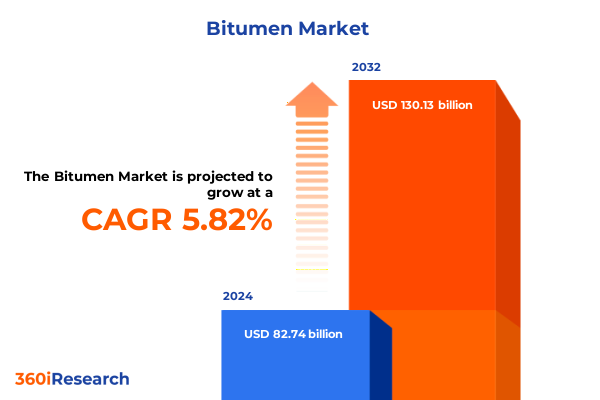

The Bitumen Market size was estimated at USD 82.74 billion in 2024 and expected to reach USD 87.36 billion in 2025, at a CAGR of 5.82% to reach USD 130.13 billion by 2032.

Unveiling the Underlying Forces and Fundamental Drivers Shaping the Bitumen Industry’s Role in Modern Construction and Energy Infrastructure

Bitumen, a viscous hydrocarbon derivative produced from the distillation of crude oil, has long been recognized as a cornerstone material in constructing and maintaining critical infrastructure worldwide. As an adhesive and waterproofing agent, it serves as the quintessential binder in asphalt pavements, ensuring durability and resilience under heavy traffic and diverse environmental conditions. Beyond its traditional applications in roadways, bitumen’s versatility extends to roofing membranes, sound and thermal insulation, industrial coatings, and sealants, illustrating its multifaceted role across construction, automotive, and energy sectors.

In recent years, escalating infrastructure investments, particularly in emerging and mature economies, have intensified demand for high-performance binders capable of withstanding temperature extremes and heavy loading. Moreover, as urbanization accelerates and redevelopment projects proliferate, stakeholders increasingly prioritize materials that balance long-term performance with environmental compliance. Consequently, innovators have directed efforts toward enhancing bitumen formulations through additive inclusion, polymer modification, and crumb rubber technologies.

Looking ahead, the industry must navigate a complex interplay of regulatory imperatives, raw material availability, and shifting consumer preferences toward sustainable solutions. As environmental standards tighten and circular economy principles gain traction, producers and end-users alike will seek advanced bitumen products that deliver superior performance while minimizing carbon footprints and facilitating end-of-life recyclability.

Navigating the Emerging Paradigm Shifts That Are Redefining Bitumen Production Processes Sustainability and Technological Integration Across the Industry

The bitumen landscape has witnessed transformative shifts as emerging technologies and evolving sustainability targets redefine traditional production and application paradigms. Digitalization initiatives now enable real-time monitoring of supply chains and production lines, resulting in improved operational efficiencies and tighter integration between refineries and end-use facilities. Simultaneously, advanced analytics and predictive maintenance tools have reduced downtime, optimized batch consistency, and accelerated the development of customized formulations tailored to specific performance criteria.

Furthermore, sustainability concerns have propelled bio-based and recycled content into the spotlight, driving research into renewable feedstocks and post-consumer crumb rubber reintegration. These eco-conscious practices not only reduce dependency on virgin hydrocarbons but also align with global commitments to lower greenhouse gas emissions and adhere to circular economy principles. As a result, manufacturers invest in pilot programs to validate the lifecycle benefits and long-term durability of alternative bitumen blends.

Transitioning from reactive to proactive regulatory engagement has also marked a significant industry evolution. Producers now collaborate with policymakers and standards organizations to shape guidelines that balance performance requirements with environmental safeguards. This shift fosters a collaborative ecosystem in which innovation thrives, enabling the bitumen market to adapt swiftly to new mandates without compromising on quality or scalability.

Examining the Comprehensive Consequences of the Latest United States Trade Tariffs on Bitumen Imports and Supply Chain Resilience Through 2025

In 2025, the United States enacted revised import tariffs targeting specific bitumen grades imported from key supply regions, augmenting existing measures designed to protect domestic producers. These adjustments, classified under the Harmonized Tariff Schedule, introduced incremental duties on oxidized and polymer modified variants, effectively narrowing cost differentials with locally sourced alternatives. Consequently, end-users in the paving and waterproofing segments faced elevated input costs, prompting procurement teams to explore alternative sourcing strategies and renegotiate supply agreements.

Moreover, the tariff escalation exerted pressure on multinational integrators that rely on transshipment hubs in the Americas, compelling a reevaluation of logistical networks. Shipping routes were optimized to minimize port duties, while some players diverted imports through tariff-exempt zones or leveraged free trade agreements to mitigate financial burdens. Despite these adaptive measures, smaller contractors and niche applicators encountered tighter margin constraints, leading many to adjust pricing models or scale back expansion plans in regions most affected by duty realignment.

As a result, alliances between domestic refiners and international bitumen specialists gained prominence, fostering joint ventures that secure tariff-free production or local blending facilities. These collaborative efforts not only circumvent punitive duties but also enhance supply resilience and shorten lead times. Looking forward, the cumulative impact of these tariff changes underscores the need for proactive trade compliance strategies and dynamic supply chain configurations to maintain competitiveness in an increasingly tariff-sensitive environment.

Uncovering Segmentation-Driven Perspectives on Product Varieties Applications and Distribution Modalities That Shape Bitumen Market Dynamics

A nuanced examination of the bitumen market reveals that product type differentiation plays a critical role in shaping competitive landscapes and end-user adoption patterns. Commodity bitumen, encompassing emulsions, cutback formulations, oxidized grades, and paving-specific binders, continues to dominate traditional infrastructure applications due to its cost efficiency and proven performance history. Conversely, specialty grades-such as polymer modified blends, crumb rubber modified variants, industrial bitumen, and additive-enhanced compounds-are gaining traction in demanding environments where longevity and resilience are paramount.

In addition to product diversity, form factor analysis demonstrates that liquid bitumen provides greater ease of handling and compatibility with inline mixing systems, while solid grades offer enhanced storage stability and reduced risk of material segregation during transportation. Source variation further influences market dynamics, as naturally derived bitumen from crude extraction competes with synthetic alternatives produced via tailored processes, each presenting distinct viscosity profiles and environmental footprints.

Production processes also delineate market segments, with distilled grades serving as the backbone of conventional binders, oxidized products enabling higher temperature performance, and solvent extraction techniques yielding specialized formulations for industrial sealants. Grading classifications-penetration, performance, and viscosity-provide standardized benchmarks that guide specification compliance and quality assurance across projects. From a distribution standpoint, offline channels maintain strong relationships with large-scale construction firms, whereas online procurement platforms accelerate direct sourcing for emerging market participants. Finally, application segmentation underscores the multifaceted use cases spanning adhesives and sealants, insulation systems, roadways in airport and urban infrastructures, and comprehensive waterproofing solutions for roofs and building envelopes.

This comprehensive research report categorizes the Bitumen market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Source

- Production Process

- Distribution Channel

- Application

- End-User

Revealing Critical Regional Trends Shaping Bitumen Consumption Infrastructure Development and Regulatory Frameworks Across Global Market Hub Categories

The Americas region continues to leverage extensive highway networks and urban renewal initiatives to sustain demand for robust bitumen solutions, with federal infrastructure bills and state-level investments reinforcing procurement cycles for paving and waterproofing applications. In parallel, municipally funded airport expansions have prompted specialized requirements for high-performance polymer modified grades that resist rutting and thermal fatigue, elevating interest in collaborative partnerships between refiners and construction integrators.

Across Europe, the Middle East, and Africa, regulatory frameworks focused on emissions reduction and circular economy integration have catalyzed the adoption of recycled and bio-based bitumen products. Urban centers in Western Europe emphasize low-temperature performance and noise attenuation, fueling demand for crumb rubber modified and warm mix formulations. Meanwhile, mega-projects in the Gulf Cooperation Council countries drive interest in industrial-grade bitumen for large-scale infrastructure, despite stringent sustainability targets that encourage hybrid blends and pilot recycling schemes.

Within the Asia-Pacific corridor, rapid urbanization and expanding manufacturing hubs underpin steady growth in both commodity and specialty segments. Southeast Asian nations prioritize cost-effective cutback binders for rural road networks, whereas developed markets like Japan and Australia focus on advanced performance grades to extend pavement lifecycles in extreme climates. The region’s diverse climatic and regulatory conditions compel bitumen producers to maintain agile production capabilities and localized formulation expertise.

This comprehensive research report examines key regions that drive the evolution of the Bitumen market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Competitive Positioning of Leading Global Oil and Chemical Companies Advancing Bitumen Innovation and Market Influence

Industry leaders have adopted varied strategies to strengthen their market positions and drive innovation in bitumen production and applications. Major multinational oil and chemical companies have accelerated investments in polymer modification technologies, forming strategic alliances with specialty additive providers to expand their premium grade portfolios. These collaborations not only optimize performance attributes such as elasticity and adhesion but also facilitate faster commercialization cycles for next-generation binders.

Meanwhile, integrated refining conglomerates have pursued vertical integration, establishing in-house bitumen blending facilities adjacent to existing petrochemical complexes to achieve cost synergies and logistics efficiencies. This approach reduces dependency on external third-party suppliers and enhances responsiveness to shifting customer requirements across the adhesive, waterproofing, and road construction sectors. Additionally, select regional players have differentiated through sustainable initiatives, launching pilot programs that incorporate post-consumer crumb rubber or bio-based rejuvenators to meet evolving eco-label standards.

Strategic acquisitions and joint ventures have further reshaped competitive dynamics, enabling firms to penetrate high-growth markets and diversify distribution networks. By combining global R&D capabilities with local market expertise, these partnerships accelerate the diffusion of advanced formulations while mitigating trade barrier risks. Looking ahead, sustained emphasis on innovation pipelines and proactive regulatory engagement will determine leadership trajectories in an increasingly performance-driven and sustainability-focused bitumen ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bitumen market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agarwal Industrial Corporation

- Asia Bitumen

- Asphalt & Bitumen West Company

- Bouygues Group

- BP PLC

- Cemex, S.A.B. de C.V.

- Chevron Corporation

- China National Petroleum Corporation

- China Petrochemical Corporation

- ConocoPhillips Company

- ENEOS Holdings, Inc.

- Exxon Mobil Corporation

- Gazprom Group

- GOIL PLC

- Hindustan Petroleum Corporation Limited

- Indian Oil Corporation Limited

- Mangalore Refinery and Petrochemicals limited by ONGC Limited

- Marathon Petroleum Corporation

- Maruti Bitumen Pvt Ltd.

- Moeve

- MOL Hungarian Oil and Gas Company Plc

- NYNAS AB

- PJSC LUKOIL

- RAHA GROUP

- Repsol, S.A.

- Rosneft

- Saudi Arabian Oil Company

- Shell PLC

- TotalEnergies SE

- Tüpraş

- Vivasvanna Exports Private Limited

Delivering Actionable Strategic Recommendations to Enhance Operational Efficiency Sustainability and Competitive Advantage for Bitumen Industry Stakeholders

Industry participants should prioritize the integration of advanced digital platforms to enhance traceability and operational efficiency across the bitumen value chain. By deploying cloud-based analytics and blockchain-enabled supply chain tracking, organizations can achieve end-to-end visibility from crude feedstock procurement through final application delivery. Consequently, this digital backbone will facilitate more agile decision-making, reduce wastage, and optimize inventory levels.

Furthermore, a strategic shift toward hybrid production models-combining traditional refining with renewable feedstock pilot initiatives-can significantly reduce carbon intensity while fostering market differentiation. Investing in research that validates the performance and lifecycle benefits of recycled and bio-derived bitumen formulations will not only satisfy tightening regulatory standards but also unlock untapped segments focused on sustainable infrastructure development.

Finally, cultivating cross-sector partnerships with construction firms, municipal authorities, and research institutions will accelerate product adoption and co-create value beyond material supply. Collaborative frameworks can support joint demonstration projects and shared performance monitoring, delivering tangible proof of concept for specialized binders. By pursuing these actionable strategies, industry leaders will fortify their competitive positioning and drive resilient growth in a market defined by performance excellence and environmental stewardship.

Detailing the Rigorous Research Methodology Employed to Ensure Comprehensive Data Quality and Unbiased Insight Generation in Bitumen Market Analysis

This analysis employed a robust two-tier methodology combining exhaustive secondary research with targeted primary engagements to ensure data validity and insight depth. Initially, extensive literature reviews were conducted across technical journals, regulatory filings, patent databases, and industry white papers to map historical trends, material specifications, and regional policy frameworks. These secondary sources provided a comprehensive backdrop against which emerging technologies and regulatory shifts were contextualized.

Subsequently, in-depth interviews with senior executives, process engineers, and procurement specialists across refineries, construction conglomerates, and additive manufacturers enriched the data landscape with firsthand perspectives. This primary research phase facilitated direct validation of strategic initiatives and uncovered nuanced adoption barriers. All interviews adhered to a structured discussion guide to maintain consistency and comparability across stakeholder categories.

Finally, insights were triangulated through cross-verification of qualitative findings and quantitative benchmarks to minimize bias and ensure actionable accuracy. Data integrity was further reinforced through peer-review processes, with domain experts scrutinizing methodologies, assumptions, and thematic interpretations. This rigorous approach underpins the reliability of the analysis, equipping decision-makers with a clear, unbiased portrayal of the current and future bitumen market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bitumen market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bitumen Market, by Product Type

- Bitumen Market, by Form

- Bitumen Market, by Source

- Bitumen Market, by Production Process

- Bitumen Market, by Distribution Channel

- Bitumen Market, by Application

- Bitumen Market, by End-User

- Bitumen Market, by Region

- Bitumen Market, by Group

- Bitumen Market, by Country

- United States Bitumen Market

- China Bitumen Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Concluding Reflections on the Strategic Imperatives and Future Outlook of the Bitumen Market Amidst Evolving Global Infrastructure and Sustainability Priorities

Our comprehensive examination of the bitumen market underscores the critical convergence of performance requirements, sustainability imperatives, and trade policy dynamics as defining factors for future competitiveness. The interplay between evolving regulatory landscapes, particularly around emissions and recycling mandates, and technological advancements in polymer modification and digital integration will shape the next wave of product innovation.

As global infrastructure initiatives continue to expand, industry stakeholders must navigate regional nuances-from tariff structures and logistics constraints to climate-specific formulation demands-to secure resilient supply chains. Furthermore, the emerging emphasis on circular economy principles will redefine value chains, elevating recycled and bio-based inputs from niche offerings to mainstream solutions.

Ultimately, success in this sector hinges on the ability to align strategic investment with operational agility. Firms that proactively engage with policy makers, pioneer sustainable feedstock programs, and leverage digital capabilities are poised to lead a more efficient, environmentally responsible boom in bitumen applications. These core imperatives will guide market trajectories and foster resilient long-term growth within an increasingly complex global ecosystem.

Connect with Associate Director Ketan Rohom to Secure Tailored Bitumen Market Intelligence and Propel Strategic Decision-Making for Sustainable Growth

Unlock unparalleled access to comprehensive analysis on the evolving bitumen market by partnering with Ketan Rohom, the Associate Director specializing in Sales & Marketing. Engage directly to receive customized insights that address your organization’s unique challenges, spanning product innovation, regulatory shifts, and regional opportunities. By collaborating with a senior strategist deeply versed in market intricacies, you can accelerate your decision-making processes and secure a competitive edge. Act now to transform analysis into actionable strategy, ensuring you capitalize on emerging trends and mitigate risks in this dynamic sector. Reach out today to secure your copy of the full market research report and embark on a data-driven journey toward sustainable growth and resilient operations.

- How big is the Bitumen Market?

- What is the Bitumen Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?