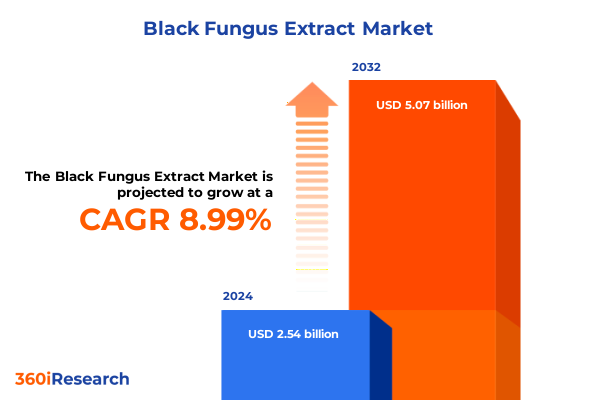

The Black Fungus Extract Market size was estimated at USD 2.77 billion in 2025 and expected to reach USD 3.00 billion in 2026, at a CAGR of 8.99% to reach USD 5.07 billion by 2032.

Exploring the Origins, Unique Bioactive Properties, and Expanding Applications of Black Fungus Extract That Are Shaping Modern Health and Wellness Markets

Black fungus extract, derived from the Auricularia auricula-judae species commonly known as wood ear mushroom, has been revered in traditional medicine for its high content of bioactive polysaccharides that promote wound healing through collagen synthesis and antioxidant properties. Recent in vitro and in vivo studies have confirmed that water-soluble polysaccharide-rich extracts accelerate fibroblast and keratinocyte migration, enhance collagen deposition, and mitigate ultraviolet-induced reactive oxygen species, paving the way for novel skin health applications.

Beyond dermatological benefits, emerging clinical research highlights the potential of tremella mushroom polysaccharides to support cognitive and metabolic health. A controlled human trial demonstrated significant improvements in short-term memory and executive function among participants receiving 600 to 1,200 milligrams of tremella extract daily over eight weeks, while animal studies suggest promising glycemic regulation properties that warrant further exploration in larger cohorts.

In parallel with its nutraceutical promise, black fungus extract has gained traction in the beauty industry as an innovative moisturizing and anti-aging ingredient. Investigations published in dermatological research journals reveal that tremella polysaccharides can increase endogenous collagen, elastin, and hyaluronic acid production in skin fibroblasts exposed to UVA radiation, offering hydration levels comparable to hyaluronic acid and supporting claims of photoprotective and anti-inflammatory benefits.

Identifying the Major Disruptions in Extraction Technology, Consumer Preferences, and Regulatory Standards Revolutionizing Black Fungus Extract Production

In recent years, the landscape of black fungus extract production has undergone significant transformation driven by advances in extraction technology. The development and validation of microwave-assisted extraction (MAE) protocols for mushroom phenolic compounds have demonstrated optimal yields with pure water solvents at 44 °C over ten minutes, delivering high recovery rates and precision while minimizing the reliance on organic solvents. This shift toward MAE underscores a broader industry trend favoring rapid, energy-efficient processes that elevate the bioactivity and consistency of final extracts.

Concurrently, sustainability and clean-label imperatives are reshaping sourcing and processing practices. Companies are increasingly adopting supercritical CO₂ and ultrasound-assisted extraction methods to align with consumer demand for transparent, eco-friendly botanical solutions. These green techniques not only reduce solvent usage and energy consumption but also resonate with evolving regulatory standards that emphasize responsible ingredient stewardship and supply chain traceability.

Moreover, pioneering research on ultrasonic-microwave vacuum drying and enzymatic treatments illustrates the potential to tailor the molecular weight and branching architecture of fungal polysaccharides, thereby optimizing functional attributes such as antioxidant potency and solubility. This granular control over extract quality stimulates innovation across nutraceutical, cosmetic, and pharmaceutical applications, positioning black fungus as a versatile ingredient in next-generation wellness formulations.

Analyzing the Far-Reaching Consequences of Evolving United States Tariff Policies in 2025 on Black Fungus Extract Importation and Supply Chains

Following a national emergency declaration on April 2, 2025, the U.S. imposed a universal 10 percent tariff on all imports, alongside elevated rates for strategic trade partners, resulting in effective duties exceeding 50 percent on Chinese-origin botanical goods. This unprecedented measure, implemented on April 5, 2025, was designed to counteract perceived trade imbalances but has directly escalated the cost base for black fungus extract importers who are subject to both Section 301 tariffs and the universal levy.

As reported by a major supplier of mushroom extracts, these compounded duties compel businesses to either absorb significant cost increases-thereby limiting resources for talent acquisition and innovation-or transfer the burden to end users through higher product prices. The dual pressures of heightened duties and supply chain reconfiguration underscore the critical need for policymakers and industry leaders to collaborate on tariff exclusion petitions, alternative sourcing strategies, and domestic production incentives to sustain market vitality.

Deriving Actionable Intelligence from Application, Form, Extraction Method, Distribution Channel, and Grade Segmentation of the Black Fungus Extract Market

In dissecting the application spectrum of black fungus extract, the ingredient exhibits versatile functionality across five key domains. In animal nutrition, specialized polysaccharide fractions target aquafeed, poultry, and swine diets to support gut integrity and growth performance. The cosmetic sector leverages fractionated components in creams, masks, and serums to harness antioxidant and anti-inflammatory benefits. Dietary supplement formulations capitalize on concentrated extract forms-capsules, powders, and tablets-to deliver standardized health-promoting doses. Within food and beverage innovations, black fungus imparts texturizing and nutritive enhancements to beverages and snack items. Pharmaceutical developers integrate extract fractions into capsules, syrups, and tablet forms, optimizing bioavailability and therapeutic profiling.

Considering physical presentation, powdered extracts dominate industrial use due to handling convenience and storage stability, while liquid and encapsulated forms gain traction within direct-to-consumer channels seeking ready-to-use solutions. Extraction methodologies reveal a landscape inclusive of enzymatic processes, microwave-assisted techniques, solvent variants-spanning ethanol, methanol, and water subtypes-and ultrasonic-assisted systems, each tailored to maximize yield and maintain bioactive integrity. Distribution pathways bifurcate into offline and online channels; traditional retail and wholesale outlets accommodate bulk industrial procurement, whereas brand websites and e-commerce platforms cater to consumer-facing sales. Finally, grade differentiation in the market distinguishes cosmetic, food, and pharmaceutical grades, reflecting stringent quality, purity, and regulatory specifications across end-use categories.

This comprehensive research report categorizes the Black Fungus Extract market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Extraction Method

- Form

- Grade

- Application

- Distribution Channel

Deciphering Regional Demand Nuances and Growth Drivers for Black Fungus Extract Across Americas, EMEA, and Asia-Pacific Territories

Across the Americas, particularly in the United States, import volumes of black fungus mushrooms reached approximately 374,650 kilograms in 2023, marking a 22.98 percent year-over-year increase as consumers embrace functional foods and nutraceutical supplements. This surge underscores North America’s growing appetite for novel bioactive ingredients that promise immune support and skin health benefits, driving formulators to incorporate black fungus extract into mainstream dietary and beauty products.

In Europe, Middle East, and Africa (EMEA), demand is fueled by stringent regulatory frameworks and elevated consumer expectations for organic and sustainably sourced ingredients. European cosmetics and dietary supplement brands are increasingly adopting black fungus extract to meet clean-label mandates and capitalize on its scientifically validated antioxidant properties. Regulatory bodies within the EU enforce rigorous quality standards, ensuring that cosmetic-grade extracts conform to safety and efficacy criteria before market approval, thereby enhancing consumer confidence in black fungus-infused products.

Within the Asia-Pacific region, China solidifies its position as the preeminent producer of Auricularia auricula, accounting for 98.58 percent of global exports with export values of $273 million in 2023. This dominant supply base benefits from advanced cultivation techniques and supportive agricultural policies, enabling manufacturers to access large volume, cost-competitive black fungus raw material. Simultaneously, emerging markets such as Japan, South Korea, and Southeast Asian nations are expanding domestic consumption, driven by traditional culinary use and a renaissance in functional food applications.

This comprehensive research report examines key regions that drive the evolution of the Black Fungus Extract market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Strengths, Operational Focus, and Collaborative Initiatives of Leading Black Fungus Extract Producers and Innovators

Nammex stands as a benchmark in certified organic mushroom extract supply, reporting utilization of more than 900 tons of dried organic mushrooms in 2024-surpassing total U.S. organic specialty mushroom production-and highlighting the scale of industry demand for reliable, traceable sourcing. By navigating evolving tariff landscapes and supply chain complexities, Nammex reinforces the strategic importance of vertically integrated operations and organic certification in the extraction sector.

Xi’an Sost Biotech Co., Ltd. exemplifies large-scale manufacturing excellence with over two decades of experience, three GMP-standard production bases, and a dedicated 1,000 square-meter R&D platform. The company’s product portfolio includes a 10:1 polysaccharide black fungus extract tested via UV spectroscopy, demonstrating their commitment to consistent quality and global distribution capabilities through both wholesale and online channels.

This comprehensive research report delivers an in-depth overview of the principal market players in the Black Fungus Extract market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- All Link Medical & Health Products Pte Ltd.

- Creative Enzymes

- Fungi Perfecti, LLC

- GreenHerb Biological Technology Co., Ltd

- Hawaii Pharm LLC

- Natural Remedies 4U Ltd T/A Natural Thrive

- Nutralion, Inc.

- Nutrient Innovations

- Shaanxi Zhongyi Kangjian Biotechnology Co., Ltd.

- The Shroom Shop

- Xi'an Laybio Natural Ingredients Co.,Ltd

- Xian Yuensun Biological Technology Co.,Ltd.

Formulating Practical Strategic Initiatives for Industry Leaders to Navigate Tariff Challenges, Harness Innovative Extraction, and Optimize Market Positioning

Industry leaders must prioritize adoption of advanced green extraction technologies to enhance yield efficiency and minimize environmental impact. Embracing microwave-assisted and ultrasound-assisted methods will not only optimize bioactive retention but also align with consumer demand for sustainable, clean-label ingredients. Investing in R&D to refine process parameters and validate extract standardization can differentiate product offerings in increasingly competitive markets.

Given the elevated tariff environment, companies should proactively engage in policy advocacy and pursue tariff exclusion petitions for botanical extract classifications to mitigate cost escalations. Simultaneously, diversifying supply chains by cultivating partnerships with alternate origin suppliers, including domestic growers and non-Chinese producers, will reduce exposure to geopolitical and tariff risks. Establishing vertically integrated operations or co-development agreements can further insulate businesses from external disruptions.

Finally, to capture emerging opportunities across key regions, businesses should tailor product grade offerings-cosmetic, food, pharmaceutical-to meet local regulatory requirements and consumer preferences. Collaborating with regulatory experts and leveraging digital channels for consumer education on black fungus extract benefits will strengthen brand credibility. A concerted focus on quality certifications, transparent sourcing narratives, and robust supply chain traceability will fortify market positioning and foster long-term trust among stakeholders.

Outlining the Comprehensive Research Approach, Data Collection Techniques, and Analytical Framework Employed in This Black Fungus Extract Market Study

The research methodology for this executive summary combines primary and secondary data collection with rigorous analytical frameworks to deliver comprehensive market insights. Trade and customs data were sourced from government and industry databases, including detailed HS code performance from international trade intelligence platforms, to map import-export patterns and tariff impacts. Scientific literature review encompassed peer-reviewed journals and open-access repositories to validate functional benefits and extraction advancements.

Segmentation analysis employed a structured approach to categorize market participants by application, form, extraction method, distribution channel, and grade, ensuring that insights reflect both breadth and specificity. Key company information was corroborated through official corporate disclosures and reputable supplier websites. Qualitative input from industry experts and stakeholder interviews supplemented quantitative findings, enabling the formulation of actionable recommendations grounded in real-world operational constraints and strategic priorities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Black Fungus Extract market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Black Fungus Extract Market, by Extraction Method

- Black Fungus Extract Market, by Form

- Black Fungus Extract Market, by Grade

- Black Fungus Extract Market, by Application

- Black Fungus Extract Market, by Distribution Channel

- Black Fungus Extract Market, by Region

- Black Fungus Extract Market, by Group

- Black Fungus Extract Market, by Country

- United States Black Fungus Extract Market

- China Black Fungus Extract Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Summarizing Critical Insights on Black Fungus Extract Market Dynamics, Emerging Opportunities, and Imperatives for Stakeholders in a Rapidly Evolving Sector

In conclusion, black fungus extract’s multifaceted bioactive properties and versatile application potential have catalyzed widespread interest across nutraceutical, cosmetic, food, and pharmaceutical sectors. Technological innovations in green extraction are redefining product quality, while evolving tariff policies underscore the necessity for strategic supply chain diversification. Segmentation insights reveal differentiated market dynamics based on application and grade, and regional analysis highlights the dominant supply role of China alongside burgeoning consumption in the Americas and EMEA.

Leading companies are leveraging scale, certification, and manufacturing prowess to navigate cost pressures and meet stringent quality requirements. To sustain momentum and unlock new growth avenues, stakeholders must embrace advanced extraction techniques, policy advocacy, and robust quality assurance frameworks. By aligning operational excellence with regulatory compliance and consumer expectations, industry participants can position black fungus extract products at the forefront of functional health and wellness innovations.

Connect with Ketan Rohom to Acquire the In-Depth Black Fungus Extract Market Research Report and Drive Strategic Decision-Making with Data-Driven Insights

For an in-depth exploration of these findings and to equip your organization with precise data and strategic guidance, connect with Ketan Rohom, Associate Director of Sales & Marketing, to acquire the comprehensive Black Fungus Extract Market Research Report. Elevate your decision-making with tailored insights and expert analysis designed to drive sustainable growth and competitive advantage in this dynamic market.

- How big is the Black Fungus Extract Market?

- What is the Black Fungus Extract Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?