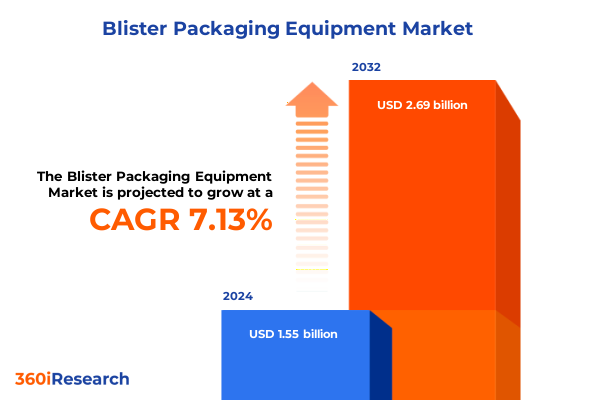

The Blister Packaging Equipment Market size was estimated at USD 1.64 billion in 2025 and expected to reach USD 1.75 billion in 2026, at a CAGR of 7.30% to reach USD 2.69 billion by 2032.

Discover the Critical Role of Advanced Blister Packaging Equipment in Safeguarding Products and Driving Efficiency Across Diverse Industries

Blister packaging equipment plays an indispensable role in safeguarding a wide range of products, from pharmaceuticals to consumer electronics. By forming individual cavities that tightly encase each item, these systems prevent damage, contamination, and counterfeiting, ensuring compliance with stringent regulatory standards. Beyond protection, blister packaging streamline handling and display, delivering an efficient balance of visibility and preservation that resonates across global supply chains.

As industries evolve, the importance of advanced blister formers continues to grow. Pharmaceutical and medical device manufacturers rely on high-precision machines to secure patient safety and meet regulatory demands, while consumer goods producers leverage specialized configurations to enhance shelf appeal and reduce returns. Simultaneously, equipment suppliers are innovating rapidly to address sustainability objectives, integrating resource-efficient technologies that minimize energy consumption and material waste.

Consequently, understanding the latest developments in machine architecture, material compatibility, and automation strategies has never been more critical. This executive summary presents a concise yet comprehensive overview of transformative trends, tariff-driven dynamics, segmentation insights, regional nuances, leading players, and actionable recommendations. By examining these facets in tandem, decision-makers gain a clear perspective on where to invest and how to adapt in order to maintain a competitive edge in the blister packaging equipment landscape.

Uncover the Industry 4.0 Revolution and Sustainability Imperatives Reshaping Blister Packaging Equipment Design and Operational Landscapes

The blister packaging equipment sector is undergoing a paradigm shift fueled by Industry 4.0 principles and mounting sustainability imperatives. Manufacturers are embedding sensors and IoT connectivity to enable real-time monitoring of machine performance and environmental conditions. Such digital integration not only enhances operational transparency but also facilitates predictive maintenance, dramatically reducing unplanned downtime and prolonging equipment life.

Simultaneously, there is an intensifying focus on eco-conscious design. Low-energy heating elements, on-demand air assist, and localized cooling systems are being deployed to shrink carbon footprints. Within this framework, equipment builders are exploring bio-based polymers and recyclable composites to align with global waste reduction targets. These sustainable materials frequently require bespoke forming profiles, prompting machine suppliers to develop adaptable platforms that support rapid tool changeovers without sacrificing throughput.

Moreover, advancements in robotics and AI-driven vision systems are streamlining changeover processes and quality control. Automated material loading, shape recognition, and defect detection capabilities are making mid-run adjustments seamless, thus meeting the growing demand for customization and small-batch production. As a result, blister packaging equipment is transitioning from static, single-purpose machinery to intelligent, multifunctional solutions that can navigate the complexities of modern supply chains and consumer expectations.

Analyze the Multifaceted Consequences of United States 2025 Tariff Adjustments on Blister Packaging Equipment Supply Chains and Cost Structures

In early 2025, the United States implemented a series of tariff enhancements targeting imported blister packaging machinery, auxiliary tooling, and certain raw materials. Equipment components sourced from key manufacturing hubs now face elevated duty rates, compelling OEMs and end users to reassess cost structures and supplier relationships. These adjustments have interwoven challenges related to procurement timing, financial planning, and long-term capital investment strategies.

As a direct consequence, many domestic producers are increasing vertical integration, expanding in-house tooling and maintenance capabilities to offset incremental import costs. Strategic partnerships with local engineering firms have become more prevalent, enabling tailored equipment adaptations while mitigating exposure to fluctuating tariff regimes. In parallel, some international suppliers are re-evaluating their global footprint, establishing regional assembly centers in North America to qualify under more favorable trade provisions.

Transitioning to compliant sourcing and production models requires meticulous coordination across engineering, procurement, and finance teams. Companies that swiftly recalibrated their supply chains have preserved margin integrity and reduced lead times, whereas those reliant on imported finished goods encountered extended delivery windows and unpredictable cost pass-throughs. Ultimately, the 2025 tariff landscape underscores the necessity for agile supply chain frameworks and proactive scenario planning to maintain resilience amid regulatory shifts.

Delve into Segmentation Dynamics Illuminating How End Use Industries Equipment Types Materials Automation Levels and Speeds Shape Market Trajectories

A detailed segmentation analysis reveals distinct growth drivers and operational priorities across varied end use industries. Pharmaceutical and medical device applications demand the highest levels of sterility, traceability, and precision, often integrating serialization modules and tamper-evident seals. In contrast, consumer electronics manufacturers prioritize blister shapes that balance product visibility with protective rigidity, while cosmetics brands seek packaging that enhances shelf allure through custom contouring and high-gloss finishes. Automotive sectors employ blister systems for small parts organization and damage prevention during assembly, and food and beverage producers focus on barrier performance to preserve freshness and prevent leakage.

Examining equipment types shows that cold forming solutions, comprising primary and secondary cold formers, excel at producing high-barrier aluminum cavities ideal for sensitive pharmaceuticals and perishable foods. Thermoforming platforms, including roll fed and sheet fed variants, provide flexibility for plastics-based packaging across mid-size batch runs and customized shapes. Linear blister machines are favored for low to medium speed requirements and simple cavity designs, whereas rotary equipment delivers unmatched high-speed output for mass production environments demanding continuous performance and minimal changeover durations.

The choice of forming material further influences machine configurations. Aluminum systems deliver superior barrier protection but require higher forming forces and precision tooling, whereas composite options blend multiple polymers to tailor strength and barrier attributes. Polyvinyl chloride remains widely used due to its cost-effectiveness and formability, though polyvinylidene chloride is gaining traction where enhanced moisture resistance is critical. Automation levels vary from manual setups within small-scale operations to fully automatic cells that handle indexing, forming, sealing, and inspection without human intervention. Finally, speed classifications from low to medium to high dictate frame rigidity, drive mechanisms, and control architectures, ensuring that each equipment solution aligns with throughput targets and quality specifications.

This comprehensive research report categorizes the Blister Packaging Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Forming Material

- Automation Level

- Speed

- End Use Industry

Explore Regional Nuances and Competitive Advantages Across the Americas Europe Middle East Africa and Asia Pacific Blister Packaging Equipment Markets

Regional insights demonstrate that the Americas lead in adoption of high-throughput solutions and advanced automation. The robust pharmaceutical clusters in the United States and Canada drive investment in fully automatic rotary systems outfitted with serialization and track-and-trace functions. In Latin America, growing consumer goods demand has spurred upgrades from manual and semi automatic machines to more sophisticated thermoforming models, enhancing product presentation and reducing waste.

Within Europe, the Middle East, and Africa, regulatory frameworks around waste management and energy consumption are accelerating the shift to eco-friendly equipment designs. Manufacturers in Western Europe emphasize recyclable forming materials and energy recovery systems, while Eastern European markets are scaling up capacity with a mix of linear and rotary machines sourced from regional OEMs. In the Middle East and Africa, demand is concentrated on modular platforms that can be locally maintained, facilitating rapid deployment across diverse climates and infrastructure conditions.

Asia-Pacific represents a dynamic growth frontier fueled by booming pharmaceutical and consumer electronics production. China and India are investing heavily in domestic equipment capabilities, driving collaboration between global and local suppliers to deliver cost-effective, medium-speed blister lines. Southeast Asian markets are prioritizing agility and customization, favoring cold forming solutions for niche pharmaceutical segments and thermoforming machines for food and FMCG applications. Overall, regional strategies reflect a convergence of technology transfer, sustainability mandates, and market-specific production profiles.

This comprehensive research report examines key regions that drive the evolution of the Blister Packaging Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examine Innovations and Strategic Positioning of Leading Blister Packaging Equipment Manufacturers Driving Competitive Differentiation

Leading blister packaging equipment providers are distinguishing themselves through a combination of technological prowess, service excellence, and strategic alliances. Global industry stalwarts have introduced integrated software suites that unify machine control, preventive maintenance scheduling, and supply chain analytics, creating a unified ecosystem that links production floors with enterprise planning systems. Other vendors are partnering with sensor manufacturers and software firms to offer turnkey predictive maintenance contracts, guaranteeing uptime and performance metrics under performance-based service agreements.

Innovation pipelines are notably populated with developments in quick-change tooling, enabling rapid conversion between cavity geometries without manual retooling. This feature addresses the growing imperative for shorter product lifecycles and small-batch customization. Additionally, an emerging cohort of niche suppliers specializes in retrofit kits, allowing legacy machines to adopt digital controls and automated feeders, thereby extending operational life and upgrading capabilities at a fraction of replacement costs.

Complementing these technological enhancements, leading companies are expanding global service networks to provide localized commissioning, spare parts distribution, and training programs. This full-spectrum support model reduces machine downtime and accelerates return on investment. By weaving together advanced machine features, comprehensive aftermarket services, and collaborative R&D partnerships, these players are setting the benchmark for competitive differentiation in the blister packaging equipment arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blister Packaging Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accutek Packaging Equipment Companies Inc.

- Algus Packaging Inc.

- Amcor Plc

- Bradman Lake Group

- CAM Packaging Systems

- Coesia S.p.A.

- IMA S.p.A.

- KOCH Packaging Systems

- Marchesini Group S.p.A.

- Multivac Group

- Optima packaging group GmbH

- Pro Mach Inc.

- Romaco Group GmbH

- Royal Pharmaceutical Machinery Co. Ltd.

- Sonoco Products Company

- Starview Packaging Machinery Inc.

- Syntegon Technology GmbH

- Tecnicam S.r.l.

- Uhlmann Pac-Systeme GmbH & Co. KG

- Zed Industries Inc.

Implement Strategic Initiatives Centered on Automation Sustainability Supply Chain Resilience and Customization to Strengthen Market Position

To fortify market standing, equipment manufacturers and end users should prioritize targeted investments in automation and digitalization. Implementing fully automatic lines equipped with real-time performance dashboards will streamline production workflows and rapidly highlight inefficiencies. At the same time, adopting sustainable material trials in collaboration with suppliers can reveal new barrier solutions that reduce environmental impact and enhance brand reputation.

Strengthening supply chain resilience requires establishing multiple sourcing channels and evaluating options for local assembly or contract manufacturing. By diversifying component suppliers and securing regional inventory hubs, companies can mitigate the effects of future tariff shocks and logistical disruptions. Simultaneously, fostering vertical integration or forming joint ventures with material producers can secure preferential access to advanced polymers and aluminum alloys, locking in competitive cost advantages.

Finally, enhancing customization capabilities through modular machine architectures and quick-change tool systems will meet evolving customer demands for personalized blister designs. Providing shared services such as design consultation and prototyping supports strategic account development, elevating customer loyalty and unlocking new revenue streams. By aligning modernization roadmaps with these strategic priorities, industry leaders can navigate market complexities and drive sustained growth.

Understand the Rigorous Research Methodology Leveraging Primary Interviews Public Data Patent Analysis and Expert Validation Ensuring Depth and Accuracy

This analysis is built on a rigorous research methodology combining both primary and secondary sources. Primary research included in-depth interviews with engineering directors, production managers, and supply chain executives from leading equipment manufacturers and end-user organizations. These discussions provided firsthand perspectives on technology adoption challenges, regulatory compliance strategies, and future capital expenditure plans.

Secondary research encompassed a comprehensive review of industry publications, trade show proceedings, patent literature, and publicly available regulatory filings. Patents were analyzed to identify emerging innovations in forming tool geometries, drive mechanisms, and sealing technologies. Trade association reports and whitepapers provided contextual background on material sustainability trends and digitalization benchmarks, while regulatory databases offered insight into updated compliance requirements and tariff schedules.

To ensure data integrity, a triangulation process was applied, cross-referencing insights from interviews with publicly available documentation and third-party expert commentary. This multi-layered verification approach ensures that the findings are both accurate and representative of current industry dynamics. Furthermore, expert panels were convened to validate the conclusions and actionable recommendations, providing an additional layer of scrutiny and domain-specific context.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blister Packaging Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blister Packaging Equipment Market, by Equipment Type

- Blister Packaging Equipment Market, by Forming Material

- Blister Packaging Equipment Market, by Automation Level

- Blister Packaging Equipment Market, by Speed

- Blister Packaging Equipment Market, by End Use Industry

- Blister Packaging Equipment Market, by Region

- Blister Packaging Equipment Market, by Group

- Blister Packaging Equipment Market, by Country

- United States Blister Packaging Equipment Market

- China Blister Packaging Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesize Key Insights on Technological Evolution Regulatory Influences Tariffs and Segmentation to Chart Future Directions in Blister Packaging Equipment

Through a synthesis of technological developments, regulatory adaptations, and tariff-driven shifts, blister packaging equipment is positioned at the nexus of innovation and operational resilience. Digital integration and Industry 4.0 enablers are reinventing how machines communicate and self-optimize, while sustainability imperatives are redefining material usage and energy efficiency. Tariff adjustments have underscored the critical need for supply chain flexibility and regional sourcing strategies.

Segmentation insights highlight the diverse requirements of different end use industries, from pharmaceuticals demanding airtight barrier integrity to consumer electronics emphasizing visual presentation. Equipment typologies, forming materials, automation levels, and speed classifications each present unique considerations that must be carefully balanced against productivity and cost objectives. Regional landscapes further influence strategic decisions, with distinct regulatory pressures and market maturities shaping adoption patterns in the Americas, EMEA, and APAC.

Collectively, these insights form a cohesive roadmap for stakeholders seeking to innovate, compete, and thrive in the blister packaging equipment domain. By embracing data-driven decision-making and proactively addressing emerging challenges, companies can secure competitive advantages, ensure compliance, and deliver superior packaging solutions that meet the exacting demands of today’s global markets.

Seize the Opportunity to Collaborate with Ketan Rohom and Access the Comprehensive Blister Packaging Equipment Report to Drive Informed Business Decisions

For organizations poised to capitalize on the blister packaging equipment industry’s most pressing insights, partnering with a dedicated expert can accelerate decision-making and strategic planning. Ketan Rohom, Associate Director of Sales & Marketing, is available to guide you through the comprehensive research findings, offering tailored support to unlock the full potential of this market. By engaging directly, you will gain prioritized access to in-depth analysis on technological developments, tariff impacts, and segmentation strategies that directly influence operational efficiency and competitive advantage.

Securing the full report will equip you with the critically needed context and data to craft robust investment and procurement roadmaps. Whether your focus lies in expanding automation capabilities, optimizing material usage, or navigating regional trade dynamics, this report serves as an indispensable tool. Reach out to Ketan Rohom today to take the next step toward data-driven innovation and sustainable growth in blister packaging equipment.

- How big is the Blister Packaging Equipment Market?

- What is the Blister Packaging Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?