biologics manufacturing. As a result, many sponsors adopt a dual-sourcing strategy that balances established Western partners with high-capacity, lower-cost providers in Asia-Pacific to optimize both cost and speed to market.

This comprehensive research report examines key regions that drive the evolution of the Biotechnology & Pharmaceutical Services Outsourcing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing strategic profiles of leading service providers whose innovations, collaborations, and business models are reshaping the competitive biotech outsourcing landscape

Leading service providers have adopted distinct strategies to capture value in this dynamic market. Several established contract research organizations have enhanced their portfolios through strategic acquisitions of niche technology firms, uniting traditional trial management strength with digital patient engagement platforms. In parallel, select CDMOs have invested in single-use bioreactor technologies and continuous manufacturing systems, offering sponsors unprecedented flexibility in scale-up and modular production.

Data-centric providers have emerged as crucial partners by offering integrated eClinical solutions, real-world evidence platforms, and advanced safety monitoring dashboards. Their ability to fuse multiple data streams and deliver predictive analytics has become a key differentiator in long-term collaborations. Meanwhile, specialized regulatory affairs firms have deepened their expertise in cross-border submissions, digital labeling compliance, and post-market safety surveillance, addressing the growing complexity of global regulatory requirements.

Additionally, a cohort of mid-sized niche players has prospered by focusing on underserved therapeutic domains or offering highly tailored functional services. By aligning their capabilities with rare disease pipelines or gene therapy projects, these providers have carved out profitable segments. Taken together, these strategic profiles underscore how innovation, targeted investment, and collaborative business models are redefining competitive positioning across the outsourcing landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biotechnology & Pharmaceutical Services Outsourcing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AmerisourceBergen Corporation

- Catalent, Inc.

- CEVA Logistics AG

- Charles River Laboratories, Inc.

- Concept Heidelberg GmbH

- Curia Global, Inc.

- Dalton Pharma Services by Seikagaku Corporation

- DHL International GmbH

- Eurofins Scientific (Ireland) Limited

- Evotec SE

- GenScript Biotech Corporation

- Icon PLC

- IQVIA HOLDINGS, INC.

- Laboratory Corporation of America Holdings

- Lachman Consultant Services, Inc.

- McKesson Corporation by Aurelius Group

- Medpace Holdings, Inc.

- Parexel International Corporation

- Syneos Health, Inc.

- Thermo Fisher Scientific Inc.

- WuXi AppTec Co., Ltd.

Presenting recommendations to empower executives with actionable steps for maximizing operational efficiency and driving innovation in outsourced biotech services

To thrive amidst evolving market conditions, industry leaders should pursue a three-fold approach centered on digital integration, strategic diversification, and collaborative innovation. First, adopting unified data platforms and interoperable analytics tools will enhance decision-making speed and accuracy, enabling sponsors to proactively manage risk and optimize resource allocation.

Next, diversifying the supplier base across regions, service models, and therapeutic expertise can mitigate geopolitical and tariff-related risks. By maintaining both full-service partnerships and functional service arrangements, organizations can flexibly scale activities and capture cost efficiencies without sacrificing quality or timelines. Scenario planning exercises should be leveraged to stress-test supply chain resiliency and tariff-impact scenarios.

Finally, fostering co-innovation through joint R&D initiatives, shared-risk financing models, and strategic alliances will position sponsors and providers to capitalize on breakthrough modalities. Engaging in early-stage collaboration with innovative contract organizations and technology incubators can accelerate proof-of-concept efforts in emerging areas such as cell therapy and digital endpoints. This integrated approach will enable industry leaders to maximize operational efficiency while driving sustained innovation across the outsourcing continuum.

Outlining rigorous research methodology that integrates primary interviews, secondary data analyses, and statistical techniques to ensure robust and validated industry insights

This study employs a multi-stage research methodology designed to ensure rigorous validation and comprehensive coverage. Initially, secondary research was conducted across scientific journals, regulatory publications, industry white papers, and select public filings to establish foundational knowledge of market trends, technological developments, and policy changes. Insights gleaned from this phase informed the development of interview guides for primary engagement.

Subsequently, extensive primary interviews were undertaken with senior executives from sponsor organizations, service providers, technology innovators, and regulatory experts. These discussions explored strategic imperatives, operating model adaptations, and regional considerations. Synthesized interview findings were cross-verified with secondary data and triangulated against financial performance indicators where available.

Finally, quantitative analyses-including growth rate calculations, cost impact simulations, and scenario modeling-were applied to key parameters such as tariff adjustments, outsourcing mix shifts, and technology adoption metrics. A series of expert panel reviews and validation workshops ensured alignment of assumptions and robustness of conclusions, resulting in actionable insights for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biotechnology & Pharmaceutical Services Outsourcing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biotechnology & Pharmaceutical Services Outsourcing Market, by Service Type

- Biotechnology & Pharmaceutical Services Outsourcing Market, by Mode of Outsourcing

- Biotechnology & Pharmaceutical Services Outsourcing Market, by Company Size

- Biotechnology & Pharmaceutical Services Outsourcing Market, by Therapeutic Area

- Biotechnology & Pharmaceutical Services Outsourcing Market, by Service Provider Type

- Biotechnology & Pharmaceutical Services Outsourcing Market, by Region

- Biotechnology & Pharmaceutical Services Outsourcing Market, by Group

- Biotechnology & Pharmaceutical Services Outsourcing Market, by Country

- United States Biotechnology & Pharmaceutical Services Outsourcing Market

- China Biotechnology & Pharmaceutical Services Outsourcing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing critical findings and future considerations across evolving biotech outsourcing dynamics to guide decision-makers toward strategic value creation

The convergence of advanced therapeutics, digital technologies, and evolving regulatory frameworks has irrevocably transformed the biotechnology and pharmaceutical services outsourcing market. Organizations that embrace integrated, data-enabled models will outpace competitors by accelerating program timelines and optimizing cost structures. Strategic segmentation analysis reveals that diversified service portfolios and flexible outsourcing models are critical to addressing the varied needs of small and large sponsors alike.

Moreover, regional diversification and tariff mitigation strategies will remain essential to supply chain resilience in a dynamic policy environment. Leading service providers are responding by expanding domestic capabilities and forging cross-border alliances, underscoring the value of agility and partnership. Ultimately, the principles of co-innovation, shared risk, and transparent collaboration will define the high-performing ecosystems of tomorrow.

As the industry continues to adapt to new modalities and regulatory paradigms, decision-makers must remain vigilant in identifying emerging hotspots of innovation and potential bottlenecks. By leveraging the insights and recommendations presented here, organizations can chart a strategic path that balances operational excellence with breakthrough discovery.

Connect with Ketan Rohom to unlock comprehensive strategic insights and secure your customized market research report on biotech and pharmaceutical outsourcing services

We welcome collaboration and engagement to address your specific research requirements. Ketan Rohom, Associate Director of Sales & Marketing, is available to guide you through the breadth and depth of the report’s insights. By connecting with Ketan, you can explore tailored deliverables, unlock proprietary analyses, and ensure your organization gains a competitive edge. Reach out today to discuss licensing options, customized data extractions, and ongoing advisory support, and take decisive steps toward advancing your strategic initiatives in biotechnology and pharmaceutical outsourcing services

- How big is the Biotechnology & Pharmaceutical Services Outsourcing Market?

- What is the Biotechnology & Pharmaceutical Services Outsourcing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?