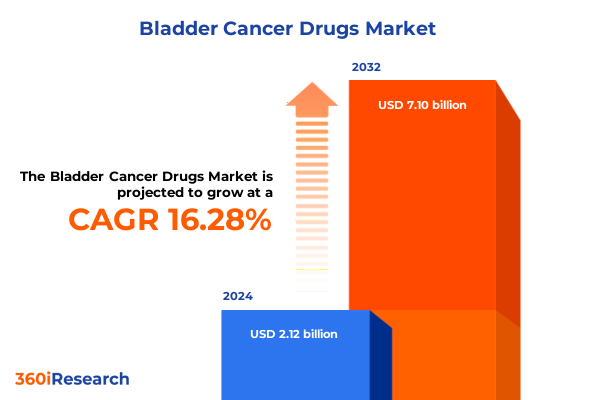

The Bladder Cancer Drugs Market size was estimated at USD 2.47 billion in 2025 and expected to reach USD 2.82 billion in 2026, at a CAGR of 16.25% to reach USD 7.10 billion by 2032.

Comprehensive Overview of Advances and Unmet Needs Defining the Modern Bladder Cancer Therapeutics Environment for Stakeholders and Decision Makers

The evolving bladder cancer therapeutics environment demands a nuanced understanding of emerging modalities, persistent challenges, and the pivotal role of innovation in patient outcomes. Rapid advances in molecular biology and immunology have opened new avenues for treatments that extend survival and improve quality of life, while longstanding limitations in early detection and therapy resistance underscore the need for continued research and collaboration.

Against this backdrop, decision makers and oncology stakeholders must balance optimism about transformative modalities such as immune checkpoint inhibitors and targeted therapies with pragmatism regarding drug access, safety, and patient adherence. By framing the current landscape within the context of evolving clinical guidelines and the shifting regulatory environment, this section provides a holistic overview of the forces driving change and the unmet needs that define the trajectory of bladder cancer care.

Exploration of Pivotal Shifts and Innovative Modalities Revolutionizing the Clinical Management of Bladder Cancer Treatment Paradigms Globally

Major shifts in the bladder cancer treatment paradigm have been propelled by the integration of immunotherapy agents targeting PD-1 and PD-L1 pathways. The FDA’s accelerated approval of atezolizumab marked the first immunotherapeutic option for patients with platinum-resistant metastatic urothelial carcinoma, establishing a new benchmark for second-line therapy and validating the potential of immune checkpoint blockade in genitourinary oncology. Subsequent approvals of perioperative immunotherapy regimens-most notably durvalumab in combination with neoadjuvant chemotherapy-have redefined curative intent strategies for muscle-invasive disease, delivering significant reductions in recurrence risk and enhancing long-term survival prospects for high-risk patients.

Beyond immunomodulation, the advent of FGFR inhibitors and tyrosine kinase inhibitors has introduced precision medicine approaches tailored to tumor-specific genetic alterations. This molecularly driven transformation extends to novel antibody-drug conjugates and subcutaneous formulations, which aim to improve therapeutic index and patient convenience, thereby broadening access to effective regimens and reshaping the standard of care in a landscape that rewards personalization and multidisciplinary collaboration.

Impact Assessment of New United States Tariff Measures on Drug Supply Chains, Pricing Dynamics, and Domestic Manufacturing Strategies in 2025

The initiation of a Section 232 investigation in early 2025 underscores the strategic significance of pharmaceuticals to national security and the potential for import adjustments under the Trade Expansion Act of 1962. This inquiry, which encompasses finished drug products, active pharmaceutical ingredients, and key starting materials, has catalyzed stakeholder engagement and public commentary on the delicate balance between supply chain resilience and cost containment.

Concurrently, advocacy organizations have urged the administration to calibrate tariff policy to avoid critical drug shortages and undue price inflation. In a formal letter, healthcare leaders highlighted the essential role of APIs sourced from China and called for selective exemptions to safeguard patient access while encouraging domestic manufacturing investments. Financial analyses warn that even moderate levies could elevate consumer costs and compress industry margins, potentially imperiling the timely delivery of life-saving therapies.

In response to tariff uncertainty, major pharmaceutical companies have accelerated U.S. capital commitments, pledging multi-billion-dollar expansions to bolster on-shore production capacities. Although these efforts promise long-term supply security, they also highlight transitional challenges, as domestic manufacturing scale-up may lag behind immediate demand and create interim constraints in availability.

In Depth Analysis of Critical Market Segmentation Dimensions Shaping the Bladder Cancer Treatment Landscape Across Types, Therapies, Agents, Administration and Distribution

Segmentation by cancer type enables targeted analysis of disease biology and clinical outcomes, focusing on distinctions between muscle-invasive bladder cancer and non-muscle-invasive bladder cancer and revealing unique treatment pathways and risk profiles. Treatment type segmentation sheds light on the relative contributions of chemotherapy, immunotherapy modalities-divided into immune checkpoint inhibitors and monoclonal antibodies-and the innovations emerging from targeted therapy, particularly FGFR inhibitors and tyrosine kinase inhibitors, which address specific genomic alterations. Examining the market through the lens of drug type emphasizes the competitive interplay among key agents such as Atezolizumab, Avelumab, and Erdafitinib. Administration route segmentation underscores the importance of intravenous, intravesical, and oral formulations in defining patient preference, adherence, and logistical considerations. Distribution channel segmentation differentiates the roles of hospital pharmacies, retail outlets, and specialty pharmacies in ensuring timely delivery, clinical oversight, and reimbursement alignment.

This comprehensive research report categorizes the Bladder Cancer Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Cancer Type

- Treatment Type

- Drug Type

- Administration Route

- Distribution Channel

Strategic Regional Perspectives on Bladder Cancer Drug Adoption, Reimbursement Landscape, and R&D Ecosystems Across the Americas, EMEA and Asia Pacific Territories

Regional dynamics in the Americas reflect an environment characterized by robust clinical trial activity, a well-established reimbursement infrastructure, and ongoing efforts to streamline regulatory approval pathways. Patient advocacy initiatives and public–private partnerships continue to drive awareness and access, while evolving payer models emphasize value-based contracts and patient-support programs.

The Europe, Middle East & Africa region presents a mosaic of regulatory frameworks and healthcare funding mechanisms that influence adoption timelines and price negotiation strategies. Centralized European regulatory approvals coexist with head-to-head health technology assessments, creating a dynamic environment for market entry and post-launch evidence generation. Emerging markets across the Middle East and Africa show growing interest in novel immunotherapies but face budgetary constraints and supply chain challenges that necessitate targeted access programs.

In Asia-Pacific, accelerated approvals and conditional authorization pathways have enabled early access to breakthrough therapies, particularly in countries with high bladder cancer incidence rates. Collaborative research agreements, co-development partnerships, and local manufacturing incentives underscore the strategic importance of this region, where patient demographics, clinical practices, and evolving regulatory standards shape commercial potential and long-term growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Bladder Cancer Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insightful Evaluation of Leading Biopharmaceutical Innovators Driving Research, Collaborations, and Competitive Positioning in Bladder Cancer Drug Development

Leading biopharmaceutical companies have differentiated their bladder cancer portfolios through strategic alliances, targeted acquisitions, and internal pipeline expansion. Roche has reinforced its position with advancements in PD-L1 inhibitor formulations, including subcutaneous delivery platforms that promise to reduce infusion times and enhance patient convenience in multiple oncologic indications. AstraZeneca’s perioperative immunotherapy success has generated significant interest in neoadjuvant-adjuvant sequencing strategies, positioning the company at the forefront of curative-intent regimens.

Simultaneously, Pfizer’s licensing agreements with Chinese biotechnology firms have expanded its access to early-stage assets, while Merck’s investment in antibody-drug conjugate platforms underscores a commitment to harnessing precision payload delivery. Emerging biotechnology players contribute agility and specialized expertise in FGFR and kinase inhibitor discovery, often entering co-development partnerships with larger organizations to accelerate clinical development. Collectively, these company-level strategies shape competitive positioning, foster innovation, and respond to stakeholder demands for differentiated treatment options.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bladder Cancer Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asieris Pharmaceuticals

- Astellas Pharma Inc.

- AstraZeneca PLC

- Bristol-Myers Squibb Company

- EMD Serono, Inc. (Merck KGaA)

- Ferrer Internacional, S.A.

- Ferring Pharmaceuticals S.A.

- Gilead Sciences, Inc.

- Ipsen SA

- Janssen Biotech, Inc. (Johnson & Johnson)

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- QED Therapeutics, Inc.

- Roche Holding AG (F. Hoffmann-La Roche Ltd)

- Seagen Inc. (A Pfizer Company)

- TARIS Biomedical LLC (a Bayer Company)

- Theralase Technologies Inc.

- UroGen Pharma Ltd.

Actionable Strategic Recommendations for Industry Leaders to Enhance Innovation, Optimize Supply Chains, and Strengthen Market Positioning in Bladder Cancer Therapeutics

Industry leaders should prioritize biomarker-driven clinical trial designs to match therapeutic mechanisms with patient subpopulations most likely to benefit, thereby enhancing response rates and cost-effectiveness. Strengthening supply chain resilience through diversified sourcing of active pharmaceutical ingredients and finished dosage forms can mitigate the impact of tariff fluctuations and regulatory shifts.

Engagement with payers around value-based agreements will be essential to demonstrate real-world outcomes and justify premium pricing for novel therapies. Investment in patient support initiatives, including adherence monitoring and education programs, can improve persistence on complex regimens and optimize long-term outcomes. Collaboration across stakeholder groups-regulators, payers, providers, and patient advocacy organizations-will facilitate the development of pragmatic reimbursement pathways and ensure rapid uptake of breakthrough treatments.

Detailed Description of Research Framework Incorporating Primary Expert Engagement, Robust Secondary Data Analysis, and Rigorous Validation Methodologies

This analysis integrates primary research involving in-depth interviews with oncologists, urologists, payers, and patient advocacy representatives to capture frontline perspectives on treatment patterns, unmet needs, and access barriers. Secondary research comprised systematic reviews of peer-reviewed literature, clinical trial registries, regulatory agency publications, and company press releases to ensure comprehensive coverage of recent developments.

Quantitative data were subjected to triangulation methodologies, cross-referencing multiple reputable sources to validate insights and minimize bias. Continuous engagement with external subject matter experts provided ongoing calibration of findings and facilitated the incorporation of emerging trends and regulatory updates. This rigorous mixed-method approach underpins the reliability of conclusions and ensures actionable relevance for decision-makers in the bladder cancer therapeutic domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bladder Cancer Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bladder Cancer Drugs Market, by Cancer Type

- Bladder Cancer Drugs Market, by Treatment Type

- Bladder Cancer Drugs Market, by Drug Type

- Bladder Cancer Drugs Market, by Administration Route

- Bladder Cancer Drugs Market, by Distribution Channel

- Bladder Cancer Drugs Market, by Region

- Bladder Cancer Drugs Market, by Group

- Bladder Cancer Drugs Market, by Country

- United States Bladder Cancer Drugs Market

- China Bladder Cancer Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesis of Core Findings and Forward Looking Reflections on the Evolving Bladder Cancer Therapeutics Landscape and Strategic Implications for Stakeholders

The bladder cancer drug landscape is marked by profound innovation alongside enduring challenges in access, affordability, and therapeutic resistance. Immunotherapies have irrevocably altered treatment paradigms, while targeted agents and next-generation formulations promise further gains in precision and convenience. At the same time, external pressures-ranging from trade policy shifts to complex reimbursement dynamics-underscore the need for proactive strategies to maintain patient access and optimize value.

Strategic alignment of research, manufacturing, and commercial efforts will determine which stakeholders can effectively leverage these opportunities. By synthesizing clinical advances, regulatory developments, and market forces, this analysis illuminates the pathways through which organizations can navigate uncertainty and drive meaningful progress in bladder cancer care. The collective insights presented here serve as a foundation for informed decision making and guide the path toward transformative impact.

Engage with Ketan Rohom to Acquire Comprehensive Bladder Cancer Market Research Insights and Uncover Strategic Opportunities for Informed Decision Making

Unlock unparalleled insights into the bladder cancer drug market by partnering with Ketan Rohom. As Associate Director of Sales & Marketing, he offers tailored guidance to align report findings with your strategic priorities and decision-making processes. Reach out to discuss how our in-depth analysis can empower your organization to navigate complex therapeutic trends, regulatory challenges, and evolving market dynamics. Elevate your competitive edge with comprehensive research designed for actionable impact-connect with Ketan Rohom today and secure your path to informed growth and innovation.

- How big is the Bladder Cancer Drugs Market?

- What is the Bladder Cancer Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?