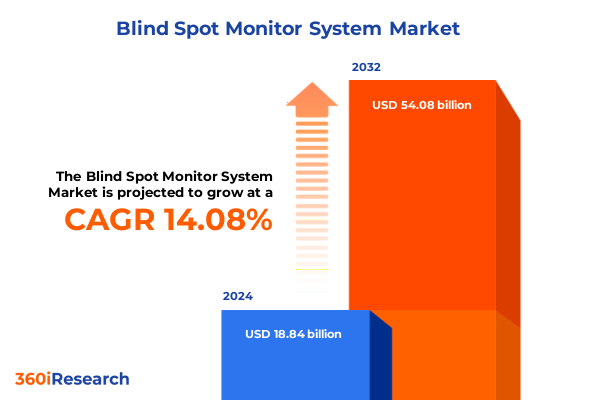

The Blind Spot Monitor System Market size was estimated at USD 21.33 billion in 2025 and expected to reach USD 24.14 billion in 2026, at a CAGR of 14.21% to reach USD 54.08 billion by 2032.

Emerging Opportunities and Challenges Driving Next-Generation Blind Spot Monitoring Innovations and Advanced Safety Solutions Across Modern Vehicle Platforms

Blind spot monitoring technology has rapidly evolved from rudimentary proximity sensors into sophisticated driver assistance solutions central to modern vehicle safety systems. As advanced sensor fusion, machine learning, and enhanced display interfaces converge, blind spot monitoring is no longer an optional convenience feature but a critical safeguard that addresses rising concerns over roadway incidents caused by undetected adjacent vehicles. In this context, automakers and Tier-1 suppliers are racing to integrate more accurate, reliable, and cost-effective blind spot systems that align with evolving regulatory mandates and heightened consumer expectations for safety and convenience.

At the heart of this evolution lies the control unit, the display interface, and a variety of sensors working in concert to create a comprehensive situational awareness bubble around the vehicle. The foundational shift toward camera, radar, and ultrasonic sensor synergies enables dramatically improved detection accuracy under diverse driving conditions, from congested urban corridors to high-speed highways. Transitional advances in processing power and algorithmic sophistication have further expanded the potential of blind spot monitoring, paving the way for predictive collision avoidance and integrated lane-change assistance features.

This analysis explores how emerging technology trends, shifting policy landscapes, and competitive dynamics are reshaping the blind spot monitoring ecosystem. By examining transformative shifts in sensor and software integration, the cumulative effects of United States tariff revisions implemented in 2025, and critical segmentation and regional insights, decision-makers will gain a holistic understanding of key market drivers. The report also profiles major industry participants, delivers actionable recommendations for leaders, and outlines the rigorous research methodology underpinning the findings. Ultimately, this summary provides a strategic foundation for stakeholders seeking to navigate the complexity of next-generation blind spot monitoring deployment and capture growth opportunities.

Forces Redefining the Blind Spot Monitoring Ecosystem Including Technological Convergence, Regulatory Pressure, and Changing Automotive Mobility Paradigms

The blind spot monitoring landscape is undergoing a profound transformation driven by converging technological, regulatory, and mobility forces. Sensor fusion stands at the forefront of these shifts, with camera, radar, and ultrasonic inputs integrated through advanced control units to produce a unified, real-time awareness platform. Recent breakthroughs in edge computing have enabled data from disparate sensor modalities to be processed locally, reducing latency and supporting predictive collision avoidance capabilities that were previously unattainable.

Regulatory frameworks are also influencing system architecture, as safety assessment programs globally elevate blind spot detection requirements. Mandates that once focused primarily on forward collision warning are expanding to encompass lateral monitoring performance, compelling automakers to invest in more robust sensor arrays and fail-safe control unit topologies. Accordingly, display units are evolving beyond simple indicator lights to feature full-color multi-function screens, augmented reality overlays, and haptic feedback pathways designed to communicate hazards more intuitively to drivers.

In parallel, the rise of electrification and autonomous mobility models is reinforcing the strategic importance of blind spot monitoring. Electrified powertrains free up design constraints in vehicle layouts, creating opportunities for sensor placement optimization and modular component integration. Meanwhile, the pathway to conditional and full autonomy hinges on comprehensive 360-degree sensing capabilities, with blind spot monitoring functioning as a critical subsystem within broader perception and decision-making stacks. Taken together, these transformative shifts underscore the need for a flexible, scalable, and software-centric ecosystem to support future generations of advanced driver assistance systems.

Assessing How 2025 United States Tariff Measures Have Reshaped Supply Chains, Cost Structures, and Strategic Sourcing in the Blind Spot Monitoring Value Chain

In 2025, the United States intensified its tariff posture on a broad range of imported automotive electronic components, creating a ripple effect throughout global supply networks. As sensor modules, display assemblies, and control units faced higher import duties, suppliers were compelled to reevaluate sourcing strategies and cost structures across their blind spot monitoring portfolios. Many Tier-1 original equipment manufacturers accelerated partnerships with domestic producers to mitigate tariff exposure, while smaller suppliers sought tariff-neutral materials or leveraged free trade zone benefits to soften cost impacts.

These protective measures also triggered a resurgence of near-shoring initiatives, with component fabrication and subassembly operations relocating closer to North American vehicle assembly plants. Demand for locally sourced printed circuit boards and display panels surged, fostering new alliances between automakers and regional electronics specialists. Concurrently, pricing pressure on camera sensors and radar chips nudged semiconductor firms to establish or expand manufacturing footprints in tariff-free jurisdictions, reinforcing the imperative for agile procurement and dual-sourcing models.

While cost inflation in the short term disrupted traditional supplier-customer agreements, it also created opportunities for innovative cost management practices. Strategic design re-engineering led to consolidated sensor modules with shared control logic, minimizing duty liabilities by reducing the number of discrete importable components. Cross-industry collaborations enabled pooled volume discounts, and provision-in-kind arrangements facilitated cooperative R&D investment in domestic test facilities. Ultimately, the cumulative impact of the 2025 tariff revisions underscored the critical role of adaptive supply chain architectures in sustaining competitive positioning within the blind spot monitoring market.

Uncovering How Component, Vehicle, and Sales Channel Segmentation Are Driving Differentiated Growth Paths in the Blind Spot Monitoring Market

Insightful segmentation reveals distinct pathways through which blind spot monitoring technologies are advancing across the automotive landscape. From a component type perspective, the market encompasses three primary categories: the control unit acting as the central processing hub, the display unit delivering real-time driver alerts, and a diverse array of sensors. Within the sensor segment, camera sensors provide visual context and lane marking detection, radar sensors offer long-range object tracking under adverse weather, and ultrasonic sensors excel at close-proximity detection in low-speed maneuvers. Each component category is evolving under unique cost, performance, and integration constraints, driving specialized innovation cycles.

Vehicle type segmentation further differentiates adoption trajectories between commercial vehicles and passenger cars. In commercial fleets, blind spot monitoring is increasingly viewed as a risk mitigation tool to reduce liability and insurance costs, accelerating uptake of modular retrofit systems alongside factory-installed solutions. Passenger cars, by contrast, are witnessing broader integration of display units paired with immersive head-up displays and infotainment overlays, reflecting consumer demand for seamless user experiences. These divergent requirements are fostering tailored system architectures and aftermarket support models that prioritize ease of installation for fleet operators and intuitive interfaces for individual buyers.

Sales channel segmentation underscores contrasting distribution dynamics between aftermarket and OEM channels. While OEM adoption continues to drive baseline volumes as manufacturers standardize blind spot monitoring across trim levels, the aftermarket segment capitalizes on retrofit demand and upgrade cycles. Aftermarket suppliers are innovating with plug-and-play sensor modules and smartphone-integrated alert systems to capture segments of the vehicle parc that lack factory-installed solutions. As both channels evolve, competitive differentiation hinges on software update capabilities, multisensor compatibility, and end-user support offerings tailored to distinct customer profiles.

This comprehensive research report categorizes the Blind Spot Monitor System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Vehicle Type

- Sales Channel

Analyzing Regional Dynamics Across Americas, Europe Middle East Africa, and Asia-Pacific to Illuminate Divergent Growth Drivers and Adoption Patterns

Regional dynamics in the blind spot monitoring market reflect a spectrum of regulatory rigor, infrastructure maturity, and consumer preferences. In the Americas, stringent safety protocols and influential consumer safety ratings have positioned advanced sensor fusion systems as standard equipment in a growing number of vehicle models. North American OEMs continue to set the pace for feature complexity, with control units and display units engineered to deliver seamless integration with existing vehicle architecture. Latin American markets are gradually adopting similar technologies, driven by rising safety awareness and the expansion of vehicle financing programs.

In the Europe, Middle East & Africa region, regulatory bodies are at the forefront of expanding type-approval requirements to include lateral hazard detection, prompting rapid upgrades to camera and radar sensor arrays. European automakers are leveraging high-precision sensors and multi-function displays to comply with new assessment protocols, while Middle Eastern markets demonstrate a strong appetite for premium retrofit offerings tailored to luxury vehicles. In several African nations, pilot deployments focus on cost-effective ultrasonic sensors to address urban traffic management challenges and emerging vehicle safety initiatives.

The Asia-Pacific region showcases some of the most dynamic blind spot monitoring adoption rates, propelled by domestic OEMs in China, Japan, and South Korea. Camera sensor suppliers and semiconductor partners are investing heavily in local R&D centers to refine deep learning algorithms for complex urban environments. Southeast Asian markets are surfacing as attractive opportunities for aftermarket expansion, with retrofit kits gaining traction among used-car fleets. Overall, regional variations in infrastructure, regulatory frameworks, and consumer priorities are shaping tailored strategies for market participants to capture growth opportunities across geographies.

This comprehensive research report examines key regions that drive the evolution of the Blind Spot Monitor System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Emerging Challengers to Highlight Strategic Partnerships, R&D Investments, and Competitive Edge in Blind Spot Monitoring

Leading players in the blind spot monitoring arena are distinguishing themselves through strategic collaborations, targeted R&D investments, and differentiated solution portfolios. Established Tier-1 sensor manufacturers are forging partnerships with semiconductor firms to co-develop next-generation radar arrays and high-resolution camera modules, aiming to reduce power consumption while improving detection accuracy. Meanwhile, control unit designers are collaborating with software startups specializing in machine learning to accelerate algorithm refinement and predictive analytics capabilities.

In addition to technology alliances, several key automotive OEMs are entering joint ventures with specialized display suppliers to create immersive human-machine interfaces that seamlessly blend blind spot alerts with navigation and driver assistance data. These alliances underscore the growing importance of cross-industry collaboration to deliver cohesive multi-sensor ecosystems. Emerging challengers are carving out niches by offering modular retrofit systems that allow fleet owners to add ultrasonic-based monitoring at a fraction of the cost of factory-installed solutions, thereby addressing underserved segments of the vehicle parc.

R&D investment patterns reveal a shift toward software-defined safety platforms, as companies allocate budgets to develop over-the-air update functionalities and cloud-based diagnostic services. This strategic pivot not only enhances product longevity but also fosters recurring revenue models through subscription-based feature enhancements. As competition intensifies, the ability to demonstrate a robust technology roadmap, validated through pilot programs and performance benchmarks, is becoming a key differentiator among blind spot monitoring suppliers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blind Spot Monitor System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aptiv PLC

- Autoliv, Inc.

- Continental AG

- DENSO CORPORATION

- Ford Motor Company

- Hyundai Mobis Co., Ltd.

- Infineon Technologies AG

- Magna International Inc.

- Mobileye

- NXP Semiconductors

- Panasonic Holdings Corporation

- Rear View Safety, Inc.

- Robert Bosch GmbH

- Sensata Technologies, Inc.

- Subaru

- Valeo SA

- VOXX Electronics Corp.

- ZF Friedrichshafen AG

Practical Strategies for Industry Stakeholders to Enhance Technology Integration and Accelerate Adoption of Next-Generation Blind Spot Monitoring

To navigate the evolving blind spot monitoring landscape, industry stakeholders should prioritize a series of strategic initiatives. First, investment in multi-modal sensor fusion research is essential to achieve robust detection performance under all driving conditions. By collaborating with chipset providers and algorithm specialists, suppliers can accelerate time-to-market for advanced control units that support deep learning inference at the edge.

Second, building resilient supply networks through diversified sourcing and near-shoring arrangements will mitigate exposure to tariff fluctuations and geopolitical disruptions. Establishing dual-sourcing agreements for key camera and radar components, as well as fostering partnerships with regional electronics fabricators, will help maintain production continuity and optimize cost structures.

In parallel, stakeholders should engage proactively with regulatory bodies to shape evolving safety standards and ensure alignment with anticipated performance benchmarks. Participation in industry consortia and collaborative test programs will provide early visibility into forthcoming mandates, enabling companies to preemptively adapt sensor calibration protocols and display interface requirements.

Finally, cultivating aftermarket service capabilities and retrofittable sensor solutions will unlock incremental revenue streams from existing vehicle fleets. By offering plug-and-play modules and subscription-based software updates, companies can deliver sustained value to customers while reinforcing their brand presence in a competitive aftermarket environment.

Comprehensive Research Framework Detailing Data Collection, Expert Consultations, and Analytical Approaches Guiding the Blind Spot Monitoring Market Evaluation

This analysis is underpinned by a rigorous research framework that blends primary interviews, secondary source reviews, and expert validation. Secondary research encompassed an extensive review of regulatory publications, technical white papers, and open-source industry reports to map technology trends and compile comprehensive component landscapes. Primary research included confidential interviews with senior executives at leading OEMs, Tier-1 integrators, sensor manufacturers, and aftermarket specialists, providing qualitative insights into current challenges and future priorities.

Quantitative data collection leveraged proprietary datasets and publicly available registries to track adoption rates, product launch timelines, and regulatory milestones. These inputs were triangulated with field trials and technical performance benchmarks to ensure that the analysis reflects real-world conditions. An expert panel of automotive engineers and regulatory advisors reviewed preliminary findings, offering critical feedback on sensor performance metrics and integration strategies.

Analytical approaches incorporated thematic analysis of interview transcripts, comparative benchmarking of product features, and scenario modeling to assess the impact of external factors such as tariff changes and regulatory updates. This multi-method methodology ensured that conclusions are robust, actionable, and grounded in both qualitative and quantitative evidence, providing stakeholders with a high degree of confidence in the strategic insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blind Spot Monitor System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blind Spot Monitor System Market, by Component Type

- Blind Spot Monitor System Market, by Vehicle Type

- Blind Spot Monitor System Market, by Sales Channel

- Blind Spot Monitor System Market, by Region

- Blind Spot Monitor System Market, by Group

- Blind Spot Monitor System Market, by Country

- United States Blind Spot Monitor System Market

- China Blind Spot Monitor System Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 795 ]

Synthesis of Key Findings Emphasizing Market Drivers, Technological Imperatives, and Strategic Imperatives for Sustainable Growth in Blind Spot Monitoring

A holistic synthesis of the key findings underscores the convergence of technological innovation, regulatory evolution, and strategic supply chain adaptations as primary market drivers. Technological imperatives, such as advanced sensor fusion and machine learning inference at the edge, are redefining control unit architectures and unlocking new safety functionalities. Meanwhile, the cumulative impact of 2025 tariff measures has catalyzed agile sourcing strategies and near-shoring initiatives that underscore the importance of resilient procurement models.

Segmentation insights reveal differentiated growth pathways across component types, vehicle classes, and distribution channels, highlighting the unique challenges and opportunities within control units, display interfaces, and sensor subsegments. Regional analysis further illuminates the diversity of adoption drivers, from stringent safety mandates in the Americas to rapid innovation cycles in Asia-Pacific and emerging retrofit demand in Europe, Middle East & Africa.

Profiles of leading suppliers and emerging challengers demonstrate that strategic partnerships, R&D investments, and software-defined safety solutions are critical competitive differentiators. The actionable recommendations emphasize targeted technology integration, supply chain optimization, proactive regulatory engagement, and aftermarket expansion as the cornerstones of sustainable growth. Collectively, these insights provide a clear roadmap for stakeholders aiming to capture value in the rapidly evolving blind spot monitoring market.

Engage with Ketan Rohom to Explore Customized Insights and Secure Access to the Comprehensive Blind Spot Monitoring Market Research Report Today

To unlock unparalleled market intelligence and a competitive edge in the emerging blind spot monitoring arena, contact Associate Director Ketan Rohom. Engaging directly with Ketan will allow you to explore tailored research deliverables designed around your strategic priorities, whether you seek deeper insights into evolving technology roadmaps, supply chain dynamics influenced by recent tariff changes, or granular segmentation comparisons across components and regions. By initiating a dialogue with Ketan Rohom, you gain priority access to bespoke data visualizations, interactive scenario analyses, and high-resolution supplier maps that empower informed decision-making. Seize this opportunity to secure the comprehensive blind spot monitoring market research report and equip your organization with the clarity needed to capitalize on accelerated adoption trends. Reach out today to transform your market strategy with expert guidance and personalized support from a dedicated industry specialist.

- How big is the Blind Spot Monitor System Market?

- What is the Blind Spot Monitor System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?