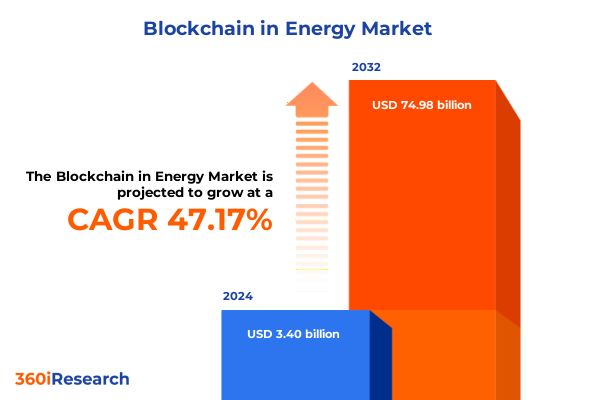

The Blockchain in Energy Market size was estimated at USD 4.96 billion in 2025 and expected to reach USD 7.24 billion in 2026, at a CAGR of 47.36% to reach USD 74.98 billion by 2032.

Harnessing Blockchain Technology to Revolutionize Energy Systems with Unprecedented Transparency, Enhanced Efficiency and Security to Drive a Decentralized Future

Energy markets around the globe are experiencing an unprecedented wave of digital transformation driven by the need for enhanced transparency, efficiency and resilience. Blockchain technology, with its inherent capabilities for immutable record-keeping and decentralized consensus, is emerging as a cornerstone of this revolution. As energy generation becomes increasingly diversified-ranging from utility-scale renewables to behind-the-meter installations-the industry confronts new complexities in tracking transactions, verifying certificates and coordinating distributed assets. In this context, blockchain solutions offer a single source of truth that can streamline processes across the energy value chain.

Simultaneously, regulatory bodies and grid operators are exploring innovative digital frameworks to accommodate the evolving energy mix and maintain grid stability. Pilot projects in peer-to-peer energy trading, carbon credit tracking and transparent billing have demonstrated blockchain’s potential to reduce transaction costs and accelerate settlement cycles. Moreover, the convergence of blockchain with complementary technologies such as Internet of Things (IoT) sensors and smart metering is enabling real-time data sharing while preserving data integrity. These developments set the stage for a new era of digital energy ecosystems underpinned by distributed ledger constructs.

This executive summary provides a concise yet comprehensive overview of how blockchain is reshaping energy sector paradigms, evaluates the impact of emerging tariff pressures, delves into key segmentation and regional trends, and outlines strategic actions industry leaders can adopt. By synthesizing the latest research findings and expert perspectives, this document equips stakeholders with the knowledge required to navigate the evolving landscape and capitalize on blockchain-driven innovations.

Exploring Transformations in Energy Infrastructure, Market Dynamics and Collaborative Ecosystems Driven by the Adoption of Distributed Ledger Innovations

The energy sector is undergoing foundational shifts as distributed ledger technologies redefine traditional operational models. At the core of this transformation lies the movement away from centralized transaction processing toward peer-to-peer settlement frameworks. This shift enables prosumers to transact renewable power directly, bypassing legacy intermediaries. Consequently, energy markets are becoming more agile and customer-centric, fostering a dynamic ecosystem where localized generation and consumption patterns can be reconciled in near real time.

Alongside market decentralization, blockchain integration is catalyzing the emergence of new collaborative ecosystems. Energy producers, grid operators, technology vendors and regulatory agencies are forming consortium networks to standardize protocols, enhance data interoperability and establish governance structures. These federated networks facilitate multi-party coordination across supply chain management, certification of renewable attributes and cross-border energy transactions. As a result, participants can leverage shared infrastructure to lower operational costs and accelerate time to market for innovative services.

Furthermore, the convergence of blockchain with distributed energy resources (DERs) and smart grid initiatives is reinforcing grid resilience. By embedding ledger nodes at edge devices such as smart meters and charge controllers, stakeholders gain instantaneous visibility into asset performance, consumption trends and grid health indicators. This real-time intelligence supports predictive maintenance, dynamic load balancing and rapid response to fault conditions. Ultimately, these transformative shifts are laying the groundwork for an interconnected, transparent and secure energy fabric that can adapt to evolving regulatory mandates and market demands.

Assessing the Comprehensive Effects of Recent United States Energy Tariff Policies on Blockchain Integration and Cross-Border Energy Technology Supply Chains in 2025

In 2025, adjustments to U.S. tariff policies are exerting notable pressure on the cost structure of hardware components critical to blockchain deployment in the energy sector. Tariffs on imported semiconductor chips, solar panel modules and specialized networking equipment have increased by up to 15%, prompting stakeholders to reassess procurement strategies. While the intention of these tariffs is to bolster domestic manufacturing and reduce supply chain vulnerabilities, they simultaneously raise capital expenditure thresholds for pilot implementations and full-scale rollouts of distributed ledger systems.

These tariff-induced cost headwinds have accelerated initiatives to localize production and diversify supplier networks. Blockchain platform developers and energy project consortiums are actively investing in domestic manufacturing partnerships to mitigate exposure to import duties. Moreover, the industry is witnessing heightened collaboration between technology providers and U.S.-based fabrication facilities to co-develop blockchain-optimized hardware solutions. This strategic alignment not only addresses the tariff impact but also enhances supply chain transparency, ensuring that component provenance can be verified through the ledger itself.

Despite the additional costs, the cumulative effect of tariff policies has underscored the strategic value of blockchain’s inherent traceability features. By capturing granular provenance data on the ledger, stakeholders can confidently demonstrate compliance with domestic content requirements and regulatory reporting obligations. This ability to trace hardware origins and utilization reinforces the business case for blockchain implementation, even amid elevated tariff environments. Consequently, organizations that seamlessly integrate ledger-based supply chain tracking are poised to navigate tariff volatility more effectively and sustain momentum in their energy innovation programs.

Revealing Critical Segmentation Insights Across Components, Deployment Models, Applications and End-User Verticals Shaping Blockchain Adoption in Energy

Component segmentation reveals that blockchain solutions in energy span two core categories, Services and Solutions, each encompassing distinct offerings and development pathways. Under the Services domain, organizations rely on expert consulting advisory to align distributed ledger strategies with business objectives, while managed services deliver end-to-end deployment and operational support for real-world applications. Professional services further augment these capabilities by providing bespoke system integration, customization and training to ensure seamless adoption across diverse energy workflows. In parallel, the Solutions domain offers the foundational technology infrastructure. Hardware components such as secure ledger nodes and IoT-enabled metering devices form the physical backbone. Platforms provide modular frameworks for transaction processing, smart contract orchestration and data sharing. Underlying these elements, software layers deliver analytics, user interfaces and compliance management to meet regulatory and market requirements.

Deployment segmentation highlights the choice between Cloud Based and On Premise architectures as a pivotal factor in blockchain adoption. Cloud Based deployments leverage the scalability of public, private and multi-cloud environments to accommodate variable transaction volumes and distributed user communities. Public cloud platforms offer rapid provisioning and global accessibility, while private cloud setups ensure dedicated resources and enhanced security controls. Multi-cloud strategies combine both approaches to optimize performance and resilience. Conversely, On Premise deployments cater to organizations with stringent data sovereignty, latency and network availability requirements. Dedicated on-premise installations maintain complete operational control, while virtualized on-premise infrastructures deliver the benefits of containerization and resource flexibility without exposing sensitive data to external networks.

Application segmentation underscores the breadth of blockchain use cases across the energy value chain. From billing and payment settlements to demand response management, ledger technology automates complex financial flows and accelerates reconciliation cycles. Electric vehicle charging and integration benefit from transparent tracking of energy flows, enabling dynamic pricing and interoperability among charging operators. Supply chain management processes gain end-to-end visibility as materials, components and equipment movements are immutably recorded. Grid management systems leverage distributed ledgers to coordinate distributed energy resources, enhance fault detection and optimize load balancing. Infrastructure and asset management teams capitalize on detailed maintenance logs and warranty tracking, while peer-to-peer energy trading platforms empower prosumers to transact directly. Additionally, renewable energy certificates and carbon credit tracking solutions utilize blockchain to create auditable records for compliance and voluntary market activities.

End-user segmentation distinguishes between Oil & Gas companies and Power Sector utilities as principal adopters of blockchain technology in energy. Oil & Gas firms, with complex supply chains and cross-border trade flows, leverage distributed ledgers to streamline import/export documentation, automate contract settlements and manage emissions reporting. Power Sector utilities focus on grid modernization initiatives, integrating blockchain with advanced metering infrastructure and distributed resource orchestration to improve operational resilience, customer engagement and regulatory compliance. This delineation underscores how distinct end-user priorities shape solution design, deployment models and strategic roadmaps.

This comprehensive research report categorizes the Blockchain in Energy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment

- Application

- End User

Mapping Regional Dynamics in the Americas, Europe Middle East Africa and Asia-Pacific Illuminating Distinct Blockchain Deployment Trends in Energy Markets

Regional dynamics in the Americas showcase a mature landscape characterized by robust regulatory support for renewable integration and blockchain pilot initiatives. In North America, policy frameworks at federal and state levels are increasingly accommodating the role of distributed ledger technologies in improving grid transparency and accelerating carbon accounting processes. Meanwhile, Latin American nations are exploring blockchain as a means to enhance cross-border electricity trade and stabilize grids prone to frequency fluctuations, driving consortium efforts that span national power pools.

Across Europe, the Middle East and Africa, the regulatory environment is heterogeneous yet promising. European Union member states are pioneering blockchain-based guarantees of origin for renewable energy certificates, setting interoperability standards that facilitate cross-market transactions. In the Middle East, national utilities are embracing ledger solutions to optimize solar power dispatch and water-energy nexus management at utility scale. African microgrid operators leverage blockchain to enable transparent community energy trading and streamline subsidy distribution, unlocking new investment flows for off-grid deployments.

The Asia-Pacific region exhibits dynamic growth driven by high renewable capacity additions and digital infrastructure investments. In Southeast Asia, government-backed innovation labs are testing blockchain for peer-to-peer energy exchanges and real-time settlement in islanded grids. Meanwhile, advanced economies in the region are integrating ledger platforms with smart city initiatives, marrying energy data with mobility, water and telecommunications networks. This regional diversity underscores the importance of localized regulatory design, technology partnerships and ecosystem development as key drivers of blockchain adoption in energy markets.

This comprehensive research report examines key regions that drive the evolution of the Blockchain in Energy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unlocking Competitive Intelligence by Highlighting Leading Blockchain Innovators Transforming Energy Sector Operations Partnerships and Technological Roadmaps

Leading technology providers and energy incumbents have accelerated collaborations to advance blockchain use cases across the value chain. Energy conglomerates with extensive grid infrastructures are partnering with specialized distributed ledger developers to co-create solutions that address asset tokenization, digital identity and automated settlement. Meanwhile, software vendors are augmenting their core platforms with energy-centric modules, embedding smart contract templates tailored for peer-to-peer trading, carbon credit issuance and compliance workflows.

Emerging startups focused on blockchain in energy are securing strategic investments from utility venture arms and renewable energy funds. These ventures demonstrate proof-of-concepts in granular load forecasting, electric vehicle charging orchestration and community energy cooperatives. Their nimble innovation cycles and domain expertise challenge established firms to incorporate more agile development methodologies. Concurrently, global engineering and consulting networks are building dedicated blockchain practices, providing end-to-end advisory on ecosystem design, regulatory alignment and go-to-market strategies.

Consortia such as industry alliance groups and standards bodies are playing a pivotal role in defining interoperable protocols and governance frameworks. By uniting diverse stakeholders-from hardware manufacturers to retail off-takers-these consortiums accelerate technology validation, foster best-practice sharing and lower the barriers to entry for new participants. Collectively, the interplay between multinational energy firms, specialized technology vendors, agile startups and industry coalitions is shaping a competitive landscape where collaborative innovation and strategic partnerships are paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blockchain in Energy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acciona Energy

- Amazon Web Services, Inc.

- E.ON SE

- Electrify.Asia Pte. Ltd.

- Enel S.p.A.

- Energy Web Foundation

- Engie SA

- GridBeyond

- GridPlus, Inc.

- Iberdrola, S.A.

- International Business Machines Corporation

- NRG Blockchain Solutions LLC

- Power Ledger Pty Ltd

- Royal Dutch Shell plc

- Schneider Electric SE

- Siemens AG

- SunContract d.o.o.

Implementing Strategic Roadmaps and Operational Best Practices to Maximize Value and Drive Scalable Blockchain Integration in the Energy Industry

Industry leaders should prioritize the integration of blockchain strategy into broader digital transformation roadmaps to ensure alignment with organizational goals. By embedding distributed ledger pilots within existing grid modernization and IoT deployments, executives can leverage established data streams and infrastructure investments to validate technology efficacy under real operational conditions. In doing so, they can accelerate time to value, mitigate deployment risks and secure stakeholder buy-in early in the process.

Moreover, forging cross-sector partnerships with renewable energy developers, telematics providers and academic research institutions can foster open innovation ecosystems. Such collaborations enable the pooling of domain expertise, access to real-world use cases and shared resource commitments for proof-of-concept studies. Leaders should adopt co-development agreements that outline intellectual property governance, data sharing protocols and commercialization pathways to ensure sustainable partnerships.

Investing in upskilling and organizational change management is also crucial. Establishing dedicated blockchain centers of excellence or digital labs empowers multidisciplinary teams to experiment with smart contract development, distributed identity frameworks and cryptographic security models. Structured training programs and knowledge exchange forums cultivate internal capabilities and foster a culture of continuous innovation. Finally, executives should implement clear metrics for success-such as transaction throughput, settlement time reduction and carbon reduction quantified through immutable records-to monitor progress and inform iterative scaling strategies.

Detailing Rigorous Research Approaches and Analytical Frameworks Underpinning the Comprehensive Blockchain in Energy Market Study for Data-Driven Insights

This market research study employs a structured multi-stage methodology combining primary research, secondary data analysis and advanced analytical frameworks. Primary research involved in-depth interviews with over fifty senior executives across energy utilities, oil and gas operators, technology vendors and regulatory agencies. These interviews provided qualitative insights into strategic priorities, pain points and expected adoption timelines for blockchain solutions.

Secondary research encompassed a comprehensive review of industry publications, regulatory filings, company financial reports and patent databases to capture the latest technology developments and policy shifts. Publicly available datasets on grid performance, renewable capacity additions and international energy trade flows were triangulated with proprietary market intelligence to validate emerging trends. A systematic data triangulation approach ensured consistency and accuracy across multiple data sources.

Analytical frameworks incorporated scenario analysis to assess the impact of tariff changes, regulatory incentives and technology maturation on blockchain adoption trajectories. Use case scoring matrices evaluated each application against criteria such as technical feasibility, regulatory compliance, economic viability and stakeholder readiness. Regional mapping techniques identified geographic clusters of innovation and regulatory support, while vendor benchmarking assessed competitive positioning based on partnership networks, solution breadth and deployment track record. Throughout the process, rigorous data governance protocols maintained confidentiality and ensured unbiased interpretation of findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blockchain in Energy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blockchain in Energy Market, by Component

- Blockchain in Energy Market, by Deployment

- Blockchain in Energy Market, by Application

- Blockchain in Energy Market, by End User

- Blockchain in Energy Market, by Region

- Blockchain in Energy Market, by Group

- Blockchain in Energy Market, by Country

- United States Blockchain in Energy Market

- China Blockchain in Energy Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings and Strategic Imperatives from the Executive Summary to Illuminate the Future Trajectory of Blockchain in the Energy Ecosystem

This executive summary has synthesized the key drivers propelling blockchain adoption within the energy sector, highlighting the transformational shifts in market dynamics, regulatory landscapes and technology ecosystems. By examining the cumulative effects of 2025 tariff adjustments, we have illustrated both the cost implications and strategic opportunities arising from enhanced supply chain transparency. The segmentation and regional analyses underscore the nuanced requirements of diverse stakeholder groups-from utilities modernizing grid operations to oil and gas firms optimizing cross‐border trading workflows.

Key insights reveal that successful blockchain implementations hinge on collaborative ecosystems, robust data governance and alignment with broader digital transformation initiatives. Leading companies are differentiating themselves through targeted partnerships, specialized solution portfolios and proactive engagement in industry consortiums. Moreover, the research methodology underpinning these findings ensures a balanced perspective, blending qualitative executive insights with quantitative data from authoritative sources.

Looking ahead, the trajectory of blockchain in energy will be shaped by evolving regulatory frameworks, technology interoperability standards and market demand for decarbonization. Organizations that embrace agile experimentation, co-creation models and transparent governance structures will be best positioned to capture the full potential of distributed ledger innovations. Ultimately, the ability to translate strategic vision into measurable operational outcomes will define the next frontier of energy industry leadership.

Engage with Ketan Rohom to Secure the Definitive Blockchain in Energy Market Research Report Empowering Strategic Decisions and Driving Competitive Advantage

Engaging with Ketan Rohom, Associate Director of Sales & Marketing provides an exclusive opportunity to access the definitive market research report on blockchain adoption in the energy sector. This comprehensive study draws on rigorous primary interviews, proprietary energy market datasets and advanced analytical frameworks to deliver actionable insights tailored for executives and decision-makers. Partnering directly with Ketan Rohom ensures your organization benefits from personalized guidance on the report’s findings, unlocking paths to strategic growth and competitive differentiation. Reach out to schedule a briefing and secure your copy before competitors capitalize on these critical energy innovation insights

- How big is the Blockchain in Energy Market?

- What is the Blockchain in Energy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?