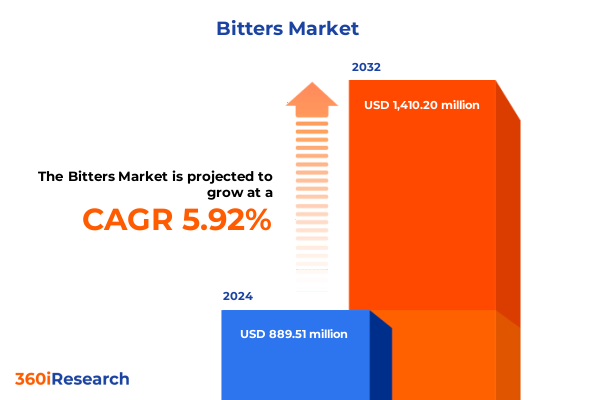

The Bitters Market size was estimated at USD 939.76 million in 2025 and expected to reach USD 993.42 million in 2026, at a CAGR of 5.96% to reach USD 1,410.20 million by 2032.

Setting the Stage for Bitters in Modern Mixology: Unveiling Origins, Evolution, and Core Market Dynamics for Industry Stakeholders

The bitters market traces its roots to centuries-old apothecary traditions, where herbal infusions were crafted to aid digestion and elevate medicinal tonics. Over time, these concentrated botanical blends found a natural pairing with spirits, offering cocktail artisans a tool to balance flavors, add complexity, and imbue drinks with layered aromatic profiles. As consumer palates have grown more sophisticated, bitters have evolved from niche bar ingredients into a vibrant category of their own, appealing to both home mixologists and premium beverage producers.

Revolutionary Forces Redefining the Bitters Landscape with Technological, Sustainability, and Consumption Patterns Driving Lasting Change

In recent years, the bitters landscape has undergone seismic shifts driven by consumer demand for authenticity, environmental stewardship, and digital convenience. Bars and brands are embracing elevated simplicity, crafting cocktails with fewer, higher-quality components that place bitters at the forefront of flavor formulation. Sustainability has likewise become a defining criterion, with upcycled botanicals and transparent supply chains reshaping product narratives and securing consumer trust.

Moreover, technology is introducing new frontiers: AI-powered flavor pairing engines and smart home mixing devices are enabling personalized bitters experiences that bridge the gap between professional bars and at-home aficionados. Concurrently, the ready-to-drink segment is harnessing artisanal bitters to premiumize shelf-stable cocktails, marrying convenience with sophistication and extending bitters’ reach beyond traditional on-premise establishments.

Examining the Layered Consequences of 2025 United States Tariff Policies on Bitters Supply Chains, Costs, and Import Dynamics

The introduction of new tariff structures in 2025 has added layers of complexity to bitters supply chains. A universal 10% duty on imports from non-exempt countries took effect in April 2025, immediately lifting base costs for flavored spirits, botanical extracts, and specialized ingredients used in bitters production. Just days later, reciprocal tariffs ranging from 11% to 50% began stacking on top of existing duties, pushing total levies on targeted imports as high as 145% for goods originating from China, while other countries face combined rates that can exceed 70%.

Dissecting the Bitter Market Through Type, Category, Packaging, Application, End-User, and Distribution Channel to Reveal Strategic Opportunities

Analysis through a multi-dimensional lens reveals distinct opportunities and challenges across key market segments. Aromatic, bean & nut, and citrus bitters each command unique flavor profiles and ingredient sourcing requirements, where innovations in botanical blends are expanding creative boundaries. Consumers continue to seek both cocktail-oriented applications and digestive formulations, underscoring bitters’ dual role as a flavor enhancer and wellness adjunct. Packaging choices vary widely, with traditional glass bottles coexisting alongside emergent can formats and Tetra Pak offerings designed for on-the-go consumption and sustainability considerations. The versatility of bitters extends to applications in beverages, culinary dishes, and even medicinal tonics, driving cross-category experimentation. In addition to commercial establishments such as bars and restaurants, home users are increasingly purchasing bitters for personal mixology, while distribution channels split between time-tested offline retail outlets and rapidly growing online platforms that facilitate direct-to-consumer engagement.

This comprehensive research report categorizes the Bitters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type Of Bitters

- Category

- Packaging Format

- Application

- End-User

- Distribution Channel

Highlighting Regional Distinctions and Emerging Opportunities in the Americas, Europe-Middle East-Africa, and Asia-Pacific Bitters Markets

Regional markets exhibit markedly different trajectories and consumer drivers. In the Americas, the United States remains the epicenter of craft cocktail innovation, fueling demand for both heritage brands and small-batch producers, while Latin American nations are integrating bitters into traditional beverages and street-food fare, enriching cultural drinking experiences. Across Europe, Middle East & Africa, centuries-old bitters traditions from Italy, Germany, and the United Kingdom support a robust heritage segment even as modern mixologists in metropolitan centers like London, Dubai, and Berlin experiment with novel botanical infusions. In Asia-Pacific, cities such as Tokyo, Singapore, and Hong Kong have emerged as global cocktail capitals thanks to a confluence of traditional ingredients, sustainability practices, and design-driven bar concepts that showcase bitters as an essential tool in the bartender’s repertoire.

This comprehensive research report examines key regions that drive the evolution of the Bitters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading and Emerging Bitters Producers to Illuminate Competitive Strategies, Collaborations, and Innovation Pathways

The competitive landscape features a blend of established beverage conglomerates and nimble specialty producers. Major spirits firms are incorporating signature bitters into broader portfolios, leveraging global distribution networks, while boutique brands are forging co-branding partnerships with distilleries and mixology academies to build niche followings. Craft pioneers focus on heritage recipes and small-batch processes, emphasizing artisanal credibility, whereas larger players invest in sustainability certifications and scalable production to meet rising demand. Collaborative ventures between distilleries and bitters houses are accelerating product diversification, and key acquisitions are reshaping market dynamics by bringing premium blends under the umbrella of global beverage brands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bitters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Angostura Limited

- Anton Riemerschmid Weinbrennerei & Likörfabrik GmbH & Co. KG

- Bitter & Barrel

- Bittercube

- Brown-Forman Corporation

- Cocktail Kingdom LLC

- DASHFIRE LLC

- El Guapo Bitters

- Fee Brothers, Inc

- Haus Alpenz USA

- Hella Cocktail Co.

- Hudson Standard Alliance, LLC

- Infuse Spirits Group, LLC.

- Jack Rudy Cocktail Co.

- Ms Betters US

- Pernod Ricard SA

- Sazerac Company, Inc

- Scrappy’s Bitters

- Stock Spirits Group PLC

- Strongwater

- The Bitter Housewife

- The Bitter Truth GmbH

- The Cocktail Alchemist Limited

- Underberg AG

- Wines & Spirits Inc

Strategic Imperatives and Innovative Approaches for Industry Leaders to Capitalize on Growth Trends and Navigate Market Complexities

Industry leaders should prioritize transparent, traceable sourcing of botanical ingredients, partner with regenerative agriculture initiatives, and champion refillable packaging models to align with evolving eco-conscious consumer values. Embracing digital platforms for personalized flavor design and expanding direct-to-consumer channels will elevate brand engagement and capture value beyond traditional distribution. Additionally, forging alliances with on-premise establishments and culinary influencers can amplify bitters’ role in experimental menus and limited-edition collaborations. Policymakers and trade associations must also actively engage in tariff advocacy to mitigate escalating import costs and safeguard ingredient diversity. Cultivating a balanced portfolio of classic and innovative bitters formulations will enable businesses to adapt swiftly to shifting consumer tastes and regulatory developments.

Comprehensive Methodological Framework Outlining Data Collection, Validation, and Analytical Techniques Supporting Our Bitters Market Analysis

This analysis integrates qualitative insights and quantitative data through a rigorous, multi-stage research process. Initial secondary research encompassed a comprehensive review of trade publications, regulatory announcements, and industry databases to identify prevailing market drivers and barriers. Primary research involved structured interviews with botanical suppliers, bitters producers, mixologists, and distribution channel leaders to validate assumptions and capture real-world perspectives. Data triangulation techniques were employed to reconcile discrepancies across sources, while segmentation frameworks were applied to ensure nuanced understanding across product types, end-users, and geographies. Analytical modeling and expert reviews were conducted to pinpoint key trends, competitive dynamics, and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bitters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bitters Market, by Type Of Bitters

- Bitters Market, by Category

- Bitters Market, by Packaging Format

- Bitters Market, by Application

- Bitters Market, by End-User

- Bitters Market, by Distribution Channel

- Bitters Market, by Region

- Bitters Market, by Group

- Bitters Market, by Country

- United States Bitters Market

- China Bitters Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Critical Findings to Reinforce Strategic Imperatives, Market Outlook, and the Transformative Potential of the Bitters Industry

Bitters stand at the intersection of heritage craftsmanship and contemporary innovation, offering a versatile ingredient platform poised for continued expansion. The convergence of sustainability, digital customization, and evolving regulatory landscapes underscores the need for agile strategies that balance artisanal authenticity with scalable growth. As market participants navigate tariff headwinds and intensifying competition, those who invest in transparent sourcing, collaborative partnerships, and consumer-centric product design will unlock new avenues for differentiation. Collectively, these insights lay the groundwork for informed decision-making and underscore bitters’ transformative potential across beverages, culinary applications, and beyond.

Connect with Ketan Rohom to Unlock the Full Insights of the Bitters Market Research Report and Accelerate Your Strategic Advantage

Ready to delve deeper into the trends, drivers, and strategic imperatives shaping the bitters market?

Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure your comprehensive market research report and gain a competitive edge.

Connect today to transform insights into action and drive growth in your portfolio of bitters products.

- How big is the Bitters Market?

- What is the Bitters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?