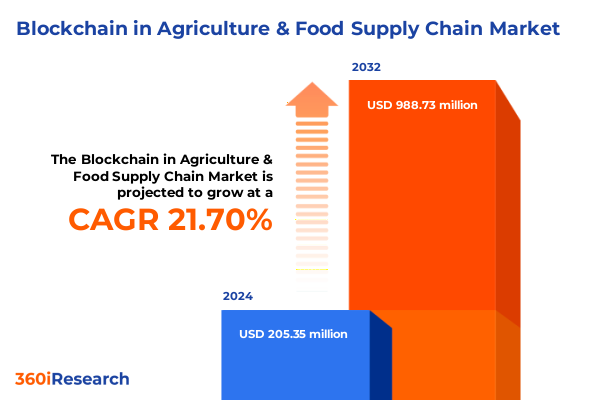

The Blockchain in Agriculture & Food Supply Chain Market size was estimated at USD 250.24 million in 2025 and expected to reach USD 308.91 million in 2026, at a CAGR of 21.68% to reach USD 988.72 million by 2032.

Exploring How Blockchain Innovations Are Redefining Traceability Transparency and Efficiency across the Agricultural and Food Supply Continuum

Blockchain technology is rapidly emerging as one of the most promising solutions for tackling longstanding challenges within global agriculture and the food supply chain. From farm gate to retail shelf, stakeholders face persistent issues related to provenance verification, real-time traceability, and coordinated quality assurance. In recent years, heightened consumer demand for transparency, coupled with increasingly stringent regulatory frameworks, has accelerated the search for systems that can deliver immutable records and seamless data sharing across complex, multi-tiered networks. Against this backdrop, distributed ledger platforms are being embraced as catalysts for greater operational resilience and trust.

By providing a decentralized yet permissioned environment, blockchain offers participants-from primary producers to logistics providers-the ability to record and verify transactions at every stage of the value chain. This not only mitigates risk of fraud and contamination but also sharply reduces reconciliation time and administrative overhead. As agricultural ecosystems become more data-driven, integrating blockchain with complementary technologies such as Internet of Things (IoT) sensors and advanced analytics further enhances visibility and predictive insights around yield optimization, resource management, and environmental impact. The synergy between these emerging solutions is setting the stage for a new era of digital agriculture.

This executive summary presents an overview of the key trends, market dynamics, and strategic imperatives shaping blockchain adoption in agriculture and food supply management. It highlights critical shifts driving implementation, examines the cumulative effects of recent tariff changes, and distills essential segmentation and regional takeaways. Additionally, the report identifies leading companies, offers actionable recommendations for industry leaders, outlines the underlying research methodology, and concludes with strategic imperatives for decision-makers seeking to capitalize on this transformational technology.

Unveiling the Digital Transformation Wave Propelled by Decentralized Ledgers Smart Contracts and IoT Integration in Food and Agriculture

The agricultural and food supply landscape is undergoing a profound transformation driven by digitalization and heightened stakeholder expectations. Traditional paper-based record-keeping and siloed information flows are giving way to interconnected platforms capable of capturing, validating, and disseminating data in real time. This shift is rooted in the need to strengthen food safety protocols, reduce waste, and address growing concerns around carbon footprints and ethical sourcing. Blockchain’s immutable ledger mechanism is uniquely positioned to underpin these objectives by offering a single source of truth that harmonizes data across disparate actors.

Simultaneously, the integration of smart contracts is automating key processes such as payment settlement, compliance auditing, and certification validation. These programmable agreements self-execute when predefined conditions are met, streamlining operations and minimizing disputes. Coupled with IoT-enabled monitoring of temperature, humidity, and location parameters, the ecosystem is evolving toward a more agile and responsive model. As a result, proof-of-origin credentials and quality attestations can be generated and shared instantaneously, enhancing consumer trust and brand differentiation.

Moreover, emerging regulatory frameworks in major markets are increasingly mandating end-to-end traceability and sustainability reporting. Governments and industry bodies are collaborating to establish interoperable standards, further accelerating blockchain pilots and consortium-led initiatives. Through these collaborative efforts, stakeholders are not only redefining compliance paradigms but also unlocking new revenue streams tied to premium traceable products. Consequently, the supply chain is shifting from reactive problem resolution to proactive risk management, heralding a new era of digital agriculture where transparency, efficiency, and sustainability converge.

Examining How Elevated 2025 United States Tariff Policies Are Driving Blockchain Adoption for Enhanced Trade Compliance and Cost Management

The United States’ tariff landscape in 2025 has compounded complexity for agricultural stakeholders, with elevated duties on key imports and retaliatory measures affecting export markets. Tariffs on critical inputs such as fertilizers, advanced sensor equipment, and packaging materials have driven up production costs for farmers, while duties on select commodity exports have narrowed overseas market access. These cumulative duties have imposed additional compliance burdens, requiring supply chain participants to meticulously document tariff classifications, country-of-origin details, and transaction records to secure preferential treatment under trade agreements.

In response, blockchain platforms are emerging as indispensable tools for streamlining customs processes and automating tariff reconciliation. By embedding tariff schedules and product classification codes within smart contracts, participants can trigger automated duty calculations and generate auditable certificates of origin. This capability not only accelerates border clearance but also reduces the risk of fines and shipment delays. Furthermore, the immutable record of cross-border transactions supports deeper analytical insights into cost drivers and margin pressures, enabling exporters and importers to adapt sourcing strategies in near real time.

Beyond tariff compliance, distributed ledger solutions facilitate enhanced scenario planning amid volatile trade policy environments. By simulating the impact of proposed duty adjustments on price flows and contractual obligations, companies can hedge supply chain risks more effectively. As trade policy continues to evolve, blockchain-enabled transparency ensures that every stakeholder-from cooperative boards to multinational processors-can navigate regulatory shifts with greater confidence and agility. Ultimately, the fusion of ledger-based traceability with tariff management tools is reshaping global trade dynamics and fortifying the competitiveness of U.S. agriculture in 2025 and beyond.

Unraveling Critical Insights Across Platform Frameworks Service Offerings Application Use Cases and Deployment Preferences in Agri-Food Blockchain Solutions

When analyzing market segmentation by component, platforms have emerged as the foundational enabler of blockchain adoption within agriculture and food supply chains. These scalable frameworks offer distributed consensus mechanisms, permissioned access controls, and modular integration points that accommodate diverse stakeholder needs. Meanwhile, services are playing an increasingly pivotal role in guiding implementation, with managed offerings providing end-to-end operational support and professional services delivering specialized expertise in network design, smart contract development, and regulatory compliance.

Within the application segment, the use cases for blockchain extend across several mission-critical functions. Asset tracking remains a cornerstone, empowering producers and logistics providers to monitor goods in transit and verify authenticity. Compliance and certification management has gained momentum as businesses seek demonstrable proof of adherence to safety standards and sustainable practices. In parallel, payments and settlement capabilities are being streamlined through tokenized transactions, reducing reliance on traditional banking channels and accelerating cross-border remittances. Smart contracts enhance procedural efficiencies by automating contract execution and dispute resolution, while comprehensive supply chain traceability solutions deliver end-to-end visibility from farm gate to consumer table.

Deployment mode continues to shape organizational preferences, with cloud-based solutions favored for their rapid scalability, lower upfront investment, and ongoing platform maintenance. Conversely, on-premise deployments retain appeal among enterprises demanding heightened data sovereignty, customization, and integration with existing infrastructure. Collectively, these segmentation insights highlight the necessity for solution providers to offer flexible, modular approaches that address the nuanced requirements of stakeholders across the agricultural value chain.

This comprehensive research report categorizes the Blockchain in Agriculture & Food Supply Chain market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Blockchain Type

- Application

- Deployment Mode

Illuminating Regional Dynamics That Shape Adoption Patterns and Regulatory Drivers across the Americas EMEA and Asia-Pacific Agricultural Ecosystems

In the Americas, blockchain adoption has been driven by pioneering consortia and technology alliances that have demonstrated tangible improvements in traceability and food safety. The region’s mature regulatory environment, combined with consumer demand for provenance awareness, has catalyzed the launch of large-scale pilot programs across major crop and livestock sectors. As a result, stakeholders in North and South America are forging interoperable networks that facilitate cross-border data sharing and unified standards for quality assurance and ethical sourcing.

Europe, the Middle East, and Africa have witnessed a surge in regulatory-led initiatives designed to bolster food security and sustainability. European Union regulations requiring granular traceability for meat and dairy products have prompted blockchain integrations that link farm-level data with distribution center checkpoints. In the Middle East, governments are investing in agricultural modernization efforts that leverage digital ledgers to optimize scarce water resources and export processes. African producer cooperatives are embracing blockchain to secure fair trade certifications and connect smallholder farmers to global markets, enhancing economic inclusion and system transparency.

Asia-Pacific stands out for its rapid scaling of blockchain deployments, underpinned by significant investments in smart agriculture and digital infrastructure. Nations such as China and India are integrating distributed ledger technologies with IoT networks to monitor environmental conditions and automate compliance reporting. In Australia and New Zealand, agritech firms are coupling blockchain with carbon tracking frameworks to support sustainability commitments and value-added product branding. This dynamic regional landscape underscores the importance of tailored strategies that accommodate diverse regulatory, cultural, and technological contexts.

This comprehensive research report examines key regions that drive the evolution of the Blockchain in Agriculture & Food Supply Chain market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping the Competitive Terrain Where Technology Providers Agritech Innovators and Consortium Alliances Are Accelerating Blockchain Uptake

Several leading organizations have shaped the blockchain landscape in agriculture and food supply chains, forging paths for wider adoption. Technology giants have leveraged their extensive research capabilities to develop enterprise-grade platforms that support multi-party ecosystems. Concurrently, specialized agritech startups have introduced innovative proof-of-concept solutions tailored to niche segments such as organic produce verification and fair trade certification. System integrators and consulting firms have emerged as critical partners, bridging the gap between generic blockchain stacks and the unique operational demands of agricultural enterprises.

Strategic partnerships have also become a hallmark of industry advancement, as agribusinesses collaborate with financial institutions, logistics providers, and regulatory agencies to co-develop standards and use case pilots. Consortium models have proven effective in aligning incentives across the value chain, enabling shared investment in infrastructure and collaborative governance frameworks. Moreover, open-source initiatives are attracting developer communities to contribute to protocol enhancements, interoperability modules, and analytics toolkits that accelerate time-to-value for adopters.

Despite the early successes, the competitive landscape remains fragmented, with emerging players vying to differentiate through proprietary features, sustainability credentials, or domain-specific expertise. Going forward, the capacity of key companies to demonstrate integration capabilities, regulatory compliance, and robust service models will determine market leadership and long-term viability in the evolving ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blockchain in Agriculture & Food Supply Chain market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Research Cryptography Ltd.

- AgriDigital Pty Ltd

- Amazon Web Services, Inc.

- Ambrosus AG

- Bext360 Holdings Inc.

- GrainChain, Inc.

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- OriginTrail d.o.o.

- SAP SE

- TE-FOOD International GmbH

- VeChain Foundation

Guiding Industry Executives on Strategic Collaborations Workforce Development and Iterative Deployments to Maximize Blockchain Value Realization

Industry leaders should prioritize the development of cross-sector alliances to establish common data standards and governance protocols that facilitate seamless interoperability. By engaging in joint pilot programs, companies can share the cost burden of infrastructure development while validating high-value use cases across diversified product lines. Furthermore, embedding IoT sensors and machine-learning analytics alongside distributed ledger frameworks will enhance predictive insights around yield, quality, and logistics optimization.

Decision-makers must also invest in workforce capacity-building to nurture in-house expertise in blockchain architecture, smart contract auditing, and compliance management. Establishing centers of excellence that consolidate digital innovation resources will accelerate project delivery and ensure alignment with broader digital transformation goals. Simultaneously, executive sponsors should champion regulatory engagement to influence policy development and secure favorable conditions for scalable implementation. Maintaining active dialogue with standards bodies and trade associations can mitigate potential regulatory bottlenecks and foster an enabling environment.

Lastly, organizations should adopt an iterative, outcome-driven approach to deployment, focusing on incremental value realization rather than comprehensive overhauls. By sequencing proof-of-concept initiatives around critical pain points-such as recall management or supply chain financing-participants can demonstrate tangible ROI, build stakeholder buy-in, and lay the groundwork for wider ecosystem participation.

Detailing a Multi-Method Research Framework Combining Secondary Analysis Expert Interviews and Case Study Validation for Credible Insights

This research adopts a rigorous, multi-method approach to ensure comprehensive coverage of the blockchain in agriculture and food supply chain domain. The study began with an extensive review of secondary sources, including academic journals, regulatory publications, and industry white papers, to identify foundational concepts and emerging trends. Complementing this, a series of in-depth interviews was conducted with subject-matter experts spanning technology providers, agribusiness operators, logistics specialists, and policy advisors. These conversations yielded qualitative insights into real-world implementation challenges and success factors.

Primary data collection included detailed case study analyses of live blockchain deployments in major agricultural sectors. Each case was examined for architecture design, integration complexity, governance frameworks, and realized benefits. Quantitative assessments of transaction volumes, process efficiency gains, and compliance outcomes provided objective benchmarks. To validate findings, an iterative review process engaged a panel of senior stakeholders for feedback and alignment against market realities.

Finally, triangulation of secondary research, expert interviews, and case data ensured that conclusions reflect a balanced and robust understanding of the landscape. This methodology underscores the report’s credibility, enabling decision-makers to base strategic planning on empirically grounded insights and proven deployment models.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blockchain in Agriculture & Food Supply Chain market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blockchain in Agriculture & Food Supply Chain Market, by Component

- Blockchain in Agriculture & Food Supply Chain Market, by Blockchain Type

- Blockchain in Agriculture & Food Supply Chain Market, by Application

- Blockchain in Agriculture & Food Supply Chain Market, by Deployment Mode

- Blockchain in Agriculture & Food Supply Chain Market, by Region

- Blockchain in Agriculture & Food Supply Chain Market, by Group

- Blockchain in Agriculture & Food Supply Chain Market, by Country

- United States Blockchain in Agriculture & Food Supply Chain Market

- China Blockchain in Agriculture & Food Supply Chain Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Insights on Blockchain’s Role in Elevating Traceability Compliance and Resilience throughout the Food Supply Network

The integration of blockchain technology within agriculture and the food supply chain represents a paradigm shift from fragmented, opaque processes to interconnected, transparent ecosystems. By leveraging distributed ledgers, smart contracts, and IoT integration, stakeholders can achieve unprecedented levels of traceability, regulatory compliance, and operational efficiency. The cumulative impact of recent tariff changes has further underscored the importance of automated compliance mechanisms, driving accelerated adoption among producers, logistics providers, and retailers alike.

Segmentation insights reveal that platform scalability and managed service expertise are essential for supporting diverse application needs, from asset tracking to certification management. Regional dynamics highlight distinct regulatory drivers and market maturity profiles, from the Americas’ consumer-led transparency initiatives to Asia-Pacific’s technology-driven scalability ambitions. The competitive landscape is characterized by collaborations among leading technology firms, agritech startups, and consortium alliances, each contributing to the development of robust ecosystems.

As organizations navigate this evolving landscape, strategic recommendations emphasize the value of partnership models, capacity-building initiatives, and phased deployment strategies. Anchored by a rigorous research methodology, this executive summary provides the foundation for informed decision-making. Ultimately, embracing blockchain solutions will empower industry leaders to enhance supply chain resilience, foster consumer trust, and drive sustainable growth in an increasingly interconnected global food system.

Empower Your Organization’s Future with a Customized Briefing from an Associate Director of Sales & Marketing to Unlock Blockchain Insights in Agri-Food

To explore comprehensive insights into blockchain’s transformative role in agriculture and the food supply chain, engage with Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through tailored opportunities to harness distributed ledger solutions, optimize compliance pathways, and strengthen resilience against market volatility. Reach out to schedule a personalized briefing on how this research can inform strategic investments, pilot design, and digital roadmap initiatives designed to unlock value across your organization’s end-to-end operations.

- How big is the Blockchain in Agriculture & Food Supply Chain Market?

- What is the Blockchain in Agriculture & Food Supply Chain Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?