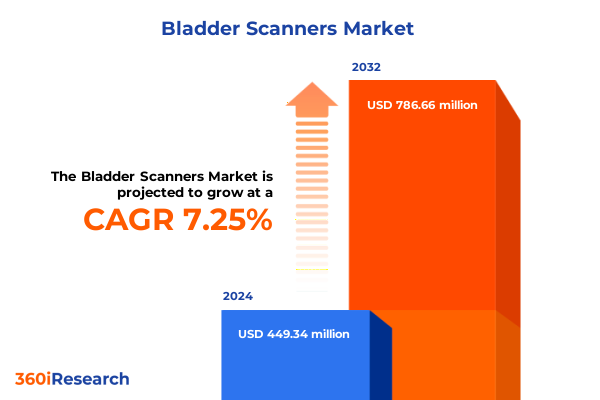

The Bladder Scanners Market size was estimated at USD 475.32 million in 2025 and expected to reach USD 507.67 million in 2026, at a CAGR of 7.46% to reach USD 786.65 million by 2032.

Unveiling the Evolving Landscape of Bladder Scanners as Innovations Drive NonInvasive Diagnostics and Enhance Patient Care Across Clinical Settings

Bladder scanners have emerged as indispensable tools in modern urological diagnostics, offering fast, noninvasive assessments of bladder volume that reduce patient discomfort and mitigate infection risks. With the global incidence of urinary retention and incontinence rising alongside aging populations, clinicians are increasingly relying on portable ultrasound devices to streamline workflows and enhance bedside care. These innovations not only accelerate diagnostic decision-making in emergency and urology settings, but also contribute to improved patient throughput and reduced catheterization rates, driving positive outcomes in diverse clinical environments.

Accelerating Transformation Through AI Integration Telehealth Expansion and Miniaturization Propelling Bladder Scanners into PointOfCare Urological Diagnostics

Recent years have witnessed transformative shifts reshaping how bladder scanners integrate within healthcare delivery. The convergence of artificial intelligence and ultrasound imaging now enables automated bladder recognition and real-time volume calculations, enhancing diagnostic precision and reducing operator variability. FDA clearance of AI-enabled devices such as Clarius Bladder AI underscores growing regulatory confidence in machine learning applications that streamline workflow and elevate clinical confidence through rapid, automated analysis.

Simultaneously, the trend toward miniaturization and wireless connectivity has made handheld bladder scanners more compact and mobile, allowing healthcare providers to perform point-of-care assessments without tethering to bulky consoles. This evolution aligns with broader telemedicine initiatives, enabling remote monitoring and consultative care models that extend diagnostic capabilities beyond hospital walls. As a result, home healthcare and ambulatory centers are embracing portable ultrasound solutions to support decentralized care delivery and reduce readmission rates.

Assessing the BroadReaching Consequences of Newly Imposed US Import Tariffs on Bladder Scanner Supply Chains Cost Structures and Access to Technology

The introduction of new U.S. tariffs in early 2025 has imposed additional financial and logistical burdens on bladder scanner manufacturers and healthcare providers alike. A 10 percent duty on Chinese imports, coupled with threatened 25 percent levies on EU-origin medical devices, has driven concerns over rising equipment costs and supply chain disruptions, potentially inflating acquisition expenses by up to 15 percent. Industry groups warn that such tariffs could trigger temporary earnings adjustments for leading device makers and prolong procurement timelines as hospitals reassess capital allocations under tighter budgets.

Moreover, derivative tariffs on steel and aluminum components risk further compounding cost pressures for ultrasound transducers and device housings, prompting some manufacturers to explore alternative sourcing strategies or onshore certain production processes. While temporary exemptions may alleviate immediate strains, the cumulative impact underscores the need for proactive supply chain resilience planning and stakeholder collaboration to safeguard access to these vital diagnostic tools.

Unlocking Strategic Insights Through Detailed Analysis of Product Imaging Technology End User Application and Distribution Channel Dynamics

Insights drawn from detailed segmentation reveal nuanced drivers shaping market trajectories across product, technology, end-user, application, and distribution dimensions. The handheld segment, encompassing both compact and pencil-style devices, continues to gain favor in urgent care and surgical settings for its ease of maneuverability and rapid deployment. Portable scanners, available in AC-operated and battery-operated configurations, offer versatile point-of-care solutions adaptable to bedside assessments in hospitals and home healthcare alike. Standalone systems, meanwhile, deliver comprehensive imaging performance where stationary consoles meet the demands of high-volume diagnostic centers.

Imaging innovations further differentiate market offerings through two-, three-, and four-dimensional ultrasound capabilities. While two-dimensional scanners maintain broad adoption due to cost efficiency and established clinical protocols, three-dimensional systems are capturing share by facilitating volumetric analyses and reducing repeat scans. Four-dimensional platforms, though at an earlier adoption stage, promise dynamic real-time visualization that could transform complex urological assessments and interventional guidance.

End users from ambulatory diagnostic and specialty clinics to secondary and tertiary hospitals underscore the importance of tailored solutions. Ambulatory centers demand streamlined scanners for rapid throughput, whereas home care models emphasize user-friendly interfaces and remote connectivity. Hospitals rely on both portable and standalone units for routine monitoring and post-operative evaluations. Finally, applications across obstetrics, gynecology, and urology highlight the versatility of bladder scanners, addressing needs from fetal bladder health assessments to chronic urinary retention management. Distribution channels blend direct sales relationships for customized service agreements with distributor networks spanning online platforms and retail pharmacies, ensuring broad market penetration and after-sales support.

This comprehensive research report categorizes the Bladder Scanners market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Imaging Technology

- End User

- Application

- Distribution Channel

Exploring the Nuanced Regional Landscape Across the Americas Europe Middle East Africa and AsiaPacific to Identify Growth Drivers

Regional dynamics are shaping distinct growth pathways as market participants navigate varying regulatory landscapes, reimbursement frameworks, and healthcare infrastructure levels. In the Americas, robust hospital networks, established reimbursement policies, and early adoption of point-of-care ultrasound underpin a dominant position for bladder scanner sales. North American providers benefit from government incentives promoting noninvasive diagnostics and aging population demographics that drive sustained demand for urinary health monitoring.

Across Europe, the Middle East, and Africa, regulatory complexity and cost-containment measures in key markets such as Germany, France, and the United Kingdom influence procurement cycles and pricing negotiations. At the same time, emerging Gulf Cooperation Council nations are investing heavily in healthcare modernization, creating pockets of rapid uptake. Tariff threats on EU imports also add uncertainty, reinforcing the importance of regional manufacturing partnerships to mitigate cross-border cost escalations.

Asia-Pacific is emerging as the fastest growing region thanks to strategic government initiatives to expand telemedicine and rural health programs, along with rising awareness of noninvasive diagnostic tools. Countries like China, India, and Australia are prioritizing mobile health integrations, propelling demand for handheld and wireless scanners that can bridge gaps in resource-limited settings. The convergence of digital health reforms and aging demographics positions Asia-Pacific as a key frontier for future market expansion.

This comprehensive research report examines key regions that drive the evolution of the Bladder Scanners market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Competitive Landscape Highlighting Major Players Innovations Partnerships and Strategic Moves Shaping the Future of Bladder Scanner Solutions

Competitive positioning in the bladder scanner market reflects both global healthcare giants and specialized innovators advancing product portfolios and service models. Established players such as GE Healthcare, Philips Healthcare, and Siemens Healthineers leverage extensive distribution networks and integrated healthcare platforms to deliver comprehensive diagnostic ecosystems. At the same time, niche providers including Verathon, Clarius Mobile Health, and dBMEDx are forging momentum through differentiated features such as AI-assisted bladder recognition, wireless connectivity, and subscription-based service offerings.

Partnerships and strategic investments further define the landscape, with established manufacturers collaborating with technology startups to accelerate digital health integrations. Recent product launches, clinical validation studies, and multi-center pilot programs are setting new benchmarks for imaging accuracy, workflow efficiency, and patient comfort. As the market evolves, competitive agility will hinge on the ability to anticipate end-user needs, streamline regulatory approvals, and cultivate value-based service agreements that drive predictable revenue streams.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bladder Scanners market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Clarius Mobile Health Inc.

- Contec Medical Systems Co., Ltd.

- EchoNous, Inc.

- Edan Instruments, Inc.

- GE Healthcare

- Mindray Medical International Limited

- Shantou Institute of Ultrasonic Instruments Co., Ltd.

- Siemens Healthineers AG

- UroLife International Limited

- Verathon Medical, Inc.

Empowering Leaders with Actionable Strategies for Innovation Regulatory Navigation Supply Chain Resilience and Market Expansion in Bladder Scanning

Leaders aiming to capitalize on market momentum should pursue a multifaceted strategy centered on innovation, regulatory advocacy, and supply chain resilience. Product roadmaps must prioritize AI-fusion features, mobile interoperability, and ergonomic designs to meet growing demands across clinical and home care environments. At the same time, engaging in dialogue with policymakers and industry associations to secure tariff exemptions for essential diagnostic devices can help stabilize cost structures and protect access.

Supply chain diversification through near-sourcing initiatives and multi-locational manufacturing footprints will safeguard operations against tariff volatility and geopolitical risks. Additionally, forming strategic alliances with telehealth providers and health system integrators can unlock new distribution channels, enable bundled service offerings, and foster recurring revenue models. Finally, investing in comprehensive training programs for end users across ambulatory, hospital, and home care segments will accelerate adoption, ensure optimal utilization, and reinforce customer loyalty.

Detailing a Rigorous Multimethod Framework Integrating Expert Interviews Secondary Research and Quantitative Analysis to Guarantee Robust Data Integrity

Our research methodology combines qualitative and quantitative approaches to deliver robust, validated insights. Expert interviews with industry leaders and frontline clinicians provide deep contextual understanding of clinical workflows and end-user priorities. Secondary research draws on a comprehensive review of peer-reviewed publications, government databases, regulatory filings, and company reports to map competitive landscapes and regulatory frameworks. Quantitative analysis uses triangulation techniques to cross-verify data inputs and ensure consistency across geographies and segments. Rigorous data audits and validation exercises are conducted at each stage to guarantee high levels of accuracy and integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bladder Scanners market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bladder Scanners Market, by Product Type

- Bladder Scanners Market, by Imaging Technology

- Bladder Scanners Market, by End User

- Bladder Scanners Market, by Application

- Bladder Scanners Market, by Distribution Channel

- Bladder Scanners Market, by Region

- Bladder Scanners Market, by Group

- Bladder Scanners Market, by Country

- United States Bladder Scanners Market

- China Bladder Scanners Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesis of Key Discoveries Underscoring Innovation Dynamics Market Drivers and Strategic Imperatives for Future Success in Bladder Imaging Technology

In summary, bladder scanners represent a rapidly advancing segment of ultrasound diagnostics, driven by an aging population, rising urological health needs, and the quest for noninvasive, point-of-care solutions. Technological innovations, including AI-enabled imaging and wireless mobile integrations, are redefining clinical workflows and extending diagnostic capabilities beyond traditional settings. Market dynamics are being shaped by evolving tariff regimes, shifting regulatory landscapes, and competitive forces that favor agile, value-centric offerings. As healthcare systems worldwide navigate cost pressures and decentralization trends, bladder scanner manufacturers that align their strategies with emerging end-user needs, regional growth priorities, and regulatory frameworks will be best positioned to succeed. This executive summary distills key insights, actionable recommendations, and strategic imperatives to guide decision makers in capturing new opportunities and steering future growth in bladder imaging technology.

Engage with Ketan Rohom to Access the Comprehensive Bladder Scanner Market Report Providing Your Team Insights Strategies and Opportunity Roadmaps

If you’re looking to inform your strategic vision with in-depth analysis on market drivers, segmentation dynamics, regulatory impacts, and competitive positioning, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through the comprehensive bladder scanner report, equipping your team with tailored insights, robust strategies, and actionable roadmaps to capture growth opportunities and strengthen market resilience.

- How big is the Bladder Scanners Market?

- What is the Bladder Scanners Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?