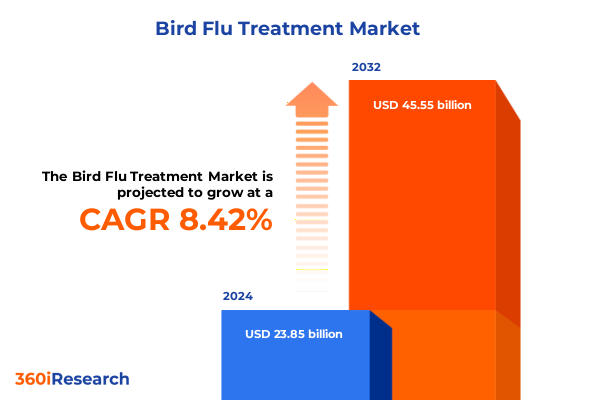

The Bird Flu Treatment Market size was estimated at USD 25.86 billion in 2025 and expected to reach USD 28.05 billion in 2026, at a CAGR of 8.42% to reach USD 45.55 billion by 2032.

Understanding the Complexities of Avian Influenza Treatment Strategies and Their Role in Mitigating Escalating Global Health Risks

Avian influenza continues to present an escalating threat to global health security, requiring a nuanced understanding of therapeutic approaches across drug, diagnostic, vaccine, and supportive care domains. The introduction of novel antiviral compounds, advanced molecular diagnostic tools, and next-generation vaccines underscores the complexity inherent in developing comprehensive intervention strategies. As zoonotic spillovers become more frequent due to intensifying interactions between humans and poultry, stakeholders must appreciate the intricate interplay between pathogen evolution, regulatory policy, and supply chain resilience. This section provides a foundational overview of the technical and logistical challenges that inform current treatment frameworks and the critical imperatives driving research, development, and deployment of effective countermeasures.

The burden of avian influenza extends beyond clinical outcomes, encompassing agricultural stability, public health preparedness, and international trade considerations. Recent outbreaks have underlined the need for rapid detection, timely therapeutic intervention, and prophylactic vaccination campaigns. Consequently, industry participants are channeling investments into diverse modalities, ranging from combination antiviral regimens to mRNA-based vaccine platforms. Simultaneously, health systems are integrating telehealth monitoring and point-of-care testing capabilities to reduce diagnostic turnaround times and optimize patient management pathways. This introduction establishes the context for dissecting the transformative shifts, tariff-driven cost pressures, segmentation intricacies, and regional nuances that collectively shape the evolving avian influenza treatment landscape.

How Technological Breakthroughs and Evolving Therapeutics Are Reshaping the Avian Influenza Treatment Paradigm for Future Preparedness

Over the past several years, the avian influenza treatment ecosystem has undergone profound transformations fueled by breakthroughs in molecular biology and precision medicine. The advent of polymerase inhibitors, which target the viral replication machinery at its core, represents a departure from traditional neuraminidase inhibitors and adamantanes, offering renewed hope against resistant strains. Concurrently, diagnostic innovation has moved from centralized laboratory testing toward decentralized molecular assays and rapid antigen platforms, dramatically shrinking the interval between specimen collection and actionable results. These advances not only accelerate clinical decision making but also support dynamic surveillance systems capable of early outbreak detection and containment.

Beyond pharmacological and diagnostic breakthroughs, the emergence of mRNA and recombinant vaccine technologies has redefined prophylactic strategies for avian influenza. Unlike inactivated or live attenuated vaccines that rely on established production pipelines, mRNA vaccines can be designed and synthesized with unprecedented speed, enabling prompt responses to antigenic drift. Moreover, the integration of nanoparticle delivery systems for injectable formulations and smart infusion pumps for intravenous supportive care illustrates a broader trend toward precision administration. As a result, healthcare providers can tailor treatment regimens to patient-specific factors, optimize dosing schedules, and minimize adverse effects. These converging innovations collectively presage a new era of preparedness in which agility and personalization underpin the global response to avian influenza threats.

Assessing the Far-Reaching Effects of 2025 United States Tariff Measures on the Supply Chain, Cost Structures, and Accessibility of Avian Influenza Treatments

The introduction of a new tranche of tariffs by the United States in early 2025 has exerted palpable pressure on the avian influenza treatment supply chain, particularly for key active pharmaceutical ingredients and specialized diagnostic reagents sourced from major international producers. Manufacturers dependent on cost-competitive imports have faced escalating raw material expenses, prompting reevaluation of sourcing strategies and contract renegotiations. This shift has had downstream consequences on pricing structures for antiviral drugs such as neuraminidase inhibitors and combination therapies, as well as on the cost of molecular diagnostic kits that leverage proprietary enzymes and reagents.

In response to these cost headwinds, corporate entities have pursued dual approaches involving supply chain diversification and localized manufacturing partnerships. Some have accelerated investments in domestic production capabilities to mitigate tariff exposure, while others have engaged with government agencies to secure tariff exclusions or waivers for critical health-security materials. Nonetheless, logistical constraints and capacity limitations within the United States have underscored the challenges of rapidly scaling up local facilities. As a result, stakeholders must balance cost containment with the imperative to ensure uninterrupted access to essential treatment modalities, all while navigating the evolving policy landscape of 2025 and beyond.

Unveiling Critical Dimensions of the Avian Influenza Treatment Market Through Comprehensive Product, Administration, End User, and Application Segmentation Analysis

A granular analysis of product type reveals that the antiviral drug segment maintains robust R&D momentum, driven by the need to outpace viral resistance mechanisms. This segment bifurcates into adamantanes, which provide a legacy mode of action yet exhibit diminished efficacy against contemporary strains; combination therapies that synergize distinct antiviral classes to enhance potency; neuraminidase inhibitors that inhibit viral release; and polymerase inhibitors that block replication at its genesis. Diagnostic kits similarly traverse a spectrum from advanced molecular diagnostics enabling high-throughput laboratory workflows to point-of-care molecular assays designed for near-patient testing, rapid antigen test kits offering immediate preliminary screening, and serological diagnostics that support epidemiological assessments of exposure.

Delving into administration route, inhalation therapies delivered via dry powder inhalers, metered dose inhalers, or nebulizer platforms facilitate direct pulmonary targeting, an approach particularly effective for acute respiratory infections. Injectable formulations encompass intramuscular injections, cutting-edge nanoparticle delivery systems, and subcutaneous options, each tailored to optimize bioavailability and patient compliance. Intravenous delivery through central or peripheral lines and emerging smart infusion pump technologies ensures precise dosing in critical care scenarios. Meanwhile, oral dosage forms-including capsules, sublingual tablets, suspensions, and conventional tablets-continue to represent the most accessible and widely adopted mode, laying the foundation for outpatient and prophylactic uses.

Considering end-user segmentation, clinical settings ranging from community health centers to specialty outpatient clinics leverage rapid diagnostics and oral antivirals for early intervention, whereas hospitals-both private and public, along with specialized care centers-prioritize intravenous therapies, intensive supportive care, and confirmatory molecular testing. Laboratories, whether hospital-affiliated or independent, serve as hubs for high-throughput sequencing and serological surveillance, while point-of-care testing units extend diagnostic reach beyond traditional facilities. Pharmacies, spanning retail, mail order, and digital platforms, play a critical role in dispensing oral antivirals, vaccines, and supportive care products, underscoring the importance of streamlined distribution channels.

In terms of application, the animal health domain addresses disease management in livestock, poultry operations, and wildlife populations, where vaccination campaigns and rapid field diagnostics mitigate zoonotic spillover risks. Conversely, the human health segment focuses on adult, geriatric, and pediatric patient cohorts, each with unique immunological profiles and treatment considerations. This dual-application framework highlights the interconnectedness of animal and human health imperatives, reinforcing the One Health paradigm as a guiding principle for comprehensive avian influenza interventions.

This comprehensive research report categorizes the Bird Flu Treatment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Administration Route

- End User

- Application

Key Regional Dynamics Driving Avian Influenza Treatment Adoption Across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

The Americas region continues to lead in the adoption of advanced avian influenza treatments, bolstered by robust public health infrastructure and significant R&D investment in both antiviral therapeutics and diagnostic innovations. The United States, in particular, has prioritized the expansion of domestic manufacturing capacity and the integration of telehealth platforms to support remote monitoring of patients receiving outpatient therapies. Meanwhile, Canada’s coordinated surveillance networks facilitate early detection, and Latin American nations are increasingly participating in cross-border partnerships to enhance vaccine coverage in poultry and wildlife.

In Europe, Middle East, and Africa, diverse regulatory environments and heterogeneous healthcare systems present both opportunities and challenges. The European Union’s centralized approval processes for vaccines and novel antiviral agents streamline market entry, while Middle Eastern countries are investing in strengthening laboratory networks to enable rapid molecular diagnostics. In Africa, endemic poultry farming and wildlife interactions necessitate scalable field-deployable tests and accessible vaccine formulations. Regional initiatives aimed at harmonizing standards and pooling procurement efforts are gradually improving access to essential treatments across varied contexts.

The Asia-Pacific landscape is characterized by a dual focus on cutting-edge innovation and mass-market deployment. China and India dominate manufacturing output for generic antivirals and diagnostic reagents, often at lower cost points, yet stringent regulatory requirements for newer modalities such as mRNA vaccines can delay market introduction. Southeast Asian nations, facing recurrent avian influenza outbreaks, are adopting collaborative manufacturing consortia to ensure timely vaccine production and equitable distribution. In Australia and New Zealand, strategic stockpiling of combination therapies and advanced diagnostic platforms reflects a proactive stance toward potential zoonotic flare-ups.

This comprehensive research report examines key regions that drive the evolution of the Bird Flu Treatment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Movements and Collaborative Ventures Shaping Leadership Positions Among Pioneers in Avian Influenza Treatment Development and Distribution

Leading pharmaceutical and biotechnology firms are repositioning their portfolios to capture emerging opportunities in the avian influenza treatment space. Several global drug developers have entered strategic alliances with diagnostic specialists to co-develop companion tests that ensure the precise calibration of antiviral regimens. At the same time, established vaccine manufacturers are exploring joint ventures with biotech startups to leverage mRNA and recombinant platforms, accelerating the transition from proof-of-concept to commercial deployment.

Diagnostic companies are forging partnerships with telehealth providers to create integrated platforms that combine at-home sample collection with centralized laboratory analysis, effectively extending the reach of rapid detection capabilities. Concurrently, contract manufacturing organizations are expanding their capacities to accommodate complex therapies, including nanoparticle-based injectables and advanced point-of-care molecular assays. These convergent efforts underscore a broader trend toward collaborative ecosystems, in which cross-sector coordination and shared intellectual property arrangements facilitate accelerated development and streamlined regulatory pathways.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bird Flu Treatment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alltech, Inc.

- BioCryst Pharmaceuticals, Inc.

- Boehringer Ingelheim International GmbH

- Ceva Santé Animale

- Cipla Limited

- CSL Limited

- F. Hoffmann-La Roche Ltd.

- FATRO S.p.A.

- Gilead Sciences, Inc.

- GlaxoSmithKline PLC

- Hester Biosciences Limited

- Johnson & Johnson Services, Inc.

- Macleods Pharmaceuticals Ltd

- Merck KGaA

- Moderna, Inc.

- Novartis AG

- PetSmart LLC

- Pfizer Inc.

- Sanofi S.A.

- Serum Institute of India Pvt. Ltd.

- Sinovac Biotech Ltd.

- Takeda Pharmaceutical Company Limited

- Tianjin Ringpu Biotechnology Co. Ltd.

- Yebio Bioengineering Co. Ltd.

- Zoetis Inc.

Actionable Industry Imperatives for Optimizing Production, Distribution, and Innovation in Avian Influenza Treatment Solutions Amidst Emergent Challenges

Industry leaders should prioritize diversification of their supplier networks to mitigate risks associated with concentrated manufacturing footprints and evolving tariff regimes. Establishing regional production hubs closer to key demand centers can reduce lead times and enhance resilience against geopolitical disruptions. Simultaneously, investing in modular manufacturing technologies permits rapid retooling of facilities to accommodate emerging therapeutics, such as next-generation polymerase inhibitors and novel vaccine constructs.

To capitalize on the promise of precision medicine, companies must deepen collaborations with academic institutions and government research bodies, fostering early-stage discovery of antiviral candidates tailored to conserved viral targets. Strengthening regulatory engagement through proactive dialogue and data sharing can expedite approval processes, particularly for innovative platforms like mRNA. Additionally, expanding telehealth-enabled service models will support decentralized monitoring of treatment adherence, enabling real-time adjustments to dosing regimens and improving patient outcomes. Finally, embracing the One Health framework by integrating animal health strategies with human therapeutic programs will not only curb zoonotic transmission but also unlock synergies in vaccine development and deployment.

Rigorous Research Approach Combining Expert Interviews, Secondary Data Synthesis, and Triangulation to Ensure Robust Insights into Avian Influenza Treatment Trends

This report synthesizes insights derived from a rigorous methodological framework that integrates both primary and secondary research phases. During the secondary research phase, peer-reviewed scientific literature, regulatory filings, patent registries, and industry white papers were systematically reviewed to establish baseline trends and emerging technological themes. Building upon this foundation, a series of in-depth interviews with key opinion leaders-including infectious disease specialists, regulatory authorities, and supply chain executives-provided qualitative perspectives on market drivers, barriers, and strategic priorities.

Data triangulation was employed to validate quantitative observations, cross-referencing findings from proprietary company reports, clinical trial registries, and government databases. Expert panel discussions were convened to challenge preliminary conclusions and ensure robustness of actionable insights. The combination of iterative hypothesis testing, stakeholder validation, and comprehensive data integration underpins the credibility of the strategic recommendations presented herein, offering decision-makers a clear line of sight on the latest advancements and future trajectories in avian influenza treatment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bird Flu Treatment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bird Flu Treatment Market, by Product Type

- Bird Flu Treatment Market, by Administration Route

- Bird Flu Treatment Market, by End User

- Bird Flu Treatment Market, by Application

- Bird Flu Treatment Market, by Region

- Bird Flu Treatment Market, by Group

- Bird Flu Treatment Market, by Country

- United States Bird Flu Treatment Market

- China Bird Flu Treatment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3021 ]

Synthesis of Key Insights and Strategic Considerations Underlining the Imperative to Accelerate Innovation and Collaboration in Avian Influenza Treatment Efforts

In conclusion, the avian influenza treatment landscape is entering a pivotal phase characterized by rapid innovation and heightened geopolitical complexity. The confluence of polymerase inhibitor development, advanced diagnostic decentralization, and mRNA vaccine platforms presents unprecedented opportunities to enhance global preparedness. However, emerging tariff structures, supply chain vulnerabilities, and regional disparities necessitate strategic agility and proactive collaboration across public, private, and academic sectors.

As stakeholders navigate this multidimensional environment, the imperative to align animal health and human health initiatives under a unified One Health paradigm has never been clearer. By embracing integrated approaches to manufacturing, distribution, and regulatory engagement, organizations can not only mitigate immediate outbreak risks but also foster sustainable resilience against future viral threats. This report’s insights and recommendations seek to equip decision-makers with the knowledge required to drive transformative action and secure a safer global health ecosystem.

Engage with Ketan Rohom to Secure the Definitive Market Intelligence Report on Avian Influenza Treatment and Drive Strategic Decision Making

To explore the insights detailed in this report and equip your organization with actionable intelligence on avian influenza treatment innovations and market dynamics, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to discuss purchasing options and customizable research solutions.

- How big is the Bird Flu Treatment Market?

- What is the Bird Flu Treatment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?