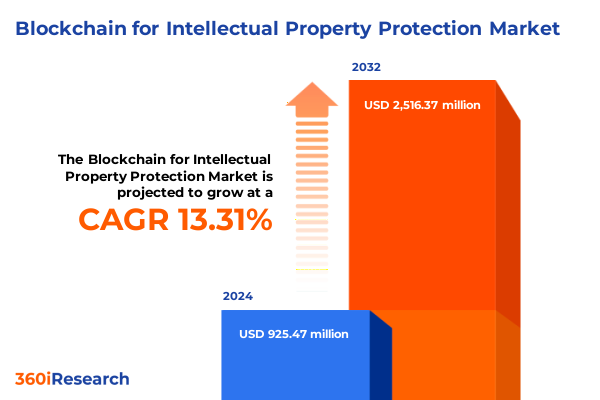

The Blockchain for Intellectual Property Protection Market size was estimated at USD 1.03 billion in 2025 and expected to reach USD 1.17 billion in 2026, at a CAGR of 13.45% to reach USD 2.51 billion by 2032.

An authoritative introduction to how blockchain solutions reshape rights management provenance verification and enforcement for intellectual property

Blockchain-enabled approaches to intellectual property protection intersect technical innovation, legal evolution, and commercial strategy. Traditional IP frameworks rely on records maintained by centralized authorities and manual processes for registration, verification, and enforcement. Distributed ledger technologies introduce the potential for immutable provenance trails, cryptographic proof of creation, and programmable licensing mechanisms that reduce friction, increase transparency, and enable new monetization pathways. This introduction frames the core concepts and clarifies how cryptographic timestamps, smart contracts, and tokenization map to real-world IP workflows across copyright, patent, trade secret, and trademark domains.

Adoption is not purely a technical exercise; it also requires alignment across legal counsel, R&D, product, and commercialization teams. Technology decisions influence evidentiary value, chain-of-custody practices, and interoperability with existing registries and enterprise resource systems. As a result, successful initiatives balance proof-of-concept experiments with governance models, standards alignment, and an explicit risk mitigation plan. Throughout this introduction, emphasis is placed on practical outcomes: reducing infringement detection times, streamlining rights transfers, and creating auditable records that support dispute resolution.

Finally, this section positions blockchain as a complementary tool rather than a panacea. The most impactful deployments pair distributed ledger capabilities with robust identity frameworks, API-enabled rights management platforms, and legal strategies tailored to jurisdictional requirements. By setting clear objectives and success criteria up front, organizations can pilot with measurable KPIs and scale IP protection interventions in a disciplined manner.

Analysis of shifts reshaping intellectual property ecosystems emphasizing technological convergence regulatory evolution and stakeholder behavior change

The intellectual property landscape is undergoing several convergent shifts that change how creators, corporations, and intermediaries capture and defend value. First, technology convergence-where cryptography, tokenization, and decentralized identifiers intersect with cloud-native services-enables automated, auditable workflows that did not exist in legacy systems. This shift reduces reliance on paper-based evidence, lowers the time to verify provenance, and allows rights to be transferred via programmable contracts with reduced administrative overhead.

Second, regulatory evolution is accelerating. Policymakers are scrutinizing data sovereignty, cross-border evidence admissibility, and the intersection of digital rights with consumer protection. As jurisdictions clarify how cryptographic records map to legal standards for ownership and authorship, organizations must adapt governance frameworks and compliance controls to ensure that blockchain-derived evidence integrates with formal IP processes.

Third, stakeholder behavior is changing. Rights holders increasingly expect real-time royalty visibility and flexible licensing models, while platforms and intermediaries seek transparent revenue-sharing mechanisms. This behavioral shift encourages technology vendors and service providers to design modular solutions that support multiple monetization pathways and interoperate with legacy rights management systems. Taken together, these transformative shifts create a strategic imperative: align technical design, legal counsel, and business models to convert technological capability into defensible commercial advantage.

Perspective on US tariff developments in 2025 and how they reshape supply chains technology sourcing cross-border enforcement and IP protection strategies

The tariff posture adopted by the United States in 2025 has ripple effects across supply chains and technology sourcing strategies that are directly relevant to organizations implementing blockchain-based intellectual property protections. Increased tariffs on hardware components, specialized chips, and cross-border IT services raise procurement costs and make localized sourcing decisions more consequential. When hardware and infrastructure costs rise, some organizations re-evaluate on-premises deployments in favor of cloud or hybrid models; others accelerate consolidation with regional partners to mitigate customs exposure. These procurement shifts influence the choice of deployment mode for IP protection platforms and the economics of on-chain versus off-chain architectures.

Tariff-related restrictions also affect cross-border collaboration on joint R&D projects and consortium-based blockchain networks. Entities that previously relied on seamless international collaboration now face higher transactional frictions, which encourages regionalization of consortia and data localization strategies to reduce exposure to import duties and compliance complexity. Consequently, designs that assume global node distribution may need to incorporate flexible governance to permit regional nodes or permissioned architectures that align with trade constraints.

In parallel, tariff-driven supply chain reconfiguration heightens the importance of traceability and provenance in physical-digital hybrids. Industries such as manufacturing and consumer electronics with complex component origins benefit from cryptographic provenance records that accompany hardened logistics documentation. For IP owners, this can strengthen enforcement by linking physical goods to on-chain credentials, making counterfeiting more costly and detection more precise. Organizations should therefore revisit sourcing policies, deployment models, and consortium agreements to ensure resilience amid tariff-induced volatility.

Segmentation insights clarifying offerings blockchain network types monetization models application domains verticals and deployment choices informing strategy

A granular understanding of segmentation drives practical product and go-to-market choices for IP protection platforms that use distributed ledger technology. From an offering perspective, it matters whether an organization pursues services-led engagement-covering consulting, systems integration, and ongoing support and maintenance-or whether it emphasizes packaged solutions such as digital rights management, IP asset management, or licensing and monetization engines. These choices define revenue models and influence required capabilities in legal interoperability and systems integration. When examine blockchain network type, decision-makers must weigh consortium networks for multi-party governance, hybrid networks that blend public and private elements, private permissioned deployments for internal control, and public networks for broad transparency and token-based ecosystems. Each network type carries different trade-offs in performance, privacy, and regulatory exposure.

Monetization models further shape product design, with licensing fees, subscription-based arrangements, and transaction fee frameworks each requiring distinct billing and audit capabilities. Applications range across copyright protection where timestamping and watermarking complement creative workflows, patent protection where chaining invention disclosures and assignment records improves clarity, trade secret protection where access controls and immutable audit logs deter leakage, and trademark protection where brand provenance and authorized reseller registries reduce infringement. End-user verticals include automotive, consumer goods, entertainment and media, healthcare and pharmaceuticals, IT and telecommunication, and manufacturing, and each sector emphasizes different functional priorities such as lifecycle traceability, royalty settlement speed, or regulatory evidence. Finally, deployment mode considerations-cloud versus on-premises-determine integration complexity, latency characteristics, and compliance posture, and they must align with enterprise procurement and data governance policies.

This comprehensive research report categorizes the Blockchain for Intellectual Property Protection market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Blockchain Network Type

- Monetization Models

- Application

- End-User

- Deployment Mode

Regional analysis showing how adoption varies across the Americas Europe Middle East & Africa and Asia-Pacific due to regulatory regimes and industry priorities

Regional dynamics materially affect the trajectory and design of blockchain-enabled IP protection initiatives. In the Americas, the ecosystem emphasizes commercial pragmatism: rapid proofs of concept, strong private-sector consortium activity, and emphasis on monetization mechanisms that accelerate licensing and royalty automation. Regulatory regimes in the Americas tend to favor market-driven solutions, yet privacy and evidentiary standards vary between jurisdictions, influencing deployment models and data residency choices. Transitional strategies in this region commonly combine cloud-based services with permissioned networks to balance speed to market with enterprise governance.

In Europe, Middle East & Africa, regulatory rigor and data protection considerations lead to a focus on legal compliance, standards alignment, and interoperable architectures. European initiatives often prioritize technical designs that demonstrate chain-of-custody robustness and integrate with national IP registries or notarization services. In parts of the Middle East and Africa, regional hubs adopt consortium models to enable cross-border collaboration while maintaining local controls and compliance with emerging digital trade policies. Infrastructure readiness and talent distribution in these regions shape adoption cadences and partnership strategies.

Across Asia-Pacific, the combination of manufacturing scale, innovation centers, and varied regulatory frameworks creates a landscape of rapid experimentation coupled with pragmatic risk management. High-volume manufacturing sectors and consumer electronics ecosystems prioritize provenance and anti-counterfeiting use cases, while service providers push subscription and transaction-based monetization approaches. Across all regions, successful initiatives tailor governance and deployment choices to local regulatory expectations while preserving interoperability for cross-border enforcement and commercialization.

This comprehensive research report examines key regions that drive the evolution of the Blockchain for Intellectual Property Protection market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Company insights on competitive positioning partnership models technology differentiation and commercialization strategies among incumbents startups and consortia

Company strategies in the blockchain for IP protection space cluster around distinct competitive plays: platform incumbents that emphasize end-to-end integrated stacks, specialized vendors that focus on narrow functional capabilities such as rights management or provenance tracking, and consortium entities that balance shared infrastructure with member governance. Firms differentiating on technology invest in performance, privacy-preserving cryptography, and API ecosystems to integrate with royalty management, ERP, and identity systems. Others differentiate on go-to-market by assembling channel partnerships with law firms, industry associations, and cloud providers to accelerate enterprise sales cycles.

Commercial partnerships and consortium participation serve as important signals of credibility and reduce buyer perceived risk. Companies that build strong legal and compliance practices, publish interoperability specifications, and participate in standards initiatives tend to secure larger enterprise contracts and cross-industry collaborations. Startups frequently position proof-of-concept offerings around single-use cases-such as creative rights tracking or pharma provenance-while larger firms offer enterprise-grade SLAs, global support, and integration services. Competitive dynamics also reflect differing approaches to monetization: some vendors emphasize subscription licensing with premium support, others adopt transaction fee models that align vendor incentives with usage, and a subset offers hybrid pricing to attract both pilots and large-scale rollouts. Buyers should assess vendor roadmaps, partnership networks, and demonstrated case studies when prioritizing supplier engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blockchain for Intellectual Property Protection market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Alibaba Group Holding Ltd.

- Amazon Web Services, Inc.

- Chetu, Inc.

- ConsenSys AG

- Dapper Labs Inc.

- Eastman Kodak Company

- Einfolge Technologies P Ltd

- Fujitsu Limited

- Guardtime AS

- Hitachi, Ltd.

- Infosys Limited

- International Business Machines Corporation

- IP LEVERAGED SAS

- LexisNexis Risk Solutions

- Microsoft Corporation

- Samsung Electronics Co., Ltd.

- SIMBA Chain, Inc.

- TATA Consultancy Services Limited

- Tencent Holdings Ltd

- Verisart, Inc.

- Winston Artory Group

Actionable recommendations to accelerate adoption de-risk deployments align with regulation and capture IP monetization opportunities for industry leaders

Industry leaders should take a pragmatic, phased approach to unlock the strategic benefits of blockchain for intellectual property protection. Begin by defining clear business objectives and success criteria that tie technological outcomes to commercial KPIs such as licensing velocity, time-to-evidence in disputes, or reduction in manual reconciliation costs. Next, design a governance model that assigns legal, technical, and operational responsibilities. Effective governance clarifies data ownership, node participation rules, and dispute-resolution pathways, and it accelerates decision-making once pilots scale.

Leaders should prioritize interoperable architectures that enable modular adoption: decouple on-chain proofs from off-chain content delivery, adopt open standards for identity and consent, and select middleware that provides robust APIs for ERPs and rights management systems. To de-risk deployments, structure pilots with a narrow scope, measurable outcomes, and phased integration into core systems. Secure executive sponsorship and legal sign-off early to ensure evidentiary and compliance requirements are baked into the technical design. Additionally, explore consortium participation or strategic partnerships to share implementation costs and create network effects that increase the value of recorded provenance.

Finally, develop talent and operational capabilities to support sustained adoption. Invest in legal training for blockchain evidence, develop clear operational runbooks for incident handling, and align incentive structures for product and licensing teams so that technology adoption translates into measurable revenue and defensible IP positions.

Methodology overview outlining data sources primary and secondary research steps expert validation case study review and measures taken to ensure rigor

This study uses a mixed-methods research design to ensure analytical rigor and actionable insights. Primary research included structured interviews with practitioners across legal, R&D, product, and procurement functions, along with dialogues with technology providers, integrators, and consortium participants to capture firsthand implementation experiences. Secondary research involved review of public filings, legal precedents, white papers, and technical specifications to situate primary findings within documented practices. Case studies were selected to illustrate diverse deployment patterns across verticals and to surface replicable governance and technical patterns.

To validate findings, an expert review panel comprising technologists, IP lawyers, and industry operators provided iterative feedback on draft conclusions and recommended refinements. Data triangulation techniques ensured that claims were cross-checked across multiple sources, and methodological transparency is preserved by documenting interview protocols, inclusion criteria for case studies, and the assumptions used in comparative analyses. The study also acknowledges limitations: rapidly evolving regulation and nascent commercial models mean that some strategic recommendations will require ongoing validation as standards and precedents mature. Ethical considerations guided the treatment of proprietary and sensitive information, and confidentiality protocols were observed for all primary engagements.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blockchain for Intellectual Property Protection market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blockchain for Intellectual Property Protection Market, by Offering

- Blockchain for Intellectual Property Protection Market, by Blockchain Network Type

- Blockchain for Intellectual Property Protection Market, by Monetization Models

- Blockchain for Intellectual Property Protection Market, by Application

- Blockchain for Intellectual Property Protection Market, by End-User

- Blockchain for Intellectual Property Protection Market, by Deployment Mode

- Blockchain for Intellectual Property Protection Market, by Region

- Blockchain for Intellectual Property Protection Market, by Group

- Blockchain for Intellectual Property Protection Market, by Country

- United States Blockchain for Intellectual Property Protection Market

- China Blockchain for Intellectual Property Protection Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding synthesis highlighting strategic imperatives long-term value drivers and how blockchain strengthens IP ecosystems and enables commercialization

In synthesis, blockchain-enabled solutions offer a meaningful set of mechanisms to strengthen intellectual property protection through immutable provenance, automated licensing, and enhanced auditability. The technology’s value crystallizes when it is embedded in coherent governance, aligned with legal requirements, and connected to commercial processes that capture and distribute economic value. Organizations that treat blockchain as part of a broader IP protection and commercialization portfolio-rather than a point solution-are better positioned to translate proofs of concept into sustained revenue streams and enforceable rights.

Strategic imperatives include building interoperable architectures, prioritizing use cases that demonstrate rapid ROI, and engaging legal and operational stakeholders early. Equally important is selecting monetization frameworks that reflect user behavior and sector economics, whether licensing fees, subscriptions, or transaction-based settlements. The path to scale requires demonstrable governance, standards alignment, and repeatable integration patterns with legacy systems. When those elements align, distributed ledger technologies become a force multiplier for IP protection: they reduce transaction friction, increase transparency in revenue distribution, and create stronger evidentiary records for cross-border enforcement.

Contact Ketan Rohom Associate Director Sales & Marketing to purchase the report request an executive briefing and explore enterprise licensing options

This report is available for purchase and for scheduling a tailored executive briefing with Ketan Rohom, Associate Director, Sales & Marketing. The full study delivers an integrated view of the technological, legal, and commercial forces shaping the application of distributed ledger systems to intellectual property protection and monetization. Prospective buyers will receive a comprehensive package that supports procurement decisions, pilot planning, and commercial negotiations, and it includes technical assessments and vendor comparison frameworks to accelerate procurement cycles and adoption timelines.

Contacting Ketan Rohom enables organizations to arrange a customized walkthrough of the report’s findings, obtain a tailored scope of services, and discuss enterprise licensing arrangements that align with procurement policies. The briefing can be structured to focus on specific verticals, preferred deployment modes, or regional regulatory themes. Organizations engaging him can expect a pragmatic conversation that clarifies next steps, identifies high-impact pilots, and suggests partnership pathways to de-risk early deployments.

For teams preparing board materials, procurement rationales, or investor briefings, direct engagement will expedite access to charts, case studies, and validated use cases. Reach out to arrange a confidential consultation to evaluate how the insights in this report translate into strategic initiatives, procurement choices, and revenue capture opportunities for your organization

- How big is the Blockchain for Intellectual Property Protection Market?

- What is the Blockchain for Intellectual Property Protection Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?