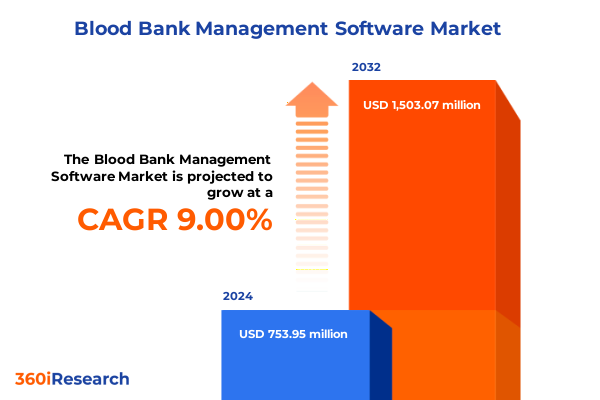

The Blood Bank Management Software Market size was estimated at USD 821.37 million in 2025 and expected to reach USD 890.68 million in 2026, at a CAGR of 9.01% to reach USD 1,503.07 million by 2032.

Unveiling the Strategic Imperative of Modernizing Blood Bank Management Systems to Enhance Efficiency and Ensure Patient Safety at Scale

The landscape of blood transfusion services has evolved dramatically, driven by an unwavering commitment to patient safety, operational efficiency, and regulatory compliance. In this complex environment, blood bank management software serves as the backbone of modern transfusion medicine, orchestrating workflows from donor recruitment through testing, inventory control, and transfusion tracking. As healthcare providers face mounting pressure to deliver error-free services, these platforms have become indispensable tools for streamlining processes and ensuring end-to-end traceability.

Today’s solutions must reconcile the intricacies of stringent quality standards, interoperability with broader healthcare ecosystems, and the imperative of real-time visibility across the supply chain. With regulatory bodies enforcing increasingly rigorous oversight and patients demanding heightened transparency, software platforms now function as strategic partners that underpin risk mitigation and audit readiness. Consequently, organizations are prioritizing systems that integrate seamlessly with laboratory instruments, electronic health records, and national registries to foster data consistency and operational continuity.

At their core, advanced blood bank management applications drive significant gains in efficiency by automating critical tasks. From barcode-enabled specimen tracking to automated alerts for low inventory levels, these solutions reduce human error and enable proactive decision-making. Furthermore, they support donor engagement initiatives by capturing granular donor histories and preferences, thereby boosting retention and loyalty. As institutions continue to reinvent their transfusion services around software-driven insights, the strategic imperative for robust, flexible, and secure platforms has never been clearer.

Exploring the Accelerated Technological and Operational Transformations Shaping the Future of Blood Bank Management Practices Worldwide

Technological innovation is reshaping the way blood banks operate, ushering in an era of unprecedented automation and data-driven decision-making. Artificial intelligence and machine learning algorithms now analyze donor profiles and historical usage patterns to optimize inventory allocations and predict future demand trends. Simultaneously, cloud computing has liberated data silos, enabling geographically distributed centers to share real-time updates on inventory status, enabling rapid redistribution during emergencies and humanitarian crises.

In parallel, the proliferation of the Internet of Things has introduced smart sensors and RFID tags that monitor storage conditions continuously, ensuring temperature integrity and reducing the risk of spoilage. Blockchain technology is also gaining traction as a means to secure transaction records and verify chain-of-custody information, reinforcing trust between collection sites, testing laboratories, and transfusion facilities. These shifts are not merely incremental; they represent a fundamental reimagining of operational paradigms, where digital ecosystems replace legacy paper-based systems.

Consequently, blood bank management is transitioning from reactive process controls toward proactive, predictive operations. Organizations that embrace these transformative shifts are achieving shorter turnaround times and superior compliance metrics. Moreover, they are enhancing donor experiences by leveraging mobile interfaces and personalized communications, fostering deeper engagement and community trust. As these technologies converge, the landscape of transfusion medicine is poised for continued evolution, driven by the quest for higher quality, lower costs, and greater responsiveness to patient needs.

Assessing the Multifaceted Effects of United States Tariffs Implemented in 2025 on Blood Bank Software Ecosystem and Operational Cost Structures

The implementation of new United States tariffs in 2025 has reverberated across the blood bank management software ecosystem, influencing both operational cost structures and procurement strategies. Tariffs imposed on imported data center hardware and ancillary IT equipment have inflated capital expenditure budgets, compelling some organizations to re-evaluate their infrastructure roadmaps. As the cost of servers, network switches, and storage arrays rose significantly, providers and end users alike have scrutinized total cost of ownership, seeking avenues to offset these headwinds.

In response, many institutions accelerated their migration toward cloud-based deployments, favoring subscription-based models that shift capital outlays to operational expenses. This redirection has not only mitigated the immediate impact of hardware tariffs but has also spurred innovations in hybrid and multi-cloud architectures designed to optimize performance and cost efficiency. At the same time, software vendors have restructured service level agreements and pricing models to accommodate these changing budgetary constraints, offering more flexible payment terms and bundling hardware-agnostic solutions.

Looking ahead, the cumulative impact of these tariffs is expected to drive greater collaboration between software providers and domestic hardware manufacturers. This alignment promises to foster resilient supply chains and promote localized technology ecosystems. While the short-term effect has been a noticeable uptick in deployment costs, the long-term outcome may translate into more robust, scalable, and geopolitically insulated infrastructures for blood bank management.

Unlocking Actionable Insights Through Comprehensive Segmentation Analysis of Components, Deployment Models, End Users, Organization Sizes, and Applications

A granular view of market segmentation reveals the nuanced demands shaping blood bank management solutions. Based on component, service offerings such as implementation, support maintenance, and training have gained prominence as organizations seek hands-on guidance to deploy complex workflows and maintain peak system performance, while software modules dedicated to donor management, inventory control, testing oversight, and transfusion coordination continue to evolve in tandem with regulatory and clinical requirements.

Examining deployment mode, cloud-based architectures-whether in hybrid, private, or public environments-are increasingly favored for their scalability and cost-predictable attributes, yet on-premise installations endure in markets where data sovereignty and legacy integrations remain critical. Meanwhile, the end-user landscape bifurcates between community blood banks, composed of independent centers and Red Cross operations that emphasize regional donor outreach, and hospital blood banks in both government and private settings, which require seamless interoperability with broader electronic health record infrastructures.

Consideration of organization size further illuminates adoption dynamics as large institutions leverage enterprise-grade platforms to support high-volume throughput and advanced analytics, medium organizations opt for modular, cost-conscious packages, and smaller entities adopt streamlined solutions with core functionality. Finally, the breakdown by application underscores differentiated growth, as donor acquisition and retention tools intersect with inventory management dashboards, testing quality assurance frameworks, and transfusion tracking modules to deliver holistic, end-to-end oversight across the entire blood management continuum.

This comprehensive research report categorizes the Blood Bank Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Organization Size

- End User

- Application

Deciphering Regional Variations in Adoption, Regulatory Dynamics, and Technological Priorities Across the Americas, EMEA, and Asia-Pacific Blood Bank Markets

Regional nuances in blood bank management adoption reflect varying levels of healthcare infrastructure maturity, regulatory frameworks, and funding priorities. In the Americas, the United States and Canada drive market leadership through early adoption of integrated platforms, bolstered by supportive regulatory agencies and incentives for interoperability with electronic health record ecosystems. These conditions foster innovation and rapid deployment of cloud-native solutions, enabling seamless data exchange and advanced analytics deployments across national networks.

In Europe, Middle East & Africa, adoption rates fluctuate as national regulatory directives such as the European Union Blood Directive and data privacy laws like GDPR shape requirements for data handling and operational transparency. While Western Europe exhibits high penetration of sophisticated solutions, parts of the Middle East and Africa are experiencing incremental modernization as public-private partnerships and regional health initiatives prioritize digitization of blood management processes, paving the way for future scale-up.

Across the Asia-Pacific region, burgeoning demand in China, India, and Southeast Asian nations spurs investment in centralized blood bank networks. Government-led initiatives emphasize standardizing testing protocols and inventory distribution, encouraging the shift toward cloud-enabled platforms. Despite budgetary constraints in certain emerging economies, cost-effective models and local partnerships are rapidly expanding the market, highlighting the critical role of adaptable deployment strategies in capturing regional growth opportunities.

This comprehensive research report examines key regions that drive the evolution of the Blood Bank Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Strategic Collaborators Driving Advances in Blood Bank Management Solutions Through Cutting-Edge Technology Integration

A diverse roster of companies is shaping the competitive landscape for blood bank management solutions. Established healthcare IT providers bring extensive portfolios that integrate laboratory, clinical, and administrative modules, enabling organizations to consolidate vendor relationships and streamline support operations. These incumbents frequently leverage broad interoperability frameworks and invest heavily in research and development to maintain compliance with evolving standards and certification requirements.

Conversely, specialized technology vendors focus exclusively on niche aspects of blood bank operations, offering modular architectures that deliver deep functionality in areas such as donor recruitment analytics, cold-chain monitoring, and automated testing workflows. Their agility in addressing specific pain points enables rapid feature enhancements and close alignment with end-user feedback.

Increasingly, strategic alliances between software developers and diagnostic device manufacturers are broadening solution capabilities. By embedding sensor data from point-of-care instruments and laboratory analyzers directly into management platforms, these partnerships are enhancing quality assurance processes, reducing manual data entry, and improving overall system reliability. Consequently, organizations that choose providers with robust partner ecosystems position themselves to capitalize on next-generation innovations in transfusion medicine.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blood Bank Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Allscripts Healthcare Solutions Inc

- Becton Dickinson and Company

- Clinisys

- CompuGroup Medical SE & Co KGaA

- Epic Systems Corporation

- GPI USA (part of GPI Group)

- Grifols SA

- Haemonetics Corporation

- Hemosoft

- Integrated Medical Systems

- InterSystems Corporation

- IT Synergistics

- MAK-System

- Medical Information Technology Inc

- Netripples Software Limited

- Oracle Corporation

- Orchard Software Corporation

- Roper Technologies Inc

- SafetyCulture

- SCC Soft Computer

- Siemens AG

- Strides Software Solutions

- TECHNIDATA

- WellSky Corporation

Delivering Practical Strategic Recommendations to Empower Industry Leaders to Navigate Evolving Regulatory, Technological, and Market Challenges Effectively

Industry leaders must adopt a forward-looking posture to navigate evolving regulatory, technological, and market challenges effectively. First, investments in cloud-first architectures will prove essential to achieve elasticity, geographic redundancy, and predictable cost models. Organizations should evaluate hybrid cloud strategies that balance on-premise control with public cloud scalability to optimize performance and compliance.

Next, prioritizing interoperability through open application programming interfaces and adherence to industry standards will facilitate seamless data exchange with electronic health records, laboratory information systems, and national health registries. By fostering an ecosystem of connected solutions, institutions can eliminate silos and accelerate decision-making.

Furthermore, leveraging artificial intelligence and machine learning to develop predictive analytics capabilities will empower teams to anticipate inventory shortages, detect testing anomalies, and personalize donor engagement strategies. Building strong data governance frameworks is crucial to ensure these technologies operate within ethical and regulatory boundaries.

Finally, establishing comprehensive training and support services with clear performance metrics will secure user adoption and maximize return on technology investments. Tailored change management programs will ease the transition for staff and reinforce best practices, ensuring sustained operational excellence.

Detailing the Rigorous Research Methodology Employed to Garner Deep Industry Insights Through Primary Interviews, Data Triangulation, and Expert Validation

A rigorous multi-tiered research methodology underpins the insights presented in this report. It commenced with in-depth primary interviews with senior executives, laboratory managers, and IT directors across diverse blood bank operations, capturing firsthand perspectives on emerging challenges and solution priorities. These dialogues provided an authentic view of real-world deployment experiences, pain points, and success stories.

Secondary research complemented these findings through comprehensive analysis of industry publications, regulatory documents, technology white papers, and peer-reviewed journals. This review encompassed regional health authority directives, advancements in transfusion protocols, and technology adoption road maps. The integration of diverse information sources ensured a holistic understanding of market drivers and inhibitors.

To validate and refine key insights, data triangulation techniques were applied, comparing quantitative indicators with qualitative feedback. An expert panel of clinicians, IT strategists, and regulatory specialists conducted iterative reviews, challenging assumptions and verifying emerging trends. This layered approach underlines the robustness and credibility of the conclusions drawn throughout the executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blood Bank Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blood Bank Management Software Market, by Component

- Blood Bank Management Software Market, by Deployment Mode

- Blood Bank Management Software Market, by Organization Size

- Blood Bank Management Software Market, by End User

- Blood Bank Management Software Market, by Application

- Blood Bank Management Software Market, by Region

- Blood Bank Management Software Market, by Group

- Blood Bank Management Software Market, by Country

- United States Blood Bank Management Software Market

- China Blood Bank Management Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Key Takeaways Emphasizing the Critical Role of Integrated, Scalable, and Secure Blood Bank Management Solutions in Shaping the Healthcare Landscape

The journey toward digital excellence in blood bank management is marked by a convergence of technological innovation, strategic partnerships, and regulatory evolution. The insights outlined in this executive summary underscore the urgent need for integrated platforms that bridge operational silos and foster data-driven efficiencies. As healthcare providers navigate the complexities of donor retention, inventory optimization, and compliance, the choices made today will define their agility in responding to future public health challenges.

Adopting cloud-enabled architectures, embedding artificial intelligence for predictive capabilities, and upholding interoperability standards will serve as foundational pillars for resilient blood transfusion services. Equally, the cultivation of strong training ecosystems and partnerships with specialized vendors will accelerate adoption and amplify the impact of these investments.

Ultimately, the strategic integration of advanced software solutions holds the promise of transforming the blood management continuum. By embracing these imperatives, organizations can deliver safer transfusions, optimize resource utilization, and build trust with both donors and recipients, thereby reinforcing the vital role of blood services in modern healthcare.

Engaging with Ketan Rohom, Associate Director of Sales & Marketing, to Secure Exclusive Access to the Full Market Research Report on Blood Bank Management Software

If you are ready to deepen your understanding and gain a competitive edge in the blood bank management software arena, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Leveraging his extensive industry expertise, Ketan will guide you through the exclusive insights, detailed analyses, and actionable recommendations contained in the full market research report. Secure your access today to unlock strategic intelligence tailored to your organization’s goals and stay ahead of evolving market dynamics.

- How big is the Blood Bank Management Software Market?

- What is the Blood Bank Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?