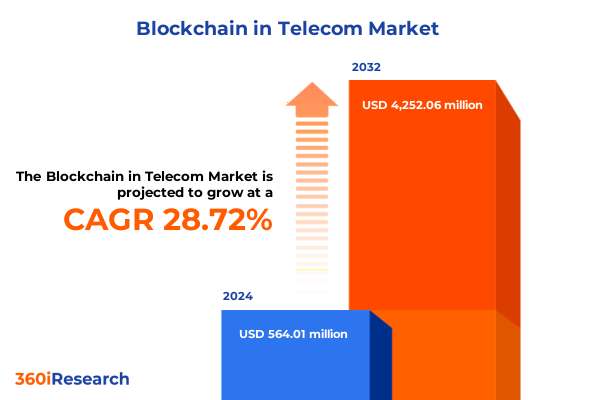

The Blockchain in Telecom Market size was estimated at USD 723.25 million in 2025 and expected to reach USD 929.61 million in 2026, at a CAGR of 28.79% to reach USD 4,252.06 million by 2032.

Unlocking the Future of Global Telecommunications by Harnessing Blockchain Innovation to Drive Network Security, Operational Efficiency, and Service Differentiation

The telecommunications industry is experiencing an era of relentless change as service providers grapple with escalating network complexity, burgeoning security threats, and the imperative to deliver seamless, high-value experiences. Traditional architectures often struggle to scale quickly and maintain trust across sprawling supply chains, regulatory regimes, and global partner ecosystems. In response, blockchain technology has emerged as a powerful enabler, promising to streamline processes, enhance transparency, and reduce operational friction. By providing an immutable distributed ledger, smart contract capabilities, and decentralized identity frameworks, blockchain offers a foundation for telecom operators to future-proof their networks and service portfolios.

Against this backdrop, this executive summary distills the critical elements of blockchain adoption within the telecom sector. It examines how this technology is driving fundamental shifts in infrastructure design and business models, evaluates the cumulative impact of new U.S. tariffs on 2025 deployments, and uncovers key segmentation and regional insights. Furthermore, it highlights leading solution providers, actionable strategic recommendations for industry leaders, and the rigorous methodology underpinning the research. Together, these sections equip decision-makers with a clear, authoritative perspective on harnessing blockchain to achieve heightened security, operational efficiency, and innovative service differentiation.

How Blockchain Technology Is Accelerating Transformative Shifts in Telecom Infrastructure, Enhancing Service Delivery, and Redefining Competitive Dynamics

Blockchain technology is catalyzing transformative shifts across the entire telecommunications value chain. At the core of network infrastructure, decentralized and permissioned ledger systems are enabling carriers to optimize resource allocation and automate reconciliation processes between roaming partners. This shift reduces billing disputes and settlement delays, while increasing transparency in wholesale agreements. Simultaneously, blockchain-based identity management frameworks are enhancing subscriber authentication and mitigating fraud, thereby reinforcing trust at every touchpoint in the customer journey. These foundational changes are fostering a new generation of agile, secure network architectures.

Service delivery is also being reshaped by blockchain-driven innovations. Smart contracts are automating end-to-end workflows for charging, settlement, and service provisioning, thereby minimizing manual intervention and accelerating time to market for new offerings. Furthermore, decentralized architectures are enabling more robust Internet of Things (IoT) connectivity and edge computing integration, opening pathways for novel use cases in smart cities, connected vehicles, and machine-to-machine communication. Such advancements underscore the growing convergence of blockchain with other emerging technologies to redefine customer experiences and operational models.

On a competitive level, telecom operators that embrace blockchain are differentiating through enhanced service reliability and cost efficiency. Ecosystem collaboration-spanning network providers, equipment vendors, and enterprise customers-is becoming more streamlined, as shared distributed ledgers remove silos and foster co-innovation. This collaborative ethos is giving rise to consortium-driven initiatives and new business alliances aimed at unlocking collective value, positioning blockchain as a pivotal force in shaping the future strategic landscape of telecommunications.

Assessing the Far-Reaching Impacts of 2025 United States Telecom Tariffs on Blockchain Deployments and Operational Strategies

In 2025, the United States government implemented a series of tariffs targeting telecommunications equipment and related technology imports, aiming to bolster domestic manufacturing and national security. These measures have led to higher procurement costs for network hardware components and raised compliance complexity for international supply chains. As a result, telecom operators and equipment vendors are re-evaluating sourcing strategies, with many seeking alternative manufacturing partners or exploring onshore production options to mitigate tariff exposure.

For blockchain deployments within telecom, the tariff regime has a pronounced effect on infrastructure rollout and total cost of ownership. Organizations investing in blockchain-enabled routers, gateways, and secure hardware modules face incremental expenses that can defer pilot projects or constrain network scaling. Additionally, higher import duties on middleware and platform solutions have prompted solution providers to reassess pricing structures and renegotiate licensing agreements. These adjustments are essential for maintaining return on investment projections and ensuring seamless integration of blockchain protocols into existing network environments.

To adapt, leading carriers and equipment manufacturers are prioritizing strategic procurement partnerships and exploring tariff engineering techniques, such as reclassification of hardware components and leveraging trade compliance expertise. By proactively addressing tariff-driven cost pressures through supply chain diversification and operational efficiencies, the industry is safeguarding the momentum of blockchain innovation in telecom. This approach underscores the critical need for agile purchasing frameworks and collaborative vendor relationships to offset the cumulative impact of U.S. tariffs on blockchain-driven network modernization.

Unveiling Critical Segmentation Dimensions to Navigate Blockchain Technology Adoption and Service Customization in Telecom Markets

This analysis delves into the core segmentation dimensions that shape the blockchain in telecom market, beginning with components where the landscape divides into services and solutions. Within services, consulting, integration, and support and maintenance each represent critical value streams, addressing strategic advisory, system deployment, and ongoing operational support respectively. The solutions axis comprises application, middleware, and platform layers, each delivering differentiated functionality from user-facing smart contract interfaces through connectivity middleware to foundational ledger infrastructures.

Zooming into application segmentation, this report examines billing and settlement, fraud detection, identity management, roaming and SIM management, and supply chain management. Billing and settlement subdivides into postpaid and prepaid scenarios, reflecting differing charging models and revenue assurance needs. Roaming and SIM management further bifurcates into roaming settlement and SIM swap security, highlighting the importance of cross-border billing accuracy and subscriber data protection. These nuanced application areas underscore how blockchain’s immutable ledger and automation capabilities address specific telecommunications challenges.

Additional segmentation by deployment model identifies consortium, private, and public blockchain architectures, illustrating the trade-offs between governance, transparency, and scalability. End user segmentation parses enterprises and telecom operators, with enterprises further segmented into banking, financial services and insurance (BFSI), manufacturing, and retail, illuminating varied adoption drivers based on regulatory and operational priorities. Finally, enterprise size differentiation between large enterprises and small and medium enterprises reveals distinct resource profiles, risk tolerances, and integration timelines that influence how blockchain initiatives are planned and executed across the telecom ecosystem.

This comprehensive research report categorizes the Blockchain in Telecom market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Model

- Enterprise Size

- Application

- End User

Exploring Regional Dynamics Across Americas, Europe Middle East & Africa, and Asia Pacific for Strategic Blockchain Integration in Telecom

Regional market dynamics for blockchain in telecom reveal divergent priorities and maturity levels across the Americas, Europe Middle East & Africa, and Asia Pacific. In the Americas, operators are prioritizing supply chain transparency and secure roaming settlements, leveraging blockchain to streamline cross-border partnerships and reduce billing disputes. Advanced digital infrastructure and a progressive regulatory environment have accelerated pilot programs, with leading carriers collaborating in consortium networks to validate use cases at scale.

Within Europe Middle East & Africa, a focus on data privacy, regulatory compliance, and identity management is driving blockchain adoption. Operators are integrating distributed ledger frameworks to meet stringent data protection mandates and to bolster fraud detection capabilities. Strategic partnerships with regional governments and financial institutions further support the expansion of blockchain use cases in value-added services, such as digital identity verification and transparent subsidy distribution programs across public and private networks.

In the Asia Pacific region, high mobile penetration rates and rapid digital transformation initiatives are catalyzing blockchain investments in IoT connectivity and supply chain optimization. Telecom operators in advanced markets are deploying public blockchain trials for cross-border data exchange, while emerging economies emphasize consortium-based platforms to pool resources and share infrastructure costs. This regional diversity underscores the need for tailored strategies that align technical architectures, regulatory landscapes, and end user requirements to maximize blockchain’s transformative potential in telecommunications.

This comprehensive research report examines key regions that drive the evolution of the Blockchain in Telecom market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlight on Leading Blockchain Solution Providers Transforming Telecom Networks Through Innovation and Strategic Partnerships

A number of pioneering technology vendors and telecom incumbents are at the forefront of blockchain enablement for the industry. Global solution providers with deep expertise in distributed ledger platforms are collaborating with network operators to co-develop end-to-end offerings, integrating smart contract engines and decentralized identity modules directly into core network functions. At the same time, established telecommunications equipment manufacturers are embedding blockchain capabilities into next-generation routers and gateways, ensuring compatibility with existing network protocols.

In parallel, specialized software firms are focusing on high-value applications such as fraud detection and secure roaming settlement, creating plug-and-play modules that can be adopted incrementally. Strategic alliances between large systems integrators and emerging blockchain startups are accelerating implementation timelines, combining domain-specific knowledge with innovative protocol designs. This ecosystem approach enables operators to pilot multifaceted solutions ranging from middleware connectivity layers to digital asset management platforms.

Meanwhile, key industry consortia are playing a catalytic role by defining governance frameworks, interoperability standards, and compliance guidelines. Consortium-driven proof-of-concepts are validating blockchain use cases in cross-network billing and identity verification, establishing best practices that are rapidly adopted by consortium members. These cooperative efforts are forging a new paradigm where shared distributed ledgers unlock collective efficiency gains and create scalable templates for blockchain deployment across telecom landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blockchain in Telecom market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amdocs Limited

- AT&T Inc.

- China Telecom Corp Ltd

- Cisco Systems, Inc.

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Nokia Corporation

- Oracle Corporation

- Samsung Electronics Co., Ltd.

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

Strategic Roadmap for Telecom Executives to Leverage Blockchain Advancements and Drive Sustainable Growth Amid Market Disruption

Telecom executives seeking to harness blockchain must adopt a strategic roadmap that balances innovation with operational discipline. The first recommendation is to initiate pilot programs focused on high-impact use cases such as automated roaming settlements and decentralized identity management. By defining clear success metrics and leveraging consortium frameworks, operators can validate technical assumptions and build stakeholder buy-in before scaling.

Next, organizations should forge partnerships with experienced blockchain vendors and systems integrators, ensuring access to specialized implementation expertise and governance best practices. Collaborative models that share development risks and pool network data create a foundation for robust, interoperable platforms. Simultaneously, operators must invest in upskilling internal teams and establishing cross-functional centers of excellence to facilitate knowledge transfer and maintain project momentum.

Finally, industry leaders should engage proactively with regulators and standardization bodies to shape policy frameworks that support distributed ledger technologies. By contributing to compliance guidelines and interoperability standards, telecom operators can mitigate regulatory uncertainty and promote ecosystem-wide adoption. Together, these strategic actions will empower telecom companies to unlock blockchain’s potential, driving operational efficiencies, enhancing customer trust, and fostering sustainable competitive advantage.

Comprehensive Research Approach Combining Qualitative and Quantitative Techniques to Ensure Robust Blockchain in Telecom Insights

This research employs a mixed-methods approach to ensure comprehensive and actionable insights. The foundation of the study is a series of qualitative interviews with senior telecom executives, blockchain solution architects, and regulatory experts, capturing firsthand perspectives on technology adoption challenges and strategic priorities. These discussions informed the development of targeted survey instruments, which were distributed across a balanced sample of operators, vendors, and enterprise end users to quantify market sentiment and readiness.

To augment primary data, extensive secondary research was conducted, reviewing industry reports, white papers, and regulatory filings. This desk research provided context on evolving policy landscapes, consortium initiatives, and technology roadmaps. All data points were triangulated through rigorous cross-validation processes, ensuring consistency and reliability. In addition, expert panel workshops were convened to validate preliminary findings, refine segmentation frameworks, and identify emerging use cases.

Finally, the study applies analytical models to map correlations between adoption drivers, deployment models, and regional dynamics. Insight synthesis is grounded in a continuous feedback loop with key stakeholders, ensuring the conclusions and recommendations reflect both macro trends and on-the-ground realities. This holistic methodology delivers a robust blueprint for decision-makers seeking to leverage blockchain across the telecommunications sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blockchain in Telecom market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blockchain in Telecom Market, by Component

- Blockchain in Telecom Market, by Deployment Model

- Blockchain in Telecom Market, by Enterprise Size

- Blockchain in Telecom Market, by Application

- Blockchain in Telecom Market, by End User

- Blockchain in Telecom Market, by Region

- Blockchain in Telecom Market, by Group

- Blockchain in Telecom Market, by Country

- United States Blockchain in Telecom Market

- China Blockchain in Telecom Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Embracing Blockchain as a Catalyst for Next-Generation Telecom Services and Operational Excellence in a Rapidly Evolving Digital Landscape

Blockchain is poised to serve as a catalyst for redefining telecommunications in the digital era. By enabling secure, transparent, and automated processes, distributed ledger technologies address critical pain points from identity management and fraud prevention to roaming settlements and supply chain visibility. As telecom operators and ecosystem partners deepen their collaboration, blockchain will become integral to next-generation network architectures and service delivery paradigms.

The evolving regulatory and tariff landscape underscores the importance of agile strategies that anticipate policy changes and cost pressures. Operators that proactively invest in pilot programs, governance frameworks, and cross-functional capabilities will be better positioned to translate blockchain’s promise into tangible business outcomes. Moreover, regional nuances-from the Americas to Europe Middle East & Africa and Asia Pacific-require tailored roadmaps that align technical deployments with local regulatory requirements and market dynamics.

Ultimately, the path to blockchain-powered telecommunications hinges on a balanced approach: combining visionary innovation with pragmatic implementation planning. Through targeted partnerships, standardized protocols, and sustained knowledge sharing, the industry stands ready to unlock new levels of operational efficiency, service differentiation, and customer trust. This conclusion sets the stage for a strategic journey toward a decentralized telecom ecosystem, where blockchain is a foundational enabler of growth and resilience.

Secure Your Competitive Advantage Today by Engaging with Ketan Rohom to Access the Definitive Market Analysis on Blockchain in Telecom

I appreciate your interest in exploring this comprehensive market analysis on blockchain in telecom. To secure a competitive edge and gain access to in-depth research findings, I invite you to reach out directly to Ketan Rohom, our Associate Director of Sales & Marketing. Engaging with him will provide you with tailored guidance on how this report can address your strategic objectives and implementation roadmap. Don’t miss the opportunity to leverage these insights for driving innovation and operational excellence within your organization-connect with Ketan Rohom today to acquire this definitive study and begin transforming your telecom capabilities with blockchain technology

- How big is the Blockchain in Telecom Market?

- What is the Blockchain in Telecom Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?