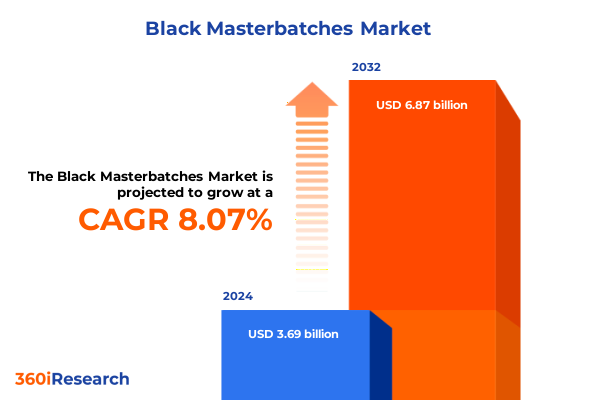

The Black Masterbatches Market size was estimated at USD 3.93 billion in 2025 and expected to reach USD 4.20 billion in 2026, at a CAGR of 8.28% to reach USD 6.87 billion by 2032.

Exploring the Evolution of Black Masterbatch Applications and Key Drivers Behind Industry Innovation and Production Efficiencies Worldwide

The development of black masterbatch has been instrumental in advancing the performance and visual appeal of plastic products across diverse applications. Fundamentally, black masterbatch consists of high concentrations of carbon-based pigments or iron oxide dispersed in a polymer carrier, offering manufacturers the ability to impart consistent coloration, UV protection, and electrical conductivity without compromising processability. In recent years, the demand for black masterbatch has intensified as end-users across automotive, consumer goods, and industrial sectors seek solutions that balance aesthetic precision with functional performance. Consequently, color accuracy, lightfastness, and regulatory compliance have emerged as pivotal selection criteria for material formulators.

Moreover, the evolution of smart manufacturing and Industry 4.0 initiatives has driven innovation within masterbatch production processes. Advanced compounding techniques, real-time quality monitoring, and digital color matching systems have enabled producers to deliver tighter tolerances and shorter lead times. These technological enhancements not only satisfy exacting customer requirements but also reduce waste and energy consumption during production. In parallel, environmental considerations have propelled a shift toward eco-friendly carriers and lower carbon footprints, reinforcing the role of masterbatch suppliers as partners in sustainable product development.

Furthermore, regulatory frameworks addressing microplastic pollution and carbon emissions continue to steer the market toward cleaner formulations and transparent supply chains. With stakeholders demanding traceability and compliance across the value chain, manufacturers are prioritizing certifications and transparent ingredient disclosures. As a result, black masterbatch has transcended its traditional function of mere pigmentation, becoming a strategic enabler for brands committed to quality, sustainability, and regulatory adherence.

Unveiling Transformative Shifts in Sustainability, Technology Integration, and Regulatory Frameworks Reshaping the Black Masterbatch Landscape

The landscape of black masterbatch is undergoing transformative shifts driven by converging pressures for sustainability, regulatory compliance, and technological integration. Historically, carbon black has dominated as the pigment of choice, prized for its deep color intensity and UV stabilization properties. However, rising concerns over fossil-based feedstocks and particulate emissions have spurred the emergence of Black Iron Oxide as an alternative. This shift toward iron oxide not only alleviates environmental burdens but also addresses regulatory scrutiny in regions enforcing stringent particulate standards.

In parallel, the integration of advanced digital color management has revolutionized how formulators achieve consistent results across batches and sites. Real-time spectrophotometric feedback loops and cloud-based analytics now enable continuous process optimization, reducing color variance and accelerating new product introductions. Consequently, masterbatch manufacturers are investing in smart compounding lines and automated inspection systems to meet the growing expectations of brand owners for precision and reproducibility.

Furthermore, circular economy principles are reshaping raw material sourcing and product end-of-life strategies. Post-industrial and post-consumer recycled carriers are gaining traction, enabling a closed-loop approach to black pigmentation. Producers are exploring pyrolysis-derived carbon blacks and biogenic-derived iron oxides, melding performance requirements with environmental credentials. As a result, the black masterbatch sector is pivoting toward integrated sustainability roadmaps, aligning with corporate net-zero targets and evolving regulatory mandates.

Assessing the Comprehensive Influence of 2025 United States Tariffs on Supply Chains, Material Costs, and Competitive Positioning in Black Masterbatch Sourcing

The imposition of additional duties on pigment and raw material imports under the 2025 United States tariff schedules has exerted substantial influence on supply chain economics and sourcing strategies for black masterbatch. While previous tariff adjustments primarily focused on steel and aluminum, the expanded scope now envelops specialty additives, prompting formulators to reassess global procurement channels. Confronted with elevated landed costs, material buyers have accelerated qualification of domestic pigment producers and diversified sourcing to non-tariffed regions.

Consequently, manufacturers have intensified collaboration with local pigment suppliers, leveraging proximity to offset duty implications and lead-time uncertainties. In addition, strategists are employing advanced total cost of ownership models to balance tariff expenses against logistics, inventory holding, and quality variances. This holistic perspective has elevated the importance of integrated supply chain visibility platforms that dynamically assess duty impacts versus alternative sourcing scenarios.

Moreover, the tariff-driven cost headwinds have galvanized innovation in process efficiencies and alternative pigment technologies. Research efforts exploring iron oxide derivatives and novel conductive carbon formulations aim to mitigate reliance on tariff-exposed feedstocks. Concurrently, formulators are engaging in hedging programs and long-term offtake agreements to stabilize pricing and secure supply. As a result, the 2025 tariff changes have not only pressured short-term cost structures but also accelerated strategic shifts toward resilient, diversified, and locally anchored pigment ecosystems.

Deriving Strategic Insights from Type, Carrier Resin, Form, and End-Use Industry Segmentation to Illuminate Market Dynamics of Black Masterbatch

An in-depth segmentation analysis unveils how distinct categories influence market dynamics and stakeholder strategies within the black masterbatch domain. Based on the composition of pigments, the landscape is studied across two principal types-Black Iron Oxide and Carbon Black-each presenting unique performance attributes. While Carbon Black remains the preferred choice for high UV resistance and electrical conductivity, Black Iron Oxide is rapidly gaining favor for applications demanding reduced environmental impact and compliance with emerging particulate regulations.

In addition, the choice of carrier resin plays a critical role in determining application suitability and processing behavior. The market’s examination across Polyethylene, Polypropylene, Polystyrene, and PVC carriers highlights the nuanced interactions between pigment dispersion, melt viscosity, and end-product properties. For instance, polyethylene-based systems are favored in film and packaging, whereas polypropylene carriers excel in injection-molded components, each demanding tailored masterbatch formulations to optimize performance.

Furthermore, the physical form of masterbatch-whether pellets or powder-impacts handling, dosing precision, and compounding efficiency. Pellets offer ease of feeding and consistent melt flow, supporting automated processing lines, while powder forms provide greater pigment loading flexibility and cost optimization in batch processes. Formulation scientists evaluate these characteristics to align with production constraints and targeted product attributes.

Finally, segmentation by end-use industry reveals differentiated demand patterns across automotive, construction, electrical and electronics, medical, packaging, and textiles sectors. Automotive applications prioritize thermal stability and UV protection, whereas medical components demand stringent purity and regulatory compliance. Packaging solutions emphasize lightweighting and recyclability, and textile coloring demands fastness and compatibility with diverse polymer fibers. Understanding these segmentation-driven requirements empowers suppliers to tailor value propositions and address specific performance challenges.

This comprehensive research report categorizes the Black Masterbatches market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Carrier Resin

- Form

- End-Use Industry

Unlocking Regional Trends and Opportunities Across Americas, Europe Middle East Africa, and Asia Pacific for Strategic Black Masterbatch Deployment

A regionally nuanced perspective illuminates divergent growth trajectories, regulatory landscapes, and supply chain configurations across the Americas, Europe Middle East Africa, and Asia Pacific territories. In the Americas, mature manufacturing hubs in North America coexist with burgeoning demand in Latin America, driven by expanding automotive production and infrastructure investments. Proximity to major pigment producers and integrated logistics corridors has fostered localized compounders, enabling rapid response to customer specifications and minimized exposure to cross-border tariffs.

Conversely, the Europe Middle East Africa region is characterized by rigorous environmental mandates and an escalating emphasis on decarbonization. European regulators have implemented strict emissions and microplastic policies, incentivizing the adoption of recycled carriers and low-particulate pigments such as iron oxide. Meanwhile, the Middle East’s emerging industrial zones are investing in capacity expansions, attracted by feedstock availability and strategic port infrastructures that facilitate exports to neighboring markets.

Asia Pacific remains the global epicenter of black masterbatch production, underpinned by vast manufacturing ecosystems, cost-competitive feedstocks, and government initiatives supporting advanced materials. China, India, and Southeast Asian nations continue to scale up compounding plants, leveraging digital automation and process intensification to serve both domestic consumption and global export demand. Nevertheless, rising labor costs and environmental scrutiny are prompting regional players to adopt cleaner technologies and circular practices to sustain competitiveness.

Collectively, these regional insights underscore the imperative for suppliers and end-users to calibrate strategies based on localized regulatory drivers, supply chain resilience considerations, and the maturity of downstream manufacturing sectors.

This comprehensive research report examines key regions that drive the evolution of the Black Masterbatches market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Black Masterbatch Producers and Their Competitive Strategies Shaping Innovation, Partnerships, and Supply Chain Resilience Globally

Mapping the competitive terrain reveals that a cadre of specialized pigment producers and compounders is defining the strategic contours of the black masterbatch market. Global leaders prioritize integrated value chains, leveraging proprietary production processes for carbon black and iron oxide pigments, alongside advanced compounding capabilities. These players differentiate through investments in research and development, forging partnerships with resin producers, and deploying digital platforms for quality assurance and order fulfillment.

At the same time, nimble regional specialists capitalize on localized expertise and customer proximity to deliver customized masterbatch solutions. By maintaining flexible manufacturing footprints and cultivating deep technical support networks, these companies can swiftly adapt formulations to evolving end-use requirements. Furthermore, strategic collaborations with downstream processors and OEMs enable co-development of high-performance blends tailored to specific application challenges.

In addition, cross-sector alliances between pigment producers and recyclers are gaining traction, as market participants seek circular feedstock streams. Collaboration extends beyond joint development agreements to include shared infrastructure projects for pyrolysis-based carbon recovery and closed-loop resin reclamation. Manufacturers that embrace these partnerships not only enhance their sustainability credentials but also secure alternative supply sources amid geopolitical uncertainties.

Finally, mergers and acquisitions remain a salient theme, as larger corporations pursue consolidation to expand geographic reach and diversify pigment portfolios. These strategic transactions often focus on acquiring niche iron oxide capacities, specialty conductive carbon blacks, or regional compounding assets. The resulting synergies create end-to-end solution providers capable of addressing both performance and sustainability imperatives concurrently.

This comprehensive research report delivers an in-depth overview of the principal market players in the Black Masterbatches market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adeka Corporation

- Ampacet Corporation

- Avient Corporation

- Birla Carbon Private Limited

- Borealis AG

- Cabot Corporation

- Clariant AG

- DIC Corporation

- Hubron International Ltd

- LyondellBasell Industries Holdings B.V.

- Plastiblends India Limited

- Plastika Kritis S.A.

- Ravago Group SA

- RTP Company

- Tosaf Group Ltd

Implementing Actionable Strategies for Industry Leaders to Advance Sustainable Practices, Optimize Cost Structures, and Leverage Technological Innovations

To navigate complex market dynamics and capture new growth opportunities, industry leaders must implement multifaceted strategies that align operational efficiency with sustainability goals. First, accelerating the adoption of bio-based and recycled carrier resins will strengthen environmental credentials and preempt regulatory constraints on virgin polymer usage. Integrating circular feedstock initiatives, such as pyrolysis-derived carbon recovery, further reinforces supply security while reducing lifecycle emissions.

Moreover, investing in digital color management and real-time process analytics can drive yield improvements and minimize waste. By deploying advanced sensors and cloud-based platforms, manufacturers gain visibility into pigment dispersion quality, enabling rapid corrective actions and consistent color outcomes. Additionally, leveraging machine learning algorithms to predict maintenance needs and optimize compounding parameters fosters uptime and reduces operational costs.

In parallel, cultivating strategic supplier partnerships across diversified geographies is essential to mitigate tariff impacts and logistic disruptions. Establishing long-term procurement agreements with non-tariffed pigment producers and exploring nearshoring opportunities can stabilize supply chains. Concurrently, engaging in collaborative research initiatives with academic institutions and technology providers will accelerate the development of next-generation conductive and eco-friendly pigments.

Finally, embedding a culture of continuous innovation, supported by cross-functional teams and agile project management, will ensure responsiveness to evolving end-user requirements. Regularly reviewing portfolio performance against emerging industry standards and proactively piloting alternative pigment technologies will position organizations at the vanguard of black masterbatch evolution.

Outlining a Comprehensive Research Methodology Integrating Qualitative and Quantitative Approaches, Expert Consultations, and Data Triangulation Techniques

The research methodology underpinning these insights integrates a blend of qualitative and quantitative approaches, ensuring robustness and reliability. Primary data collection involved in-depth interviews with key stakeholders across the pigment value chain, including masterbatch producers, resin suppliers, equipment manufacturers, and end-use industry experts. These conversations provided nuanced perspectives on performance criteria, regulatory influences, and emerging innovations.

Supplementing the primary research, extensive secondary analysis was conducted on publicly available technical papers, trade association reports, and regulatory documents. This desk research facilitated validation of industry trends and enabled cross-referencing of market developments across different geographical regions. Quantitative data points derived from production metrics and trade flow statistics were synthesized to identify overarching patterns without relying on proprietary market forecasts.

To enhance the accuracy of findings, a multi-stage triangulation process was employed. Initial hypotheses drawn from desk research were tested through stakeholder interviews, and subsequent insights were iteratively refined with additional expert feedback. This cyclical validation approach ensured that the reported trends and strategic recommendations are grounded in real-world practices and experiential knowledge.

Finally, thematic analysis was applied to distill insights across segmentation groups and regional clusters, enabling the construction of targeted strategic frameworks. The combination of primary rigor, comprehensive secondary review, and iterative triangulation underpins the credibility of the conclusions presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Black Masterbatches market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Black Masterbatches Market, by Type

- Black Masterbatches Market, by Carrier Resin

- Black Masterbatches Market, by Form

- Black Masterbatches Market, by End-Use Industry

- Black Masterbatches Market, by Region

- Black Masterbatches Market, by Group

- Black Masterbatches Market, by Country

- United States Black Masterbatches Market

- China Black Masterbatches Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarizing Critical Insights and Future Imperatives in the Black Masterbatch Industry to Empower Decision-Makers with Strategic Vision

The black masterbatch industry stands at a pivotal juncture, shaped by evolving sustainability mandates, digital transformation, and supply chain recalibrations. Each segmentation category-ranging from pigment type and carrier resin to form and end-use application-reveals unique drivers that influence material selection and product performance. Simultaneously, regional dynamics in the Americas, Europe Middle East Africa, and Asia Pacific underscore the importance of localized strategies and regulatory compliance.

Tariff developments in the United States have catalyzed supply chain diversification, prompting manufacturers to balance cost optimization with proximity sourcing. Moreover, the escalating demand for circular and low-emission solutions highlights the need for robust partnerships and technological innovation. Leading companies are responding through R&D investments, strategic collaborations, and selective M&A activity to secure competitive advantage.

Moving forward, organizations that embrace a holistic approach-integrating sustainable feedstocks, digital process control, and resilient supplier networks-will be best positioned to meet rigorous performance and compliance requirements. By leveraging the insights and actionable recommendations outlined in this executive summary, decision-makers can craft strategic roadmaps that address immediate challenges while capitalizing on emerging growth opportunities.

Ultimately, the convergence of environmental imperatives and customer-driven innovation will redefine the black masterbatch landscape, rewarding proactive leaders who anticipate change and adapt with agility.

Connect with Associate Director of Sales and Marketing Ketan Rohom to Discover How the Black Masterbatch Report Can Inform Your Strategic Decisions Today

To secure unrivaled visibility into the Black Masterbatch market and gain a competitive edge, reach out to Ketan Rohom, Associate Director of Sales & Marketing, who can guide you through the comprehensive report’s strategic insights and bespoke offerings. Engaging directly with Ketan will enable you to align the research findings with your specific organizational objectives, ensuring that procurement, product development, and sustainability goals are all addressed with precision. By collaborating with an experienced sales and marketing leader, you can unlock tailored consultation, expedited delivery, and access to supplementary data modules that drive actionable decision making. Contact Ketan today to elevate your understanding of black pigmentation solutions, optimize your supply strategies, and capitalize on emerging industry trends before your competitors do.

- How big is the Black Masterbatches Market?

- What is the Black Masterbatches Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?