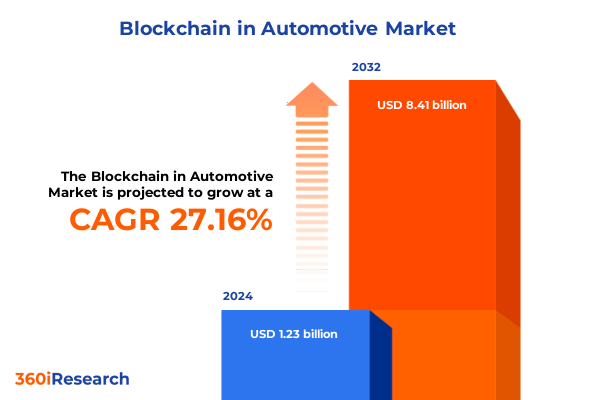

The Blockchain in Automotive Market size was estimated at USD 1.54 billion in 2025 and expected to reach USD 1.95 billion in 2026, at a CAGR of 27.34% to reach USD 8.41 billion by 2032.

Unveiling the Convergence of Blockchain Innovation and Evolving Automotive Dynamics to Revolutionize the Future of Connected Mobility Experiences

The automotive sector stands at a pivotal crossroads where emerging technologies converge to redefine traditional paradigms of manufacturing, sales, and customer engagement. At the heart of this transformation lies blockchain-a decentralized ledger technology renowned for its ability to establish immutable records, enforce trust without intermediaries, and facilitate seamless information exchange. Its integration promises to overhaul the way vehicles are financed, serviced, and connected, marking a shift from siloed operations to transparent, collaborative ecosystems.

In recent years, the potential of blockchain has been demonstrated through pilot programs that enhance supply chain traceability, secure over-the-air software updates, and streamline micro-transactions within connected vehicles. As industry stakeholders-from original equipment manufacturers to aftermarket service providers-seek to navigate rising customer expectations for security, connectivity, and convenience, blockchain emerges as a foundational enabler. This introduction outlines the critical pathways through which blockchain is poised to revolutionize the automotive value chain and sets the stage for deeper exploration of its transformative impact.

Exploring How Emerging Technologies Have Transformed the Automotive Landscape Through Decentralized Trust and Data-Driven Collaboration

When decentralized ledger technology first gained prominence, the automotive industry largely viewed it through the lens of cryptocurrency. However, today’s landscape reveals far-reaching transformations that extend well beyond tokenized assets. Blockchain has evolved into a versatile platform for establishing digital trust among OEMs, suppliers, insurers, and end users. Its distributed nature eliminates single points of failure, reduces the risk of data tampering in vehicle identity management, and fosters collaborative frameworks that accelerate product development and aftermarket services.

Furthermore, this shift toward decentralized ecosystems has empowered stakeholders to adopt micro-payment models for in-vehicle services and to implement secure, peer-to-peer communication channels for real-time data sharing. Automakers are increasingly leveraging blockchain for provenance tracking, ensuring that critical components-from semiconductor chips to battery cells-are authenticated at each step of the supply chain. Moreover, the rise of consortium-based networks has enabled competitive players to coalesce around shared standards, harmonizing regulatory compliance efforts across borders. These transformative shifts underscore the maturation of blockchain as a strategic asset in reshaping automotive operations.

Assessing the Layered Consequences of Recent United States Tariff Adjustments on Cross-Border Automotive Trade and Blockchain Integration

In 2025, new tariff adjustments enacted by the United States government introduced additional duties on imported automotive electronics and semiconductor components critical for blockchain implementations. These measures have led to immediate cost pressures for manufacturers that rely heavily on offshore hardware suppliers. As a result, many organizations have reevaluated their sourcing strategies, prioritizing domestic procurement of IoT modules and cryptographic processors to control expenses and mitigate supply chain disruptions.

Moreover, the elevated import duties have spurred collaborative ventures between automakers and domestic technology providers, driving investments in local manufacturing and R&D centers dedicated to blockchain hardware. This localization trend not only offsets tariff-induced cost increases but also strengthens the resilience of automotive blockchain ecosystems against geopolitical fluctuations. Furthermore, the heightened scrutiny on cross-border data transfers has prompted companies to optimize their onshore data storage and consortium governance structures, ensuring compliance with trade regulations while preserving the integrity and security of distributed ledgers.

Decoding Key Segmentation Insights to Illuminate Diverse Applications and Deployment Models in Blockchain-Enabled Automotive Solutions

The automotive blockchain market encompasses a diverse spectrum of applications, components, end users, deployment models, and offerings that collectively shape its growth trajectory. Based on application, the industry stretches from secure Financial Transactions-encompassing e-wallet integration, micro-payments, and tokenization-to Infotainment and Connectivity solutions, including multimedia streaming, over-the-air updates, and real-time data sharing. It further extends into Insurance verticals such as claims management, risk assessment, and underwriting, while also covering Supply Chain Management functions like IoT integration, provenance tracking, and smart contracts, and rounded out by Vehicle Identity Management areas focused on access control, anti-theft security, and digital VINs.

In parallel, the component segmentation spans Hardware, Services, and Software, reflecting the intertwined roles of physical devices, professional expertise, and platform solutions in enabling blockchain adoption. End users range from Dealerships and Fleet Operators to Original Equipment Manufacturers and Suppliers, each driving distinct value propositions and ROI timelines. Deployment typologies include Consortium networks that foster collaborative governance, Private ledgers tailored to proprietary data environments, and Public chains that emphasize transparency and open participation. Finally, the market’s offerings are categorized into Infrastructure layers that underpin system architecture, Platform services that facilitate application development, and comprehensive Solutions that address end-to-end business challenges. Together, these segmentation insights illuminate the multifaceted nature of blockchain applications in automotive contexts, guiding stakeholders toward targeted strategies that align with their operational and strategic imperatives.

This comprehensive research report categorizes the Blockchain in Automotive market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Type

- Application

- End User

Mapping Regional Dynamics to Highlight Distinct Drivers and Adoption Patterns Across Global Automotive Blockchain Markets

Regional dynamics are instrumental in shaping the pace and scope of blockchain adoption within the automotive sector. In the Americas, progressive regulatory frameworks and strong private sector investment have catalyzed pilot programs in electric vehicle charging settlements and dealer financing platforms. The prevalence of connected vehicle infrastructure and venture-backed blockchain start-ups has further accelerated proof-of-concept initiatives, with a focus on enhancing transparency in warranty management and streamlining fleet telematics operations.

By contrast, the Europe, Middle East & Africa region exhibits a distinct trajectory driven by harmonized regulatory standards and high cross-border logistics activity. Automotive manufacturers and logistics consortiums collaborate on shared ledgers to optimize spare parts provenance and reduce counterfeit risks. Meanwhile, government-led innovation hubs explore blockchain’s potential for enabling sustainable mobility solutions and integrating smart city frameworks. In the Asia-Pacific region, the convergence of rapid urbanization and digital transformation has prompted large-scale deployments of blockchain-enabled mobility services in markets such as China, Japan, and India. Here, cross-industry partnerships between telecom operators, automotive OEMs, and financial institutions drive scalable applications in vehicle leasing, usage-based insurance, and digital identity verification for ride-hailing platforms.

This comprehensive research report examines key regions that drive the evolution of the Blockchain in Automotive market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders Shaping the Blockchain Automotive Ecosystem Through Pioneering Partnerships and Innovative Solutions

A burgeoning ecosystem of both established corporations and agile innovators is driving momentum in blockchain-based automotive solutions. Leading automakers, including globally recognized brands, have formed cross-industry alliances to develop shared data infrastructures that ensure end-to-end traceability of components and streamline over-the-air software rollouts. Technology conglomerates specializing in distributed ledger platforms have partnered with tier-one parts suppliers to integrate secure provenance tracking into complex manufacturing operations, thereby enhancing component authenticity and minimizing warranty disputes.

At the same time, forward-thinking insurance firms have launched blockchain pilots to automate claims processing and implement dynamic underwriting models based on real-time telematics data. Meanwhile, specialized start-ups leverage tokenization to enable micro-payment ecosystems within vehicles, covering functions such as in-car commerce and pay-as-you-go charging. Collectively, these organizations are forging a network of complementary capabilities-from cryptographic hardware manufacturers and system integrators to software-as-a-service providers-that underpin the rapid evolution of the automotive blockchain landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blockchain in Automotive market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Alibaba Group Holding Limited

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Fujitsu Limited

- Helbiz Inc.

- Hewlett Packard Enterprise Company

- International Business Machines Corporation

- LimeChain

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- SHIFTMobility Inc.

Strategic Imperatives for Industry Leaders to Harness Blockchain’s Potential and Accelerate Transformation in Automotive Operations

To capitalize on the transformative potential of blockchain, industry leaders must adopt a multifaceted strategy that balances innovation with risk mitigation. Initially, establishing private consortium networks can accelerate interoperability by aligning stakeholders around common technical standards and governance frameworks. Concurrently, pilot programs targeting high-value use cases-such as digital twin asset management and micro-payment-enabled infotainment services-can generate tangible ROI and build internal expertise without exposing core operations to undue risk.

Furthermore, organizations should invest in robust change management processes to foster blockchain literacy across engineering, legal, and procurement teams. Collaborative engagement with regulators and standardization bodies will ensure that new solutions comply with evolving data privacy and security requirements. In parallel, developing modular, API-driven architectures will enable scalable integration with existing enterprise systems and support incremental feature rollouts. Ultimately, this structured approach-grounded in strategic partnerships, continuous learning, and flexible technology frameworks-will empower decision-makers to drive sustainable innovation across the automotive value chain.

Rigorous Research Methodology Underpinning Comprehensive Analysis of Blockchain Applications in the Automotive Sector

This research synthesizes insights from a rigorous methodology designed to capture the multifaceted nature of blockchain applications in automotive environments. Primary interviews were conducted with senior executives from original equipment manufacturers, tier-one suppliers, insurance carriers, and technology vendors to validate emerging trends and identify critical success factors. Complementing this qualitative research, secondary analysis incorporated publicly available data from regulatory filings, consortium whitepapers, and technical standards bodies to triangulate findings and uncover market dynamics.

In addition, interactive workshops brought together cross-functional teams-including engineers, legal counsels, and cybersecurity experts-to test proof-of-concept scenarios and evaluate system performance against real-world requirements. An advisory panel consisting of blockchain academics and industry practitioners provided ongoing validation of assumptions and guided the selection of high-priority use cases. Throughout the process, data integrity was maintained through adherence to industry best practices in research governance, ensuring that conclusions reflect both current realities and future potential of blockchain in the automotive sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blockchain in Automotive market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blockchain in Automotive Market, by Component

- Blockchain in Automotive Market, by Deployment Type

- Blockchain in Automotive Market, by Application

- Blockchain in Automotive Market, by End User

- Blockchain in Automotive Market, by Region

- Blockchain in Automotive Market, by Group

- Blockchain in Automotive Market, by Country

- United States Blockchain in Automotive Market

- China Blockchain in Automotive Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Drawing Conclusive Perspectives on Blockchain’s Role in Steering the Automotive Industry Toward Enhanced Efficiency and Security

The integration of blockchain technology into the automotive industry heralds a new era of transparency, efficiency, and security across the entire value chain. By enabling immutable record-keeping, fostering peer-to-peer interactions, and automating transactional workflows, decentralized ledgers address longstanding challenges in supply chain traceability, vehicle identity management, and in-vehicle commerce. As stakeholders continue to refine governance models, standardize protocols, and scale pilot initiatives, the foundational principles of distributed trust are poised to unlock innovative business models and revenue streams.

Looking ahead, the convergence of blockchain with complementary technologies-such as artificial intelligence, advanced telematics, and the Internet of Things-will further enhance predictive maintenance, dynamic insurance products, and autonomous vehicle ecosystems. While challenges remain, including interoperability, regulatory alignment, and skills development, the collective momentum of cross-industry collaborations underscores a clear trajectory toward mainstream adoption. In conclusion, blockchain represents not just an incremental improvement but a paradigm shift that will shape the future of mobility, forging a more secure, responsive, and customer-centric automotive landscape.

Engage with Ketan Rohom to Unlock Tailored Market Intelligence and Empower Decision-Making on Blockchain-Driven Automotive Innovations

To gain strategic advantage and comprehensive clarity on how blockchain can transform your automotive business, reach out to Ketan Rohom, Associate Director, Sales & Marketing. As an accomplished leader in delivering tailored market intelligence, Ketan will guide you through the unique insights, custom analysis, and actionable recommendations that address your organization’s specific challenges and objectives. By scheduling a one-on-one consultation, you will unlock exclusive access to the full market research report, detailed data visualizations, and expert commentary designed to accelerate your blockchain initiatives.

Engaging directly with Ketan ensures that you receive a personalized briefing, clarifications on emerging trends, and dedicated support for decision-making processes. Whether you are exploring supply chain optimization, deploying secure vehicle identity solutions, or developing next-generation infotainment platforms, this collaboration will empower you with the knowledge to chart your strategic roadmap. Contact Ketan to secure your copy of the report and embark on the next phase of blockchain-driven innovation in the automotive industry.

- How big is the Blockchain in Automotive Market?

- What is the Blockchain in Automotive Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?